Table of Contents

THE CONTEXT: In September 2021, Union Finance Minister announced that the Cabinet had approved Rs 30,600 crore in security receipts to be issued by the National Asset Reconstruction Company (NARC) or Bad Bank towards the resolution of bad loans.

WHAT IS THE PROPOSAL?

- The move is another step in the direction of making the NARC operational.

- Banks have identified bad loans worth Rs 2 lakh crore, which will be shifted to the NARC for resolution, and nearly Rs 90,000 crore of bad debt would be resolved in the first phase.

- The NARC is now awaiting a licence of operation from the Reserve Bank of India after applying with the central bank.

- The government indicated that the licence is under process and could be issued soon.

THE DEVELOPMENT SO FAR

- The National Asset Reconstruction Company Limited (NARCL) has already been incorporated under the Companies Act. It will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases.

- Another entity — India Debt Resolution Company Ltd (IDRCL), which has also been set up — will then try to sell the stressed assets in the market. The NARCL-IDRCL structure is the new bad bank.

- To make it work, the government has okayed Rs 30,600 crore to be used as a guarantee.

How will the NARCL-IDRCL work?

- The NARCL will first purchase bad loans from banks, and it will pay 15% of the agreed price in cash, and the remaining 85% will be in the form of “Security Receipts”. When the assets are sold, with the help of IDRCL, the commercial banks will be paid back the rest.

- Suppose the bad bank is unable to sell the bad loan or has to sell it at a loss. In that case, the government guarantee will be invoked and the difference between what the commercial bank was supposed to get and what the bad bank was able to raise will be paid from the Rs 30,600 crore that the government has provided.

ALL YOU NEED TO KNOW ABOUT BAD BANK

What is the bad bank?

- A bad bank is a financial entity set up to buy banks’ non-performing assets (NPAs) or bad loans.

- Setting up a bad bank aims to help ease the burden on banks by taking bad loans off their balance sheets and getting them to lend again to customers without constraints.

- After purchasing a bad loan from a bank, the bad bank may later try to restructure and sell the NPA to investors who might be interested in buying it.

- Generating profits is usually not the primary purpose of a bad bank – the objective is to ease the burden on banks, hold a large pile of stressed assets, and get them to lend more actively.

Why Bad Bank?

- Indian banks’ pile of bad loans is a significant drag on the economy, and it’s a drain on banks’ profits.

- Due to the lockdown imposed last year, the proportion of banks’ gross non-performing assets is expected to rise sharply from 7.5% of gross advances in September 2020 to at least 13.5% of gross advances in September 2021.

- Because profits are eroded, public sector banks (PSBs), where the bulk of the bad loans reside, cannot raise enough capital to fund credit growth.

- Lack of credit growth, in turn, comes in the way of the economy’s return to an 8% growth trajectory. Therefore, the bad loan problem requires effective resolution.

Evolution of Concept of Bad Bank:

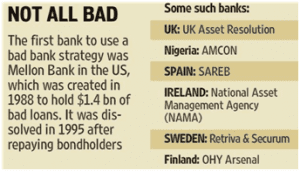

- The concept was pioneered at the Pittsburgh-headquartered Mellon Bank in 1988 in response to problems in the bank’s commercial real estate portfolio.

- According to McKinsey & Co, the concept of a “bad bank” was applied in previous banking crises in Sweden, France, and Germany.

PROS AND CONS OF SETTING UP A BAD BANK

PROS

- In one quick move, a bank will get rid of all its toxic assets, which were eating up its profits.

- When the recovery money is paid back, it will further improve the bank’s position. Meanwhile, it can start lending again.

- It can help consolidate all bad loans of banks under a single exclusive entity. A single government entity will be more competent to take decisions rather than 28 individual PSBs.

- International experience: The troubled asset relief program, also known as TARP, implemented by the U.S. Treasury in the aftermath of the 2008 financial crisis, was modelled around the idea of a bad bank. Under the program, the U.S. Treasury bought troubled assets, such as mortgage-backed securities, from U.S. banks at the peak of the crisis and later resold them when market conditions improved. According to reports, it is estimated that the Treasury, through its operations, earned nominal profits.

