THE CONTEXT: Recently, there is a debate on the illusion of rating agencies. Basically, the issues are -their necessities, flaws &fragilities, and the need for regulation. Similarly, credit score has also become complicated due to the current covid induced financial crisis.

WHAT IS A RATING AGENCY?

Credit rating is an informed opinion of a recognized entity on the relative creditworthiness of an issuer or instrument. In other words, it is an opinion “on the relative degree of risk associated with the timely payment of interest and principal on a debt instrument”. Such recognized entity is known as Credit Rating Agencies (CRAs).

CRAs typically rate on the basis.

- Debt securities

- Short term debt instruments, like commercial papers

- Structured debt obligations

- Loans and fixed deposits

WHY THERE ARE ISSUES OF ILLUSION?

IDEOLOGICAL BIASES: CRAs might lower ratings for left governments as a strategy to limit negative policy and market surprises as they strive to keep ratings stable over the medium term. For e.g. A panel analysis of Standard & Poor’s, Moody’s, and Fitch’s rating actions for 23 Organisation for Economic Co-Operation and Development (OECD) countries from 1995 to 2014 shows that left executives and the electoral victory of nonincumbent left executives are associated with significantly higher probabilities of negative rating changes.

CONFLICT OF INTERESTS: CRAs are funded by the very companies they rate.

LACK OF ABILITY TO PREDICT: CRAs follow the market, so the market alerts the agencies of trouble. This reason can be attributed to CRA’s ability to predict frequent near default, default, and financial disasters.

NEGLIGENCE & INCOMPETENCE: The methodology of CRAs has come under question. For example, even after using different methodologies, the result for sovereign debts comes the same. It is also alleged that CRAs can make a sound judgement on rating, but they didn’t make an effort to do it. For e.g. Moody accepted that it did not have a good model on which it could have estimated a correlation between mortgage-backed securities, so they made them up.

POLITICALLY MOTIVATED: It has also been alleged that CRAs, through their rating mechanism, force the govt to follow the path they prescribe. For e.g. During the turmoil in Tunisia, S&P issued a report warning of “downward rating pressures” on neighbouring governments if they tried to calm social unrest with “populist” tax cuts or spending increases. Further, after Crimea’s annexation, rating agencies downgraded the rating of Russia.

POLICY MEDDLING: In 203, to stop predatory lending state of Georgia brought a law. Other states of the USA, was to follow suit until S&P retaliated. And it is well known that predatory lending is responsible for the financial crisis of 2008-09.

HOW A RATING AGENCY FUNCTION

1. FOR COMPANIES

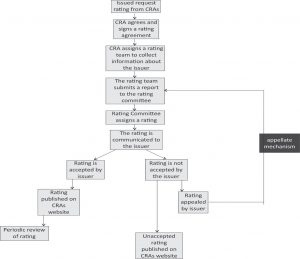

It is evident from the Above picture that credit rating agencies depend upon the audited statements. The agencies are only as effective the as honesty of their clients.

2. FOR COUNTRY

Following are the parameters on which a country is rated

- Regulatory framework

- Tariffs

- Fiscal Policy

- Monetary Policy

- Foreign Currency Control

- Physical and human Infrastructure

- Financial Markets

- Macro Factors (Consumer spending, Inflation, Interest Rates)

WHY RATING AGENCY IS REQUIRED

From the 80s onwards, as the financial system became more deregulated, companies started borrowing more and more from the globalized debt markets, and so the opinion of the credit rating agencies became more and more relevant.

ROLE OF THE CRAs

REDUCE INFORMATION ASYMMETRY: Since CRAs get access to the tcompany’s management and confidential information about its working, they can give an informed opinion about the ability of an instrument to meet its obligations.

UTILITY FOR ISSUERS: The issuer concisely communicates the quality of their issue through the rating of the CRAs, which helps it establish its creditworthiness.

GATEKEEPERS FOR FINANCIAL MARKETS: CRAs provide tangible benefits to financial market regulators by reducing the costs of regulation. Regulators such as RBI use CRAs to improve the awareness and decision-making of their regulated entities. For instance, credit ratings are used to determine the capital adequacy of banks the resolution of stressed assets.

PURVEYORS OF REGULATORY LICENSES: Some financial regulators mandate that certain instruments must be rated mandatorily before they are issued. Extensive integration of CRAs into the financial system transforms their role as purveyors.

MORAL SUASION: It compels developing countries to pursue more prudent and sensible monetary and fiscal policies.

INSTANCES WHEN RATING AGENCIES FAILED

- The financial collapse of New York City in the mid-1970s

- Asian financial crisis

- Enron scandal

- Global Financial Crisis

- During the global financial crisis, hundreds of billions of dollars worth of triple-A-rated mortgage-backed securities were abruptly downgraded from triple-A to “junk” (the lowest possible rating) within two years of the issue of the original rating.

- The US Financial Crisis Inquiry Commission called them “key enablers” of the financial crisis and “cogs in the wheel of financial destruction.”

