THE CONTEXT: The retail inflation in the Indian economy accelerated in Nov. 2021 towards the upper limit of the RBI’s target range as fruit and vegetable prices rose. There are chances that inflation may rise above 6 percent in early 2022. It is fear that the rising of inflation can impact the recovery of the Indian economy in post-pandemic times. Let us understand the issue of inflation that is impacting the Indian Economy.

TREND OF INFLATION IN INDIA

- In the latest bi-monthly meeting of MPC in December 2021, the committee projects 5.30% inflation rate for FY22 and a dovish forecast at around 5% thereafter.

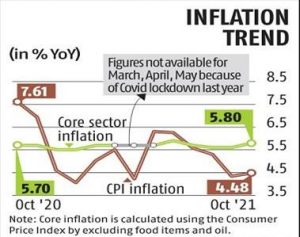

- Retail inflation rose 4.48 percent in October 2021 from 4.35 percent in September. The data for November 2021 is yet to come. It will release on 13th

- The food inflation: determined by the consumer food price index rose to 0.85 percent in October, compared to 0.68 percent in September. The inflation in the ‘fuel and light’ category remained elevated at 14.35 percent during the month, according to data released by the National Statistical Office (NSO).

REASONS FOR THE RISING IN INFLATION IN INDIA

- The sharp rise in commodity prices across the world is a major reason behind the inflation spike in India. This is increasing the import cost for some of the crucial consumables, pushing inflation higher.

- High petrol, diesel, and cooking gas prices drove fuel inflation, while high prices of basic metals, textiles, plastics, and edible oils drove inflation of manufactured items.

- The price of vegetable oils, a major import item, shot up 57% to reach a decadal high in April 2021.

- Metals prices are near the highest in 10 years and international freight costs are escalating.

- The rise in inflation was mostly due to rising in prices of fuel, edible oil prices, and non-alcoholic beverages. Retail inflation edged higher last month despite the base effect as it stood at 7.61 percent in October 2020, while the food inflation was at 11 percent in the year-ago period.

EFFECTS OF INFLATION ON VARIOUS ASPECTS OF THE ECONOMY AND ECONOMIC GROWTH

NEGATIVE EFFECT

- On Imports: They become costly due to high inflation as the currency depreciates and more foreign currency is lost for imports.

- On Lending: Lending institutions (like banks) feel the pressure of higher lending due to the high inflation rate in the economy. Therefore, they don’t revise the nominal interest rates as the real cost of borrowing falls by the same percentage with which the inflation rises.

- On Income: Increase in inflation increases the nominal value of income while the real value of income remains the same.

- On Expenditure: Increased prices make consumption levels fall as goods and services get costlier.

POSITIVE EFFECT

- On Exports: Inflation makes exportable goods competitive in the world market and thus exports increase.

- On Aggregate demand: High rate of inflation shows there is high demand

- On Savings: Money loses value due to inflation, that’s why people keep less money with them and keep more money in banks. It means that the savings rate increases in the short run. In long run, higher inflates deplete the savings rate in an economy.

- On Wages: Inflation increases the nominal value of wages but their real values fall.

WILL INFLATON DENT ECONOMIC RECOVERY?

- One of the key factors why inflation probably witnessed a rise in November is the sharp rise in the prices of various vegetables. The jump in vegetable prices, though temporary, could hit demand and disrupt economic recovery for a short period.

- While fuel prices have been cut by the government, it seems that fuel demand has fallen after the festive season. This indicates a lower demand for fuel. India’s fuel consumption in November was down 4 percent on a quarterly basis and over 11 percent lower year on year.

- However, the demand will rise again as Covid-19 fades further. This indicates that the present scenario of inflation is unlikely to impact economic recovery for a long period.

BUT RISING INPUT COST BIGGEST WORRY FOR ECONOMIC RECOVERY

- While vegetable prices and fuel demand may fade away over the next few months, India could face a period of persistently high inflation due to rising input costs.

- Many companies across the spectrum from automakers to electronic goods manufacturers have hiked prices of their products due to prolonged disruption in global supply chains and a severe shortage of semiconductors. Car manufacturers are already going for another round of price hikes in January 2022.

- Rising inflation in the non-food category, arising from global supply chain disruptions and fresh restrictions due to the new Omicron variant of coronavirus, seems to be the biggest hurdle in the path of swift economic recovery.

ROLE OF RBI IN CONTROLLING INFLATION

The RBI has adopted policies through which it decreases or increases certain rates to control inflation. Hence it is important to understand what these rates are and how they affect inflation.

- Interest rate

- Repo Rate- Repo rate (Repurchase or Repossession) is the rate at which RBI buys government securities with an agreement of repossession, from the commercial banks. It is a short-term borrowing from the central bank, against securities, to inject money to meet the gap between the demand for money (loans) and deposits in the bank.

- Reverse Repo rate- It is the rate at which the RBI borrows money from commercial banks. Banks deposit money in RBI when there is no other profitable option to invest the short-term excess liquidity or when there is uncertainty in the market for a significant period of time.