CONS

- Former RBI governor Raghuram Rajan has been one of the critics, arguing that a bad bank backed by the government will merely shift bad assets from the hands of public sector banks, which the government owns, to the hands of a bad bank, which the government again owns.

- Analysts believe that unlike a bad bank set up by the private sector, a bad bank backed by the government is likely to pay too much for stressed assets.

- While this may be good news for public sector banks, which have been reluctant to incur losses by selling off their bad loans at low prices, it is bad news for taxpayers, who will once again have to foot the bill for bailing out troubled banks.

AN ANALYSIS OF THE MOVE?

IS IT A RIGHT MOVE?

- Professional Management: The new bad bank can be equipped with professional management which will be capable enough to run the assets and sell them while making a profit.

- Competition: The new bad bank can provide the required competition to the private bad banks and thus provide better pricing to the banks for their NPAs.

- Failure of the current system of Private Bad Banks: Banks are scared of selling the bad loans to private sector bad banks at a heavy discount due to the fear of being accused of causing loss to the bank and exchequer. Thus, the current system has failed.

- Ownership of new Bad Bank: The new bad bank should be owned by the Public sector banks and by private banks that want to join in and their respective shares of ownership can be their share in the total bad loan portfolio. Thus, the profit by resolution will accrue to the banks themselves and thus, the scare of causing loss to the bank and exchequer is eliminated.

CASE OF JHABUA POWER: IBC vs. Bad Bank

1. Jhabua power for resolution under Insolvency and Bankruptcy code on account of shortage of working capital.

2. Bids: Two bids were received for Jhabua power.

a. NTPC Bid – 1900 Crore at the rate of Rs. 3.2 per MW.

b. Adani Power – 750 crores at Rs 1.25 per MW.

Lesson: If NTPC had not entered the bid, the plant, in all probability, could have been purchased by Adani power at the cost to the exchequer. This would have given less money to the government and also brought the wrath of CVC/CBI and further litigation. A Bad bank can do this with expertise and manage the asset until it finds a suitable buyer.

WILL A ‘BAD BANK’ REALLY HELP EASE THE BAD LOAN CRISIS?

- Some critics point out that a key reason behind the bad loan crisis in public sector banks is the nature of their ownership. Unlike private banks, which are owned by individuals with strong financial incentives to manage them well, public sector banks are managed by bureaucrats who may often not have the same commitment to ensuring these lenders’ profitability. To that extent, bailing out banks through a bad bank does not address the root problem of the bad loan crisis.

- Further, there is a huge risk of moral hazard. Commercial banks that a bad bank bails out are likely to have little reason to mend their ways. After all, the safety net provided by a bad bank gives these banks more reason to lend recklessly, and thus, further exacerbate the bad loan crisis.

2. HOW WILL BANKS BENEFIT FROM NARC?

For banks, mainly state-owned banks, the NARC is heaven-sent. It will allow banks to transfer the bad loans from their balance sheets to NARC. The reduction of bad loans on balance sheets will enable banks to free up capital that was locked up to cover the bad loans. Eventually, a successful resolution of the bad loan will also allow banks to reverse a substantial chunk of their provisions depending on the amount recovered, which will boost their earnings.

3. HOW WILL NARC BENEFIT THE ECONOMY?

- The majority of the bad loan pile in India is stuck with the state-owned lenders. The pandemic has worsened the crisis, although relatively less than expected, RBI is projecting Indian banking sector GNPAs to rise in 2021-22.

- Public sector banks account for the majority of loans generated in the Indian economy. Because their capital has been stuck in providing for a large amount of bad loans, their ability to lend has been constrained.

- For post-COVID recovery, banks must be free of their bad loans for providing fresh loans, which will play a major role in recovery.

