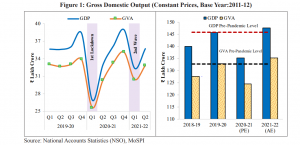

THE ECONOMY RECOVERS PAST PRE-PANDEMIC LEVELS

The Indian economy, as seen in quarterly estimates of GDP, has been staging a sustained recovery since the second half of 2020-21(see Figure: 1). Advance estimates suggest that GDP will record an expansion of 9.2 percent in 2021-22. This implies that the level of real economic output will surpass the pre-COVID level of 2019-20.

DIFFERENCE BETWEEN GDP AND GVA

In 2015, in the wake of a comprehensive review of its approach to GDP measurement, India opted to make major changes to its compilation of national accounts and bring the whole process into conformity with the United Nations System of National Accounts (SNA) of 2008. As per the SNA, gross value added, is defined as the value of output minus the value of intermediate consumption and is a measure of the contribution to GDP made by an individual producer, industry, or sector. At its simplest, it gives the rupee value of goods and services produced in the economy after deducting the cost of inputs and raw materials used. GVA can be described as the main entry on the income side of the nation’s accounting balance sheet, and from economics, perspective represents the supply side. While India had been measuring GVA earlier, it had done so using ‘factor cost’ and GDP at ‘factor cost’ was the main parameter for measuring the country’s overall economic output till the new methodology was adopted. In the new series, in which the base year was shifted to 2011-12 from the earlier 2004-05, GVA at basic prices became the primary measure of output across the economy’s various sectors and when added to net taxes on products amounts to the GDP.

SECTORAL TRENDS IN THE ECONOMY

AGRICULTURE

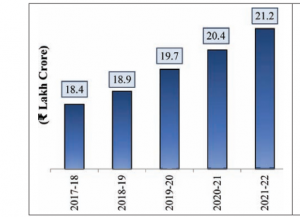

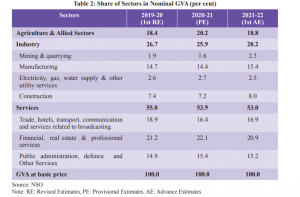

AGRI GROWTH: The agricultural sector was the least impacted by the pandemic-related disruptions. It is estimated to grow 3.9 percent in 2021-22. This sector now accounts for 18.8 percent of GVA(Figure 2)

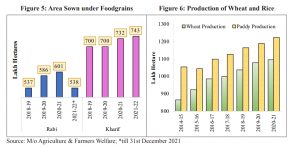

FOOD PRODUCTION: The area is sown under Kharif and Rabi crops, and the production of wheat and rice has been steadily increasing over the years(Figures 5 and 6). In the current year, food grains production for the Kharif season is estimated to post a record level of 150.5 million tonnes.

FIGURE 2- REAL GVA: AGRICULTURE AND ALLIED SECTOR

INDUSTRIAL SECTOR

GROWTH DATA:

- The industrial sector went through a big swing by first contracting by 7 percent in 2020-21 and then expanding by 11.8 percent in this financial year.

- The share of industry in GVA is now estimated at 28.2 percent (Table 2)

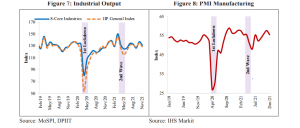

INDICES TRAJECTORY:

- Since January 2021, the Purchasing Managers’ Index-Manufacturing has remained in the expansionary zone (i.e. over 50) except for one month when the second wave had slowed down economic activity.

- The Index of Industrial Production (IIP) and Core Industry indices have both followed a similar pattern and, in November 2021, went past their pre-pandemic level for the corresponding month in 2019(See Figure 7 and 8).

SERVICES

GROWTH DATA:

- Services account for more than half of the Indian economy and were the most impacted by the COVID-19 related restrictions, especially for activities that need human contact.

- Although the overall sector first contracted by 8.4 percent in 2020-21 and then is estimated to grow by 8.2 percent in 2021-22, it should be noted that there is a wide dispersion of performance by different sub-sectors.

