THE CONTEXT: With the continuing global risks and uncertainties, the availability of fiscal space with governments has become paramount. In India, particularly when all economic activities had reached a standstill, fiscal policy was instrumental in providing a safety net to the vulnerable, reviving the economy by boosting demand, and addressing certain domestic supply-side constraints through public investments and sustained structural reforms. The Government of India adopted a calibrated fiscal response to the pandemic and planned to withdraw the fiscal stimulus gradually as it moves along the glide path outlined in the Budget FY22.

DEVELOPMENTS IN UNION GOVERNMENT FINANCES

- While India entered the pandemic with a stretched fiscal position, the government’s prudent and calibrated fiscal response enabled stable public finances even amidst the present uncertainties.

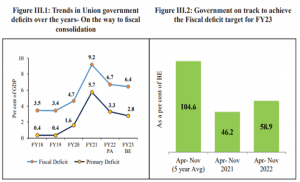

- The fiscal deficit of the Union Government, which reached 9.2 per cent of GDP during the pandemic year FY21, has moderated to 6.7 per cent of GDP in FY22 and is further budgeted to reach 6.4 per cent of GDP in FY23.

- This gradual decline in the Union government’s fiscal deficit as a per cent of GDP, in line with the fiscal glide path envisioned by the government, is a result of careful fiscal management supported by buoyant revenue collection over the last two years.

Union Government on track to achieve the Fiscal deficit target for FY23

- The Union Government is well on track to achieve the budget estimate for the fiscal deficit in FY23. The fiscal deficit of the Union Government at the end of November 2022 stood at 58.9 per cent of the BE, lower than the five-year moving average of 104.6 per cent of BE during the same period.

Conservative budget assumptions provide a buffer during global uncertainties

- As an illustration, the Gross Tax Revenue (GTR) to the Centre was envisaged to grow at 9.6 per cent in FY23. Against this implicit (budgeted) growth, the data for the first eight months of the year show that GTR has grown at a much higher rate. The annual estimate of GTR for FY23 is thus expected to overshoot the budget estimates.

Direct taxes propelling the growth in Gross tax revenue

- Direct taxes, which broadly constitute half of the Gross Tax Revenue (Figure III.3), have registered a YoY growth of 26 per cent from April to November 2022, enabled by corporate and personal income tax growth. The growth rates observed in the major direct taxes during the first eight months of FY23 were much higher than their corresponding longer-term averages.

- Customs and Excise duties act as Flexi-fiscal policy tools: The excise duty collection has declined by 20.9 per cent from April to November 2022 on a YoY basis.

- Stabilising Goods and Services Tax yielding returns: The pick-up in GST collections was consistently spread across all the months during the current fiscal year, with an average monthly collection of ₹1.5 lakh crore. Apart from directly supporting government revenues, GST has led to better reporting of income, which in turn has positive externalities for income tax collection and economic activity.

PERFORMANCE OF UNION GOVERNMENT EXPENDITURE

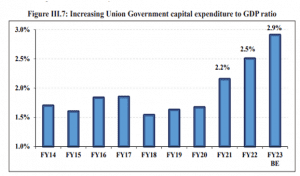

- The government adopted a pragmatic approach of increasing its expenditure in a calibrated way. Upon ensuring the basic safety nets for the vulnerable, the emphasis of the Government expenditure shifted to productive domestic capital expenditure.

- The Government’s thrust on Capital expenditure, particularly in the infrastructure-intensive sectors like roads and highways, railways, and housing and urban affairs, has longer-term implications for growth.

Geopolitical developments stretched the Revenue Expenditure requirements

- Due to the sudden outbreak of geopolitical conflict resulting in higher international prices for food, fertilizer and fuel, there was a higher food and fertilizer subsidy requirement for supporting the people and ensuring macroeconomic stability. Around 94.7 per cent of the budgeted expenditure on subsidies has been utilized from April to November 2022.

- Another major component of revenue expenditure, interest payments, had maintained a stable ratio of non-debt receipts and revenue expenditure during the pre-pandemic years.

OVERVIEW OF STATE GOVERNMENT FINANCES

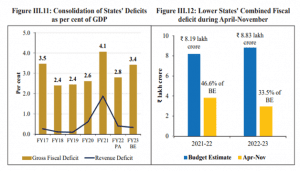

- State Governments improved their finances in FY22 after being adversely impacted by the pandemic in FY21. The combined Gross Fiscal Deficit (GFD) of the States, which increased to 4.1 per cent of GDP in the pandemic-affected year, was brought down to 2.8 per cent in FY22.

- Given the geopolitical uncertainties, the consolidated GFD-GDP ratio for States has been budgeted 3.4 per cent in FY23.

- However, the States’ monthly fiscal Accounts data released by CAG shows that from April- November 2022, the combined borrowings of the 27 major states have just reached 33.5 per cent of their total budgeted borrowings for the year.

Cooperative fiscal federalism drives a well-targeted fiscal policy

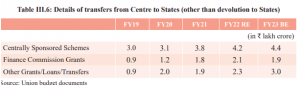

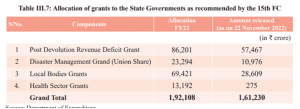

- Transfer of funds to the States comprises the share of States in Union taxes devolved to the States, Finance Commission Grants, Centrally Sponsored Schemes (CSS), and other transfers. Total transfers to the States have risen between FY19 and FY23.

DEBT PROFILE OF THE GOVERNMENT

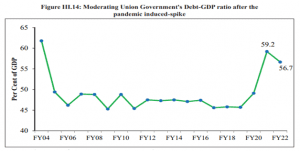

- For India, the total liabilities of the Union Government, which were relatively stable as a percentage of GDP over the past decade, witnessed a sharp spike in the pandemic year FY21.

- This spike in debt resulted from the pandemic-induced higher Government borrowings to finance the additional expenditure needs, given the strained revenues and sharp contraction in the GDP.

- Total liabilities of the Union Government moderated from 59.2 per cent of GDP in FY21 to 56.7 per cent in FY22 (P).

- India’s public debt profile is relatively stable and is characterized by low currency and interest rate risks.

THE CONCLUSION: The Government of India has adopted a holistic policy towards fiscal stability in the last few years. Using the crisis as an opportunity to bring about reforms, the government undertook a series of policy measures in the previous few years. The Centre should continue incentivizing the States for reforms and higher capital spending to ensure a stronger General government. The capex-led growth strategy will ensure sustainable debt levels in the medium term.

Spread the Word