BUT THERE ARE SOME CONCERNS ALSO

1. Current Situation: India already has 28 asset reconstruction companies in operation and banks have been unable to sell their bad loans to these entities.

2. Just Shifting Blame: Raghuram Rajan, in his book “I Do What I Do” suggests that by creating bad bank, we are just shifting blame from the bank to Bad Bank. If the bad bank is owned by Public Sector, the reluctance to act will be shifted to bad bank.

3. Insolvency and Bankruptcy Code: The enactment of IBC has reduced the need for having a bad bank as a transparent and open process is available to all lenders for resolving insolvency.

4. Government Resources: COVID-19 has already strained the government resources and setting up a bad bank will further put tremendous strain on the resources.

5. Pricing: The price at which toxic assets are transferred are not market-determined and price discovery might not happen.

THINGS TO CONSIDER WHILE CREATING A BAD BANK

- The first is that it should be based on a criterion that any such exercise should not create a moral hazard.

- Second, there have to be strict performance criteria for the banks selling such assets. This can be through a multi-stage approach where these assets are bought piecemeal by the bad bank based on how future incremental assets perform.

- Third, the criteria for buying assets should be transparent and a pecking order must be drawn up where probably the restructured assets get priority.

- Last, a competitive approach should prevail among the banks to work hard to qualify for the sale of bad assets to the bad bank. This, in fact, will ensure better governance standards too.

“BAD BANK A BAD IDEA FOR INDIA”- RAGHURAM RAJAN

Former RBI governor Raghuram Rajan was ‘fundamentally’ opposed to the idea of a bad bank. Reserve Bank of India (RBI) former governor Raghuram Rajan view the concept of a good bank and bad bank may not be relevant for India since much of the assets backing the banks’ loans are viable or can be made viable. He emphasized the need to deepen the corporate bond market.

Why he opposed the idea?

- Rajan was of the view that banks should themselves recover their dues.

- He also believed that in specific cases where the loans are not appropriately prices, the transfer of NPA to the “bad bank” would create further issues.

- Additionally, he thought that the idea of a good and bad bank might not make sense for India.

- He felt that most of the assets backing the banks’ loans are viable or could be made viable.

How other Countries solve NPA Problem?

- There have been several successful instances of resolution of the NPA problem in different countries in the past. For example, asset management companies formed in Sweden after the banking crisis of the early 1990s have done well. One of the underlying features of the resolution of the banking crisis in Sweden was political unity. Political unity eased the passage through parliament of measures to support the financial system.

- The Korea Asset Management Corp. has also been successful in resolving the bad debt problem in Korea after the Asian financial crisis.

- The bank investment programmes under the Troubled Asset Relief Program, implemented after the 2008 financial crisis in the US, has earned positive returns for the government.

WAY FORWARD

1. Capitalisation of Banks: It is being said that bad banks will not be beneficial unless we simultaneously also recapitalise the banks. It can help improve their capacity to lend.

2. Two Tiered Bad Bank Structure: A two tiered bad bank structure can be created as follows

a. First Tier (NARCL): It will include an Asset Reconstruction company fully backed by the government, which will buy bad loans from banks and issue security receipts to them.

b. Second Tier (IDRCL): It will include an Asset Management Company, which would be run by private and public bodies, including banks, turnaround professionals etc.

3. Legal Backing: Parliament can pass a law to set up a bad bank and empower it to recover from borrowers, with minimum legal hassles and respect to the acquisition or disposal of bad assets.

4. Learn from International Experience: Bad banks have successfully resolved NPAs in countries such as UK, the US, Spain, Malaysia, France, Finland, Belgium, Germany, Austria and Sweden. India can learn from their experience.

CONCLUSION: A bad bank, in reality, could help improve bank lending not by shoring up bank reserves but by improving banks’ capital buffers. To the extent that a new bad bank set up by the government can improve banks’ capital buffers by freeing up capital, it could help banks feel more confident to start lending again. However, the only sustainable solution is to improve the lending operation in PSBs.

Spread the Word