THE INTRODUCTION: Global Industrial activity continued to be affected by the disruptions caused by the COVID-19 pandemic. While the Indian industry was no exception to these disruptions, its performance has improved in 2021-22. Gradual unlocking of the economy, record vaccinations, improvement in consumer demand, continued policy support towards industries by the government in the form of Atma Nirbhar Bharat Abhiyan, and further reinforcements in 2021-22 have led to an upturn in the performance of the industrial sector. The introduction of the production linked incentive scheme (PLI) to encourage scaling up of industries and a major boost provided to infrastructure-both physical as well as digital– combined with continued measures to reduce transaction costs and improve ease of doing business, would support the pace of recovery.

INDEX OF INDUSTRIAL PRODUCTION (IIP)

- The impact of the pandemic on the industrial sector is reflected in the negative growth of 8.4 percent in 2020-21. From April-November 2021-to 22 the IIP grew by 17.4 percent as compared to (-15.3) percent in the corresponding period of the previous year.

- The supply-side measures as also steps to bolster demand, taken to address the contraction, are responsible for the significantly improved performance of the industrial sector in 2021-22.

- In November 2021 the IIP index grew by 1.4 percent with the mining sector recording a growth of 5.0 percent followed by electricity at 2.1 percent and manufacturing at 0.9 percent.

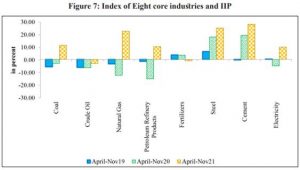

EIGHT CORE INDEX (ICI)

- The monthly Index of Eight Core Industries (ICI) measures the collective and individual performance of production in selected eight core industries like Coal, Crude Oil, Natural Gas, Refinery Products, Fertilizers, Steel, Cement, and Electricity. This is an index of the eight most fundamental industrial sectors of the Indian economy and comprises 40.27 percent of the weight in IIP.

- The growth rate of the ICI index during the period of April-November 2021-22 was 13.7 percent as compared to (-)11.1 percent in the corresponding period of the last financial year. This acceleration in ICI is mainly driven by improved performance in steel, cement, natural gas, coal, and electricity. Fertilizers and crude oil registered a negative growth of 0.6 percent and 2.7 percent respectively.

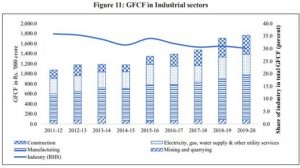

GROSS FIXED CAPITAL FORMATION

- Gross fixed capital formation (GFCF) is the gross addition to fixed assets like machinery and equipment, intangible assets and indicates the state of investments in the economy. During 2019-20, the share of the industrial sector in total GFCF in the economy (at current prices) was recorded at 30.1 percent, which is slightly lower than 31 percent in the previous financial year.

- Within the industrial sector, the share of manufacturing in GFCF was 51 percent, followed by electricity at 23 percent, construction at 21 percent, and mining with 5 percent. While aggregate GFCF (at constant prices) grew by 9.9 percent and industrial GFCF grew by 12.4 percent in 2018-19, it grew by 5.4 percent and 3.7 percent respectively in 2019-20.

- During 2019-20, GFCF in the mining and electricity sectors registered a negative growth of 12.9 percent and 6 percent respectively, but the GFCF grew by 10.2 and 4.4 percent in the manufacturing and construction sectors respectively on a yo-y basis.

CREDIT IN INDUSTRY

- Gross bank credit to the industrial sector, recorded a growth of 4.1 percent in October 2021 (Y-o-Y basis) compared to a negative growth of 0.7 growth in October 2020.

- The share of industry in non-food credit stood at 26 percent in October 2021. Certain industries such as mining, textiles, petroleum, coal products and nuclear fuels, rubber, plastic, and infrastructure have shown consistent improvement in credit growth.

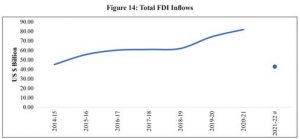

FDI IN INDUSTRIES

- India registered its highest-ever annual FDI inflow of US$ 81.97 billion (provisional) in 2020-21 reflecting a growth of 10 percent as compared to the previous year.