SUBSECTOR VARIATIONS:

- Both the Finance/Real Estate and the Public Administration segments are now well above pre-COVID levels.

- However, segments like Travel, Trade, and Hotels are yet to fully recover. It should be added that the stop-start nature of repeated pandemic waves makes it especially difficult for these sub-sectors to gather momentum.

INDICES PROJECTIONS:

- Despite contact-sensitive services still being impacted by COVID, there has been a strong recovery of the Purchasing Managers’ Index-Services since August 2021.

- Similarly, the Google Mobility Index has also recorded recovery to pre-pandemic levels. Both these indices, capture data before the Omicron struck the country.

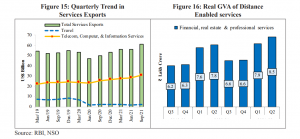

NON-CONTACT SERVICES:

- In contrast to contact-based services, distance-enabled services have increased their share with the growing preference for remote interfaces for office work, education, and even medical services.

- Indeed, there has been a boom in software and IT-enabled services exports even as earnings from tourism have declined sharply (see Figures 15 and 16).

DEMAND TRENDS: COMPONENTS OF GDP

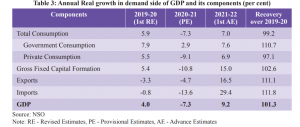

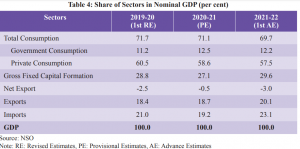

CONSUMPTION (PRIVATE AND GOVERNMENT):

- Total consumption is estimated to have grown by 7.0 percent in 2021-22 with government consumption remaining the biggest contributor as in the previous year.

- private consumption is yet to see the pre-pandemic level. Private consumption is poised to see stronger recovery with rapid coverage in vaccination and faster normalization of economic activity. This assessment is also seconded by RBI’s Consumer Confidence Survey.

- However, Government consumption is estimated to grow by a strong 7.6 percent surpassing pre-pandemic levels. (See Table 3).

INVESTMENT:

- Investment, as measured by Gross Fixed Capital Formation (GFCF) is expected to see strong growth of 15 percent in 2021-22 and achieve full recovery of pre-pandemic level.

- Government’s policy thrust on quickening virtuous cycle of growth via CAPEX and infrastructure spending has increased capital formation in the economy lifting the investment to GDP ratio to about 29.6 percent in 2021-22, the highest in seven years (Figure 19).

EXPORTS AND IMPORTS:

- India’s exports of both goods and services have been exceptionally strong so far in 2021-22.

- India’s total exports are expected to grow by 16.5 percent in 2021-22 surpassing pre-pandemic levels.

- Imports also recovered strongly with the revival of domestic demand and a continuous rise in the price of imported crude and metals. Imports are expected to grow by 29.4 percent in 2021-22 surpassing corresponding pre-pandemic levels.

- Merchandise exports have been above US$ 30 billion for eight consecutive months in 2021-22, and net services exports have also risen sharply.

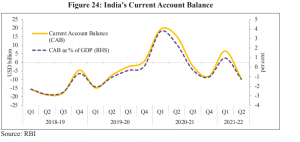

- India’s net exports have turned negative in the first half of 2021-22, compared to a surplus in the corresponding period of 2020-21 with the current account recording a modest deficit of 0.2 percent of GDP in the first half (Figure 24).

GREEN SHOOTS IN INVESTMENT

While private investment recovery is still at a nascent stage, there are many signals which indicate that India is poised for stronger investment. The number of private investment projects under implementation in the manufacturing sector has been rising over the years. Companies hitting record profits in recent quarters and mobilization of risk capital bode well for an acceleration in private investment. A sturdy and cleaned-up banking sector stands ready to support private investment adequately. The expected increase in private consumption levels will propel capacity utilization, thereby fuelling private investment activity. RBI’s latest Industrial Outlook Survey results indicate rising optimism of investors and expansion in production in the upcoming quarters.

