THE CONTEXT: India is planning to replace its minimum wage system with a living wage by the year 2025. In this context, the government is seeking technical assistance from the International Labour Organization (ILO) to develop a framework for estimating and implementing it. This move follows the ILO’s endorsement of the concept of a living wage which came after an agreement was reached during a meeting of experts on wage policies recently. It was subsequently endorsed by the ILO’s governing body. This article analyses the concept of living wage and its significance and challenges in its implementation from the UPSC PERSPECTIVE.

EXPLANATION OF THE CONTEXT

The country aims to transition from the minimum wage to the living wage by 2025 that covers housing, healthcare, food, education, and clothing expenditure.

- India is seeking technical assistance from the International Labour Organization (ILO) to improve its capacity for systemic data collection to establish a framework for calculating and implementing a living wage.

- Living wages, designed to exceed basic minimum wages, are intended to provide workers with income sufficient to cover essential social expenditures such as housing, food, healthcare, education, and clothing.

- The ILO’s recent endorsement of the concept of a living wage underscores the global momentum toward uplifting millions out of poverty and safeguarding their well-being.

- India has more than 500 million workers, with 90% in the unorganized sector. While many earn a daily minimum wage of ₹176 or more, stagnant since 2017, the national wage floor lacks enforceability across states leading to wage payment discrepancies.

- This lack of upward movement in wages has led to disparities in wage payments across different states. In this context, Indian government hopes to demonstrate the beneficial economic impacts of adopting living wages.

DIFFERENT TYPES OF WAGES

MINIMUM WAGE

- International Labour Organisation (ILO) defines it as “the minimum amount of remuneration that an employer is required to pay wage earners for the work performed during a given period. It cannot be reduced by collective agreement or an individual contract”.

- In India, minimum wage changes from state to state and city to city. In some states it is Rs 22 per hour to Rs 50 per hour.

- Maharashtra has a basic minimum wage of Rs 62.87 for unskilled labourers as compared to Bihar which has the minimum wage at Rs 49.37 an hour.

LIVING WAGE

- The living wage is defined by the ILO as “the wage level necessary to afford a decent standard of living for workers and their families, taking into account the country’s circumstances and calculated for the work performed during normal hours.”

- Living wage is wider in scope than minimum wage and tends to be higher.

- While the minimum wage aims to protect workers from low pay, the living wage goes further by providing enough income to cover basic needs such as food, clothing, shelter, and more.

FAIR WAGE

- A ‘fair wage’ is a mean between ‘living wage’ and ‘minimum wage’.

- It is above the minimum wage but still falls below what is required for a living standard.

- The upper boundary of a fair wage is determined by the industry’s financial capability to compensate.

STARVATION WAGE

- It refers to the wages which are insufficient to provide the ordinary necessities of life.

WHAT IS THE LAW REGARDING WAGES IN INDIA?

- Since labour is a concurrent subject under the Indian Constitution, minimum wage rates are determined both by the Central Government and the state governments.

- Minimum wage rates in India are declared at the national, state, sectoral and skill/ occupational levels.

- Minimum wage rates may be established for any region, occupation and sector. Also, the minimum wage is established for trainees, youth and piece-rate workers. The minimum wage is determined by considering the cost of living.

Minimum Wages Act, 1948

- Minimum wage rates in India are fixed under the Minimum Wages Act, 1948. Under the Act, both the Central and State Governments may notify the scheduled employments and fix/revise minimum wage rates for these scheduled employments.

- This varies based on location, nature of work, the type of industry and skills of the worker. For instance, different wage levels are provided for the unskilled, semi-skilled, skilled, and highly skilled employment.

- The scheduled employments include both the agricultural and non-agricultural employments. Both the Central and State Governments are empowered to notify any employment (industry/sector) in the schedule where the number of employees is 1000 or more and fix the rates of minimum wages in respect of the employees employed therein.

- The minimum wages notified by the central or state governments must be higher than the floor level wage. Where the existing minimum wages are higher than the floor wage, these cannot be reduced.

- Minimum wages notified by the government are either time based (number of hours of work) or per piece. The minimum wages must be revised and reviewed by the central or state governments at an interval of not more than 5 years.

