THE INTRODUCTION: Services sector contributes over 50 percent to India’s GDP. While the Covid-19 pandemic has hurt most sectors of the economy, the services sector has been the worst affected as its’ share in India’s GVA declined from 55 percent in 2019-20 to 53 percent in 2021-22.1 Within the services sector, the effect of Covid-19 has been varied. While non-contact services such as information, communication, financial, professional, and business services have remained resilient, the impact has been much more severe on contact-based services such as tourism, retail trade, hotel, entertainment, recreation, etc.

IMPACT OF COVID-19 AND SEQUENTIAL RECOVERY

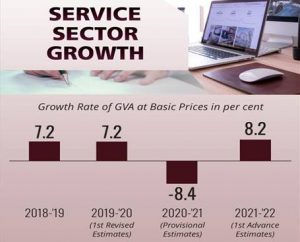

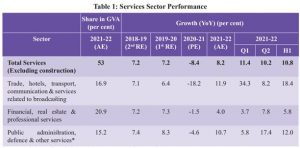

- The services sector contracted by 8.4 percent Year on Year (YoY) in 2020-21 (Table 1). This decline was driven by a sharp contraction of 18.2 percent YoY in the sub-sector ‘Trade, hotels, transport, communication & services related to broadcasting.

- Owing to its contact-intensive nature, the services included in this sub-sector had to bear the maximum brunt of the disruptions caused by the prevailing pandemic.

- The sub-sector ‘Public administration, defense & other services’ includes expenditure by the government and services such as health, education, recreation, etc, on the other, contracted by 4.6 percent YoY in 2020-21.

- The relatively less contact intensive sub-sector ‘Financial, real estate & professional services’ was the least impacted, with a marginal decline of 1.5 percent YoY in its GVA during 2020-21.

TRENDS IN HIGH-FREQUENCY INDICATORS

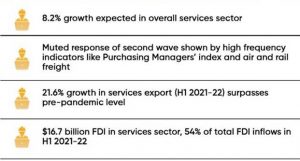

The upturn in Services GVA, when seen with the trend in high-frequency indicators such as Purchasing Managers Index (PMI) Services Index, freight and passenger traffic point to a pickup in economic momentum.

SERVICES PMI

- India’s services sector activity, gauged by PMI services, which had contracted for five consecutive months since March 2020, recovered sharply in October 2020. It dropped again for three consecutive months (May, June, and July 2021) as a consequence of the second Covid-19 wave. Notably, the contraction during May-July 2021 was not as sharp as seen during the first lockdown.

- With the easing of restrictions, PMI Services started to grow once again from August 2021 recording the strongest jump in over 10 years to 58.4 in October 20213 (Figure 1(a)). PMI index moderated to 55.5 in December 2021.

FREIGHT TRAFFIC

- As the economy gradually opened up in June 2020, freight traffic also improved. Freight traffic registered strong growth during April- June 2021, partly reflecting the rebound from the low base during the same period last year. The impact of the second covid wave in April-May 2021 on these indicators was much more muted as compared to during the full lockdown in March-May 2020.

BANK CREDIT TO THE SERVICES SECTOR

- Bank credit growth to the services sector which had moderated significantly in 2019, started picking up in 2020, increasing to 8.8 percent (YoY) at the end of December 2020, as compared to 6.2 percent in December 2019 (Figure 2). This momentum has lost its pace in 2021-22.

- Bank credit growth decelerated to 3.6 percent YoY at the end of November 2021 as compared to 8.2 percent a year ago. However, it is important to note that corporates have raised more money through capital markets than banking capital in 2021-22 so far.

SERVICES SECTOR SHARES AT THE STATE AND UT LEVEL

- The services sector accounts for more than 50 percent of the Gross State Value Added (GSVA) in 12 out of the 33 states and UTs (Table 3). Chandigarh stands out with a particularly high share of services in GSVA at 74 percent while Sikkim’s share remains the lowest at 24.25 percent. Notably, the Services share in Sikkim’s GSVA has increased from over 18 percent in 2018-19 to over 24 percent in 2020-21. Similarly, over the last three years, the share of services in GSVA has increased by over 4 percent for Himachal Pradesh and Odisha. Maharashtra and Karnataka are the top two contributors to services GSVA, with Rs 15.1 lakh crore and Rs 9.71 lakh crore gross value added by the services sector in 2020-21 respectively.

- Due to the Covid-19 pandemic and restrictions on movement, GSVA in the services sector declined in 2020-21 relative to the pre-pandemic year 2019-20. This is true for 13 out of 20 states for which data is available. During 2020-21, services GSVA contracted by almost 11 percent in Rajasthan and almost 10 percent in Jharkhand and Punjab. On the other hand, Sikkim achieved the highest growth of 11.71 percent in services GSVA during 2020-21.

FDI IN SERVICES

- The Services Sector was the largest recipient of FDI inflows in India. During H1 2021-22, Services Sector received $ 16.73 billion in FDI equity inflows. “Financial, Business, Outsourcing, R&D, Courier, Tech testing & Analysis along with Education sub-sector witnessed strong FDI inflows”, mentioned the Survey.

