Table of Contents

THE HEALTH AND SOCIAL ISSUES

1. THE 3RD WORLD NEGLECTED TROPICAL DISEASES DAY

THE CONTEXT: Observing the 3rd World Neglected Tropical Diseases (NTDs) Day on 30th January as a key moment to highlight the global community’s commitment to ending NTDs, India joined close to 40 other nations to illuminate the iconic New Delhi Railway Station in purple and orange hues, which is one of the busiest railway stations in the country in terms of train frequency and passenger movement.

THE EXPLANATION:

The Event organized by National Centre for Vector Borne Diseases Control (NCVBDC) to observe World NTD Day, Union Ministry of Health and Family Welfare highlighted that the aim of illuminating the iconic New Delhi Railway Station was to generate awareness about NTDs in the visiting public and showcase progress and achievements towards their elimination.

ABOUT WORLD NEGLECTED TROPICAL DISEASES:

- Neglected tropical diseases (NTDs) are a diverse group of 20 conditions that are mainly prevalent in tropical areas, (developing regions of Africa, Asia, and the Americas), where they mostly affect impoverished communities and disproportionately affect women and children.

- They are caused by a variety of pathogens such as viruses, bacteria, protozoa, and parasitic worms. These diseases generally receive less funding for research and treatment than malaises like tuberculosis, HIV-AIDS and malaria.

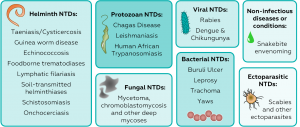

- The NTDs include:

- According to WHO estimates that over 1.7 billion of the world’s population should be targeted by prevention and treatment activities for at least one of these diseases, every year.

- In addition to significant mortality and morbidity – approximately 200,000 deaths and 19 million disability adjusted life years (DALYs) lost annually.

India’s Measures to tackle NTD’s:

- The Accelerated Plan for Elimination of Lymphatic Filariasis (APELF) was launched in 2018, as part of intensifying efforts towards the elimination of NTDs.

- A WHO-supported regional alliance established by the governments of India, Bangladesh, and Nepal in 2005 to expedite early diagnosis and treatment of the most vulnerable populations and improve disease surveillance and control of sandfly populations (Kala-azar).

- India has already eliminated several other NTDs, including guinea worm, trachoma, and yaws.

THE ENVIRONMENT AND ECOLOGY

2. INDIA’S FIRST GEO PARK TO COME UP IN MADHYA PRADESH

THE CONTEXT: The Geological Survey of India (GSI) has approved the setting up of the country’s first geo park at Lamheta village on the banks of the Narmada River in Jabalpur district of Madhya Pradesh.

THE EXPLANATION:

- The GSI has sanctioned 1.30 crore to prepare a detailed project report of the geological rock formations in five acres in the Lamheta village, located 20 km away from the Jabalpur district.

- The site is already there in the UNESCO geo-heritage tentative list for the conservation of the natural heritage. Several dinosaur fossils had been found in the Narmada valley, particularly in the Bhedaghat-Lameta Ghat area of Jabalpur”.

- In 1828, the first dinosaur fossil was collected from the Lameta Bed by Indian Civil Service (ICS) officer William Sleeman.

- According to the GSI, the Science centre will come up at Bhedaghat, also in the Jabalpur district, known forwhite marble rock formations and a famous tourist hotspot, at the cost of ₹ 15.20 crore, to be shared by the Centre and the states. The centre would shed light on modern science, including scientific theories of various topics such as food, water and soil.m

What is a Geo Park?

A geo park is a nationally protected area covering a number of geological heritage sites of particular importance, rarity or aesthetic appeal. These can be promoted as ‘geotourism’ through conservation, education, and sustainable development.

THE ECONOMIC DEVELOPMENT

3. THE HIGHLIGHTS OF THE ECONOMIC SURVEY 2021-22

THE CONTEXT: The Union Minister for Finance & Corporate Affairs, presented the Economic Survey 2021-22 in Parliament on 31 January 2022. The highlights of the Economic Survey are as follows:

STATE OF THE ECONOMY

- Indian economy estimated to grow by 9.2 percent in real terms in 2021-22 (as per first advanced estimates) subsequent to a contraction of 7.3 percent in 2020-21.