A GLIMPSE INTO THE STRATEGY OF POLICY MAKING OF THE GOVERNMENT OF INDIA

BARBELL STRATEGY: AGILE RESPONSE& SAFTEY NETS

The last two years have been particularly challenging for policy-making around the world with repeated waves from a mutating virus, travel restrictions, supply-chain disruptions, and, more recently, global inflation. Faced with all this uncertainty, the Government of India opted for a “Barbell Strategy” that combined a bouquet of safety nets to cushion the impact on vulnerable sections of society/business, with a flexible policy response based on a Bayesian updating of information. This is a common strategy used in financial markets to deal with extreme uncertainty by combining two seemingly disparate legs: agile approach and safety nets.

The Agile approach is a well-established intellectual framework that is increasingly used in fields like project management and technology development. In an uncertain environment, the Agile framework responds by assessing outcomes in short iterations and constantly adjusting incrementally. It is important here to distinguish Agile from the “Waterfall” framework which has been the conventional method for framing policy in India and most of the world. Notice that the flexibility of Agile improves responsiveness and aids evolution, but it does not attempt to predict future outcomes. This is why the other leg of the Barbell strategy is also needed. It cushions for unpredictable negative outcomes by providing safety nets.

THE WATERFALL APPROACH:

- The Waterfall approach entails a detailed, initial assessment of the problem followed by a rigid upfront plan for implementation.

- This methodology works on the premise that all requirements can be understood at the beginning and therefore pre-commits to a certain path of action.

- This is the thinking reflected in five-year economic plans, and rigid urban master plans.

- While some form of feedback-loop-based policy-making was always possible, it is particularly effective at a time when we have wealth of real-time data.

AGILE APPROACH:

- Over the last two years, Government leveraged a host of High-Frequency Indicators (HFIs) both from government departments/agencies as well as private institutions that enabled constant monitoring and iterative adaptations.

- Such information includes GST collections, power consumption, mobility indicators, digital payments, satellite photographs, cargo movements, highway toll collections, and so on.

- These HFIs helped policymakers tailor their responses to an evolving situation rather than rely on pre-defined responses of a Waterfall framework.

A BRIEF OVERVIEW OF THE TWO LEGS OF BARBELL STRATEGY ADOPTED BY GOVT

AGILE APPROACH:

- The Government made its way forward by regularly announcing packages targeted at specific challenges.

- This agile approach was preceded by Safety Net.

- The fiscal mix changed over time towards supporting demand through capital expenditure and the supply-side through measures like production-linked incentives.

- In line with the Agile approach, this mix can be changed again as per the requirements of an evolving situation.

SAFETY NET:

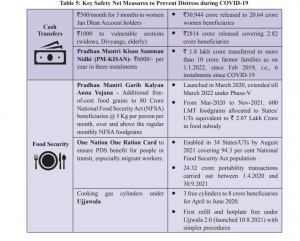

- Government’s initial measures in 2020-21 were mostly about making food available to the poor, providing emergency liquidity support for MSMEs, and holding the Insolvency and Bankruptcy Code in abeyance. (Read ahead. See Table:5)

THE BARBELL STRATEGY

The barbell strategy is an investment concept that suggests that the best way to strike a balance between reward and risk is to invest in the two extremes of high-risk and no-risk assets while avoiding middle-of-the-road choices. All investing strategies involve seeking the best return on investment that is possible given the degree of risk that the investor can tolerate. Investors who follow the barbell strategy insist that the way to achieve that is to go to extremes.

HIGH-FREQUENCY INDICATORS: LEVERAGING DATA FOR GOVERNANCE

In the last two years, Government leveraged an array of eighty HFIs representing industry, services, global trends, macro-stability indicators, and several other activities, from both public and private sources to gauge the underlying state of the economy on real-time basis. These include electricity generation, scheduled domestic flights, volume/value of financial transactions, capital flows, mobility indices, and so on. It also covers employment demanded under MGNREGA to gauge rural employment conditions, especially in the context of migrant workers. These indicators are regularly published in the Monthly Economic Report of the Ministry of Finance. While HFIs have the advantage of being real-time and frequent, they need to be used with care. Each indicator provides, at best, a partial view of developments. In a rapidly evolving situation, policy-makers can pick up useful signals that allow for faster response and better targeting. Thus, using HFIs for gauging trends in the economy is as much an art as a science.