THE HISTORY OF RATING AGENCY

- Credit rating agencies were first established after the financial crisis of 1837 in the US. Such agencies were then needed to rate the ability of a merchant to pay his debts, consolidating such data in ledgers.

- Systematic credit rating started with the rating of US railroad bonds by John Moody in 1909.

COMPARATIVE RATING SYMBOLS FOR LONG TERM RATINGS

- DEGREE OF SAFETY: Highest

- RATING: AAA

- Meaning: Timely payment of financial obligations

- DEGREE OF SAFETY: High

- RATING: AA

- Meaning: Timely payment of financial obligations

- DEGREE OF SAFETY: Adequate

- RATING: A

- Meaning: Changes in circumstances can adversely affect such issues more than those in the higher rating categories.

- DEGREE OF SAFETY: Moderate

- RATING: BBB

- Meaning: Changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal.

- DEGREE OF SAFETY: Inadequate

- RATING: BB

- Meaning: Less likely to default in the immediate future

- DEGREE OF SAFETY: A greater likelihood of default

- RATING: B

- Meaning: While currently financial obligations are met, adverse business or economic conditions would lead to a lack of ability or willingness.

- DEGREE OF SAFETY: Vulnerable to default

- RATING: C

- Meaning: Timely payment of financial obligations is possible only if favorable circumstances continue

- DEGREE OF SAFETY: In default or are expected to default

- RATING: D

- Meaning: Such instruments are extremely speculative and returns from these instruments may be realized only on reorganization or liquidation.

- DEGREE OF SAFETY: Some factors which render instruments outstanding meaningless

- RATING: NM

- Meaning: Factors include reorganization or liquidation of the issuer; the obligation is under dispute in a court of law or before a statutory authority etc.

CREDIT RATING AGENCIES IN INDIA

CRISIL:

- This full-service rating agency is India’s major credit rating agency, with a market share of more than 60%.

- It is offering its services in the financial, manufacturing, service, and SME sectors.

- The headquarter of CRISIL is in Mumbai.

- The majority stake of CRISIL was held by the world’s largest rating agency, Standard & Poor’s.

CREDIT ANALYSIS AND RESEARCH LIMITED RATINGS (CARE) RATINGS:

- Credit Analysis and Research Limited Ratings was established in 1993.

- It is supported by Canara Bank, Unit Trust of India (UTI), Industrial Development Bank of India (IDBI), and other financial and lending institutions.

- This is considered the second-largest credit rating company in India.

- The headquarter of Credit Analysis, and Research Limited Ratings is in Mumbai.

SMALL AND MEDIUM ENTERPRISES RATING AGENCY (SMERA):

- It is a rating agency entirely created for the rating of Small Medium Enterprises.

- It is a joint enterprise by SIDBI, Dun & Bradstreet Information Services India Private Limited (D&B), and some chief banks in India.

- The headquarter of SMERA is in Mumbai

- It has accomplished 7000 ratings.

ONICRA CREDIT RATING AGENCY:

- SonuMirchandani incorporated it in 1993

- It investigates data and arranges for possible rating solutions for Small and Medium Enterprises and Individuals.

- The headquarter of ONICRA Credit Rating Agency is located in Gurgaon

- It has broad experience in performing a wide range of areas such as Accounting, Finance, Back-end Management, Analytics, and Customer Relations. It has rated more than 2500 SMEs.

FITCH (INDIA RATINGS & RESEARCH):

- Fitch Ratings is a global rating agency dedicated to providing the world’s credit markets with independent and prospective credit opinions, research, and data.

- The headquarter of Fitch Ratings is in Mumbai.

ICRA:

- It was created in 1991 by prominent financial institutions and commercial banks in India with a devoted crew of experts for the MSME sector

- Moodys, which is considered the international credit rating agency holds the major share.

DIFFERENT BUSINESS MODELS OF CREDIT RATING AGENCIES

- MODELS: ISSUER PAY MODEL

- ADVANTAGE: Ratings are available to the entire market free of charge and will greatly aid small investors. It gives the rating agencies access to high-quality information that enhances the quality of analysis.

- DISADVANTAGE: It can lead to a serious conflict of interest since the company pays the CRAs to get the rating. The CRAs may inflate the rating to satisfy the company. It may lead to ‘Rating Shopping’ which refers to the situations where an issuer approaches different rating agencies for the ratings and then choose to publish the most favorable ratings to disclose them to the public via media while concealing the lower ratings.

- MODELS: INVESTOR PAYS MODEL

- ADVANTAGE: It would avoid the serious conflict of interest of the CRAs. This would enable the investors to get the credit rating based on the company’s true and actual financial condition.

- DISADVANTAGE: Ratings would be available only to those investors who can pay for them and take ratings out of the public domain and thus affecting the small investors. The company may not always share all the necessary information with the CRAs which can have an adverse impact on the quality of the ratings. It can pose a serious conflict of interest involving the investors themselves. If investors are the payees, they can influence CRAs to give lower-than-warranted ratings to help them negotiate higher interest rates.

