Table of Contents

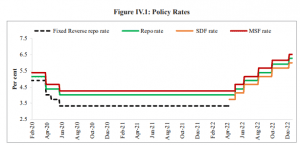

THE CONTEXT: The year 2022 marked the return of high inflation, especially in advanced economies, after nearly four decades. Inflation did not spare emerging economies either. These developments led to an unprecedented, synchronous, and sharp cycle of monetary tightening across countries. Major central banks have implemented sharp increases in policy rates, with the Federal Reserve’s rate hikes being the steepest since the 1970s. While the Federal Reserve has raised policy rates by 425 basis points (bps), the European Central Bank (ECB) and the Bank of England (BoE) have implemented 300 bps and 250 bps rate increases, respectively. The RBI initiated its monetary tightening cycle in April 2022 and has since implemented a policy repo rate hike of 225 bps. Consequently, domestic financial conditions began to tighten, which was reflected in the lower growth of monetary aggregates.

MONETARY DEVELOPMENTS

- The Monetary Policy Committee (MPC) maintained a status quo on the policy repo rate between May 2020 and February 2022 after implementing a 115 basis points (bps) reduction between March 2020 and May 2020.

- Retail inflation has crossed the upper limit of RBI’s tolerance band since January 2022. Sensing a serious risk to price stability, RBI initiated the monetary tightening cycle.

- In its April 2022 meeting, the committee introduced the Standing Deposit Facility (SDF), which allowed for the deposit of excess funds by banks with the RBI without the necessity of collateral in the form of government securities, thereby allowing effective liquidity management in a collateral-free manner.

- The MPC indicated a change in stance from ‘Accommodative’ to ‘Accommodative and focused on the withdrawal of accommodation, while supporting growth’ in this meeting, signaling the start of the monetary tightening cycle.

- Recognizing the sizeable upside risk imparted by adverse global developments, such as the generalized hardening of commodity prices and an increased likelihood of prolonged supply chain disruptions, the MPC convened an off-cycle meeting in May 2022. Members unanimously voted for an increase of 40 bps each in the policy repo rate, the SDF and the Marginal Standing Facility (MSF), and a 50 bps increase in the Cash Reserve Ratio (CRR).

- Reserve money (M0) increased by 10.3 per cent year-on-year (YoY) as on 30th December 2022 compared to 13 per cent last year.

- Growth in Currency in Circulation (CIC) broadly remained stable at levels seen after Covid-19, barring a marginal increase in the immediate aftermath of the outbreak of the Russia-Ukraine conflict, which can be attributed to a rise in precautionary holdings. So far, expansion in M0 during FY23 was mainly driven by bankers’ deposits with the RBI, with an increase in the CRR.

- The money multiplier – the ratio of M3 and M0 – has broadly remained stable at an average of 5.1 over April – December 2022 period compared to 5.2 in the corresponding period of the previous year.

LIQUIDITY CONDITIONS

- Surplus liquidity conditions that prevailed post-Covid-19 in response to the Reserve Bank’s conventional and unconventional monetary measures moderated during FY23 in consonance with the changed monetary policy stance that focused on the withdrawal of accommodation.

- With the MSF rate retained at 25 bps above the policy repo rate, the LAF corridor became symmetric around the policy repo rate – the corridor width was thus restored to 50 bps, the position that prevailed before the pandemic.

- The RBI’s move to hike the CRR by 50 bps resulted in a withdrawal of primary liquidity to the tune of ₹87,000 crore from the banking system.

MONETARY POLICY TRANSMISSION

- Lending and deposit rates of banks increased during FY23 in consonance with the policy repo rate changes.

- During FY23 (up to December 2022), external benchmark-based lending rate and 1-year median marginal cost of funds-based lending rate (MCLR) increased by 225 bps and 115 bps, respectively.

- Overall, the weighted average lending rate (WALR) on fresh and outstanding rupee loans rose by 135 bps and 71 bps, respectively, in FY23 (up to November 2022). On the deposit side, the weighted average domestic term deposit rate (WADTDR) on outstanding deposits increased by 59 bps in FY23 (up to November 2022).