- Flexibility of Minimum Wage Standards: In 1996, the concept of National Floor Level Minimum Wage (NFLMW) was introduced with state governments not allowed to go any lower than NFLMW. In 2023, that stood at INR178 per day or higher, based on location. States have rolled out their minimum wage stipulations, with this as the baseline.

The Code of Wages, 2019:

- It was introduced in an attempt to bring uniformity in the implementation of legal policies governing the payment of wages. The Code on Wages, 2019 integrates four existing labour laws, including the Minimum Wages Act, 1948.

- As per Section 5 of the Code on Wages 2019, no employer can fix the minimum wage below it. However, it’s not a mandatory provision, the minimum wage rates can be revised accordingly by the State. However, this code, which is binding on all states, is yet to be implemented.

WHAT IS THE EXTENT OF WAGE DISPARITY IN INDIA?

- Presently, India’s workforce exceeds 500 million individuals, with roughly 90% employed in the unorganized sector, leaving them outside the ambit of social security protections. In such a scenario, enforcement of the law and ensuring minimum wages becomes challenging.

- The national floor-level minimum wage (NFLMW) has remained stagnant since 2017 and lacks enforceability, potentially resulting in lower wages across various Indian states.

- The NFLMW is currently determined based on a formula linked to poverty line estimates established in 1970 by the erstwhile Planning Commission. However, critics argue that this methodology fails to account for changes in spending patterns over the years.

- According to the Economic Survey 2022-23, the real wage growth in India has been negative despite nominal wage increases, primarily due to inflation.

- Besides, employers also exploit loopholes to exempt certain types of employees from payment of minimum wages. One such example is gig workers.

- Gender wage disparity: There also tends to be a pay disparity between male and female workers.

- Rural urban disparity: Wages are a function of demand and supply. In rural areas, the MNREGA rates that range between INR221 and INR357 (across different states) often become the floor wages for agri-labourers. In urban areas, a shortage of skilled and semi-skilled workers like masons, plumbers, carpenters, painters lead to increased pay for them.

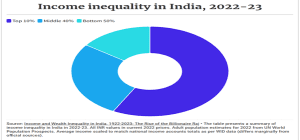

- Income inequality: The income share of the top 1% in India indicates the proportion of national income that goes to the wealthiest 1% of the population. In 2022, the income shares of wealthiest stood at 22.6%, highlighting a significant concentration of wealth at the top end of the income distribution. This share is substantially higher than what it was in 1951 (11.5%) and just before India’s economic liberalisation in the 1980s (6%).

Effectiveness of minimum wage in India:

- The main problem in the effectiveness of minimum wages is poor implementation. It affects the unorganized sector and acts as a hindrance for their growth and providing them a decent living.

- The issue arises mainly due to lack of awareness amongst the workers about minimum wage provisions and their entitlement under the labour laws.

- Surveys have shown that almost 80% of the workers in unorganized sector earn less than 208 rupees a day, or less than half the government-stipulated rural minimum wage of 49 rupees a day and urban wage of 67 rupees.

- This is particularly true in remote areas and in areas where workers are not unionized or otherwise organized. As a result, their wages have long since failed to keep pace with rising costs and continue to diminish in real value over time.

- The rates of minimum wages fixed in few states is not enough even for two times meal in a day, leave aside the needs of health, education and shelter.

WHY THE PROPOSAL FOR A LIVING WAGE?

REDUCE WAGE INEQUALITY

- Since the early 2000s, India’s inequality has increased significantly, with the top 1% owning 22.6% of the country’s income. Therefore, in order to address this inequality, India needs to redesign its wage structure.

- According to the data, the current minimum price is not sufficient in fulfilling the needs of the workers and they often fall below poverty line.

- A well-designed living wage system is required to reduce wage inequality in the country.

- As we are a developing nation, we should mandatorily fix the wage for the workers which provides them all the basic necessities.

- As minimum wages are not sufficient in fulfilling the needs of the workers, we should focus more on living wage and its efficient implementation in every state.

HIGHER ECONOMIC GROWTH

- One of the motivating factors for the government seeking a shift from the minimum to living wage system has been the buoyancy in economic growth.

- In the fiscal year 2023-2024, GDP growth is expected to rise to 7.6 per cent.

- The accelerated growth path has encouraged the government to move towards a new approach, as the economy is considered strong enough now to bear the higher burden of enhanced wages.

