Table of Contents

THE CONTEXT: Recently, RBI released the report titled ‘State Finances: A Risk Analysis,’ in which the public finances of the 10 most heavily indebted states of India were analysed. This article intends to analyse the key findings of the report and further discuss the implications of unregulated state finances.

STATE BORROWINGS: THE CONSTITUTIONAL PROVISIONS

- Chapter II of Part XII of the Constitution of India deals with borrowing by the Central Government and State Governments.

- It comprises two provisions:

- Article 292 covers borrowing by the Central Government, and Article 293, covers borrowing by State Governments.

- Article 293 (3) requires State Governments that are indebted to the Central Government to seek the consent of the Central Government before raising further borrowings.

KEY HIGHLIGHTS OF THE REPORT

- According to the report, ten states have a significantly high debt burden. These include Punjab, Rajasthan, Kerala, West Bengal, Bihar, Andhra Pradesh, Jharkhand, Madhya Pradesh, Uttar Pradesh and Haryana. These ten states account for around half of the total expenditure by all State governments in India.

- According to the report, Punjab is anticipated to stay in the worst situation because of continuing worsening in

its fiscal situation and a predicted debt-to-GSDP ratio that would reach 45% in 2026–2027. By 2026–2027, it is anticipated that Rajasthan, Kerala, and West Bengal will have debt-to-GSDP ratios higher than 35%. To stabilize their debt levels, these states will need to take major remedial action.

its fiscal situation and a predicted debt-to-GSDP ratio that would reach 45% in 2026–2027. By 2026–2027, it is anticipated that Rajasthan, Kerala, and West Bengal will have debt-to-GSDP ratios higher than 35%. To stabilize their debt levels, these states will need to take major remedial action. - The benchmarks for fiscal deficit and debt for the ten states established by the 15th Finance Commission were exceeded by Andhra Pradesh, Bihar, Rajasthan, and Punjab.

- According to the RBI analysis, Rajasthan, Kerala, and West Bengal are expected to exceed the 15th Finance Commission targets for debt and fiscal deficit in 2022–2023 (BE).

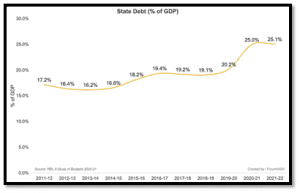

DEBT-TO-GSDP RATIO

The measure used to compare a state’s public debt to its gross state domestic product is called the debt-to-GSDP ratio (GSDP). The debt-to-GSDP ratio accurately predicts a state’s capacity to repay its debts by contrasting what it owes with what it generates.

REASONS FOR EXCEEDING BORROWING LIMITS

IMPACTS OF THE PANDEMIC

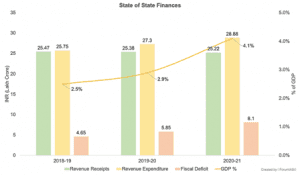

- The pandemic dried up the revenue streams of all states due to the protracted lockdown and other containment measures, while expenditure went up due to the subsidies that had to be provided to the poor and the vulnerable to survive.

- As a result, almost all states ended up beaching the FRBM limit, with Bihar’s GFD: GSDP ratio reaching as much as 11.3 per cent, and those of Punjab, Rajasthan and Uttar Pradesh reaching 4.6, 5.2 and 4.3 per cent, respectively. This led to higher borrowing by states and a swelling of their debt ratios (debt as a percentage of GSDP) much above the safe limits.

ATTENUATING TAX BUOYANCY

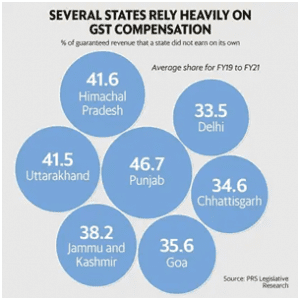

- The own tax revenue of some of these states like Madhya Pradesh, Punjab and Kerala has been declining over time, making them fiscally more vulnerable.

- The Goods and Services tax implementation has been one of the prime causes for this mismatch of funds. For example, the revenue might fall sharply if the GST compensation is stopped from July 2022, primarily as a significant part of guaranteed revenue of states like Punjab was met using compensation (37% in 2018-19, 47% in 2019-20, and 56% in 2020-21).

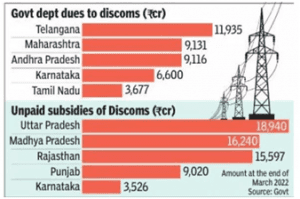

OVERBURDENED DISCOMS

- The power sector accounts for much of the financial burden of state governments in India, both in terms of subsidies and contingent liabilities.

- Illustratively, many state governments provide subsidies, artificially depressing the cost of electricity for the farm sector and a section of the household sector.

- Despite various financial restructuring measures 17, the performance of the DISCOMs has remained weak, with their losses surpassing the pre-UDAY level of 0.4 percent of GDP.

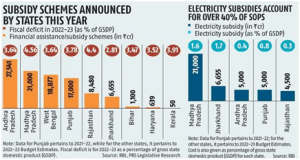

POLITICS OF ‘FREEBIES’

- Political parties are outdoing each other promising free electricity and water, laptops, cycles etc.

- The freebies put a significant strain on the fiscal position of State governments and can’t be easily taken back by succeeding governments.