DEVELOPMENTS IN THE G-SEC MARKET

- After remaining steady through 2020 and 2021, the yield on the 10-year government bond rose in 2022. The weighted average yield spike reflects the domestic bond market volatility stemming from uncertainty in crude prices, a hawkish stance of major central banks, a hardening of global bond yield and the pressure on the rupee.

BANKING SECTOR

Resilient and well-capitalized Banking System

- Since the middle of the previous decade, RBI and the government have made dedicated efforts in terms of calibrated policy measures like strengthening the regulatory and supervisory framework, implementation of 4R’s approach of Recognition, Resolution, Recapitalisation and Reforms to clean and strengthen the balance sheet of the banking system.

- These continuous efforts over the years have culminated in the enhancement of risk absorption capacity and a healthier banking system balance sheet both in terms of asset quantity and quality over the years.

- During the first half of FY23, the profitability of SCBs, measured in terms of Return on Equity (ROE) and Return on Assets (ROA), improved to levels last observed in FY15.

Credit Growth Aided by a Sound Banking System and Deleveraged Corporate Sector

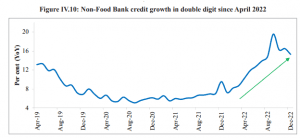

- The recovery in economic activity in FY22, along with the enhanced financial soundness of banks and corporates, has bolstered the expansion of non-food bank credit since June 2021.

- The YoY growth in non-food bank credit accelerated to 15.3 per cent in December 2022. This not only shows an acceleration in the growth of current economic activities but also an anticipation of continued momentum in economic activity in future.

Non-Banking Financial Companies (NBFCs) Continue to Recover

- The growing importance of the NBFC sector in the Indian financial system is reflected in the consistent rise of NBFCs’ credit as a proportion to GDP as well as in relation to credit extended by SCBs.

- Supported by various policy initiatives, NBFCs could absorb the shocks of the pandemic. They built up financial soundness during FY22, marked by balance sheet consolidation, improvement in asset quality, augmented capital buffers and profitability.

PROGRESS MADE UNDER THE INSOLVENCY AND BANKRUPTCY CODE

Ease of doing business: Facilitating the process of ‘exit’

- The Insolvency and Bankruptcy Code (IBC) has facilitated the exit of distressed firms, thereby allocating scarce economic resources towards more productive use.

- Since the inception of the IBC in December 2016, 5,893 Corporate Insolvency Resolution Processes (CIRPs) had commenced by end-September 2022, of which 67 per cent have been closed.

- Of these, around 21 per cent were closed on appeal or review or settled, 19 per cent were withdrawn, 46 per cent ended in orders for liquidation, and 14 per cent culminated in the approval of resolution plans.

Behavioural change: Recoding Business Relationships

- One of the far-reaching spill-over effects of the Code has been the behavioural change effectuated by it among debtors. The fear of losing control over the CD upon initiation of CIRP has nudged thousands of debtors to settle their dues even before the initiation of insolvency proceedings.

69 per cent of the distressed assets rescued, realization value around 178 per cent of the liquidation value

- Until September 30, 2022, 553 CIRPs have ended in resolution. Despite the very low value of the distressed firms to begin with, 69 per cent of distressed assets were rescued by the Code.

92 per cent of the value realized under the liquidation Process

- 1807 CDs ended up with orders for liquidation as of September 2022. These CDs assets were valued at less than 8 per cent of the aggregate claim amount on the ground.

NPAs: IBC recovers highest amount for Scheduled Commercial Banks

- As per the RBI data, in FY 22, the total amount recovered by SCBs under IBC has been the highest compared to other channels such as Lok Adalat’s, SARFAESI Act and DRTs in this period.

DEVELOPMENT IN CAPITAL MARKETS

- Though global macroeconomic and financial market developments exercised some influence on Indian capital markets, India’s capital market had a good year, overall.

PRIMARY MARKET

- From April to November 2022, the buoyant performance of the primary market has been observed despite turmoil in global financial markets. Compared to FY22, the number of firms opting to list on the bourses increased by 37 per cent, though the amount raised declined to almost half of what was raised in the last year.