- In case the policy does shift, it will come as a profitable situation to India’s roughly 550 million workforces.

ALLEVIATING POVERTY AND IMPROVE STANDARD OF LIVING

- A living wage considers essential expenses such as housing, clothing, food, education, healthcare, and overall standard of living.

- In contrast, minimum wages are based on labour productivity and skill levels, making living wages higher.

- The shift from minimum wages to living wages is aimed at accelerating efforts to lift millions out of poverty and ensure their well-being.

- The current minimum wage is seen as insufficient to meet basic needs of workers especially with inflation. They often fall below the poverty line after getting minimum wages

ACHIEVING SDGs

- India is committed to achieving the Sustainable Development Goals (SDGs) by 2030, including the goal of promoting decent work and economic growth.

- It is believed that replacing minimum wages with living wages could fast-track India’s efforts to pull millions of its people out of poverty while ensuring their wellbeing.

POSITIVE WORK CULTURE

- Higher wages can boost employee morale, leading to increased productivity, reduced turnover rates, and improved customer satisfaction.

- By investing in the well-being of their employees, businesses can create a positive work environment that fosters loyalty and a strong work ethic.

HOW CAN LIVING WAGE BE IMPLEMENTED?

SUITABLE FRAMEWORK

- The government is proposing for suitable framework for its assessment and implementation, for which technical assistance has been sought from the International Labor Organization (ILO).

- Under the living wage, all workers will get enough money to meet their basic needs. Which includes housing, food, health care, education and clothing.

IMPLEMENTATION OF WAGE CODE 2019

- The Wage Code, passed in 2019 but not yet implemented. In this, a floor wage has been proposed which after implementation will be binding on all the states.

- The government is striving towards achieving the Sustainable Development Goals (SDGs) by 2030 and implementation of wage code could accelerate efforts to lift millions of people in India out of poverty.

ROLE OF COMPANIES

- Companies have an important role to play to advance decent work and address working poverty in their operations and supply chains by improving and promoting living wages.

- They need to understand the concept of a living wage as an essential aspect of decent work and its importance for responsible business.

- Companies should be inspired to provide the incentives to ensure their employees are paid a living wage which will benefit business and act as a contribution to the achievement of the SDGs.

MULTIFACETED APPROACH

A multifaceted approach is needed to implement living wages by:

- Implementing progressive taxation to ensure that the wealthy contribute a fairer share.

- Enhancing access to quality education and healthcare for all to improve socio-economic mobility.

- Strengthening social safety nets and welfare schemes for the economically disadvantaged.

- Encouraging inclusive economic growth that benefits all segments of society.

- Ensuring fair labour practices and wages.

ECONOMIC POLICIES

- There can be additional public resources for public services by progressive taxes on wealthy and by increasing the effective taxation on corporations, more importantly broadening the tax base through better monitoring of financial transactions.

- By ensuring universal access to public funded high-quality services like public health and education, social security benefits, employment guarantee schemes inequality can be reduced to great extent.

- The Labor-intensive manufacturing has the potential to absorb millions of people who are leaving farming while service sector tends to benefit majorly urban middle class.

PROMOTING CIVIL SOCIETY ROLE

- There is a need to provide a greater voice to traditionally oppressed groups by enabling civil society groups like unions and association within these groups.

- Scheduled castes and Scheduled tribes should be motivated to become entrepreneurs, schemes like Stand-up India need to be expanded to widen its reach by increasing funding.

- For empowerment of women, gender equality policies like affirmative action by reserving seats in legislatures, increasing reservation at local self-government both at Urban and village level to 50% in all states, raising awareness about women rights.

WHAT ARE THE CHALLENGES IN IMPLEMENTATION?

DIVERSITY ACROSS STATES

- Determining and implementing a national living wage framework across diverse states with varying costs of living requires careful planning.

- Regional disparities are persistent as states lay down their minimum wages even if the Union government sets higher rates.

- Given the fact that the minimum wage is enforced in an uneven manner, the living wage initiative is bound to be resisted by state governments as well as private industry.

IMPACT ON BUSINESSES

- Some businesses, particularly small and medium enterprises, might face financial strain due to increased labour costs.

