THE CONTEXT: Since the beginning of the COVID-19 pandemic, the monetary policy and liquidity operations have been geared towards mitigating its adverse impact on the economy. Accommodative monetary policy and other regulatory dispensations, asset classification standstill, temporary moratorium, and provision of adequate liquidity were put in place to provide a safety net to the system. In 2021-22, RBI’s measures like CRR reduction reached pre-set sunset dates, liquidity has been wound down partly but remains in surplus mode and regulatory measures have been realigned.

MONETARY DEVELOPMENTS

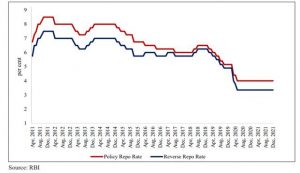

The Monetary Policy Committee (MPC) maintained the status quo on the policy repo rate from April to December 2021 after a substantial cut of 115 basis points (bps) during February May 2020 and a cumulative 250 basis points cut since February 2019. The repo rate which currently stands at 4 percent is the lowest in the last decade (Figure 1). Since May 2020, the policy rates have been on hold along with an accommodative monetary policy stance with forwarding guidance that this stance will continue as long as necessary to revive growth on a durable basis while ensuring that inflation remains within the target.

Repo and reverse repo rate (percent)

LIQUIDITY CONDITIONS AND THEIR MANAGEMENT

- Liquidity has remained in surplus in the system since mid-2019 in sync with the easing of monetary conditions (Figure 6). The liquidity conditions were further eased during the year 2020-21 after the covid pandemic, and RBI has since then maintained ample surplus liquidity in the banking system to support growth.

- In 2021-22 so far, the RBI resumed normal liquidity operations in a phased manner and engaged in rebalancing liquidity from passive absorption under fixed-rate reverse repo under its Liquidity Adjustment Facility (LAF) to market-based reverse repo auctions (like Variable Rate Reverse Repo (VRRR)).

- At the same time it also ensured adequate liquidity in the system in consonance with the accommodative monetary policy stance to support growth. The liquidity conditions remained in surplus in 2021-22.

DEVELOPMENTS IN G-SEC MARKET

- The yields on 10-year G sec which had reached 8.2 percent on 26th September 2018 reduced substantially to reach 5.75 percent in June 2020. It has since then increased to stand at 6.45 percent as of 31st December 2021.

BANKING SECTOR

The economic shock of the pandemic has been weathered well by the commercial banking system so far, even if some lagged impact is still in pipeline. The Survey also notes that the bank credit growth stands at 9.2 percent as of 31st December 2021.

GROWTH IN PERSONAL LOANS IMPROVED TO DOUBLE DIGITS:

- The Survey highlights that the growth in personal loans improved to 11.6% as compared with 9.2% in the previous year. Housing loans, the largest constituent of personal loans, registered a growth of 8 percent in November 2021. The growth of vehicle loans, the second-largest constituent, improved to 7.7 percent in November 2021 from 6.9 percent in November 2020.

CREDIT GROWTH

- The Survey states that the credit to Agriculture continued to register robust growth, and was at 10.4 percent (YoY) in 2021 as compared with 7 percent in 2020. Credit growth to micro & small industries accelerated to 12.7 percent in 2021 from 0.6 percent a year ago, reflecting the effectiveness of various measures taken by the Government and the RBI to boost credit flow to the micro, small and medium enterprises (MSME) sector.

MONETARY TRANSMISSION

- According to the Survey, Large surplus systemic liquidity, forward guidance of continuing with the accommodative stance, and the external benchmark system for pricing of loans in select sectors aided monetary transmission.

FACTORING IN INDIA

- The Survey states that Factoring is an important source of liquidity worldwide, especially for MSMEs. Hence, the Factoring Regulation (Amendment) Act, 2021 was enacted with the amendments in line with the recommendations of the UK Sinha Committee. The significant regulations about the amendment act have been notified by the RBI in January 2022. The amendments have liberalized the restrictive provisions in the Act and at the same time ensured that a strong regulatory / oversight mechanism is in place under RBI. Overall, this change would lead to the widening of the factoring ecosystem in the country and help MSMEs significantly, by providing added avenues for availing credit facilities.

