THE CONTEXT: The Russian invasion of Ukraine, which started in February 2021, is the largest conventional military attack seen since World War II and can cause a global economic catastrophe. It has deep implications for the world economy as well as the Indian economy. This article analyses those consequences and suggests the way forward for them.

ECONOMIC IMPACTS ON THE WORLD

ENERGY AND COMMODITIES MARKETS:

- Russia is the world’s 3rd largest oil producer, the 2nd largest natural gas producer, and among the top 5 producers of steel, nickel, and aluminum. It is also the largest wheat exporter globally (almost 20% of global trade).

- On its side, Ukraine is a key producer of corn (6th largest), wheat (7th), and sunflowers (1st), and is amongst the top ten producers of sugar beet, barley, soya, and rapeseed.

- On the day the invasion began, financial markets worldwide fell sharply, and the prices of oil, natural gas, metals, and food commodities surged.

- Brent oil prices breached USD 130 per barrel following the latest developments, while Europe’s TTF gas prices surged at a record EUR 192 on 4th March.

- While high commodity prices were one of the risks already identified as potentially disruptive to the recovery, the escalation of the conflict increases the likelihood that commodity prices will remain higher for much longer. In turn, it intensifies the threat of long-lasting high inflation, thereby increasing the risks of stagflation & social unrest in both advanced & emerging countries.

AUTOMOTIVE, TRANSPORT, CHEMICALS ARE THE MOST VULNERABLE SECTORS:

- The crisis is obviously strongly impacting an already strained automotive sector due to various shortages and high commodity & raw material prices: metals, semiconductors, cobalt, lithium, and magnesium.

- Ukrainian automotive factories supply major carmakers in Western Europe: some announced the stoppage of factories in Europe while other plants around the world are already planning outages due to chip shortages.

- Airlines and maritime freight companies will also suffer from higher fuel prices, airlines being the most at risk.

- First, fuel is estimated to account for about a third of their total costs.

- Second, European countries, the US and Canada, have forbidden access to their territories to Russian airlines and in turn, Russia has banned European and Canadian aircraft from its airspace.

- This means higher costs since airlines will have to take longer routes. Eventually, airlines have little room for rising costs as they continue to face lower revenues due to the impact of the pandemic.

- Rail freight will also be impacted: European companies are forbidden to do business with Russian Railways, which will likely disrupt freight activity between Asia and Europe, transiting through Russia.

- It is expected that feedstock for petrochemicals will be more expensive, and the soaring prices of natural gas will impact the fertilizer markets, hence the whole agri-food industry.

DEEP RECESSION AHEAD FOR THE RUSSIAN ECONOMY:

- The Russian economy will be in great difficulty in 2022, falling into a deep recession. Coface’s updated GDP forecast for 2022 stands at -7.5% after the recovery experienced last year. This has led to a downgrade of the country’s risk assessment from B (fairly high) to D (very high).

- Sanctions notably target major Russian banks, the Russian central bank, the Russian sovereign debt, selected Russian public officials & oligarchs, and the export control of high-tech components to Russia. These measures put considerable downward pressure on the Russian ruble, which has already plummeted and will drive a surge in consumer price inflation.

- Russia has built up relatively strong financials: a low level of public external debt, a recurrent current account surplus, as well as substantial foreign reserves (app. USD 640 bn). However, the freeze imposed by western depositary countries on the latter prevents the Russian central bank from deploying them and reduces the effectiveness of the Russian response.

- The Russian economy could benefit from higher prices for commodities, especially for its energy exports.

- However, EU countries announced their intention to limit their imports from Russia. In the industrial sector, restricted access to Western-produced semiconductors, computers, telecommunications, automation, and information security equipment will be harmful, given the importance of these inputs in the Russian mining and manufacturing sectors.

EUROPEAN ECONOMIES ARE AT A HIGH RISK:

- Because of its dependence on Russian oil & natural gas, Europe appears to be the region most exposed to the consequences of this conflict. Replacing all Russian natural gas supply to Europe is impossible in the short to medium run and current price levels will have a significant effect on inflation.

- While Germany, Italy, and some countries in the Central and Eastern European region are more dependent on Russian natural gas, the trade interdependence of Eurozone countries suggests a general slowdown.

- On top of that, we estimate that a complete cut of Russian natural gas flows to Europe would raise the cost to 4 percentage points in 2022, which would bring annual GDP growth close to zero, more probably in negative territory – depending on demand destruction management.

