Table of Contents

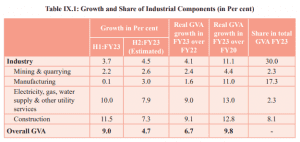

THE CONTEXT: The industry holds a prominent position in the Indian economy contributing about 30 percent of total gross value added in the country. In FY23, the Indian industry faced some extraordinary challenges as the Russian-Ukraine conflict broke out. That led to a sharp rise in the prices of many commodities. In this chapter, the survey will review the performance of the Indian industry in the current financial year.

AN OVERVIEW

- Industry holds a prominent position in the Indian economy, accounting for 31 per cent of GDP, on average, during FY12 and FY21 and employing over 12.1 crore people.

- The sector’s relevance can be identified through various direct and indirect linkages with other sectors, contributing to economic growth and employment.

- It ensures that domestic production can accommodate domestic demand and reduces the reliance on imports.

- Industrial growth has multiplier effects, which translates into employment growth.

- Industrial growth spurs growth in services sectors such as banking, insurance, logistics, etc.

- In FY23, the Industry sector witnessed modest growth of 4.1 per cent compared to the strong growth of 10.3 per cent in FY22.

DEMAND STIMULUS TO INDUSTRIAL GROWTH

- Strong external demand also served the Indian industry well in FY22 when manufactured exports soared, responding to a rebound in global growth. Trade had also recovered and grown as bottlenecks in global supply chains eased.

- The export stimulus for the Indian economy persisted in the first half of FY23. In this half of the year, exports of goods and services as a share of GDP have been the highest since FY16.

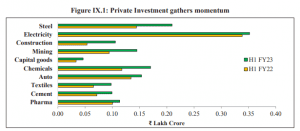

- An increase in investment demand has emerged as another powerful stimulus to industrial growth. It has been triggered by a jump in the Capex of the central government in the current and the previous year as compared to the pre-pandemic years.

SUPPLY RESPONSE OF INDUSTRY

- The supply response of the industry to the demand stimulus has been robust, as seen in high-frequency indicators. The PMI-Manufacturing, for example, has remained in the expansionary zone for 18 months since July 2021.

- The eight core industries of coal, fertilizers, cement, steel, electricity, refinery products, crude oil, and natural gas are critical in meeting the demand for inputs across industries. The growth in these industries has held steady, reflecting a broad momentum in industrial activity.

- Growth in industrial output would have been higher, but for some constraints it faced in the first half of FY23.

- Manufacturing output appears to have been constrained by a large build-up in inventory. For five consecutive quarters ending in Q2 of FY23, an increase in stocks had accumulated to more than 1.3 per cent of the annual GDP.

- The manufacturing landscape shows uneven growth across various categories. For example, the motor vehicles manufacturing segment’s performance continues to improve, induced by robust demand and an easing of chip shortage.

- The manufacturing of ‘computer, electronic and optical products’, an upcoming industry, has also been rising.

- Growth in pharmaceutical output has slowed due to an unfavourable base effect and the waning of the pandemic.

ROBUST GROWTH IN BANK CREDIT TO INDUSTRY

- Growth in bank credit has kept pace with industrial growth, with a sequential surge evident since January 2022.

- Credit to MSMEs has also seen a significant increase in part assisted by the introduction of the Emergency Credit Line Guarantee Scheme (ECLGS), which supports around 1.2 crore businesses of which 95 per cent are MSMEs.

- The share of MSMEs in gross credit offtake to the industry rose from 17.7 per cent in January 2020 to 23.7 per cent in November 2022.

RESILIENT FDI INFLOW IN MANUFACTURING SECTOR

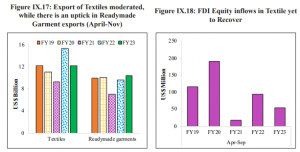

- Annual FDI equity inflows in the manufacturing sector have been steadily increasing over the last few years. It jumped from US$ 12.1 billion in FY21 to US$ 21.3 billion in FY22 as the pandemic-driven expansionary policies of advanced economies led to a surge in global liquidity.

INDUSTRY GROUPS

Micro, Small and Medium Enterprises (MSMEs) post smart recovery from pandemic

- While the contribution of the MSME sector to overall GVA rose from 29.3 per cent in FY18 to 30.5 per cent in FY20, the economic impact of the pandemic caused the sector’s share to fall to 26.8 per cent in FY21. MSME contribution to the manufacturing sector’s GVA also marginally fell to 36.0 per cent in FY21.

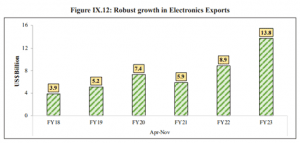

Electronics industry to be a key driver of manufacturing output and exports

- The electronics industry continues to ascend in importance as its applications become pervasive, particularly in the socio-economic development of a country.

- Electronics, supported by continuously improving communication services, will significantly enhance productivity, efficient service delivery, and social transformation.

- The domestic electronics industry, as of FY20, is valued at US$118 billion. India aims to reach US$300 billion worth of electronics manufacturing and US$ 120 billion in exports by FY26, supported by the vision of a US$ 1 trillion digital economy by 2025.

- Improvement in manufacturing and export over the past five years ensures that India is on the right trajectory to achieve this target.

- Electronic goods were among the top five commodity groups exhibiting positive export growth in November 2022, with the exports in this segment growing YoY by 55.1 per cent.