- GDP projected to grow by 8- 8.5 percent in real terms in 2022-23.

- The year ahead poised for a pickup in private sector investment with the financial system in good position to provide support for economy’s revival.

- Projection comparable with World Bank and Asian Development Bank’s latest forecasts of real GDP growth of 8.7 percent and 7.5 percent respectively for 2022-23.

- As per IMF’s latest World Economic Outlook projections, India’s real GDP projected to grow at 9 percent in 2021-22 and 2022-23 and at 7.1 percent in 2023-2024, which would make India the fastest growing major economy in the world for all 3years.

- Agriculture and allied sectors expected to grow by 3.9 percent; industry by 11.8 percent and services sector by 8.2 percent in 2021-22.

- On demand side, consumption estimated to grow by 7.0 percent, Gross Fixed Capital Formation (GFCF) by 15 percent, exports by 16.5 percent and imports by 29.4 percent in 2021-22.

- Macroeconomic stability indicators suggest that the Indian Economy is well placed to take on the challenges of 2022-23.

- Combination of high foreign exchange reserves sustained foreign direct investment, and rising export earnings will provide adequate buffer against possible global liquidity tapering in 2022-23.

- Economic impact of “second wave” was much smaller than that during the full lockdown phase in 2020-21, though health impact was more severe.

- Government of India’s unique response comprised of safety-nets to cushion the impact on vulnerable sections of society and the business sector, significant increase in capital expenditure to spur growth and supply side reforms for a sustained long-term expansion.

- Government’s flexible and multi-layered response is partly based on an “Agile” framework that uses feedback-loops, and the use of eighty High Frequency Indicators (HFIs) in an environment of extreme uncertainty.

Fiscal Developments:

- The revenue receipts from the Central Government (April to November, 2021) have gone up by 67.2 percent (YoY) as against an expected growth of 9.6 percent in the 2021-22 Budget Estimates (over 2020-21 Provisional Actuals).

- Gross Tax Revenue registers a growth of over 50 percent during April to November, 2021 in YoY terms. This performance is strong compared to pre-pandemic levels of 2019-2020 also.

- During April-November 2021, Capex has grown by 13.5 percent (YoY) with focus on infrastructure-intensive sectors.

- Sustained revenue collection and a targeted expenditure policy has contained the fiscal deficit for April to November, 2021 at 46.2 percent of BE.

- With the enhanced borrowings on account of COVID-19, the Central Government debt has gone up from 49.1 percent of GDP in 2019-20 to 59.3 percent of GDP in 2020-21, but is expected to follow a declining trajectory with the recovery of the economy.

External Sectors:

- India’s merchandise exports and imports rebounded strongly and surpassed pre-COVID levels during the current financial year.

- There was significant pickup in net services with both receipts and payments crossing the pre-pandemic levels, despite weak tourism revenues.

- Net capital flows were higher at US$ 65.6 billion in the first half of 2021-22, on account of continued inflow of foreign investment, revival in net external commercial borrowings, higher banking capital and additional special drawing rights (SDR) allocation.

- India’s external debt rose to US $ 593.1 billion at end-September 2021, from US $ 556.8 billion a year earlier, reflecting additional SDR allocation by IMF, coupled with higher commercial borrowings.

- Foreign Exchange Reserves crossed US$ 600 billion in the first half of 2021-22 and touched US $ 633.6 billion as of December 31, 2021.

- As of end-November 2021, India was the fourth largest forex reserves holder in the world after China, Japan and Switzerland.

Monetary Management and Financial Intermediation:

- The liquidity in the system remained in surplus.

- Repo rate was maintained at 4 per cent in 2021-22.

- RBI undertook various measures such as G-Sec Acquisition Programme and Special Long-Term Repo Operations to provide further liquidity.