SECONDARY MARKET

- In April-December 2022, global stock markets declined because of geopolitical uncertainty. On the contrary, the Indian stock market saw a resilient performance, with the bluechip index Nifty 50 registering a return of 3.7 per cent during the same period.

FOREIGN PORTFOLIO INVESTMENTS

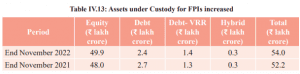

- The total assets under custody with FPIs increased by 3.4 per cent at the end of November 2022 compared to November 2021. The overall net investments by Foreign Portfolio Investors during FY23 registered an outflow of ₹16,153 crore at the end of December 2022 from an outflow of ₹5,578 crore during FY22 at the end of December 2021, with both the equity segment and the debt segment witnessing net FPI outflows.

OTHER DEVELOPMENTS

Necessity of a common approach to regulating the crypto ecosystem

- The recent collapse of the crypto exchange FTX and the ensuing sell-off in the crypto markets have placed a spotlight on the vulnerabilities in the crypto ecosystem.

- Crypto assets are self-referential instruments and do not strictly pass the test of being a financial asset because it has no intrinsic cashflows attached to them.

- The geographically pervasive nature of the crypto ecosystem necessitates a common approach to the regulation of these volatile instruments.

IFSC – GIFT CITY

- Over the last few years, various initiatives taken by the government have opened up new avenues and opportunities for capital market players. Setting up and operationalizing India’s maiden International Financial Services Centre (IFSC) in GIFT City is the most important one.

- The aim is to facilitate India to emerge as a significant economic power by accelerating the development of a strong base of International Financial Services in the country.

- IFSC can play a key role in facilitating India’s emergence as a preferred jurisdiction for international financial services and encouraging easier access and greater participation from foreign investors to bring in capital to further promote India’s growth.

DEVELOPMENTS IN THE INSURANCE MARKET

- In 2021, total global insurance premiums grew by 3.4 per cent in real terms, with the non-life insurance sector registering 2.6 per cent growth, driven by rate hardening in commercial lines in developed markets.

- However, in China, the largest emerging market, non-life premium volumes contracted by 0.7 per cent as the de-tariffication of motor insurance sparked fierce competition and rate reductions.

- India poised to emerge as one of the fastest-growing insurance markets in the coming decade.

- In keeping with this understanding, India’s largest life insurer, the Life Insurance Corporation of India, went public in May 2022, raising US$ 2.7 billion in the country’s largest IPO to date.

- Government schemes and financial inclusion initiatives have driven insurance adoption and penetration across all segments.

PENSION SECTOR

- The Government of India is implementing various pension schemes such as the Indira Gandhi National Old Age Pension Scheme (IGNOAPS), Indira Gandhi National Widow Pension Scheme (IGNWPS), Indira Gandhi National Disability Pension Scheme (IGNDPS) under the National Social Assistance Programme (NSAP) with a total beneficiary coverage of 4.7 crore.

- The National Pension System (NPS) was introduced in January 2004, the primary pension system for government employees with a pay-as-you-go defined benefit plan.

- NPS for government employees is a defined contribution plan with co-contribution from the government.

- The total number of subscribers under the NPS and APY registered a YoY growth of 25.1 per cent in November 2022, with AuM witnessing a growth of 22.7 per cent during the same period.

OUTLOOK

- Buoyant demand for bank credit and early signs of a revival in the investment cycle are benefiting from improving asset quality, a return to profitability and resilient capital and liquidity buffers.

- Further, IBC mechanism continues to support the ‘Ease of Doing Business’ in India by facilitating easy exit with time bound resolutions for firms.

- These strengths are helping the financial system absorb external spillovers, tightening global financial conditions and high volatility in financial markets.

- India is one of the fastest-growing insurance markets in the world and is expected to emerge as one of the top six insurance markets by 2032. Digitisation of India’s insurance market, accompanied by an increase in FDI limit for insurance companies, is likely to facilitate an increased flow of long-term capital, a global technology, processes, and international best practices, which will support the growth of India’s insurance sector.

- Government initiatives towards enhancing pension literacy of subscribers and intermediaries, and a nudge from the regulator and the government to encourage young adults to join the pension scheme would play a significant role in enhancing pension availability to a more extensive section of society.