DEPOSIT INSURANCE IN INDIA

- The Survey asserts that The Deposit Insurance and Credit Guarantee Corporation (Amendment) Act, passed by the Parliament in 2021, made significant changes in the landscape of deposit insurance in India. The Survey also notes that Bank-group wise, the percentage of insured deposits vis-à-vis total deposits is 84 percent for RRBs, 70 percent for cooperative banks, 59 percent for SBI, 55 percent for PSBs, 40 percent for private sector banks, and 9 percent for foreign banks. Up to 31st March 2021, a cumulative amount of Rs 5,763 crores has been paid towards claims since the inception of deposit insurance (Rs 296 crore in respect of 27 commercial banks and Rs 5,467 crores in respect of 365 co-operative banks).

DEPOSIT INSURANCE AND CREDIT GUARANTEE CORPORATION (AMENDMENT) ACT(DICGC)

- Bill seeks to ensure that account holders will get up to Rs 5 lakh within 90 days of the RBI imposing a moratorium on their banks from the Deposit Insurance and Credit Guarantee Corporation (DICGC).

- It provides immediate relief to lakhs of depositors, whose money is parked in stressed lenders such as the PMC Bank and other small cooperative banks.

- According to the previous provisions, the deposit insurance of up to Rs 5 lakh comes into play when the license of a bank is canceled, and the liquidation process starts and they needed 8-10 years for the depositors of a stressed bank to get their insured money and other claims.

- DICGC, a wholly-owned subsidiary of the RBI, provides an insurance cover on bank deposits.

DIGITAL PAYMENTS

- According to the Survey, Unified Payments Interface (UPI) is currently the single largest retail payment system in the country in terms of volume of transactions, indicating its wide acceptance In December 2021, 4.6 billion transactions worth Rs 8.26 lakh crore were carried out by UPI. RBI and the Monetary Authority of Singapore announced a project to link UPI and PayNow, which is targeted for operationalization by July 2022, Bhutan recently became the first country to adopt UPI standards for its QR code. It is also the second country after Singapore to have BHIM-UPI acceptance at merchant locations.

NBFCs

- The Survey states that the total credit of the NBFC sector increased marginally from Rs 27.53 lakh crore in March 2021 to Rs 28.03 lakh crore in September 2021. The credit intensity of NBFCs, measured by NBFC credit as a ratio of GDP has been rising consistently and stood at 13.7% at the end-March 2021. Industry remained the largest recipient of credit extended by the NBFC sector, followed by retail loans and services.

EQUITY

- The Survey observes that In April-November 2021, IPOs of 75 companies have been listed, garnering Rs 89,066 crore, as compared to 29 companies raising Rs 14,733 crore during April-November 2020, indicating a stupendous rise of 504.5 percent in fund mobilization. The money raised by IPOs has been greater than what has been raised in any year in the last decade by a large margin. Amount raised by way of preferential allotment increased by 67.3 percent during April-November 2021, as compared to the previous year. Overall, during April-November 2021, Rs 1.81 lakh crore has been raised through equity issues through diverse modes viz., public offerings, rights, QIP, and preferential issues.

MUTUAL FUND ACTIVITIES

- The Survey highlights that the net Assets under Management (AUM) of the mutual fund industry rose by 24.4 percent to Rs 37.3 lakh crore at the end of November 2021 from Rs 30.0 lakh crore end of November 2020. Net resource mobilization by mutual funds was Rs 2.54 lakh crore during April-November 2021, as compared to Rs 2.73 lakh crore during April-November 2020.

PENSION SECTOR

- The total number of subscribers under the Nthe ew Pension Scheme (NPS) and Atal Pension Yojana (APY) increased from 374.32 lakh as of September 2020 to 463 lakh as of September 2021, recording a growth of 23.7 percent over the year. The overall contribution under NPS grew by more than 29 percent during the period September 2020 – September 2021.

- Maximum growth in contribution was registered under the All Citizen model (51.29 percent) followed by Corporate Sector (42.13 percent), APY (38.78 percent), State Government Sector (28.9 percent), and Central Government Sector (22.04 percent).

- The Assets under Management (AUM) of NPS and APY stand at Rs 6.67 lakh crore at the end of September 2021 and thereby recorded an overall growth (YoY) of 34.8 percent.

- The gender gap in enrolments under APY has narrowed down with increased participation of female subscribers, which has increased from 37 percent as of March 2016; to 44 percent as of September 2021.