- The increase has been on the back of growth of 20 percent in 2019-20. In the year 2021-22, FDI inflow grew by 4 percent in the first six months to reach US$ 42.86 billion as compared to US$ 41.37 billion for the same period of last year.

- Over the last seven financial years (2014-21), India received FDI inflow worth US$ 440.27 billion which is nearly 58 percent of the FDI received by the country in the last 21 years(US$ 763.83 billion).

PERFORMANCE OF CENTRAL PUBLIC SECTOR ENTERPRISES

- CPSEs are an important constituent of the Indian industry. As of 31.03.2020, 256 CPSEs were operational. The overall net profit of operating CPSEs during 2019-20 stood at Rs. 93,295 crore Contribution of all CPSEs to the central exchequer by way of excise duty, GST, corporate tax, dividend, etc. stood at Rs. 3,76,425 crore.

- The CPSEs across sectors employed 14,73,810 persons, of which 9,21,876 were regular employees.

- By Union Budget 2021-22 announcement, the government has approved a policy of strategic disinvestment of public sector enterprises that will provide a clear roadmap for disinvestment in all non-strategic and strategic sectors.

- The non-strategic CPSEs will be privatized or otherwise shall be closed. Thus, the policy on public sector enterprises provides a clear path for disinvestment in all nonstrategic and strategic sectors and strengthens the idea of Minimum Government – Maximum Governance.

CORPORATE PERFORMANCE

- With economic recovery, concomitant improvement in demand and improved business sentiments have had a positive effect on the performance of the corporate sector.

- In response to the favorable base effect, sales of 1,687 listed manufacturing companies recorded steady and broad-based growth of 34.0 percent in Q2: FY22 as compared to (-)4.3 percent growth in Q2: FY21, on an annual (y-o-y) basis.

SECTOR-WISE PERFORMANCE AND ISSUES IN THE INDUSTRY

Steel: The performance of the steel industry is pivotal for the growth of the economy. Despite being hit by COVID-19, the steel industry has bounced back with cumulative production of crude and finished steel in 2021-22(April-October) at 66.91 MT and 62.37 MT, an increase of 25.0 percent and 28.9 percent respectively.

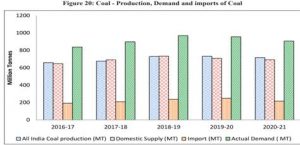

Coal: Coal is the most important and abundant fossil fuel in India and accounts for 55 percent of the country’s energy needs. Coal production increased by 12.24 percent in April-October 2021 as compared to (-) 3.91 percent in April-October 2020. Overall production of raw coal in India during the year 2020-21 was 716.08 million tonnes (provisional) as compared to 730.87 million tonnes achieved in the previous year 2019-20.

Micro Small Medium Enterprise: Micro, Small & Medium Enterprises(MSMEs) contribute significantly to the economic and social development of the country by fostering entrepreneurship and by generating employment opportunities. The relative importance of MSMEs can be gauged from the fact that the share of MSME GVA in total GVA (current prices) for 2019-20 was 33.08 percent. The CHAMPIONS portal is an ICT-based technology system for making the smaller units big by helping and hand-holding them.

The key features of the portal include:

- Information dissemination: Regular updates on recent development in the MSME sector.

- To resolve the grievances in a fast track manner, all Nationalised Banks, a good number of Private/Regional Rural Banks, State Financial Corporations, Central Government Ministries/ Departments, State Governments, and CPSEs have been boarded on the portal.

- Scheme/Programme-wise mapping of officials of the Ministry for fast-track responses to grievances.

- Integration with various portals such as MSME Samadhaan, Udyam Registration, CPGRAM, etc.

