Table of Contents

THE CONTEXT: The debate around the ability of Capital Expenditure (Capex) to boost long-term growth within the Indian economy, given both the pre and the post-pandemic weak economic environment, has seen a wide range of varying opinions being presented by economists and policymakers. The following article intends to analyse the implications of Capex in the Indian Economy from UPSC perspective.

RECENT CONTEXT: THE UNION BUDGET AND THE ARGUMENT FOR CAPEX

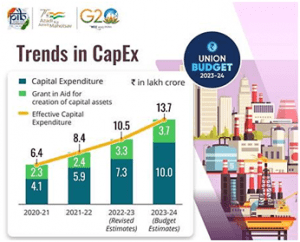

- To ramp the virtuous cycle of Investment and job creation the budget took lead again by steeply increasing the

capital expenditure outlay by 37.4 % in BE 2023-24 to whooping Rs.10 lakh crore over Rs. 7.28 lakh crore in RE 2022-23.

capital expenditure outlay by 37.4 % in BE 2023-24 to whooping Rs.10 lakh crore over Rs. 7.28 lakh crore in RE 2022-23. - The targeted capital expenditure increase of 35% to ₹7.5 lakh crore in FY23 will induce demand for services and manufactured inputs from large industries and micro, small and medium enterprises (MSMEs), and help farmers through better infrastructure.

- Plans to expand highways and establish new cargo terminals under the PM Gati Shakti master plan will enhance competitiveness of Indian industry by lowering the cost of transportation and bettering connectivity between production centres and consumption markets, both domestic and global.

WHAT IS CAPEX?

- Capital Expenditure, or Capex for short, refers to the funds spent by a government, or organization on acquiring, improving, or maintaining long-term assets. These assets can include property, buildings, equipment, machinery, vehicles, technology, and infrastructure.

- Capex is typically distinguished from operating expenses (Opex), which are the day-to-day expenses of running a business or organization, such as salaries, utilities, and office supplies. Capex, on the other hand, is a long-term investment that is expected to generate benefits over a period of time, usually several years.

- Capex can be incurred for various reasons, such as expanding business operations, replacing outdated equipment, or investing in new technology. Capital expenditures can also be categorized as mandatory, such as regulatory compliance or safety requirements, or discretionary, such as investing in research and development or expanding into new markets.

- Since capital expenditures are a long-term investment, they can have a significant impact on a government’s financial health and profitability. Governments need to carefully evaluate the potential benefits of a capital expenditure against the costs of acquiring, improving, or maintaining the long-term asset.

DIFFERENTIATING REVENUE AND CAPITAL EXPENDITURES

Revenue expenditure and capital expenditure are two distinct types of expenses incurred by businesses, governments, and other organizations. The key differences between revenue expenditure and capital expenditure are as follows:

REVENUE EXPENDITURE

DEFINITION

Revenue expenditure refers to the expenses incurred by an organization on a day-to-day basis to maintain its operations.

PURPOSE

Revenue expenditure is incurred for maintaining the current level of operations.

TIME FRAME

Revenue expenditure provides benefits in the short-term

NATURE OF THE ASSET

Revenue expenditure is generally spent on consumables, such as salaries, rent, utilities, and supplies.

TREATMENT IN FINANCIAL STATEMENTS

Revenue expenditure is typically recorded as an expense in the income statement and reduces the profit of the organization.

IMPACT ON TAXES

Revenue expenditure is generally fully deductible as an expense for tax purposes in the year in which it is incurred.

CAPITAL EXPENDITURE

DEFINITION

Capital expenditure refers to the expenses incurred by an organization to acquire or improve its long-term assets.

PURPOSE

Capital expenditure is incurred for expanding or improving the organization’s future operations.

TIME FRAME

Capital expenditure provides benefits over a long period of time.

NATURE OF THE ASSET

Capital expenditure is spent on acquiring, improving, or maintaining long-term assets, such as buildings, equipment, machinery, and infrastructure.

TREATMENT IN FINANCIAL STATEMENTS

Capital expenditure is recorded as an asset in the balance sheet and depreciated over its useful life.

IMPACT ON TAXES

Capital expenditure may be deductible over a period of time through depreciation or amortization.

IMPLICATIONS OF HIGH CAPEX

- Stimulates Economic Growth: High capex can lead to increased economic growth as businesses invest in new projects, equipment, and technology. This can create new job opportunities, increase production, and improve infrastructure, resulting in higher GDP and a stronger economy overall.

- The targeted capital expenditure increase of 35% to ₹7.5 lakh crore in FY23 will induce demand for services and manufactured inputs from large industries and micro, small and medium enterprises (MSMEs), and help farmers through better infrastructure. Plans to expand highways and establish new cargo terminals under the PM Gati Shakti master plan will enhance competitiveness of Indian industry by lowering the cost of transportation and bettering connectivity between production centres and consumption markets, both domestic and global.

- Enhances Productivity: Investment in new technology, equipment, and facilities can increase productivity and efficiency, leading to lower costs, higher profits, and increased competitiveness. This can help businesses stay ahead of the competition and increase their market share, leading to further economic growth.

- Increases Business Confidence: A high level of capex indicates that businesses are optimistic about future economic prospects and are willing to invest in long-term growth. This can create a positive sentiment in the business community and encourage further investment, leading to a virtuous cycle of economic growth.

