“GST has been a milestone in the economic landscape of India. It has decreased the number of taxes, compliance burden and overall tax burden on the common man while significantly increasing transparency, compliance and overall collection.”#4yearsofGST.

———-PMNarendra Modi

THE CONTEXT: On 1st July 2021, India marked the fourth anniversary of the Goods and Services Tax (GST). The date 1st July has been designated by the Central Government as ‘GST Day’, which is celebrated every year to mark the rollout of the historic tax reform. This article will look into achievements, challenges, and expectations related to the GST regime.

MORE ON THE NEWS:

On May 28th, 2021, at the 43rd meeting of the GST Council, finance ministers of many states raised various concerns like delay in payment of GST compensation to states, unilateral decisions, and the overall distrust between central and state governments. Four years after giving up their freedom to tax goods and services in favor of the GST Council, states are of the view that they have been short-changed and their voices muzzled.

ACHIEVEMENTS OF GST

COOPERATIVE FEDERALISM: One of the biggest triumphs associated with GST is cooperative federalism, which has demonstrated successful collective decision-making through the GST Council. India has served as an example to the world by successfully implementing one of the most complex tax transformation projects for the country.

FUNCTIONING OF GST COUNCIL: The GST Council made corrections to law, issued clarifications on complex issues, rationalized GST rates, and introduced relaxations for dealing with the Covid-19 pandemic, which establishes that the GST Council structure has been very functional and agile.

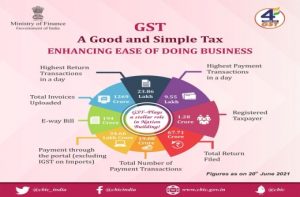

WIDENED TAX BASE: India’s tax base has almost doubled from 66.25 lakhs to 1.28 crores in the last four years. GST revenue collection in India has been over the Rs 100,000 crore mark for eight consecutive months.

EASE OF DOING BUSINESS: India’s ease of doing business ranking has improved significantly in the last four years. Before GST was implemented, India’s Ease of Doing Business ranking was 130 in 2016. In 2020, India was ranked 63rd on the list.

RATE RATIONALISATION: Over four years GST rates have been reduced on 400 goods & 80 services. According to GOI combined Centre & States rates were above 31% on most items in the pre-GST regime. An RBI report of 2019 estimated that the effective weighted average GST rate declined from 14.4 percent at the time of the introduction of the GST to 11.6 percent.

LOGISTICAL EFFICIENCY, PRODUCTION COST CUT: Over 50% of logistics effort and time is saved since GST has ensured the removal of multiple checkpoints and permits at state border checkpoints. As a result, more road hours and faster delivery have been added which has enhanced the business efficiency in the country. GST has almost ended the era of the multiplicity of taxes and its cascading effect which has sufficiently reduced production costs, leading to better margins for the industry, which were passed on to the consumers in the form of better products or lower prices.

E-WAY BILL: The introduction of the E-way bill resulted in the national unification of permit bill systems, allowing logistics to experience fewer interruptions en route making delivery quick and hassle-free.

COMPETITIVENESS AND COMPLIANCE: GST has improved the competitiveness of domestic industries in the international market by removing hidden and embedded taxes. GST helped in achieving better tax compliance by subsuming multiple taxation and reduction in taxation burden in the last four years.

E-INVOICE: The E-invoicing system helped reduce fake invoicing. The use of technology with online bill generation has resulted in smoother consignment movement and much fewer disputes with officials. After the introduction of E-invoice, GST collections have risen steadily since November 2020, surpassing the Rs. 1 lakh crore mark on several occasions.

REDUCED TRANSACTION COSTS: After the introduction of GST, there has been a significant reduction in transaction costs. While earlier, all the interstate transactions were loaded with an additional cost of 2% (Central Sales Tax), this has now been reduced to 0%. This reduction has been a huge breakthrough in the interstate movement of products, allowing the country to boast of a single national unified market for businesses.

CHALLENGES/PROBLEMS OF GST

CONCERNS HIGHLIGHTED BY THE 15th FINANCE COMMISSION REPORT:

- The multiplicity of tax rates

- The shortfall in GST collections vis-à-vis the forecast

- High volatility in GST collections

- Inconsistency in the filing of returns

- Dependence of States on the compensation from Centre

CONCERNS RAISED BY STATE FINANCE MINISTERS:

- Delay in payment of GST compensation to states.