Textiles: Textile industry is the second-largest employment generator in the country, next only to agriculture. In the last decade, close to Rs. 203,000 crores have been invested in this industry with direct and indirect employment of about 105 million people, a major part of which is women. Despite the industry being deeply affected by the lockdown, it has shown a remarkable recovery with a positive contribution to growth, as reflected by IIP, of 3.6 percent from April-October 2020.

Electronics Industry: Government accords high priority to electronics hardware manufacturing. The government has therefore notified the National Policy on Electronics 2019 (NPE 2019) on 25.02.2019 to position India as a global hub for Electronics System Design and Manufacturing (ESDM) by encouraging and driving capabilities in the country for developing core components, including chipsets. Additionally, NPE 2019 attempts to catalyze the growth of the Indian electronics ecosystem through the

- Production Linked Incentive (PLI) Schemes for Large Scale Electronics Manufacturing

- PLI Scheme for IT Hardware

- Scheme for Promotion of Manufacturing of electronic components and Semiconductors (SPECS)

- Modified Electronics Manufacturing Clusters 2.0 (EMC 2.0).

Recently, the government has approved an outlay of Rs. 76,000 Crore (>US$ 10 Bn) for the development of the Semiconductors and Display Manufacturing Ecosystem. The government’s intervention to boost this industry has come at a time when the global economy is facing an acute shortage of semiconductors due to severe disruptions in supply chains.

Pharmaceuticals: Indian Pharmaceutical industry ranks third in the world in pharmaceutical production by volume. During 2020-21, total pharma export US$ 24.4 Bn against the total pharma import of US$7.0 Bn. The initiatives taken by the government to address the requirement of the pharmaceutical and medical devices industry are as follows:

- Bulk Drug Parks that envisages the creation of world-class infrastructure facilities.

- Bulk drugs have been approved for the promotion of domestic manufacturing of 53 critical APIs.

- Production linked incentive (PLI) scheme for Pharmaceuticals.

- Promoting Domestic Manufacturing of Medical Devices was approved on 20th March 2020.

INFRASTRUCTURE

NATIONAL INFRASTRUCTURE PIPELINE (NIP)

- To achieve a GDP of $5 trillion by 2024-25, India needs to spend about $1.4 trillion over these years on infrastructure. During FYs 2008-17, India invested about US$1.1 trillion in infrastructure. However, the challenge is to step up infrastructure investment substantially.

- Keeping this objective in view, National Infrastructure Pipeline (NIP) was launched with a projected infrastructure investment of around Rs. 111 lakh crore (US$ 1.5 trillion) during FY 2020-2025 to provide world-class infrastructure across the country and improve the quality of life for all citizens.

- It also envisages improving project preparation and attracting investment, both domestic and foreign in infrastructure.

NATIONAL MONETISATION PIPELINE (NMP)

- A robust asset pipeline has been prepared to provide a comprehensive view to investors and developers of the investment avenues in infrastructure. The pipeline includes a selection of de-risked and brownfield assets with a stable revenue generation profile (or long rights) which will make for an attractive investment option.

- Total indicative value of NMP for core assets of the Central Government has been estimated at Rs 6.0 lakh crore over 4 years (5.4 percent of total infrastructure investment envisaged under NIP).

ROAD TRANSPORT

- The road network of the country consists of National Highways(NH), State-Highways (SH), District Roads, Rural Roads, Urban Roads, and Project Roads of over 63.71(Provisional) lakh km of roads as of 31 March 2019, which is the second-largest in the world, after the United States with 66.45 lakh km of roads.

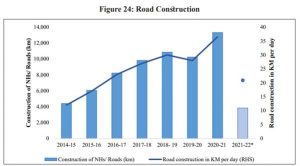

- There has been a consistent increase in the construction of National Highways/roads since 2013-14 with 13,327 km of roads constructed in 2020-21 as compared to 10,237 km in 2019-20, indicating an increase of 30.2 percent over the previous year.

RAILWAYS

- Being the third-largest network in the world under single management and with over 68,102 route km IR strives to provide a safe, efficient, competitive, and world-class transport system.

- An average of 1835 track km per year of new track length has been added through new-line and multi-tracking projects during 2014-2021 as compared to the average of 720 track km per day during 2009-14.