A BRIEF OVERVIEW OF THE MACROECONOMIC PARAMETERS OF THE INDIAN ECONOMY

EXTERNAL SECTOR:

- Despite all the disruptions caused by the global pandemic, India’s balance of payments remained in surplus throughout the last two years.

- The foreign exchange reserve as of Dec 2021 is equivalent to 13.2 months of imports and higher than the country’s external debt.

- As of end-November 2021, India was the fourth-largest foreign exchange reserves holder in the world after China, Japan, and Switzerland.

FISCAL BALANCE:

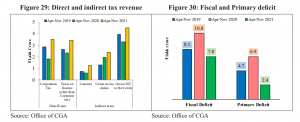

- The fiscal support given to the economy as well as the health response caused the fiscal deficit and government debt to rise in 2020-21.

- However, there has been a strong rebound in government revenues in 2021-22 so far.

- The gross monthly GST collections have crossed ` 1 lakh crore consistently since July 2021(See figures: 29 and 30)

FINANCIAL SECTOR:

- The financial system is always a possible area of stress during turbulent times. However, India’s capital markets, have done exceptionally well and have allowed record mobilization of risk capital for Indian companies.

- The Sensex and Nifty scaled up to touch their peak at 61,766 and 18,477 on October 18, 2021. Among major emerging market economies, Indian markets outperformed their peers in April-December 2021.

- Gross NPA ratio of SCBs decreased from 7.5 percent at end-September 2020 to 6.9 percent at end-September 2021.

- The Capital to risk-weighted asset ratio (CRAR) of SCBs increased from 15.84 percent at the end of September 2020 to 16.54 percent at the end-September 2021 on account of improvement for both public and private sector banks.

INFLATION:

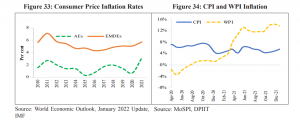

- Inflation has reappeared as a global issue in both advanced and emerging economies (Figure 33).

- The surge in energy prices, non-food commodities, input prices, disruption of global supply chains, and rising freight costs stoked global inflation during the year. (See Figure 33 and 34).

THE GLOBAL SUPPLY-SIDE DISRUPTION DUE TO THE PANDEMIC

As the world economy recovered in 2021, it is faced with serious supply-side constraints ranging from delivery delays, container shortages, and semiconductor chip shortages.

CONTAINER INDUSTRY:

- The stress in the container shortages can be captured in the Drewry’s3 Composite World Container Index, which data reflects the problems in the sector.

- The shortage of containers has also impacted the Indian sea trade.

- According to the Federation of Indian Export Organisation set up under the Ministry of Commerce and Industry, the lack of containers has resulted in rising sea freight rates in the range of 300 percent to 350 percent.

- Further, the production of the new containers has slowed since 2019.

- Simultaneously, a rise in the disposal of containers has also been observed for the same period.

- Thus, the overall growth in the containers has fallen from 11 percent in 2019 to 5 percent in 2021.

SEMICONDUCTOR CHIPS:

- A report by investment bank Goldman Sachs 2021 states that the supply chain disruptions in the semiconductor industry have spillovers in over 169 industries.

- The manufacturing of semiconductors requires a large amount of capital and has an average gestation period of 6-9 months.

- Moreover, it has a fairly long production cycle of about 18-20 weeks.

- Hence, any recovery from the supply chain disruptions will be a slow and costly affair.

- The report further stated that microchips and semiconductors account for about 4.7 percent of the value added by the automotive industry.

- With the delay in supply, the average lead time in the automobile industry for 2021 has been around 14 weeks globally.