NO REGION WILL BE SPARED BY IMPORTED INFLATION AND GLOBAL TRADE DISRUPTIONS:

- In the rest of the world, the economic consequences will be felt mainly through the rise in commodity prices, which will fuel already existing inflationary pressures. As always, when commodity prices soar, net importers of energy & food products will be particularly affected, with the specter of major supply disruptions in the event of an even greater escalation of the conflict. The drop in demand from Europe will also hamper global trade.

- In Asia-Pacific, the impact will be felt almost immediately through higher import prices, particularly in energy prices. Many economies in the region are net energy importers, led by China, Japan, India, South Korea, Taiwan, and Thailand.

- As North American trade and financial links with Russia and Ukraine are fairly limited, the impact of the conflict will mainly be felt through the price channel and through the slowdown of European growth.

- Despite the prospect of slower economic growth and higher inflation, the recent geopolitical events are not expected to derail monetary policy in North America at this stage.

IMPACT ON INDIA

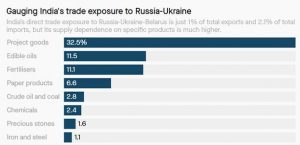

Despite India’s limited direct exposure, the combination of supply disruptions and the ongoing terms of trade shock will likely weigh on growth, resulting in a sharper rise in inflation, and (leading to) a wider current account deficit.

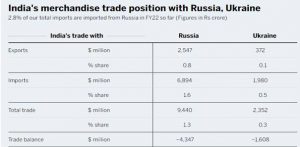

India’s trade with Russia and Ukraine

- India runs a trade deficit with Russia, with exports declining while imports are increasing. Oil forms a major part of our import basket from Russia.

- According to the MoF report, 8 percent of our total imports have been imported from Russia in FY22.

Here are the ways India could suffer due to a Russia-Ukraine war even without being part of it.

BAN ON RUSSIA’S CRUDE EXPORTS:

- In reaction to the US’s ban on all oil and gas imports from Russia, Brent crude prices surged to nearly $130 per barrel in the first week of March 2022.

- This is a major setback for global economic growth as Russia is one of the largest exporters of crude oil globally. India’s trade, however, comprises only 1% of oil imports from Russia, but there could be a spillover impact in the form of high inflation and sluggish growth.

- On March 13, Morgan Stanley lowered India’s GDP forecast for the fiscal year 2023 by 50 basis points to 7.9%. After that, the UN report downgraded India’s 2022 GDP to 4.6% due to the war.

- More risks could arise if global growth conditions weaken further, which would hamper India’s export and capital expenditure cycle.

INFLATIONARY CONCERNS:

- India depends on imports to meet up to 85% of its crude oil needs. The surge in international oil prices to a 14-year high will now result in broader price pressures.

- The impact on India’s economy will be felt mostly through higher cost-push inflation weighing in on all economic agents—households, businesses, and government.

- Every 10% rise in crude oil prices leads to a 0.4 percentage point rise in consumer inflation.

- It is estimated that retail inflation at 6% for the fiscal year 2023 is much higher than the RBI’s 4.5%.

- An increase of U.S.$25/bbl. would lead to an estimated reduction in the growth of 0.7% points and an increase in inflation of nearly 1% point. If the prices of other imported commodities also increase, the inflation impact will be higher.

- This has increased the risks of a higher import bill and, in turn, a widening of India’s current account deficit (CAD).

- A study by the RBI in 2019 had estimated an increase in the current account

- deficit (CAD) following a U.S.$10/bbl. increase in global crude price, to be nearly 0.4% points of GDP. Thus, for an increase of U.S.$25/bbl. in global crude prices, the CAD may increase by 1% point of GDP.

- The RBI Professional Forecasters Survey’s median estimate of CAD at 1.9% of GDP for 2022-23 may have to be revised upwards to 2.9%.

INDIA’S DEFENCE SUPPLIES:

- Between 2016 and 2020, India accounted for nearly 25% of Russia’s total arms exports. This explains that the share of defense expenditure in India’s budget every year is not little.

- This time, a key defense contract in question is the delivery of the Russia-developed S-400 air missile system worth $5 billion, which was signed in October 2018.

- Moreover, the Indian Army’s main battle tank force is composed predominantly of Russian T-72 M1 and T-90S, accounting for 66% and 30% of all units, respectively.