- To strengthen the agriculture sector, as of 31st December 2021, IR has operated 1,841 Kisan Rail services, transporting approximately 6.0 lakh tonnes of perishables including fruits and vegetables.

- To provide better amenities IR has embarked on providing Wi-Fi internet services at all stations (excluding halt stations). As of 5th December 2021, a total of 6,087 Railway Stations has been equipped with a Wi-Fi facility.

CIVIL AVIATION

- India has emerged as one of the fastest-growing aviation markets in the world. The domestic traffic in India has more than doubled from around 61 million in 2013-14 to around 137 million in 2019-20, registering a growth of over 14 percent per annum.

- Till the launching of UDAN in 2016, India had 74 airports have scheduled operations. But, within 4 years under UDAN, four rounds of bidding under RCS-UDAN have taken place and 153 RCS airports including 12 water aerodromes & 36 Helipads have been identified for the operation of RCS flights.

PORTS

- Port performance in an economy is crucial for the trade competitiveness of that economy. Expansion of port capacity has been accorded the highest priority by the Government through the implementation of well-conceived infrastructure development projects. The capacity of 13 major ports which was 871.52 million tonnes per annum (MTPA) at the end of March 2014, has increased by 79 percent to 1,560.61 MTPA by the end of March 2021.

- Many initiatives have been taken by the government to improve port governance, augment capacity utilization, enhance port efficiency and connectivity. The measures include the following among others:

- Sagarmala is a National Programme aimed at accelerating economic development in the country by harnessing the potential of India’s 7,500 km long coastline and 14,500 km of potentially navigable waterways.

- The Major Port Authorities Act 2021 was notified on 18.2.2021. This act provides for inter alia regulation, operation, and planning of major ports in India and vests the administration, control, and management of such ports upon the Boards of Major Port Authorities.

- A new Captive Policy for Port Dependent Industries has been prepared to address the challenges of renewal of the concession period, the scope of expansion, and the dynamic business environment.

INLAND WATERWAYS

- Regulatory amendment through the Inland Vessels Act, 2021, replaced the over 100 years old Inland Vessels Act, 1917 (1 of 1917) and ushered in a new era in the inland water transport sector.

- Augmentation in navigation capacity of National Waterway-1 (NW-1) is being implemented since 2018 through the Jal Marg Vikas Project from Varanasi to Haldia stretch of the Ganga-Bhagirathi-Hooghly River System to enable large barge movements.

- Construction of multi-modal terminals at Varanasi and Sahib Ganj has been completed and that of the multimodal terminal at Haldia and the Navigational Lock at Farakka has achieved substantial progress. The other projects such as the comprehensive development of NW-2 and NW-16 &Indo-Bangladesh Protocol (IBP) route are proposed to be undertaken for 5 years for Rs. 461 crores and Rs.145.29 crores respectively, from 2020-21 to 2024-25.

TELECOM

- The relevance of the telecom sector has increased immensely. This can be gauged from the fact that the total telephone subscriber base in India has increased from 933.02 million in March 2014 to 1200.88 million in March 2021. In March 2021, 45 percent of subscribers were based in rural India and 55 percent in urban areas.

- Internet penetration in the country is increasing steadily with internet subscribers increasing from 302.33 million in march 2015 to 833.71 million in June 2021. While 67.2 percent of internet subscribers had narrowband connections and 32.8 percent had broadband connections in 2015, the composition had reversed by June 2021 with only 4 percent of subscribers having a narrow band and 96 percent with broadband connections.

- The number of mobile towers has also increased substantially reaching 6.93 lakhs towers in December 2021, reflecting that the telecom operators have well realized the potential in the sector and seized the opportunity to build up an infrastructure that will be fundamental in boosting the Government’s Digital India campaign.

PETROLEUM, CRUDE, AND NATURAL GAS

- Crude oil and condensate production during the year 2020-21 was 30.49 million metric tonnes (MMT), lower than the production level of 32.17 MMT in 2019-20 and 94.3 percent of the target of 32.32 MMT for 2020-21. India depends on imports to meet more than 80 percent of its requirements.