SCHEDULED COMMERCIAL BANKs (SCBs)

- The Survey observes that the Gross Non-performing Advances (GNPA) of the SCBs reduced to 6.9% in the year 2021, the Net Non-performing advances (NNPA) stands @2.2% Restructured Standard Advances (RSA) ratio of SCBs increased from 0.4 percent to 1.5 percent.

- Overall, the Stressed Advances ratio of SCBs increased to 8.5% at the end of September 2021. The Survey claims that COVID-19 related dispensations/moratoriums provided concerning asset quality contributed towards an increase in restructured assets and as a result, stressed advances ratio.

PUBLIC SECTOR BANKs (PSBs)

- The Survey highlights that the GNPA decreased to 8.6 percent at the end-September 2021, The Stressed Advances ratio of PSBs increased to 10.1 percent during the same period on account of rising in restructured advances. Based on the capital position as of September 30, 2021, all Public Sector and Private Sector banks maintained the Capital Conservation Buffer (CCB) well over 2.5 percent.

INSOLVENCY AND BANKRUPTCY CODE

- The Insolvency and Bankruptcy Code (IBC) has created a cohesive and comprehensive insolvency ecosystem. With the enactment of IBC, India has witnessed the birth of two professions, namely, the insolvency profession and the valuation profession that have professionalized insolvency services.

- The Code has opened possibilities of the resolution, including merger, amalgamation, and restructuring of any kind, which often requires professional help. This has created markets for services of Insolvency Professionals, Registered Valuers, Insolvency Professional Entities and expanded the scope of services of Advocates, Accountants, and other professionals.

Cross Border Insolvency

- Cross border insolvency signifies circumstances in which an insolvent debtor has assets and/or creditors in more than one country.

- Typically, domestic laws prescribe procedures, for identifying and locating the debtors’ assets; calling in the assets and converting them into a monetary form; making distributions to creditors by the appropriate priority, etc. for domestic creditors/debtors.

- However, there are various insolvency cases in which corporations owe assets and liabilities in more than one country.

- At present, the Insolvency and Bankruptcy Code, 2016 (IBC) provides for the domestic laws for the handling of an insolvent enterprise. IBC at present has no standard instrument to restructure the firms involving cross-border jurisdictions.

- The problem of not having a cross-border framework problem was also expressed by the National Company Law Tribunal (NCLT) in Mumbai in a cross-border insolvency case involving an Indian entity.

- India needs to adopt the United Nations Commission on International Trade Law (UNCITRAL) with certain modifications to make it suitable to the Indian context.

- It has been adopted by 49 countries until now, such as Singapore, the UK, the US, South Africa, Korea, etc. This law addresses the core issues of cross border insolvency cases with the help of four main principles:

- Access: It allows foreign professionals and creditors direct access to domestic courts and enables them to participate in and commence domestic insolvency proceedings against a debtor.

- Recognition: It allows recognition of foreign proceedings and enables courts to determine relief accordingly.

- Cooperation: It provides a framework for cooperation between insolvency professionals and courts of countries.

- Coordination: It allows for coordination in the conduct of concurrent proceedings in different jurisdictions.

HIGHLIGHTS

- The liquidity in the system remained in surplus.

- Repo rate was maintained at 4 per cent in 2021-22.

- RBI undertook various measures such as G-Sec Acquisition Programme and Special Long-Term Repo Operations to provide further liquidity.

The economic shock of the pandemic has been weathered well by the commercial banking system:

- YoY Bank credit growth accelerated gradually in 2021-22 from 5.3 per cent in April 2021 to 9.2 per cent as on 31stDecember 2021.

- The Gross Non-Performing Advances ratio of Scheduled Commercial Banks (SCBs) declined from 11.2 per cent at the end of 2017-18 to 6.9 per cent at the end of September 2021.

- Net Non-Performing Advances ratio declined from 6 percent to 2.2 per cent during the same period.

- Capital to risk-weighted asset ratio of SCBs continued to increase from 13 per cent in 2013-14 to 16.54 per cent at the end of September 2021.

- The Return on Assets and Return on Equity for Public Sector Banks continued to be positive for the period ending September 2021.

Exceptional year for the capital markets:

- 89,066 crore was raised via 75 Initial Public Offering (IPO) issues in April-November 2021, which is much higher than in any year in the last decade.

- Sensex and Nifty scaled up to touch peak at 61,766 and 18,477 on October 18, 2021.

- Among major emerging market economies, Indian markets outperformed peers in April-December 2021.

Spread the Word