- India will continue to rely on Russian weapons systems in the middle term, despite the US’s threat of sanctions over the S-400 purchase looms large over India.

OTHER AREAS:

- POST-COVID DISRUPTION: The geopolitical uncertainty coupled with the likely slowdown in the global economy and high inflation could lead to a major spike in gold prices, as central banks are left with limited legroom to raise interest rates.

- DIGITAL CURRENCIES: Day one of the conflicts also witnessed 8 percent of cryptocurrencies’ market capitalization of $1.59 trillion being wiped out.

- SEMICONDUCTORS: Russia and Ukraine are both suppliers of raw materials used in semiconductor manufacturing. Russia is the leading producer of palladium, essential for memory and sensor chips. And Ukraine is a leading exporter of highly purified neon gas that is used in etching circuit designs into silicon wafers to create chips.

- PHARMA: India exported over $181 million worth of pharmaceutical goods to Ukraine in FY21, growing nearly 44 percent over FY20, while exports to Russia were nearly $591 million in FY21, with YoY growth of 6.95 percent.

- TEA: Russia is one of the biggest importers of Indian tea, with a share of 18 percent in Indian tea exports.

- SUNFLOWER OIL: Indians, as the country depends almost totally on Ukraine and Russia for sunflower oil imports. In 2020-21, India imported 1.9 million tonnes of crude sunflower oil, of which Ukraine accounted for 1.4 million tonnes. The rest came from Russia.

- IMPACT ON PAYMENT SETTLEMENT: Due to the discontinuation of transactions through SWIFT, there would be some disruption in trade to and from Russia and Ukraine.

WHAT ARE THE CHALLENGES FOR RBI AND GOI IN RECENT TIMES?

- Policymakers may have to exercise a critical choice regarding who bears the burden of higher prices of petroleum products in India among consumers and industrial users, oil marketing companies, and the Government.

- If the oil marketing companies are not allowed to raise the prices of petroleum products, the bill for oil sector-linked subsidies would go up.

- If the central and State governments reduce excise duty and value-added tax (VAT) on petroleum products, their tax revenues would be adversely affected.

- If, on the other hand, the burden of higher prices is largely passed on to the consumers and industrial users, the already weak investment and private consumption would suffer further.

- If growth is to be revived, maximum attention should be paid to supporting consumption growth and reducing the cost of industrial inputs to improve capacity utilization.

- If RBI reduces the interest rate, it will further increase the money supply, which will lead to further higher inflation. If the RBI increases the interest rate, it will reduce the money supply in the economy but will impact the economic recovery negatively.

THE WAY FORWARD:

- As a short-term measure, the Rupee-Rouble trade agreement should be finalized as soon as possible.

- Notional policy on semiconductors should be promoted effectively so that India could become self-reliant in semiconductor and chip making.

- RBI should take more liberal steps i.e. accommodative monetary policy. As developed countries are being forced to raise their interest rates and inflationary pressures continue to mount in India and abroad, the RBI may find it advisable to raise the policy rate to stem inflationary pressures and the outward flow of the U.S. dollar even as the growth objective would be served by fiscal policy initiatives.

- For recovery, maximum attention should be paid to supporting consumption growth and reducing the cost of industrial inputs to improve capacity utilization.

- India should increase the capacity of its strategic petroleum reserve so that at the time of a war-like situation, India can manage the impact of hiked crude oil prices, in a long term manner, needs to focus on renewable energy sources.

- To address the shortage of sunflowers oil, the government should take steps to promote domestic cultivation of the oil like the government is doing for palm oil under National Mission on Edible Oils – Oil Palm (NMEO-OP).

THE CONCLUSION: World leaders should come together not for discussing the scale of sanctions but to work out ways to resolve the issue and put an end to the mayhem. Diplomatic channels should be used to have dialogue, negotiate, convince and arrive at amicable solutions to end the conflicts. The increased spate of sanctions on one country is a pain to other dependent countries and it disrupts the world order. Prolonged armed conflicts will worsen the plight of innocent countries and their people.

Economic Impacts of Russia-Ukraine War, Economic Impacts on The World, Recession Ahead for the Russian Economy, European Economies, Inflation & Global Trade Disruptions, India’s Trade with Russia and Ukraine, India’s Defence Supplies, Impact on Payment Settlement

Spread the Word