REFORMS AND THE COVID-19: TWO-PRONGED STRATEGY

One distinguishing feature of India’s economic response has been an emphasis on supply-side reforms rather than a total reliance on demand management. The emphasis given to the supply-side in India’s COVID-19 response is driven by two important considerations. First, Indian policy-makers saw the disruptions caused by travel restrictions, lockdowns, and supply-chain breakdowns as an interruption of the economy’s supply side. Second, the post-Covid world will be impacted by a wide variety of factors – changes in technology, consumer behavior, geopolitics, supply-chains, climate change, and so on. In a nutshell, the supply-side reforms are built upon two broad strategies which are explained below:

FLEXIBILITY AND INNOVATION:

- Reforms that improve flexibility and innovation to deal with the long-term unpredictability of the post-Covid world.

- This includes factor market reforms; deregulation of sectors like space, drones, geospatial mapping, trade finance factoring;

- Also, process reforms like those in government procurement and in the telecommunications sector; removal of legacy issues like retrospective tax; privatization and monetization, creation of physical infrastructure, and so on.

RESILIENCE ORIENTATION:

- Reforms aimed at improving the resilience of the Indian economy range from climate/environment-related policies; social infrastructure such as the public provision of tap water, toilets, basic housing, insurance for the poor, and so on;

- Support for key industries under Atmanirbhar Bharat; a strong emphasis on reciprocity in foreign trade agreements, and so on.

- Some commentators have likened the Atmanirbhar Bharat approach to a return to old-school protectionism. Far from it, the focus on economic resilience is a pragmatic recognition of the vagaries of the international supply chain.

SOME CONCRETE EXAMPLES OF REFORMS UNDERTAKEN BY THE GoI

INDUSTRY:

- Production Linked Incentive Scheme approved for 13 sectors including Automobiles and auto components, Pharmaceuticals drugs, Specialty steel, Telecom & Networking Products, etc.

- Retrospective tax repealed to promote tax certainty and foreign investment.

TELECOM: Structural reforms:

- Rationalization of Adjusted Gross Revenue: Non-telecom revenue will be excluded from the definition of Adjusted Gross Revenue.

- Interest rates rationalized and penalties from delayed payments of License Fee or Spectrum Usage Charge (SUC) removed.

- 100 percent FDI under automatic route permitted in the telecom sector.

- No Spectrum Usage Charge (SUC) for spectrum acquired in future spectrum auctions.

- Spectrum sharing encouraged.

- The additional SUC of 0.5 percent for spectrum sharing was removed.

Process Reforms:

- Requirement of customs clearance for import of wireless equipment removed and replaced with self-declaration to improve the ease of doing business.

DRONE RULES (ANNOUNCED IN AUGUST 2021):

- Extended applicability of rules: Drones up to 500 kg are now subject to regulations, compared to the earlier limit of 300 kg.

- Several approvals were abolished with the total forms to be filled reduced from 25 to 5. Types of fees reduced from 72 to 4.

- Quantum of fees to be paid considerably reduced and delinked with the size of the drone. Removal of the requirement of prior security clearance.

- Earlier restrictions on all foreign entities owning, manufacturing, or dealing with drones in India have been done away with.

- Expanded area of drone operations: An interactive map on the Digital Sky platform specifies color-coded zones on the map i.e., green, yellow, and red, indicating free zones, those which require prior permission, and no-fly zones, respectively.

- The perimeters of these zones have also been liberalized to increase freely accessible airspace under the green category.

FINANCIAL SECTOR: Banking: Reforms in Deposit Insurance:

- Increase in deposit insurance from ` 1 lakh to ` 5 lakh per depositor per bank. Introduced interim payments:

- Interim payment will be made by Deposit Insurance and Credit Guarantee Corporation (DICGC) to depositors of those banks for whom any restrictions/ moratorium have been imposed by RBI under the Banking Regulation Act resulting in restrictions on depositors from accessing their own savings.

- Timeline of a maximum of 90 days has been fixed for providing interim payment to depositors.

Expansion in the factoring ecosystem:

- The earlier condition of NBFCs whose principal business was factoring has been removed and now all NBFCs are permitted to undertake factoring business.