- MODELS: REGULATOR PAYS MODEL

- ADVANTAGE: It eliminates the conflict of interest as seen in both Issuer Pay Model and Investor Pay Model.

- DISADVANTAGE: The problem with this model lies in choosing the CRA and payment to be fixed. The CRA chosen by the regulator may not provide the best credit rating. Further, if the regulator pays less amount of money to the CRA, the CRA may find it difficult to continue with its business and could have an adverse impact on the quality of the ratings issued.

SHOULD RATING AGENCIES BE REGULATED?

- RATING SHOPPING: It has often been seen that both issuer and investor are involved in rating shopping. CRAs inflate the rating, particularly for structured product markets for getting more market share and profit margins.

- OLIGOPOLISTIC TENDENCIES: Around 95% of the market is controlled by only 3 CRA VIZ. S&P, MOODY’S and Further, they use expansionist marketing. For e.g. Hannover Re lost a big chunk of the market share when it didn’t pay the service fee. (CRAs promised it free service).

- HEGEMONIC CONTROL: As the big three CRAsare located in North America, America exerts great control on the functioning of CRAs. When CRAs downgraded the USA, CRAs were fined. Further, the rating of the country is not done objectively. UK was rated lower than the USA, even when the fiscal deficit of the UK was lower than the USA.

- CONTROL: CRAs have great control over the world economy as their rating can result in the flight of capital.

- ACCOUNTABILITY: CRAs are not accountable to any country and their functioning is not transparent

CHANGES THAT IS IMPERATIVE FOR BETTER FUNCTIONING

DODD-FRANK ACT

In response to the Global Financial Crisis of 2008-2009, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act in July 2010. It encourages CRAs to invest in due diligence, strengthen internal controls and corporate governance, and improve their methodology. But some of the following provisions of it are still unimplemented:

- The legal liability of credit rating agencies should be increased.

- The use of credit ratings in regulations that set capital requirements and restrict asset holdings for financial institutions should be removed or replaced.

- Internal controls, conflicts of interest for credit analysts, standards for credit analysts, transparency, the internal conflict of interest, and rating performance statistics should be ruled based and regulated.

THE WAY FORWARD

- A rating agency run by the UN, funded by pooled contributions from both lenders and borrowers should be established. Rating business must be made a utility, rather than a semi-cartel that intimidates elected politicians and rakes in excess profits

- With the help of technology, open-source models with fully transparent inputs and outputs should be created and promoted. Credit Risk Initiative of the National University of Singapore Risk Management Institute is one such example.

THE CONCLUSION: CRAs play a valuable role in financial markets by analyzing credit for many investors, but their inaccurate ratings can create problems of enormous proportion for the world economy. A unified, integrated effort by all the country is needed to avoid another economic meltdown, which would have severe repercussions for both, any country or its citizen

ADDITIONAL INFORMATION

ALL YOU NEED TO KNOW CREDIT SCORE

Credit score: A credit score is a number between 300–850 that depicts a consumer’s creditworthiness. The higher the score, the better a borrower looks to potential lenders. A credit score is based on credit history: number of open accounts, total levels of debt, repayment history, and other factors. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner.

The background: The credit score model was created by the Fair Isaac Corporation, also known as FICO, and financial institutions use it.

How Credit Scores Work: A credit score can significantly affect your financial life. It plays a key role in a lender’s decision to offer you credit. People with credit scores below 640, for example, are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a higher rate than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

The history of credit scores in India: Credit Information Bureau (India) Limited was founded in August 2000 and is India’s first credit information firm. The organization gathers and manages financial records of individuals as well as business organizations relating to loan and credit card payments & borrowings. CIBIL acquires this data with the assistance of its bankers and credit institutions.

- CIBIL is RBI authorized and is also known as the Credit Bureau. It is covered under the 2005 Credit Information Companies Regulation Act. To find relevant information, it requires support from its associated partners, including bank members & credit institutions. Associate partners give it every month.

- In 2014, keeping the prevalent information asymmetry in mind, the RBI decided to set up a technical group on credit information based on the recommendations of the Aditya Puri committee.

- The committee included chief executives belonging to all the four credit bureaus, representation from large banks, an executive from the Indian Banks’ Association (IBA), and several RBI officials.

- The Puri committee suggested that the Cibil format could be used to standardize data formats for both consumer and commercial borrowers.

Problems in credit ratings: Erroneous credit score could either be a genuine mistake by the bank or, in some cases, when an individual stands as a guarantor for a loan. Experts believe that customers should check their scores regularly and report any discrepancies that they notice in their credit history. Due to the data entry operator, the lackadaisical attitude of most lenders and the long-winding dispute resolution process cannot be pinned on customers. While checking credit scores at regular intervals would weed out any

Spread the Word