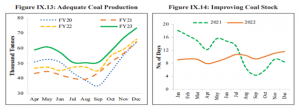

CoaI Industry: Key in maintaining energy self-reliance during uncertain times

- At the beginning of the fiscal year, coal availability became a challenge for India’s largely thermal-based power generation plants because of a resurgence in economic activity and the emergence of intense heat waves from early March to mid-May of 2022, increasing the demand for power in the country.

- In addition, in the wake of rising international coal prices, the power sector curtailed coal import drastically from 69 MT in FY20 to 45 MT in FY21 and further to 27 MT in FY22.

- As domestic coal production could not keep pace with its rising demand from power-generating plants, its availability got limited. Resultantly, in April 2022, even as coal offtake rose to meet higher demand, coal stock with power plants, as on 31st April 2022, fell to 8 days from 12 days a year ago.

Re-invigorated infrastructure sector & construction activity to drive steel industry

- Steel sector plays a pivotal role in crucial sectors such as construction, infrastructure, automobile, engineering and defence.

- Over the years, the steel sector has witnessed tremendous growth. The country is now a global force in steel production and the 2nd largest crude steel producer in the world.

- The steel sector’s performance in the current fiscal year has been robust, with cumulative production and consumption of finished steel at 88 MT and 86 MT, respectively, during April-December 2022, higher than the corresponding period during the previous four years.

- The growth in finished steel production is aided by double-digit growth in consumption (11 per cent on a YoY basis), bolstered by a pick-up in the infrastructure sector significantly driven by increased Capex of the government.

Government support to help textile Industry weather current challenges.

- The Textile industry is one of the country’s most significant sources of employment generation, with an estimated 4.5 crore people directly engaged in this sector, including a large number of women and the rural population.

- In the current financial year, the textile industry has been facing the challenge of moderating exports compared to FY22. However, the levels in the eight six months still prevail, 9.5 per cent higher than the corresponding pre-pandemic level of FY20.

- Export of readymade garments registered a growth of 3.2 per cent YoY basis during the same period.

Growth momentum in pharmaceuticals industry sustains after the pandemic

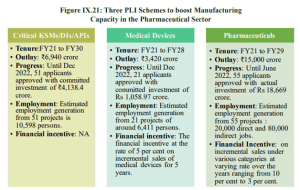

- The Indian Pharmaceuticals industry plays a prominent role in the global pharmaceuticals industry. India’s domestic pharmaceutical market is estimated at US$ 41 billion in 2021 and is likely to grow to US$ 65 billion by 2024 and is further expected to reach US$ 130 billion by 2030.

- India is ranked 3rd worldwide in the production of pharma products by volume and 14th by value.

- The nation is the largest provider of generic medicines globally, occupying a 20 per cent share in global supply by volume, and is the leading vaccine manufacturer globally with a market share of 60 per cent.

India becomes the world’s 3rd largest automobile market

- The automobile sector is a key driver of India’s economic growth. In December 2022, India became the 3rd largest automobile market, surpassing Japan and Germany in terms of sales.

INDIA’S PROSPECTS AS A KEY PLAYER IN THE GLOBAL VALUE CHAIN

- In this fast-evolving context, as global companies adapt their manufacturing and supply chain strategies to build resilience, India has a unique opportunity to become a global manufacturing hub this decade.

Make in India 2.0 and the PLI schemes

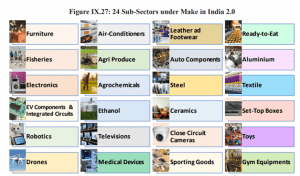

- To further enhance India’s integration in the global value chain, ‘Make in India 2.0’ is now focusing on 27 sectors, which include 15 manufacturing sectors and 12 service sectors.

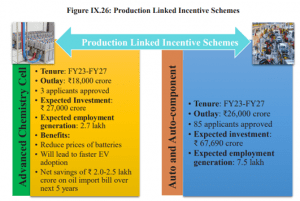

- In pursuit of the objectives of the Make-in-India programme and with a vision to achieve Aatmanirbharta, the government launched the PLI scheme.

- The scheme is expected to attract a capex of approximately ₹3 lakh crore over the next five years. It has the potential to generate employment for over 60 lakh in India and increase the share of the manufacturing sector in total capital formation.

Fostering Innovation

- The government’s efforts towards fostering innovation include incubation, handholding, funding, industry-academia partnership and mentorship.

- The government has also strengthened its IPR regime.

- This has resulted in a 46 per cent growth in the domestic filing of patents over 2016-2021, signalling India’s transition towards a knowledge-based economy.

Structural reforms have enhanced the Ease of Doing Business

- This has been done through various reforms that have led to increased investment inflows and economic growth.

- The reform measures include amendments to laws and liberalization of guidelines and regulations to reduce compliance burdens, bring down costs and enhance the ease of doing business in India.

THE CONCLUSION: Despite global headwinds, industrial production expanded during FY23, backed by sustained demand conditions. The growth in bank credit has kept pace with industrial growth, with a sequential surge evident since January 2022. Credit to MSMEs has seen a significant increase in part, assisted by the introduction of the ECLGS. Amidst heightened global uncertainty, FDI in the manufacturing sector moderated in the first half of FY23. However, inflows stayed well above the pre-pandemic levels, driven by structural reforms and measures improving the ease of doing business, making India one of the most attractive FDI destinations.

Spread the Word