- Freebies for Andhra Pradesh and Punjab exceeded two per cent of the GSDP, while for Jharkhand, Madhya Pradesh and West Bengal, it was between one and two per cent of GSDP.

LEGAL LOOPHOLES

- The current FRBM provisions mandate that the Governments disclose their contingent liabilities, but that disclosure is restricted to liabilities for which they have extended an explicit guarantee.

- In reality, the State governments resort to extra-budgetary borrowings to finance their populist measures. This debt is concealed to circumvent the FRBM targets. Further, there is no comprehensive information in the public domain to assess the size of this off-budget debt.

THE BORROWING SPREE: LOOMING CONCERNS

MENACE OF ‘ESCROW ACCOUNTS

- The report points out that, unable and unwilling to control expenditure, these states have been borrowing from banks against the collateral of future revenues by creating escrow accounts which is clearly unconstitutional, and by also pledging government assets.

- An escrow account is one that is kept outside government accounts and managed by the bank till the liability is cleared, and into which future revenues will go directly, instead of going into the consolidated fund of the states as mandated by the constitution.

- At least five states have escrowed their future revenues in this manner to raise loans.

BY PASSING CONSTITUTIONAL PROVISIONS

- Between 2019-20 and 2021-22, Andhra Pradesh raised Rs 23,899 crore, UP Rs 17,750 crore, Punjab Rs 2,879 crore, MP Rs 2,698 crore, and Himachal Rs 90 crore.

- By doing so, they were trying to bypass article 293 of the Constitution, which requires the states to take permission from the Centre to raise loans from the market if they are indebted to the Centre, which they are.

AGGRAVATING BANKING SECTOR STRESS

- Most of these loans have been given by the public sector banks, including the SBI.This could have serious implications for the already significant NPA crisis.

- RBI has now issued a directive to them to stop this practice forthwith and report compliance within three months.

REPLICATING THE SRI LANKAN CRISIS

- Taking a cue from what is happening in Sri Lanka as a result of its unsustainable debt and the precarious finances of states, the RBI report has cautioned that the tendency towards handing out cash subsidies, in normal times, provision of free utility services, the revival of the old pension scheme by some states and extension of implicit and explicit guarantees by various state governments in India is a perfect recipe for an economic disaster.

THE BORROWING SPREE: NEED FOR CAREFUL CONTEMPLATION

Considering all possible causes and concerns of unregulated borrowing by states in India, one can opine that while some expenses are inevitable, some can be addressed with more prudence and probity. For instance, one can certainly be in favour of expanding, for example, the MGNREGA type of spending and subsidy in the form of food ration schemes. These go a long way in increasing the productive capacity of the population. So, they’re not just freebies. However, what should be regulated is announcing freebies merely in the name of vote bank politics. For instance, when it comes to simply giving away loan waivers, one cannot go in favour of these because they have undesired consequences such as destroying the whole credit culture.

THE WAY FORWARD

- RBI has proposed a “triple E framework” to assess expenditure quality, which has constituents of expenditure adequacy, effectiveness and efficiency:

- Expenditure adequacy is terms of focusing on the government’s primary role;

- Effectiveness is about assessing performance;

- Efficiency involves an assessment of the output-input ratio.

- Other recommendations are given by RBI:

- Fiscal discipline: The state governments must restrict their revenue expenses by cutting down expenditure on non-merit goods in the near term. In the medium term, these states need to put efforts toward stabilizing debt levels.

- Power sector reforms: Further, large-scale reforms in the power distribution sector would enable the DISCOMs to reduce losses and make them financially sustainable and operationally efficient.

- Focus on capital creation: In the long term, increasing the share of capital outlays in the total expenditure will help create long-term assets, generate revenue and boost operational efficiency.

- Risk testing analysis: State governments need to conduct fiscal risk analyses, and stress test their debt profiles regularly to be able to put in place provisioning to manage fiscal risks efficiently

- Legal measures: The FRBM Acts need to be amended. Its provisions should be expanded to cover all liabilities of the Government, whether budget borrowing or off-budget borrowing, regardless of any guarantee.

THE CONCLUSION: Given that the Constitution of India provides clear provisions regarding the borrowing by the Central Government and State Governments, both must diligently abide by the constitutional values and limits. State borrowings must be more transparent and prudent. Also, there must be a behavioural change within political parties to participate in elections on their working capabilities rather than hampering state finances in the name of vote bank.

QUESTIONS TO PONDER

- “Taking a cue from what is happening in Sri Lanka as a result of its unsustainable debt and the precarious finances of states, the given status of significant indebtedness of India’s federal units act like swords of Damocles”. Analyse critically in the light of the recent RBI report on State Finances.

- Discuss the various causes for exceeding off-budget borrowings by state governments in India. Do you think unregulated off-budget borrowings will have economic implications? Justify your views.

its fiscal situation and a predicted debt-to-GSDP ratio that would reach 45% in 2026–2027. By 2026–2027, it is anticipated that Rajasthan, Kerala, and West Bengal will have debt-to-GSDP ratios higher than 35%. To stabilize their debt levels, these states will need to take major remedial action.

its fiscal situation and a predicted debt-to-GSDP ratio that would reach 45% in 2026–2027. By 2026–2027, it is anticipated that Rajasthan, Kerala, and West Bengal will have debt-to-GSDP ratios higher than 35%. To stabilize their debt levels, these states will need to take major remedial action.