THE CONTEXT: The Indian Rupee has depreciated nearly 10% since the beginning of the year and is making headlines, especially after falling below the psychological mark of 78 against the dollar. In this article, we will analyse the causes and impacts of rupee depreciation.

UNDERSTANDING EXCHANGE RATE THROUGH

DEMAND AND SUPPLY THEORY

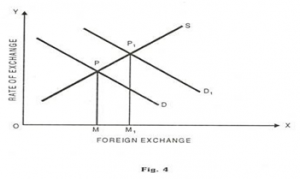

“Demand-Supply Theory” theory asserts that the rate of exchange is the function of the supply of and demand for foreign money and not exclusively the function of prices obtained between two countries.

foreign money and not exclusively the function of prices obtained between two countries.

According to this theory, when the supply of the dollar is reduced, then the more Rupee present in the market chase this less dollar, then Rupee weakens and depreciates. The reasons for the present reduced supply of dollars are given below.

FIVE TIMES RUPEE DEPRECIATION SINCE 2010: INDICATES THE VULNERABILITY OF THE RUPEE

INSTANCES OF RUPEES DEPRECIATION

- First Rupee depreciation occurred in 2011

- The second Rupee depreciation occurred in 2012

- Third Rupee Depreciation occurred in 2013

- Rupee depreciation in 2018

- Rupee depreciation in 2022

REASONS ASSOCIATED WITH THE DEPRECIATION

- It was triggered by the Euro debt crisis

- It was triggered by the likelihood of Greece’s exit from the Eurozone and global credit freeze.

- It was triggered by the increased likelihood of the US federal’s Tapering off the quantitative easing programme.

- Sudden spurt in crude oil prices, reversal of capital flow, Widening current account deficit.

- Sudden spurt in crude oil prices, reversal of capital flow, Russia-Ukraine war

REASONS

Global Reason

- Strengthening of US dollar: the US is keen to speed up its monetary policy ‘normalization’ by raising the interest rates by 75 basis points which encouraged American investors to pull out their money from emerging markets like India and invest in the domestic markets.

- Higher commodity prices (Crude Oil and edible oil): The hostilities and difficult geopolitical issue between nations like USA-Iran hostility is impacting the price of commodities. As India is one of the largest importers of these commodities, these are impacting India’s currency.

- The war between Russia- and Ukraine is another major reason for Rupee Depreciation. Due to the war, the supply chain was interrupted. Hence, India, which is among the major importers affected by this development negatively.

- Rise In Dollar Buying Due To Jump In Oil Prices: India is a net importer of crude oil. Since global oil prices have spiked more than 60% since the start of 2022, Indian companies have to shell out more dollars. It means increased demand for dollars and, consequently, a weaker rupee.

- According to the remittance report provided by RBI, the rate of growth of remittance is less compared to the past year.

- Trends in other markets: The Rupee is also following the trend seen in the currencies of other emerging economies such as Turkey, Indonesia, Russia and South Africa.

Domestic Reasons

- Widening current account deficit: This is resulting in creating more actual as well as speculative demand for the dollar and other convertible currencies.

- Growth slowdown: India’s gross domestic product (GDP) growth fell as a result of the lockdown.

- Speculative trading: Speculative trading in the currency markets is putting further pressure on the Indian Rupee

- The weak Investment environment in India due to High NPA. This has affected Indian Industry’s export potentials.

- Supply of Rupee in the Indian market: During and After the pandemic, the government announced many initiatives and schemes like Atmanirbhar Bharat, which increased the money supply in market. Moreover, RBI reduced the repo rate to 4% to increase the money supply. Such steps weaken Indian Rupee against the dollar.

IMPACT OF RUPEE DEPRECIATION

On Export

- A common belief while the Rupee depreciates against the dollar is that it would help our exports. This argument is based on textbook economics. But in the present context, compared to India, this argument does not hold true.

- As India is facing structural issues in the industry, Hence export is not being competitive to promote the export.

- If export increases, This brings the foreign reserve into India. That provides required forex to manage the deepening Current Account Deficit(CAD)

On Import

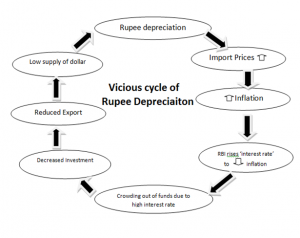

- Imports become expensive as the importer needs to pay more rupees for the dollars billed. Industries linked to imports (or having vital components of their product imported) have to bear higher input cost, which is ultimately passed on to the end-users. This impact leads to inflation.

- Petroleum is India’s largest import item. Any price rise in petroleum has a trickle-down effect on the cost of goods where transportation is an important component of the cost. For example, food grains and vegetables. Similarly, for industries where petroleum products are the major input factors.