- Multiplier effect: Capex has the maximum multiplier effect (change in rupee value of output with respect to a change in rupee value of expenditure). This multiplier effect works through expansion of ancillary industries and services and job creation.

- A Rs 1 crore increase in capital expenditure leads to more than Rs 1 crore increase in GDP. This multiplier effect works through expansion of ancillary industries and services and job creation. On the supply side also, it can facilitate labour productivity. Thus, capital expenditure is an effective tool for countercyclical fiscal policy and acts as a macroeconomic stabilizer.

IMPLICATIONS OF LOW CAPEX

Low capex, or a lack of investment in long-term assets and infrastructure, can have several implications for businesses, governments, and the economy as a whole.

- Reduced productivity: If businesses do not invest in new machinery or technology, they may be unable to increase their productivity or efficiency, leading to lower output and profitability.

- Fewer job opportunities: Low capex may result in businesses being unable to expand their operations or create new jobs, potentially leading to higher unemployment rates and reduced economic activity.

- Increased costs: A lack of investment in infrastructure or maintenance can lead to increased repair costs or even the need for expensive emergency repairs, potentially leading to higher costs for businesses and governments.

- Decreased competitiveness: If businesses or governments do not invest in new technology, infrastructure or other long-term assets, they may become less competitive in the global market, potentially leading to lower levels of exports and reduced economic growth.

- Hindered economic growth: Low capex can result in reduced economic growth, as businesses and governments are not investing in the long-term assets and infrastructure necessary to support sustainable economic growth.

- Reduced quality of life: Low capex can impact the quality of life of citizens, as it can lead to deteriorating infrastructure, such as roads, bridges, and public buildings, as well as a lack of access to essential services such as healthcare, education, and public transportation.

Overall, low capex can have significant negative consequences for businesses, governments, and the economy as a whole. To avoid these negative implications, it is important for businesses and governments to invest in long-term assets and infrastructure that support sustainable economic growth and provide essential services to citizens.

BOTTOM LINE:

In terms of economic growth, a high capex is generally considered positive as it indicates that businesses and governments are investing in long-term assets and infrastructure that can help to increase productivity, create jobs, and drive economic growth. In contrast, a low capex may signal a lack of investment and a potential slowdown in economic growth.

Capex can also influence fiscal policies. For example, governments may use capex to stimulate economic growth by investing in infrastructure or by providing tax incentives for businesses to invest in long-term assets. Conversely, governments may choose to reduce capex in times of fiscal austerity to reduce budget deficits.

THE WAY FORWARD

- Investing in Human capital: Given the huge demographic potential that India has, the GOI must invest in enhancing the multi-dimensional capabilities of its people. This would result into lasting and sustainable opportunities of growth and development.

- Prioritize Infrastructure Investment: India needs to continue investing in infrastructure projects to support economic growth. The government should allocate a significant portion of its capex budget towards developing roads, railways, airports, ports, and other essential infrastructure.

- Focus on Health and Education: The COVID-19 pandemic has highlighted the importance of investing in health and education. The Indian government should allocate capex towards building and upgrading healthcare facilities, as well as expanding access to quality education.

- Encourage Private Investment: The government should create a favorable environment for private sector investment by reducing bureaucratic hurdles, streamlining regulatory processes, and providing incentives for businesses to invest.

- Manage Debt: The government should be careful in managing its debt to avoid a debt crisis. It should ensure that the debt taken to finance capex is sustainable, and that the benefits of investment exceed the costs.

- For instance, capital expenditure funded by the government through heavy domestic borrowing (of the order of Rs 18 lakh crore by the Centre plus Rs 78,000 crore by 21 states towards loss in GST compensation due to the lockdown effect) has the potential of crowding out capital expenditure by the private sector, thus severely weakening the multiplier effect.

- Promote Innovation and Technology: The Indian government should encourage investment in innovation and technology to enhance productivity and competitiveness. This can be achieved by providing incentives for research and development, promoting startups, and investing in digital infrastructure.

THE CONCLUSION: Capex is an important measure of investment and growth potential, and a balanced approach is typically needed to ensure that capex levels support long-term economic growth while avoiding excessive debt and fiscal imbalances. The Indian government should prioritize investments that promote sustainable economic growth, social welfare, and technological advancement, while ensuring that the benefits of investment are shared equitably across the population.

Also, with the current impetus rightly given to capital expenditure, emphasis must also be provided on timely implementation of projects within the earmarked outlay by strengthening monitoring, redressal mechanisms and processes for controlling project delays. This would also help in ensuring quality control, which, in turn, will result in capital assets providing benefits over a longer term following the multiplier effect.

QUESTIONS

- “The creation of capital assets generates future cash flows for the economy and adds to value creation.” Discuss critically.

- “A lack of capital expenditure has often been criticised as neglecting long-term targets of economic growth and employment.” Do you agree? Suggest how should Government of India strategize capital expenditure in the aftermath of the pandemic and recent geopolitical issues?

capital expenditure outlay by 37.4 % in BE 2023-24 to whooping Rs.10 lakh crore over Rs. 7.28 lakh crore in RE 2022-23.

capital expenditure outlay by 37.4 % in BE 2023-24 to whooping Rs.10 lakh crore over Rs. 7.28 lakh crore in RE 2022-23.