- The economic shock of the pandemic has been weathered well by the commercial banking system:

- YoY Bank credit growth accelerated gradually in 2021-22 from 5.3 per cent in April 2021 to 9.2 per cent as on 31st December 2021.

- The Gross Non-Performing Advances ratio of Scheduled Commercial Banks (SCBs) declined from 11.2 per cent at the end of 2017-18 to 6.9 per cent at the end of September, 2021.

- Net Non-Performing Advances ratio declined from 6 percent to 2.2 per cent during the same period.

- Capital to risk-weighted asset ratio of SCBs continued to increase from 13 per cent in 2013-14 to 16.54 per cent at the end of September 2021.

- The Return on Assets and Return on Equity for Public Sector Banks continued to be positive for the period ending September 2021.

- Exceptional year for the capital markets:

- 89,066 crore was raised via 75 Initial Public Offering (IPO) issues in April-November 2021, which is much higher than in any year in the last decade.

- Sensex and Nifty scaled up to touch peak at 61,766 and 18,477 on October 18, 2021.

- Among major emerging market economies, Indian markets outperformed peers in April-December 2021.

Prices and Inflation:

The average headline CPI-Combined inflation moderated to 5.2 per cent in 2021-22 (April-December) from 6.6 per cent in the corresponding period of 2020-21.

- The decline in retail inflation was led by easing of food inflation.

- Food inflation averaged at a low of 2.9 per cent in 2021-22 (April to December) as against 9.1 per cent in the corresponding period last year.

- Effective supply-side management kept prices of most essential commodities under control during the year.

- Proactive measures were taken to contain the price rise in pulses and edible oils.

- Reduction in central excise and subsequent cuts in Value Added Tax by most States helped ease petrol and diesel prices.

Wholesale inflation based on Wholesale Price Index (WPI) rose to 12.5 per cent during 2021-22 (April to December). This has been attributed to:

- Low base in the previous year,

- Pick-up in economic activity,

- Sharp increase in international prices of crude oil and other imported inputs, and

- High freight costs.

Divergence between CPI-C and WPI Inflation:

- The divergence peaked to 9.6 percentage points in May 2020.

- However, this year there was a reversal in divergence with retail inflation falling below wholesale inflation by 8.0 percentage points in December 2021.

This divergence can be explained by factors such as:

- Variations due to base effect,

- Difference in scope and coverage of the two indices,

- Price collections,

- Items covered,

- Difference in commodity weights, and

- WPI being more sensitive to cost-push inflation led by imported inputs.

With the gradual waning of base effect in WPI, the divergence in CPI-C and WPI is also expected to narrow down.

Sustainable Development and Climate Change:

- India’s overall score on the NITI Aayog SDG India Index and Dashboard improved to 66 in 2020-21 from 60 in 2019-20 and 57 in 2018-19.

- Number of Front Runners (scoring 65-99) increased to 22 States and UTs in 2020-21 from 10 in 2019-20.

- In North East India, 64 districts were Front Runners and 39 districts were Performers in the NITI Aayog North-Eastern Region District SDG Index 2021-22.

- India has the tenth largest forest area in the world.

- In 2020, India ranked third globally in increasing its forest area during 2010 to 2020.

- In 2020, the forests covered 24% of India’s total geographical, accounting for 2% of the world’s total forest area.

- In August 2021, the Plastic Waste Management Amendment Rules, 2021, was notified which is aimed at phasing out single use plastic by 2022.

- Draft regulation on Extended Producer Responsibility for plastic packaging was notified.

- The Compliance status of Grossly Polluting Industries (GPIs) located in the Ganga main stem and its tributaries improved from 39% in 2017 to 81% in 2020.

- The consequent reduction in effluent discharge has been from 349.13 millions of litres per day (MLD) in 2017 to 280.20 MLD in 2020.

- The Prime Minister, as a part of the national statement delivered at the 26th Conference of Parties (COP 26) in Glasgow in November 2021, announced ambitious targets to be achieved by 2030 to enable further reduction in emissions.

