THE CONTEXT: On August 23rd 2021, Union Minister for Finance and Corporate Affairs launched the asset monetisation pipeline of Central ministries and public sector entities – National Monetization Pipeline.

WHAT IS MONETISATION?

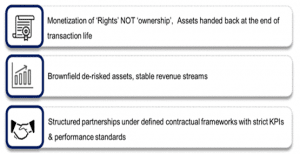

- In a monetisation transaction, the Government transfers revenue rights to private parties for a specified transaction period in return for upfront money, a revenue share, and commitment of investments in the assets. On the other hand, Disinvestment is pulling out the money invested in the company by selling the stake, either partially or fully. Disinvestment involves dilution of ownership of the business / PSU.

- Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs), for instance, are the key structures used to monetise assets in the roads and power sectors.

- These are also listed on stock exchanges, providing investors liquidity through secondary markets as well.

- While these are structured financing vehicles, other monetisation models on PPP (Public Private Partnership) basis include: Operate Maintain Transfer (OMT), Toll Operate Transfer (TOT), and Operations, Maintenance & Development (OMD). OMT and TOT have been used in the highways sector, while OMD is being deployed in the case of airports.

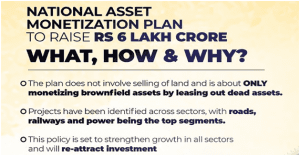

ALL YOU NEED TO KNOW ABOUT THE NATIONAL MONETISATION PIPELINE

INTRODUCTION

- Union Budget 2021-22 has identified the monetisation of operating public infrastructure assets as a key means for sustainable infrastructure financing.

- The Budget provided for the preparation of a ‘National Monetisation Pipeline (NMP)’ of potential brownfield infrastructure assets. NITI Aayog, in consultation with infra line ministries, has prepared the report on NMP.

- NMP aims to provide a medium-term programme roadmap for public asset owners, along with visibility on potential assets to the private sector.

- The end objective of this initiative is to enable ‘Infrastructure Creation through Monetisation’ wherein the public and private sector collaborate, each excelling in their core areas of competence, to deliver socio-economic growth and quality of life to the country’s citizens.

- The report on NMP has been organised into two volumes.

ü Volume I is structured as a guidebook, detailing the conceptual approaches and potential models for asset monetisation.

ü Volume II is the actual roadmap for monetisation, including the pipeline of core infrastructure assets under Central Govt.

FRAMEWORK

- The framework for monetisation of core asset monetisation has three key imperatives.

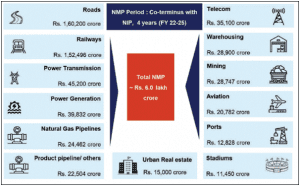

ESTIMATED POTENTIAL

- Considering that infrastructure creation is inextricably linked to monetisation, the period for NMP has been decided to be co-terminus with the balance period under National Infrastructure Pipeline (NIP).

- The aggregate asset pipeline under NMP over the four years, FY 2022-2025, is indicatively valued at Rs 6.0 lakh crore.

- The estimated value corresponds to ~14% of the proposed outlay for the Centre under NIP (Rs 43 lakh crore).

- This includes more than 12 line ministries and more than 20 asset classes. The sectors included are roads, ports, airports, railways, warehousing, gas & product pipeline, power generation and transmission, mining, telecom, stadium, hospitality and housing.

- Sector-wise Monetisation Pipeline over FY 2022-25 (Rs crore):

- The top 5 sectors (by estimated value) capture ~83% of the aggregate pipeline value. These top 5 sectors include Roads (27%) followed by Railways (25%), Power (15%), oil & gas pipelines (8%) and telecom (6%).

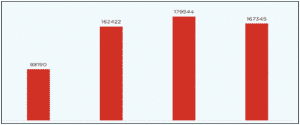

- Regarding annual phasing by value, 15% of assets with an indicative value of Rs 0.88 lakh crore are envisaged to be rolled out in the current financial year (FY 2021-22).

Indicative value of the monetisation pipeline year-wise (Rs crore):

IMPLEMENTATION & MONITORING MECHANISM

- The programme is envisaged to be supported through necessary policy and regulatory interventions by the Government to ensure an efficient and effective asset monetisation process.

- These will include streamlining operational modalities, encouraging investor participation and facilitating commercial efficiency, among others.

- Real-time monitoring will be undertaken through the asset monetisation dashboard, as envisaged under Union Budget 2021-22, to be rolled out shortly.

- The assets and transactions identified under the NMP are expected to be rolled out through various instruments. These include direct contractual instruments such as public-private partnership concessions and capital market instruments such as Infrastructure Investment Trusts (InvIT).

- The sector will determine the choice of instrument, nature of the asset, the timing of transactions (including market considerations), target investor profile, the level of operational/investment control envisaged to be retained by the asset owner, etc.

- The monetisation value that is expected to be realised by the public asset owner through the asset monetisation process may either be in the form of upfront accruals or by way of private sector investment.

- The potential value assessed under NMP is only an indicative high-level estimate based on thumb rules. This is based on various approaches such as market or cost or the book or enterprise value etc., as applicable and available for respective sectors.

BENEFITS

- Ensures resource efficiency in infrastructure operations and maintenance by creating capital assets and addressing the country’s infrastructure needs.

- It aims to provide a transparent system that allows public authorities to monitor private players’ performance and investors to plan their future actions.

- Because these are brownfield initiatives, there is less risk for the private sector. As a result, there will be no significant delays due to land and environmental approvals.

- Globally, government-led capital creation has been a vital force in overcoming the COVID-19 pandemic-induced economic slump.