- Bank Rate- Bank rate is the rate at which the RBI allows finance to the domestic banks. It is generally for a short period of time. Unlike, Repo rate, there are no securities to be kept against the finance. But, in policies designed to control inflation, Bank rates are seldom revised.

- Reserve Ratios

- Cash Reserve Ratio- Banks are required to keep a fraction of deposit liabilities in the form of liquid cash, CRR, with the RBI to ensure the safety and liquidity of the deposits.

- Statutory Liquidity Ratio- Every bank in India has to maintain a minimum proportion of their net demand and time deposits as liquid assets in the form of cash, gold, precious and semiprecious stones. SLR has nearly remained constant for the last 14 years.

- Open Market Operations

- The RBI can purchase or sell Government securities from or to the public. To control inflation, the RBI sells the securities in the money market which sucks out excess liquidity from the market. As the amount of liquid cash decreases, demand goes down. This part of monetary policy is called the open market operation.

- Selective Credit Control

- The Banking Regulation Act empowers the RBI to control the level and pattern of advances given by banks, selectively.

- The RBI has been operating selective credit control to contain inflation of goods that are short in supply or sensitive goods like food grains, vegetables, pulses, oilseeds, cotton, sugar, gur, Khansari, etc which are of mass consumption.

BRIEF BACKGROUND TO UNDERSTAND THE TOPIC

- Definition of Stagflation – It is a stage of persistently high inflation combined with high unemployment and stagnant demand in a country’s economy.

- Constituents of WPI and CPI

- WPI

- The wholesale Price Index (WPI) is an indicator of price changes in the wholesale market.

- It constitutes primary articles (22.62), fuel and power(13.15), and manufactured goods (64.23) with their weights being in the brackets.

- It is released by the office of the Economic Advisor in the ministry of commerce and Industry.

- CPI

- Consumer Price Index (CPI) is a price index that represents the average price of a basket of goods over time. CPI calculates the average price paid by the consumer to the shopkeepers.

- It is calculated on the basis of 8 groups – Education, communication, transportation, recreation, apparel, foods and beverages, housing, and medical care.

- Published by CSO.

- Monetary Policy Committee

- It is statutorily created by amending the RBI Act 1934.

- It consists of six members with three being from RBI and 3 appointed by the government

- It seeks to maintain inflation in the range of 4 +/- 2% range i.e. 2 to 6% rate.

- WPI

THE WAY FORWARD

The current Inflation spike is largely due to seasonal factors and thus will subside in a month or two. However, the major focus should lie in boosting growth so that the country doesn’t enter into a phase of stagflation. The following steps can be taken for boosting growth while controlling inflation.

FOR CONTROLLING INFLATION

Supply-side Reforms: Government needs to take steps to boost supply especially of food articles such as vegetables and pulses by bringing more area under cultivation through reclamation of fallow land and increasing productivity.

Prevention of Hoarding and Nexus: Hoarding and nexus between middlemen lead to an increase in inflation without any external factor and harm the interest of consumers. This needs to be prevented through proper monitoring of inflow and outflow of Mandis and through digitalisation of agricultural markets.

FOR BOOSTING GROWTH

Balancing Growth and Inflation: RBI has already cut the interest rates by 135 basis points but has not been passed on to the customer and market due to no change by the banks. Thus, the RBI cannot cut the interest rate anymore for improving growth but we need to focus on banks for better transmission of rates leading to boosting growth.

Boosting Private Sector Investment: Private sector investment can be improved through simplification of policy procedures and maintaining a sound economic environment. Constant protests and abrupt policy changes are going to stop investments and thus a proper environment is important for boosting private sector investment.

Structural Reforms: Land, Labour, Agriculture, and taxation need structural reforms so as to improve both the business and agriculture environment.

Regulation: Demonetisation, GST, Automobile policy, E-commerce policy, etc. have all been abrupt policies that impacted the market drastically. A business flourishes when provided with predictable environmental conditions and thus abrupt changes should be avoided. Instead of creating policy on a day-to-day basis, the government should provide the major regulations along with the budget at the start of the fiscal year and should only do minuscule adjustments around the year.

THE CONCLUSION: Indian Economy is suffering from huge challenges of suppressed growth, investment, production while inflation is increasing along with large unemployment figures. In short, all that can go wrong has been going wrong, and thus, there is a need for a predictable growth model for the Indian economy which the government has failed to provide. It is time, that instead of modifying older policies, the government needs to provide a clear model for boosting growth in all primary, secondary and tertiary sectors. Structural reforms need to be undertaken in the land, labour, and capital. Companies need to be provided with predictable regulatory regimes. The market needs to be given time to adjust to policy changes. Judiciary and the legal system need to be sensitized so as to handle economic cases so that the verdict doesn’t threaten the investors. Lastly, agriculture has the biggest multiplier effect on growth and thus agriculture needs to be boosted with long-term policies and not limited to superficial changes in MSP and loan waivers.

Spread the Word