DIVERSITY IN LIVING COSTS

- The cost of living varies significantly between cities, states, and even districts, making it challenging to establish a uniform living wage rate.

UNORGANISED SECTOR

- Of the nearly 500 million strong workforces, most of them are employed with the unorganised sector which falls outside the purview of scrutiny.

- This unorganised sector is hard to be taken into account due to lack of sufficient data.

FISCAL IMPLICATIONS

- Moving towards a living wage would impose much higher labour costs on both government and private sector.

- Private-sector employers would be reluctant to pay higher than necessary wages in fear of lower profits.

- Imposing a living wage means creating a wage floor, which would hurt the economy by impacting businesses, especially those that cannot pay hiked salaries.

- The issue of effective implementation will have to be given careful consideration while formulating the plans to launch a living wage in this country.

LACK OF AWARENESS

- There is a lack of awareness amongst the workers about minimum wage provisions and their entitlement under the labour laws.

- This is particularly true in remote areas and in areas where workers are not unionized or organized.

- As a result, their wages have failed to keep pace with rising costs and continue to diminish in real value over time.

POTENTIAL IMPACT OF AUTOMATION AND THE GIG ECONOMY ON WAGES

- The rise of automation and the gig economy presents unique challenges for maintaining fair compensation for workers.

- As technology advances, certain jobs may become obsolete or undergo significant transformations.

- On the other hand, critics of the concept say companies may cut back on hiring if forced to pay increased wages, creating more job losses.

INTERNATIONAL SCENARIOS

- The concept of minimum wage is globally followed with regional differences. While some countries like Germany rely on a government-mandated national minimum wage that applies uniformly across all regions, some others like Italy do not have a minimum wage but it protects workers through collective agreements between employers and labour unions.

- Living wage, as a concept, is more relevant for developing and underdeveloped countries where the cost of labour is very competitive and hence wages face downward pressure. The minimum wage, in the case of a developed country, may end up being more than the living wage of a developing country, as evident by the UK example.

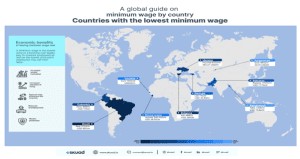

Countries with the lowest minimum wage in the world

Countries with an officially set minimum wage of less than 500 U.S. dollars (USD) a month have the lowest minimum wage in the world. They include:

- Bangladesh: The minimum wage in Bangladesh is set to 1,500 Bangladeshi taka (BDT) or 14.62 USD a month.

- Georgia: The minimum wage is approximately 115 Georgian lari (GEL) a month for public employees and 20 Georgian lari a month for private sector workers. That is around 7.45 to 42.84 USD a month.

- Kyrgyzstan: The minimum wage rate is set at 1,970 Kyrgyzstani som (KGS) or 23.31 USD per month.

- Gambia: The minimum wage is 50 Gambian dalasi (GMD) a day or roughly 23.40 USD a month.

- Sierra Leone: The minimum wage is 500,000 Sierra Leonean leones (SLL) per month or 26.95 USD.

- Pakistan: Pakistani employees must be paid at least 17,500 Pakistan rupees (PKR) per month or 77.70 USD.

- Ukraine: Ukrainian workers are entitled to a monthly minimum wage of 183.27 USD (6,700 ukrainian hryvnia). Ukraine is one of the countries remote organizations should target for hiring top talent.

- Colombia: The minimum wage in Colombia is 175 USD (689 Colombian pesos) per month. However, at the beginning of each year, the colombian government reviews the minimum wage.

- Brazil: Brazil’s minimum wage starts from 230.92 USD and goes as high as 601.62 USD monthly. The minimum wage in Brazil varies by state.

- Bulgaria: Bulgaria’s minimum wage is 382.77 USD.

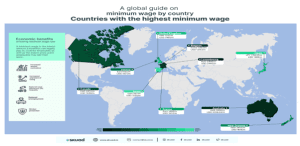

Countries with the highest minimum wage in the world

Countries with an officially set minimum wage of more than 1000 USD a month have the highest minimum wages in the world. They include:

- United Kingdom: Depending on age, the minimum wage rate is approximately 7.20 pounds sterling (GBP) per hour at a high and 3.40 pounds sterling per hour at a low. That is around 691.67 to 1,465 USD a month. Check here to learn how to manage payroll in the United Kingdom.