The need to start the one-word movement ‘LIFE’ (Lifestyle for Environment) urging mindful and deliberate utilization instead of mindless and destructive consumption was underlined.

Agriculture and Food Management:

- The Agriculture sector experienced buoyant growth in past two years, accounting for a sizeable 18.8% (2021-22) in Gross Value Added (GVA) of the country registering a growth of 3.6% in 2020-21 and 3.9% in 2021-22.

- Minimum Support Price (MSP) policy is being used to promote crop diversification.

- Net receipts from crop production have increased by 22.6% in the latest Situation Assessment Survey (SAS) compared to SAS Report of 2014.

- Allied sectors including animal husbandry, dairying and fisheries are steadily emerging to be high growth sectors and major drivers of overall growth in agriculture sector.

- The Livestock sector has grown at a CAGR of 8.15% over the last five years ending 2019-20. It has been a stable source of income across groups of agricultural households accounting for about 15% of their average monthly income.

- Government facilitates food processing through various measures of infrastructure development, subsidized transportation and support for formalization of micro food enterprises.

- India runs one of the largest food management programmes in the world.

- Government has further extended the coverage of food security network through schemes like PM Gareeb Kalyan Yojana (PMGKY).

Industry and Infrastructure:

- Index of Industrial Production (IIP) grew at 17.4 percent (YoY) during April-November 2021 as compared to (-)15.3 percent in April-November 2020.

- Capital expenditure for the Indian railways has increased to Rs. 155,181 crores in 2020-21 from an average annual of Rs. 45,980 crores during 2009-14 and it has been budgeted to further increase to Rs. 215,058 crores in 2021-22 – a five times increase in comparison to the 2014 level.

- Extent of road construction per day increased substantially in 2020-21 to 36.5 Kms per day from 28 Kms per day in 2019-20 – a rise of 30.4 percent.

- Net profit to sales ratio of large corporates reached an all-time high of 10.6 percent in in July-September quarter of 2021-22 despite the pandemic (RBI Study).

- Introduction of Production Linked Incentive (PLI) scheme, major boost provided to infrastructure-both physical as well as digital, along with measures to reduce transaction costs and improve ease of doing business, would support the pace of recovery.

Services:

- GVA of services crossed pre-pandemic level in July-September quarter of 2021-22; however, GVA of contact intensive sectors like trade, transport, etc. still remain below pre-pandemic level.

- Overall service Sector GVA is expected to grow by 8.2 percent in 2021-22.

- During April-December 2021, rail freight crossed its pre-pandemic level while air freight and port traffic almost reached their pre-pandemic levels, domestic air and rail passenger traffic are increasing gradually – shows impact of second wave was much more muted as compared to during first wave.

- During the first half of 2021-22, service sector received over US$ 16.7 billion FDI – accounting for almost 54 percent of total FDI inflows into India.

- IT-BPM services revenue reached US$ 194 billion in 2020-21, adding 1.38 lakh employees during the same period.

- Major government reforms include, removing telecom regulations in IT-BPO sector and opening up of space sector to private players.

- Services exports surpassed pre-pandemic level in January-March quarter of 2020-21 and grew by 21.6 percent in the first half of 2021-22 – strengthened by global demand for software and IT services exports.

- India has become 3rd largest start-up ecosystem in the world after US and China. Number of new recognized start-ups increased to over 14000 in 2021-22 from 733 in 2016-17.

- 44 Indian start-ups have achieved unicorn status in 2021 taking overall tally of unicorns to 83, most of which are in services sector.

Social Infrastructure and Employment:

- 94 crore doses of COVID-19 vaccines administered as on 16th January 2022; 91.39 crore first dose and 66.05 crore second dose.

- With revival of economy, employment indicators bounced back to pre-pandemic levels during last quarter of 2020-21.

- As per the quarterly Periodic Labour Force Survey (PFLS) data up to March 2021, employment in urban sector affected by pandemic has recovered almost to the pre-pandemic level.

- According to Employees Provident Fund Organisation (EPFO) data, formalization of jobs continued during second COVID wave; adverse impact of COVID on formalization of jobs much lower than during the first COVID wave.

