THE INTRODUCTION: Rising prices are always a cause of concern for policymakers as they hurt the common man the most. The perils of inflation are felt more in developing economies, where necessities have a higher share in the consumption basket than in developed countries. In recent years, India’s inflation rate has been well-behaved, lying tamely below the RBI target rate of 4 per cent from 2017 to 2019.

- In advanced economies, the rate of inflation is projected by the International Monetary Fund (IMF) to increase from 3.1 per cent in 2021 to 7.2 per cent in 2022, the highest since 1982.

- The inflation rate in Emerging Markets and Developing Economies (EMDEs) is anticipated to have increased from 5.9 per cent in 2021 to 9.9 per cent in 2022 (WEO, October 2022).

- India’s inflation rate peaked in April 2022 at 7.8 per cent before moderating to 5.7 per cent in December 2022 on the back of good monsoons as well as prompt government measures that ensured adequate food supply.

- Core inflation remains sticky at nearly 6 per cent and reflects the second-round effects of the supply shocks witnessed earlier this year.

DOMESTIC RETAIL INFLATION

Headline Inflation Declined from its Peak

- In FY23, retail inflation was mainly driven by higher food inflation, while core inflation stayed at a moderate level. Food inflation ranged between 4.2 per cent to 8.6 per cent between April and December 2022, while the core inflation rate stayed at around 6 per cent except in April 2022.

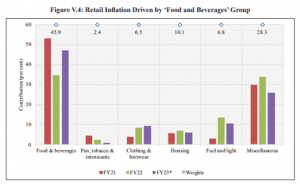

Retail Inflation Driven by Food Commodities

- Retail price inflation mainly stems from the agriculture and allied sectors, housing, textiles, and pharmaceutical sectors.

- During FY23, ‘food & beverages’, ‘clothing & footwear’, and ‘fuel & light’ were the major contributors to headline inflation– the first two contributing more this fiscal than in the previous one.

Food Inflation Caused by Vegetables and Cereals in FY23

- Food inflation based on Consumer Food Price Index (CFPI) climbed to 7.0 per cent in FY23 from 3.8 per cent in FY22. Though the increase in food inflation is broad-based, the major contributors are vegetables, cereals, milk, and spices.

- India meets 60 per cent of its edible oils demand through imports, making it vulnerable to international movements in prices.

- For instance, sunflower oil, which makes up 15 per cent of our total edible oil imports, is procured mainly from Ukraine and Russia. Thus, FY22 saw edible oil inflation on account of international price pressures. However, inflation remained subdued in FY23 because of rationalization of tariffs and the imposition of stock limits on edible oils and oil seeds.

RURAL-URBAN INFLATION DIFFERENTIAL HAS DECLINED

- Rural inflation has remained above its urban counterpart throughout the current fiscal year, reversing the trend seen during the pandemic years.

- CPI-C based food inflation seems to have cooled down after reaching a high of 8.3 per cent in April 2022 due to a subsequent moderation in global food prices and a reduction in farm input costs.

- However, the cooling was more pronounced for urban inflation, which softened to 2.8 per cent in December 2022.

- Rural fuel inflation remained lower than its urban counterpart throughout the current fiscal, due to subdued price pressures on traditional fuel items such as firewood and cow dung cakes as opposed to petrol and diesel.

Majority of the States/UTs have Higher Rural Inflation than Urban Inflation

- CPI-C inflation increased in most of the states in FY23 as compared to FY22. Telangana, West Bengal, Maharashtra, Madhya Pradesh, Haryana, and Andhra Pradesh saw especially high rates of inflation in FY23. Fuel and clothing were the major contributors to the surge in inflation.

DOMESTIC WHOLESALE PRICE INFLATION

- WPI-based inflation remained low during the Covid-19 period, and it started to gain momentum in the post-pandemic period as economic activities resumed.

- The Russia-Ukraine conflict further exacerbated the burden as it worsened global supply chains along with the free movement of essential commodities.

- As a result, the wholesale inflation rate climbed to about 13.0 per cent in FY22.

FUEL PRICE INFLATION: DECLINING GLOBAL CRUDE OIL PRICES

- In FY22 and FY23, inflation in WPI ‘fuel and power’ was mostly driven by high international crude oil prices.

- A cut in central excise duty on petrol and diesel in November 2021 and May 2022, followed by a reduction in Value Added Tax (VAT) by the State Governments, led to a moderation of the retail selling price of petrol and diesel in India.

Convergence of WPI and CPI Inflation

- The headline inflation based on WPI and the CPI-C started diverging in March 2021, as WPI inflation touched double digits due to unfavourable base effects while CPI-C inflation remained stable.

- The wedge between CPI-C and WPI inflation continued to widen before reaching its peak at 10 per cent in November 2021. Thereafter, the gap began to narrow until April 2022.

- The path to convergence, however, was short-lived as another inflationary pressure started building up in February 2022 as a consequence of the Russia-Ukraine conflict.

- The convergence between the WPI and CPI indices was mainly driven by two factors. Firstly, a cooling in inflation of commodities such as crude oil, iron, aluminium and cotton led to a lower WPI.

- Secondly, CPI inflation rose due to an increase in the prices of services. Services form a part of the core component of the CPI-C but are not included in the WPI basket.

FALLING INFLATIONARY EXPECTATIONS

- The one-year-ahead inflationary expectations for both businesses and households have moderated in the current financial year.

MONETARY POLICY MEASURES FOR PRICE STABILITY

Reserve Bank of India’s Monetary Policy Committee (MPC) increased the policy repo rate under the liquidity adjustment facility (LAF) by 2.25 per cent (225 basis points) from 4.0 per cent to 6.25 per cent between May and December 2022.

HOUSING PRICES: RECOVERING HOUSING SECTOR AFTER THE PANDEMIC

- Timely policy intervention by the government in housing sector, coupled with low home loan interest rates propped up demand and attracted buyers more readily in the affordable segment in FY23.

- An overall increase in composite Housing Price Indices (HPI) assessment and Housing Price Indices market prices indicates a revival in the housing finance sector. A stable to moderate increase in HPI also offers confidence to homeowners and home loan financiers in terms of the retained value of the asset.

KEEPING CHECK ON PHARMACEUTICAL PRICES

- The principles for the regulation of the prices of drugs are based on the National Pharmaceuticals Pricing Policy, 2012, administered by the Department of Pharmaceuticals.

- The key principles of the policy are the essentiality of drugs, control of formulation prices and market-based pricing.

- Until 31 December 2022, ceiling prices for 890 formulations of 358 drugs/medicines across various therapeutic categories under National List of Essential Medicines (NLEM), 2015 have been fixed by National Pharmaceuticals Pricing Authority.

THE CONCLUSION: It is not wishful thinking that 2023 will show less macroeconomic volatility than its preceding financial year. Both CPI-C and WPI have fallen below 6 per cent (which is the RBI tolerance limit for the former). International crude oil prices, the principal drivers of inflation this financial year, have returned to normal levels and so have prices of other major commodities. The geopolitics associated with oil can particularly affect our imported inflation. Still, overall, the inflation challenge in FY24 must be a lot less stiff than it has been this year.

Spread the Word