- US: while there is a federal minimum wage, many states and cities have rolled out their minimum wage laws that exceed the federal rate to factor in the local cost of living.

- France: The minimum wage is around 1,466.62 euros (EUR) per month or 1,533.50 USD.

- New Zealand: The approximate minimum wage is 15.25 New Zealand dollars per hour for workers ages 18 years or older and 12.20 per hour for those aged 16 or 17 or in training. That is an estimated range of 1,293.33 to 1,616.67 USD a month.

- Ireland: The minimum wage is 9.15 euros (EUR) per hour. Depending on age, training, and experience, the minimum wage rate can be only 90% or less of the full 9.15 per hour (at most 8.24 per hour). By the third year of working with a company, the employee’s minimum wage is increased to the full amount. This is around 1,445 to 1,621.67 USD a month.

- Luxembourg: The minimum wage for employees 18 and older in Luxembourg is 2,440 USD (2,300 EUR) per month.

- Australia: The minimum wage is estimated to be 812.50 Australian dollars (AUD) per week or 2208.04 USD a month.

- Belgium: Every worker in Belgium aged 18 and above is entitled to a monthly minimum wage of 1,943 USD (1,842 Euros).

- Canada: Canada’s minimum wage varies according to the employee’s province. For instance, the minimum wage in Ontario is 11 USD/hour while the minimum wage in Manitoba is 10 USD.

- Japan: Japan’s minimum wage varies according to the different provinces. However, the minimum wage ranges from 5.80 USD per hour to 7.85 USD per hour. Discover countries in the world that offer free healthcare in this article.

THE WAY FORWARD

- Government Legislation: The government needs to bring adequate legislation and policies for Living Wage by enacting laws that establish minimum wage standards, governments can set a baseline for fair pay. However, to truly address the issue of living wages, governments must push beyond minimum wage laws and consider comprehensive policies that take into account the cost of living.

- Incorporating Multidimensional Indicators in Calculating Poverty: ILO must take into account health, education and standard of living as key indicators to arrive at a definition of living wages as these measures are used to assess the national multidimensional poverty in India. The standard of living component must include the components of economic, social and demographic factors.

- Inflation Adjusted Wage: The criterion of minimum wage needs to be adjusted regularly to keep pace with the inflation.

- Incentivise small businesses: There is a need to support small businesses and industries that struggle with increased labour costs. Governments can incentivize businesses to pay living wages through tax credits, grants, or procurement policies. Additionally, organizations can collaborate with employers to develop innovative approaches, such as shared responsibility models, that distribute the costs of living wages more equitably.

- International examples: Many organizations in UK that have adopted the living wage standard have reported increased employee satisfaction, reduced turnover rates, and improved productivity. The city of Seattle in USA raised its minimum wage to $15 per hour, which is considered a living wage in the area. The move has led to improved working conditions for low-wage workers and has been heralded as a step towards a more equitable society.

- Collective Bargaining in Wage Setting: Negotiations and collective bargaining play a vital role in the establishment of fair wages. By empowering workers to collectively negotiate their wages and working conditions, unions can ensure that workers’ interests are effectively represented and protected.

- Integration of Living Wages into Sustainable Development Goals: Aligning living wages with the broader framework of sustainable development can strengthen the global commitment to fair compensation and accelerate progress towards a more just and prosperous future for all.

THE CONCLUSION: The Indian government has sought technical assistance from the ILO to create a framework for the living wage. The shift from the minimum wage to living wage by 2025 represents a significant step towards improving the lives of Indian workers. However, balancing affordability for businesses with ensuring worker well-being will be crucial for the achieving the goal. Despite various challenges, India remains committed to achieving the Sustainable Development Goals (SDGs) by 2030, including the goal of promoting decent work and economic growth. For the living wage system to play a meaningful role in aligning protection with the promotion of sustainable growth, it must be properly designed with clear goals for its effective implementation.

MAINS PRACTICE QUESTIONS

Q.1 What is your opinion about the proposal of the Indian government to implement the living wage? Will it be successful in addressing the huge income disparity and wealth inequality in India? Argue.

Q.2 Briefly explain the various types of wages. Also explain the challenges related to implementation of living wage in the country and suggest ways for its successful implementation.