- The issue of reduction in GST on Covid vaccines and essentials.

- Unilateral decisions such as the imposition of cases (whose proceeds go to only the Centre)

- Vertical split on party lines on key issues.

- Veto powers of the centreonGST Council decisions.

COMPENSATION CONUNDRUM:

- The biggest reason states agreed to give up their autonomy to tax goods and services was an assurance by the central government that it would compensate them for any revenue loss from subsuming indirect taxes such as sales tax/VAT into GST.

- The GST (Compensation to States) Act, enacted in 2017, guarantees states 14 percent annual growth in GST revenue over base year FY16 for five years between July 2017 and June 2022.

- While this worked well till FY19, problems cropped up in FY20 when the Centre started finding it tough to pay states as economic slowdown affected its revenues. The Covid-19 outbreak aggravated the problem by putting huge pressure on both countries and states.

TAX UNILATERALISM:

- Cess revenue is not shared with states.

- Close to 18 percent of central government revenue is being raised from cess and not distributed (among states). Total control of finances is with the central government.

- It needs to be discussed and reviewed.

EXPERTS CONCERNED OVER GST GROWTH:

- Experts believe the government has been unable to widen the tax net, which is why GST collections have not increased beyond a certain limit.

- Some experts suggest that the GST net may not widen further as many small businesses have not enrolled under the tax regime due to complex paperwork.

CONSTANT AMENDMENTS:

- Over the last few years, the GST law has seen many amendments. To date, more than 1,000 notifications/circulars/instructions/orders have been issued by the government machinery.

- All these revisions often confused the taxpayer and as well the tax administrators which created misunderstandings and misconceptions.

TECHNICAL GLITCHES:

- Continuous system failures and unexpected glitches faced by the industry have forced Government to extend due dates, waiver of late fees and interest liabilities. Late announcements of waiver in late fee have come out as dissatisfaction amongst the honest taxpayers also.

- Small and medium businesses are still grappling to adapt to the tech-enabled regime. The fundamental principles on which the GST law was built viz. The seamless flow of input credits and ease of compliance has been impaired by IT glitches.

IMPLEMENTATION DELAYS:

- The late implementation of E-invoicing, QR code, and E-way Bill blemished the original idea behind this which was contemplated as a revolutionary change in the tax system to curb tax evasion.

NON-IMPLEMENTATION OF GSTR-2:

- GSTR which was the only control for systemic reconciliation was never implemented. To prevent any bogus claim of ITC, reconciliations are required to be controlled by the system. However, since it was never implemented now taxpayers are asked to provide self-attested offline reconciliations maintained in annual return GSTR 9 or GSTR 9C.

REFUND DELAY ISSUES:

- Automatic processing of export refunds has always been an area of major concern under the GST. Since there are manual approvals involved in the existing process, there are chances of a discrepancy, human error, and delay in refund processing which goes against the expectations of the exporters from the system.

LOW REVENUE:

- Widespread non-compliance and non-filing of GST returns were considerable in the first three years of GST which led to low revenue collections.

WAY FORWARD

The GST structure needs an overhaul for the revenue-enhancing promise to be met. The union can at minimum do three things.

- Reaffirm its commitment to cooperative, consultative principles of federalism by reforming the functioning of the GST Council.

- Offer the FY21 compensation cess as a transfer, not a back-to-back loan with the caveat that the compensation rate will be re-negotiated.

- Be transparent about the current macro-economic scenario through an honest appraisal that revisits revenue projections.

- The pandemic has had severe impacts on GST also and led to economic contraction. Certain structural level changes to the law may help boost the business and economy.

- The policymakers need to contemplate the inclusion of petroleum and related products within the GST

- The GST Appellate Tribunal should be constituted as all taxpayers do not have the finances or means to approach the High Court for every practical difficulty faced.

- Streamlining of anti-profiteering measures and simplification of compliance procedures also needs to be revisited to ensure that the cost efficiency and reduction in prices envisaged under GST law finally reach the common man.

THE CONCLUSION: Although the shortcomings must be swiftly resolved, it needs to be understood that it takes time to reap the benefits of such a mammoth structural change. The law is still a ‘work-in-progress’ and the process of evolution. The union government must act now to deliver on its promise of a ‘Good & Simple Tax’ in the times to come.

Spread the Word