TRADE-IN SERVICES

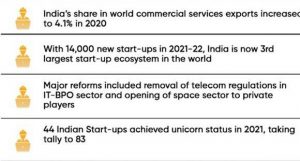

- India had a dominant presence in global services exports. It remained among the top ten services exporter countries in 2020, with its share in world commercial services exports increasing to 4.1% in 2020 from 3.4% in 2019. “The impact of Covid-19 induced global lockdown on India’s services exports was less severe as compared to merchandise exports”.

- Despite Covid-19’s impact on transport exports, double-digit growth in gross exports of services, aided by exports of software, business, and transportation services, resulting in an increase of 22.8% in net exports of services in H1 2021-22.

SUB-SECTOR WISE PERFORMANCE

IT-BPM (INFORMATION TECHNOLOGY – BUSINESS PROCESS MANAGEMENT) SECTOR

- IT-BPM sector as a major segment of India’s services. During 2020-21, according to NASSCOM’s provisional estimates, IT-BPM revenues (excluding e-commerce) reached $ 194 billion, growing by 2.26% YoY, adding 1.38 lakh employees.

- Within the IT-BPM sector, IT services constitute the majority share (>51%). The Economic Survey observed that over the last year, several policy initiatives have been undertaken to drive innovation and technology adoption in the sector, including relaxation of Other Services Provider regulations, Telecom Sector Reforms, and Consumer Protection (e-commerce) Rules, 2020.

- This would significantly expand access to talent, increase job creation and catapult the sector to the next level of growth and innovation.

STARTUPS AND PATENTS

- Startups in India had grown remarkably over the last six years, most of which belonged to the Services Sector. More than 61,400 startups have been recognized in India as of January 10, 2022.

- India had a record number of Startups (44) reaching unicorn status in 2021.

- intellectual property, specifical patents were key to a knowledge-based economy.

- The number of patents filed in India has gone up to 58,502 in 2020-21 from 39,400 in 2010-11 and the patents granted in India have gone up to 28,391 from 7,509 during the same period.

Tourism Sector

- The tourism sector was a major contributor to GDP growth, foreign exchange earnings, and employment, however, the Covid-19 pandemic had a debilitating impact on world travel and tourism everywhere, including India.

- The resumption of International tourism will continue to depend largely on a coordinated response among countries in terms of travel restrictions, harmonized safety, and hygiene protocols, and effective communication to help restore consumer confidence.

- Special international flights have been operating under the Vande Bharat Mission which was currently in its 15thphase and had carried over 63.55 lakh passengers.

PORTS, SHIPPING, AND WATERWAYS SERVICES

- The development of ports was crucial for the economy. Ports handled around 90% of export-import cargo by volume and 70% by value.

- The total cargo capacity of all ports had increased to 1,246.86 Million Tonnes Per Annum (MTPA) as of March 2021 from 1052.23 MTPA in March 2014.

- Also, the Port traffic had picked up in 2021-22 registering a growth of 10.16% during April-November 2021, after being hit by disruptions caused by Covid-19 in 2020-21.

- The Sagarmala Programme, a flagship program, aimed at promoting port-led development in the country with 802 projects worth Rs. 5.53 lakh crore under its ambit.

SPACE SECTOR

- Since its inception in the 1960s, the Indian space program has grown drastically. Capabilities have been developed in the space sector across all domains including indigenous space transportation systems, space assets comprising a fleet of satellites catering to various needs of the society.

- The Government undertook various reforms in the space sector in 2020, envisaging participation of the private sector in providing space-based services. These reforms included empowering New Space India Limited (NSIL) and changing the present supply-based model to a demand-driven model; creating an independent nodal agency i.e. Indian National Space Promotion and Authorization Centre (IN-SPACe) under the Department of Space; and providing a predictable, forward-looking, well defined and enabling regulatory regime for space activities in the country.

HIGHLIGHTS

- GVA of services crossed pre-pandemic level in July-September quarter of 2021-22; however, GVA of contact intensive sectors like trade, transport, etc. still remain below pre-pandemic level.

- Overall service Sector GVA is expected to grow by 8.2 percent in 2021-22.

- During April-December 2021, rail freight crossed its pre-pandemic level while air freight and port traffic almost reached their pre-pandemic levels, domestic air, and rail passenger traffic are increasing gradually – showing the impact of the second wave was much more muted as compared to during the first wave.

- During the first half of 2021-22, the service sector received over US$ 16.7 billion in FDI – accounting for almost 54 percent of total FDI inflows into India.

- IT-BPM services revenue reached US$ 194 billion in 2020-21, adding 1.38 lakh employees during the same period.

- Major government reforms include, removing telecom regulations in the IT-BPO sector and opening up of space sector to private players.

- Services exports surpassed the pre-pandemic level in the January-March quarter of 2020-21 and grew by 21.6 percent in the first half of 2021-22 – strengthened by global demand for software and IT services exports.

- India has become 3rd largest start-up ecosystem in the world after US and China. The number of newly recognized start-ups increased to over 14000 in 2021-22 from 733 in 2016-17.

- 44 Indian start-ups have achieved unicorn status in 2021 taking the overall tally of unicorns to 83, most of which are in the services sector.