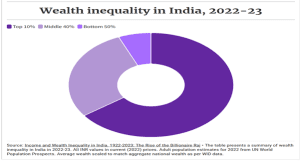

DATA ABOUT THE INCOME AND WEALTH DISPARITY IN INDIA

- The Paris-based World Inequality Lab, has released a report on the state of inequality in India. Titled, Income and Wealth Inequality in India, 1922-2023: The Rise of the Billionaire Raj.

- It says “the ‘billionaire raj’ (a term used to define the post-2010s rapid rise of billionaires in the country, at odds with lives of millions) is now more unequal than the British colonial raj”.

- It finds that while inequality has been rising sharply in India since the 1980s, “between 2014-15 and 2022-23, the rise of top-end inequality has been particularly pronounced in terms of wealth concentration.”

It has listed five “Key findings” as follows.

1. “Inequality has declined post-independence till the early 1980s, after which it began rising and has skyrocketed since the early 2000s.

2. Between 2014-15 and 2022-23, the rise of top-end inequality has been particularly pronounced in terms of wealth concentration. By 2022-23, top 1% income and wealth shares (22.6% and 40.1%) are at their highest historical levels and India’s top 1% income share is among the very highest in the world, higher than even South Africa, Brazil and US.

3. The report finds suggestive evidence that the Indian income tax system might be regressive when viewed from the lens of net wealth.

4. A restructuring of the tax code to account for both income and wealth, and broad-based public investments in health, education and nutrition are needed to enable the average Indian, and not just the elites, to meaningfully benefit from the ongoing wave of globalization. Besides serving as a tool to fight inequality, a “super tax” of 2% on the net wealth of the 167 wealthiest families in 2022-23 would yield 0.5% of national income in revenues and create valuable fiscal space to facilitate such investments.

5. The report emphasises that the quality of economic data in India is notably poor and has seen a decline recently. It is therefore likely that these new estimates represent a lower bound to actual inequality levels.

DPSP ARTICLES RELEVANT TO ENSURE INCOME EQUALITY AND EQUAL WAGE

Article 38

Promote the welfare of the people by securing a social order through justice social, economic and political and to minimise inequalities in income, status, facilities and opportunities

Article 39

Secure citizens:

- Right to adequate means of livelihood for all citizens

- Equitable distribution of material resources of the community for the common good

- Prevention of concentration of wealth and means of production

- Equal pay for equal work for men and women

- Preservation of the health and strength of workers and children against forcible abuse

- Opportunities for the healthy development of children

Article 41

In cases of unemployment, old age, sickness and disablement, secure citizens:

- Right to work

- Right to education

- Right to public assistance

Article 42

- Make provision for just and humane conditions of work and maternity relief

Article 43

- Secure a living wage, a decent standard of living and social and cultural opportunities for all workers

Article 43A

- Take steps to secure the participation of workers in the management of industries

Article 47

- Raise the level of nutrition and the standard of living of people and to improve public health

CASE LAW RELATED TO EQUAL PAY

Randhir Singh v UOI

- The legal principle of “equal pay for equal work” is mentioned under Article 39(d), Part IV of the Constitution of India.

- In Randhir Singh v UOI, it was held by Supreme Court that though this doctrine is mentioned under Part IV of the Constitution and it does not have a status of a Fundamental Right, but it is certainly regarded as a constitutional goal.

- Therefore, it can be enforced through the remedies provided under the Article 32 of the Constitution.

- The Court in a case has also held that this principle can only be invoked if there is a similarity in the nature of the job and it carries the same qualification otherwise it cannot be said to qualify the doctrine.

The Equal Remuneration Act:

- This act was passed in 1976 to ensure that men and women receive equal pay for equal work. The act applies to all organizations, whether public or private, and covers both regular and casual employees.

- Age discrimination and gender discrimination are covered by this Act. For purposes of this Act, the following expressions shall have the meanings assigned to them hereunder:-

- Age means a person’s age as of the relevant date

- Child means a person under Eighteen years of age, either wholly or partially dependent on others for support and maintenance

- Women means a female human being of any age

- Remuneration means the salary, wages, bonus, commission, and other types of monetary consideration payable to a person in return for their services, whether payable in cash or otherwise, including provident fund, pension