- NITI Aayog’s efforts to add coherence to contracts will improve the ease of doing business, particularly in contract enforcement.

- Assist in the creation of high-quality jobs in the various industries as envisioned by the programme.

CHALLENGES

ASSET-SPECIFIC CHALLENGES

- The MNP framework notes that other critical impediments to the monetisation process are asset-specific challenges, such as an identifiable revenue stream. This is specifically relevant to the railway sector, which has seen limited PPP success as a project delivery model.

- Konkan Railway, for instance, has multiple stakeholders, including state governments, which own a stake in the entity. Creating an effective monetisation transaction structure could be a bit challenging in this case.

- Other Asset-specific Challenges are:

ü Low level of capacity utilisation in gas and petroleum pipeline networks.

ü Regulated tariffs in power sector assets.

ü Low interest among investors in national highways below four lanes.

SLOW PACE OF PRIVATISATION

- The slow pace of privatisation in government companies including Air India and BPCL. Further, less-than-encouraging bids in the recently launched PPP initiative in trains indicate that attracting private investors’ interest is not that easy.

REALISING ADEQUATE VALUE

- The other challenge is whether the adequate value from the assets will be realised or not. This depends on the quality of the bidding process and whether enough private players are attracted to bid.

MONOPOLISTIC OUTLOOK

- The only way of ensuring that asset monetisation doesn’t lead to cronyism is to make the bidding conditions such that the people eligible to bid are not a minor, predetermined set. However, because of the project’s capital intensity, not everybody is going to be able to bid.

EXECUTION RISK

- There will be execution risk in such a large programme. However, this is exactly why NMP is not adopting a one-size-fits-all approach.

TAXPAYERS’ MONEY

- The taxpayers have already paid for these public assets — and, so, why should they pay again to a private party to use them.

THE LACK OF CLEAR THINKING ON SOME OF THE DEEPER ISSUES

- A greater problem is the lack of clear thinking on some of the deeper issues that may arise as a result of such monetisation. Take the monetisation of hill /mountain railways sought to be done through the Operate, Maintain and Develop (OMD) based PPP model for a period of 30-50 years, which may be extended.

- While the concessionaire is required to maintain the heritage nature of project assets, they would not just get the right to earn fare and non-fare revenues for 30-50 years through train operations but would also be allowed to charge user charges and sub-lease rights on the station and adjoining real estate on railway land for 30-50 years.

- This has the potential to jeopardise the rights of the locals living in these areas and cause protests.

A DROP IN THE OCEAN

- Such monetisation, however well-intentioned, is a drop in the ocean. It is expected to finance no more than 5-6% of the CAPEX (of Rs. 111 lakh crore) under the National Infrastructure Pipeline over the period.

- More importantly, 13 sectors, each with multiple assets, are sought to be monetised over the next four years—when the Government has been missing its disinvestment targets year on year, even when it involves blue-chip companies like BPCL.

LITTLE CLARITY ON USE PROCEEDS

- There is a larger question of where within the Budget will such proceeds from monetisation be accounted for and how these proceeds will be spent.

- The NMP document does speak about these proceeds being used to finance further infrastructure. There are no specific guidelines/rules, however, on how these proceeds could be used. Could they be used (more importantly not used) for paying salaries, giving pensions and subsidies, etc., thereby incurring revenue expenditure?

THE LITTLE ATTENTION ON IMPLEMENTATION

- The big miss is the little attention paid to the issue of how the NMP would be implemented and a precise scenario planning based on the Government’s experience in Disinvestment.

- The 101-page Volume II document with only one page devoted to an Implementation Plan, in a nutshell, maybe the biggest challenge of the NMP.

EMPLOYMENT

- The document has been silent on maintaining the current level of jobs in assets that will be monetised.

THE WAY FORWARD

- EXECUTION IS THE KEY TO SUCCESS: While the Government has attempted to solve several difficulties due to the NMP framework’s infrastructure development, the plan’s execution remains critical to its success.

- APPROACH WITH MULTI-STAKEHOLDER: Other stakeholders must do their part if the infrastructure expansion plan is to succeed. State governments and their public-sector enterprises, as well as the private sector, are among them. In this regard, the Fifteenth Finance Commission has advocated the formation of a High-Powered Intergovernmental Group to re-examine the Centre’s and States’ fiscal responsibility legislation.

- OTHER METHODS OF RAISING RESOURCES: Other strategies for raising funds include establishing a development finance institution (DFI) and increasing the percentage of infrastructure investment in the federal and state budgets.

- DISPUTE RESOLUTION MECHANISM: The importance of strengthening judicial systems cannot be overstated. The design and implementation of NMP will naturally and automatically benefit from efficient and effective conflict resolution processes.

- STREAMLINE PPP: Based on recent experience, public-private partnerships (PPPs) now feature transparent auctions, a clear understanding of the risks and payoffs, and an open field for all interested parties. As a result, the value of PPP in greenfield projects should not be overlooked.

- TRANSPARENT BIDDING: Maintaining transparency is critical to achieving a sufficient realisation of asset value.

- NITI AAYOG RECOMMENDATIONS:

- Bringing InvITs Under Insolvency and Bankruptcy Code (IBC):Extending IBC provisions to InvITs would help lenders access a faster and more effective debt restructuring and resolution option.

- Tax Breaks:Tax-efficient and user-friendly mechanisms like allowing tax benefits in InvITs would attract retail investors (individual/non-professional investors).

THE CONCLUSION: Raising financial resources upfront is a bold, proactive, and confident policy statement when global economic conditions remain unpredictable and uncertain. It sends a strong message to the rest of the world that India is open to business while protecting the public purse and its inhabitants.

Spread the Word