- Expenditure on social services (health, education and others) by Centre and States as a proportion of GDP increased from 6.2 % in 2014-15 to 8.6% in 2021-22 (BE)

As per the National Family Health Survey-5:

- Total Fertility Rate (TFR) came down to 2 in 2019-21 from 2.2 in 2015-16

- Infant Mortality Rate (IMR), under-five mortality rate and institutional births have improved in 2019-21 over year 2015-16

- Under Jal Jeevan Mission (JJM), 83 districts have become ‘Har Ghar Jal’ districts.

- Increased allotment of funds to Mahatma Gandhi National Rural Employment Guarantee Scheme (MNREGS) to provide buffer for unorganized labour in rural areas during the pandemic.

4. THE CROSS-BORDER INSOLVENCY FRAME WORK

THE CONTEXT: The Economic Survey 2021-22 has called for a standardised framework for Cross-Border insolvency as the Insolvency & Bankruptcy Code (IBC) at present does not have a standard instrument to restructure the firms involving cross border jurisdictions leading to several issues.

THE EXPLANATION:

- The proposal to frame a robust cross border insolvency framework has already been highlighted in the report of the Insolvency Law Committee (ILC) which had recommended the adoption of the United Nations Commission on International Trade Law (UNCITRAL) with certain modifications to make it suitable to the Indian context.

- UNCITRAL on Cross-Border Insolvency, 1997 has emerged as the most widely accepted legal framework to deal with cross-border insolvency issues”.

- It provides a legislative framework that can be adopted by countries with modifications to suit the domestic context of the enacting jurisdiction.

- It has been adopted by 49 countries until now, such as Singapore, the U.K., the U.S.,South Africa and Korea. This law addresses the core issues of cross border insolvency cases with the help of four main principles which includes access, recognition, cooperation, and coordination.

- It allows foreign professionals and creditors direct access to domestic courts and enables them to participate in and commence domestic insolvency proceedings against a debtor. It also allows recognition of foreign proceedings and enables courts to determine relief accordingly. Also, it provides a framework for cooperation between insolvency professionals and courts of countries and allows for coordination in the conduct of concurrent proceedings in different justifications.

What is the Need?

- Cross border insolvency signifies circumstances in which an insolvent debtor has assets and/or creditors in more than one country.Typically, domestic laws prescribe procedures, for identifying and locating the debtors’ assets; calling in the assets and converting them into a monetary form; making distributions to creditors in accordance with the appropriate priority etc. for domestic creditors/debtors.

- At present, the IBC provides for the domestic laws for the handling of an insolvent enterprise but not to restructure the firms involving cross border jurisdictions.

About UNCITRAL:

- The UN Commission on International Trade Law (UNCITRAL) is a subsidiary body of the U.N. General Assembly. Established by the UNGA in 1966. Headquartered at Vienna.

- Aim: It is responsible for helping to facilitate international trade and investment.

- Mandate: “To promote the progressive harmonization and unification of international trade law” through conventions, model laws, and other instruments that address key areas of commerce, from dispute resolution to the procurement and sale of goods.

- The Tribunal constituted in accordance with the UNCITRAL Arbitration Rules 1976 is seated at the Hague, Netherlands, and proceedings are administered by the Permanent Court of Arbitration.

THE PRELIMS PRACTICE QUESTIONS

QUESTION OF THE DAY 1ST FEBRUARY 2022

- Consider the following statements about Theyyam:

- It is a popular ritual form of dance worship in Kerala.

- It is only performed by males.

- There is no stage for the performance.

Which of the given statements is/are correct?

a only

b 2 and 3 only

c 1 and 3 only

d All of them

ANSWER FOR 31ST JAN 2022

Answer: b

Explanation:

- Statement 1 is incorrect: It is kind of extra-tropical or mid-latitude cyclone.

- Statement 2 is correct: It occurs when a storm & central barometric pressure drops at least 24 millibars in 24 hours.

- Statement 3 is correct: It can happen when a cold air mass collides with a warm air mass.