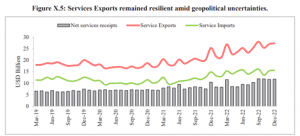

THE CONTEXT: India has been a major player in services trade, being among the top ten services exporting countries in 2021, having increased its share in world commercial services exports from 3 per cent in 2015 to 4 per cent in 2021. India’s services exports have remained resilient during the Covid-19 pandemic and amid current geopolitical uncertainties, driven by higher demand for digital support, cloud services, and infrastructure modernization catering to new challenges.

- The services sector witnessed a swift rebound in FY22, growing Year-on-Year (YoY) at 8.4 per cent compared to a contraction of 7.8 per cent in the previous financial year.

- The improvement was driven by growth in the ‘Trade, Hotel, Transport, Storage, Communication and Services related to broadcasting’ sub-sector, which bore the maximum burden of the pandemic.

- The growth momentum has continued in FY23 as well.

TRENDS IN HIGH-FREQUENCY INDICATORS

Services PMI

- India’s services sector activity, gauged by PMI Services, which remained in the contractionary zone for several months during 2020 and 2021 on account of the restrictions imposed to tackle the Covid-19 pandemic, recovered swiftly with the waning of the Omicron variant at the beginning of 2022.

- PMI services again witnessed a setback with the outbreak of the Russia-Ukraine conflict.

Bank Credit

- Bank credit to the services sector has witnessed significant growth since October 2021 with the improvement in vaccination coverage and recovery in the services sector. The credit to services sector saw a YoY growth of 21.3 per cent in November 2022, the second highest in 46 months.

Services Trade

- India’s services exports may improve as runaway inflation in advanced economies drives up wages and makes local sourcing expensive, opening up avenues for outsourcing to low-wage countries, including India. India is a significant player in services trade, being among the top ten services exporter countries in 2021, having increased its share in world commercial services exports from 3 per cent in 2015 to 4 per cent in 2021.

- A further increase in the share is likely, with the services exports registering growth of 27.7 per cent during April-December 2022 as compared to 20.4 per cent in the corresponding period last year.

Foreign Direct Investment (FDI) in Services

- In FY22 India received the highest-ever FDI inflows of US$ 84.8 billion including US$ 7.1 billion FDI equity inflows in the services sector.

- To facilitate investment, various measures have been undertaken by the Government, such as the launch of the National Single-Window system, a one-stop solution for approvals and clearances needed by investors, entrepreneurs, and businesses.

MAJOR SERVICES: SUB-SECTOR-WISE PERFORMANCE

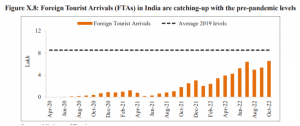

Tourism and Hotel Industry

- India’s tourism sector is showing signs of revival. Foreign tourist arrivals in India in FY23 have been growing month-on-month with the resumption of scheduled international flights and the easing of Covid-19 regulations. Yet, the arrivals are below the pre-pandemic level. Profitability ratios of the tourism industry further point towards a strong rebound in the June 2022 quarter.

- India is ranked 10th out of the top 46 countries in the World in the Medical Tourism. The way India has handled the Covid situation trust in India’s medical infrastructure has improved.

- India has also attempted to improve its attractiveness as a destination for specialized tourism. Recent initiatives like the Ayush visa for tourists who desire to visit India for medical treatment, the launch of the National Strategy for Sustainable Tourism & Responsible Traveller Campaign, the introduction of the Swadesh Darshan 2.0 scheme, and Heal in India can assist in capturing a larger share of the global medical tourism market.

Real Estate

- The sector has witnessed resilient growth in the current year, with housing sales and the launch of new houses in Q2 of FY23 surpassing the pre-pandemic level of Q2 of FY20.

- Going forward, the recent government measures, such as the reduction in import duties on steel products, iron ore, and steel intermediaries, will cool off the construction cost and help to check the rise in housing prices.

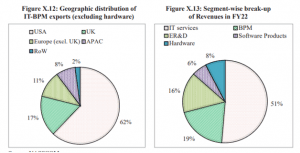

IT-BPM Industry

- IT-BPM revenues registered YoY growth of 15.5 per cent during FY22 compared to 2.1 per cent growth in FY21, with all sub-sectors showing double-digit revenue growth.

- Within the IT-BPM sector, IT services constitute the majority share (greater than 51 per cent). Exports (including hardware) witnessed a growth of 17.2 per cent in FY22 compared to 1.9 per cent growth in FY21 and the use of core operations.

E-Commerce

- On the same lines as the IT-BPM sector, the E-Commerce sector also witnessed a renewed push and a sharp increase in penetration in the aftermath of the pandemic.

- Lockdowns and mobility restrictions disrupted consumer behaviour and gave an impetus to online shopping. The Government’s push to boost the digital economy, growing internet penetration, rise in smartphone adoption, innovation in mobile technologies, and increased adoption of digital payments further accelerated the adoption and growth of e-commerce.

- According to the Global Payments Report by Worldpay FIS, India’s e-commerce market is projected to post impressive gains and grow at 18 per cent annually through 2025.

Digital Financial Services

- Digital financial services enabled by emerging technologies and innovative solutions are accelerating financial inclusion, democratizing access, and spurring the personalization of products.

- With a strong foundation provided by the Jan Dhan-Aadhaar-Mobile (JAM) trinity, UPI, and other regulatory frameworks, the pandemic has aided acceleration in digital adoption and provided a fillip to digital financial services solutions by banks, NBFCs, insurers as well as fintech.

- The pandemic provided the opportunity for fintech companies to reach the underserved and provide cost-effective financial services to those at the bottom of the pyramid.

- The government also, through various initiatives, has given a push to digital banking solutions. 75 Digital Banking Units (DBU) across 75 districts announced in Union Budget 2022-23 to take banking solutions to every nook and corner of the country have been launched.

- The introduction of CBDC will also significantly boost digital financial services.

- Digitalizing documents has also played a pivotal role in giving further impetus to digital financial services. The digitization of documents ensures safety, online verification, improved accessibility, and fraud reduction, enhancing use for end customers and the service provider.

OUTLOOK

- India’s services sector growth which was highly volatile and fragile during the last 2 fiscal years, has shown resilience in FY23 driven by the release of pent-up demand, ease of mobility restriction, near-universal vaccination coverage and pre-emptive government interventions.

- Broad-based recovery has been observed in recent months, with pick up in almost all sub-sectors especially contact intensive services sector, which bore the maximum brunt of the pandemic.

- This is reflective of an uptick in the performance of various HFIs, reflecting a solid upswing in recent months, hinting at an enhanced presentation of the services sector in the next fiscal.

- The prospects look bright with improved performance of various sub-sectors like Tourism, Hotel, Real estate, IT-BPM, E-commerce etc. The downside risk, however, lies in the external exogenous factors and bleak economic outlook in Advanced Economies impacting growth prospects of the services sector through trade and other linkages.