ON Investment

- The fund rising through external commercial borrowing (ECB) becomes costly. As the Interest has to be paid higher under the depreciating Rupee.

- Rating agencies may reduce the sovereign rating of the companies.

- The rupee depreciation will directly affect the balance sheets and credit profiles of such corporates that have issued securities without proper hedging currency risks. These corporations may find it difficult to service their foreign-currency debt and may suffer huge losses due to an increase in repayment burden.

- Foreign Portfolio Investors have pulled out nearly Rs 48,000 crore from Indian capital markets in the first six months of 2018, making it the steepest outflow in a decade.

Impact on other sectors

- Demands may further fall due to high prices leading to recession.

- Abroad trips and Foreign studies become costly.

- Domestic tourism could grow as more tourists visit India since their currency can now buy more with respect to the Rupee.

- In the medium term, Export-oriented industries may create more jobs.

STEPS TAKEN BY RBI IN SUCH A SITUATION

CHANGING MONEY SUPPLY

- RBI does it by lowering or raising the mandatory Cash Reserve Ratio (CRR) for commercial banks.

- When the CRR limit is reduced, banks have more money for lending. This increases spare money with the bank. When the CRR limit is raised, the effect is vice versa.

- When banks have more money, more loans are issued. People/businesses, in turn, spend more (control overspending). When spending increases, GDP grows faster. Foreign investment flows in. Demand for INR increases, and it becomes stronger.

- To maintain this situation, RBI is following a moderate monetary policy and the current repo rate is 4.90 percent.

CONTROLLED INFLATION

- RBI does it by lowering or raising the mandatory Cash Reserve Ratio (CRR) for commercial banks.

- When the CRR limit is reduced, banks have more money for lending. This increases spare money with the bank. When the CRR limit is raised, the effect is vice versa. When banks have more money, more loans are issued. People/businesses, in turn, spend more (control overspending). When spending increases, GDP grows faster.

- Foreign investment flows in. Demand for INR increases, and it becomes stronger.

- To maintain this situation, RBI is following a moderate monetary policy and the current repo rate is 4.90 percent.

INTEREST RATES

- This is another tool (Repo Rate) that which government alters to control inflation and economic activity. When the repo rate is low, banks borrow more money from RBI.

- When banks have more money, they lend more money to people/businesses. This way, spending increases in the country; hence government collect more taxes. More spending also leads to higher GDP growth (GDP & tax revenue).

- A balance between GDP growth and low inflation will bring in more foreign investments to India. This leads to a stronger Indian currency.

- In post-pandemic time, RBI is following a moderate monetary policy with a marginal interest rate to boost the economy.

OTHERS

- The RBI announced a series of measures, including relaxation in foreign investment in debt, external commercial borrowings, and Non-Resident Indian deposits.

- RBI has allowed banks temporarily to raise fresh Foreign Currency Non-Resident Bank and Non-Resident External deposits without reference to the current regulations on interest rates, from July 7, 2022, to October 31, 2022.

- The RBI brought in the measures in all the said segments to alleviate dollar tightness with the objective of ensuring orderly market functioning. The new measures are expected to boost inflows as nearly a third of India’s external debt will be due for maturity in the coming months.

THE WAY FORWARD

- In order to keep its own economic stability in globalized world, India should actively engage and lead discussions on addressing the shortcoming of current international monetary and financial arrangements through international cooperation. For this, Global forums like G-20, World Economic Forum etc., would form a base.

- India should develop a robust policy framework which provides for sufficient policy space when responding to external shocks like Rupee depreciation.

- India needs to develop an appropriate monitoring system to detect where financial vulnerability is building up.

- In the long term India should promote Make in India and address structural issues (like labor reforms, tax reforms etc.) to make India more competitive in the export sector. This helps in the long term as a cushion against future rupee depreciation.

- Allowing External Commercial Borrowing (ECB) up to $50 million with minimum maturity from 3 years to 1 year.

- Currency swap arrangement with major oil exporting countries. This helps both countries to stabilize the oil trade.

THE CONCLUSION: Financial market volatility is here to stay as advanced economies are unwinding years of monetary policies. The growing trade tensions between US and China could severely undermine the multilateral trading system. These global developments will continue to exert downward pressure on the Rupee in the coming months. It is therefore imperative for Indian policymakers to prepare for all eventualities.

Question:

- What are the reasons behind the recent depreciation of the Indian currency against the dollar? How will it impact the Indian economy?

- Discuss the impact of Rupee depreciation on India’s foreign trade.

- How the depreciation of any country’s currency affects its economy? In India’s case, what measures should be taken by RBI as well as government to improve the health of the Indian currency?