- Natural Gas production during the year 2020-21 was 28.67 billion cubic meters (BCM) as against the production of 31.18 BCM in 2019-20 and 85.4 percent against the target of 33.57 BCM for 2020-21.

- The production of petroleum products was 233.51 MMT in 2020-21 as against 258.18 MMT in 2019-20, showing achievement of 90.2 percent of the target of 259.02 MMT for 2020- 21.

ELECTRICITY

- India has witnessed a significant transformation from being an acute power deficit country to a situation of demand being fully met.

- India has also made remarkable strides to ensure universal access to electricity for every household.

- The total installed power capacity and captive power plant was 459.15 GW on 31.03.2021 as compared to 446.35 GW on 31.03.2020 registering a growth of 2.87 percent. Installed capacity in utilities was 382.15 GW on 31.03.2021 as compared to 370.11 GW on 31.03.2020 – increasing by 3.25 percent.

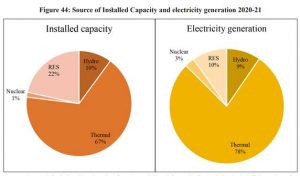

- Thermal sources of energy make the largest – 61.42 percent share of total installed capacity in utilities followed by renewable energy resource (RES) with 24.7 percent and hydro with 12.09 percent.

- The total electricity generated including that from captive plants during the year 2020-21 was 15.73 lakh GWh as compared to 16.23 lakh GWh during the year 2019-20, of which 13.73 lakh GWh was generated by utilities and 2 lakh GWh in captive plants.

Renewable energy – Solar, Wind, Biomass, and small hydro energy

- India has witnessed the fastest rate of growth in renewable energy capacity addition among all large economies, during the last 7.5 years with renewable energy capacity growing by 2.9 times and solar energy expanding by over 18 times.

- To facilitate renewable power evacuation and reshape the grid for future requirements, the Green Energy Corridor (GEC) projects have been initiated. The GEC Project aims at synchronizing electricity produced from renewable sources, such as solar and wind, with conventional power stations in the grid.

THE CONCLUSION: The Government has charted out a comprehensive program for industrial transformation. With an emphasis on supply-side measures, the reforms address long known bottlenecks of insufficient infrastructure, tardy business processes, and labour market reforms. The introduction of the production-linked incentive schemes intends to encourage the scaling up of industries that are strategic in nature or are technology-intensive. The objective is to create the capacity to integrate with the global value chains. Several measures have been taken to reduce transaction costs, especially for the small and medium enterprises as well as facilitate the inflow of capital, technology, and international best practices into the industries. The new CPSE policy provides a road map for disinvestment, opening up avenues for further growth and improvement in efficiency while enabling the government to focus its resources on the developmental needs of the country. The recovery of the industrial sector, positive business expectations propelled by extensive reforms, and improved consumer demand, suggest that further improvements in industrial performance can be expected.

HIGHLIGHTS

- Index of Industrial Production (IIP) grew at 17.4 percent (YoY) during April-November 2021 as compared to (-)15.3 percent in April-November 2020.

- Capital expenditure for the Indian railways has increased to Rs. 155,181 crores in 2020-21 from an average annual of Rs. 45,980 crores during 2009-14 and it has been budgeted to further increase to Rs. 215,058 crores in 2021-22 – a five times increase in comparison to the 2014 level.

- Extent of road construction per day increased substantially in 2020-21 to 36.5 Km per day from 28 Km per day in 2019-20 – a rise of 30.4 percent.

- Net profit to sales ratio of large corporates reached an all-time high of 10.6 percent in the July-September quarter of 2021-22 despite the pandemic (RBI Study).

- Introduction of Production Linked Incentive (PLI) scheme, the major boost provided to infrastructure-both physical as well as digital, along with measures to reduce transaction costs and improve ease of doing business, would support the pace of recovery.