DEFENCE:

- Corporatisation of Ordnance Factory Board (OFB) approved and 7 new Defence Public Sector Undertakings created.

- FDI enhanced in Defence sector up to 74 percent through the automatic route and up to 100 percent by government route.

DISINVESTMENT:

- New Public Sector Enterprise Policy and Asset Monetisation Strategy: New policy is for strategic disinvestment of public sector enterprises Public sector commercial enterprises are classified as Strategic and Non-Strategic sectors, with the policy of privatization in non-strategic sectors and bare minimum presence even in strategic sectors.

- The identified strategic sectors are (i) Atomic Energy, Space & Defense; (ii) Transport & Telecommunication; (iii) Power, Petroleum, Coal & other minerals; and (iv) Banking, Insurance & Financial Services Privatization of Air India.

- National Monetisation Pipeline: Aggregate monetization potential of ` 6 lakh crore through core assets of the Central Government over four years from 2021-22 to 2024-25. The top 5 sectors including roads, railways, power, oil & gas pipelines, and telecom account for around 83 percent of the aggregate value. So far, CPSEs have referred 3400 acres of land and other non-core assets for monetization.

GROWTH OUTLOOK

The Indian economy is estimated to grow by 9.2 percent in real terms in 2021-22 (as per the First Advance Estimates), after a contraction of 7.3 percent in 2020-21. Growth in 2022-23 will be supported by widespread vaccine coverage, gains from supply-side reforms and easing of regulations, robust export growth, and availability of fiscal space to ramp up capital spending. This projection is based on the assumption that there will be no further debilitating pandemic related economic disruption, monsoon will be normal, withdrawal of global liquidity by major central banks will be broadly orderly, oil prices will be in the range of US$70-$75/bbl., and global supply chain disruptions will steadily ease over the year. As per the IMF’s latest World Economic Outlook (WEO) growth projections released on 25th January 2022, India’s real GDP is projected to grow at 9 percent in both 2021-22 and 2022-23 and at 7.1 percent in 2023-24. This projects India as the fastest-growing major economy in the world in all these three years.

HIGHLIGHTS

- Indian economy is estimated to grow by 9.2 percent in real terms in 2021-22 (as per first advanced estimates) after a contraction of 7.3 percent in 2020-21.

- GDP projected to grow by 8- 8.5 percent in real terms in 2022-23.

- The year ahead is poised for a pickup in private sector investment with the financial system in a good position to provide support for the economy’s revival.

- Projection comparable with World Bank and Asian Development Bank’s latest forecasts of real GDP growth of 8.7 percent and 7.5 percent respectively for 2022-23.

- As per IMF’s latest World Economic Outlook projections, India’s real GDP is projected to grow at 9 percent in 2021-22 and 2022-23 and at 7.1 percent in 2023-2024, which would make India the fastest-growing major economy in the world for all 3years.

- Agriculture and allied sectors are expected to grow by 3.9 percent; industry by 11.8 percent and services sector by 8.2 percent in 2021-22.

- On the demand side, consumption is estimated to grow by 7.0 percent, Gross Fixed Capital Formation (GFCF) by 15 percent, exports by 16.5 percent, and imports by 29.4 percent in 2021-22.

- Macroeconomic stability indicators suggest that the Indian Economy is well placed to take on the challenges of 2022-23.

- Combination of high foreign exchange reserves sustained foreign direct investment, and rising export earnings will provide an adequate buffer against possible global liquidity tapering in 2022-23.

- Economic impact of the “second wave” was much smaller than that during the full lockdown phase in 2020-21, though health impact was more severe.

- Government of India’s unique response comprised of safety-nets to cushion the impact on vulnerable sections of society and the business sector, significant increase in capital expenditure to spur growth, and supply-side reforms for a sustained long-term expansion.

- Government’s flexible and multi-layered response is partly based on an “Agile” framework that uses feedback-loops, and the use of eighty High-Frequency Indicators (HFIs) in an environment of extreme uncertainty.