THE CONTEXT: The Indian government was planning to introduce a Bill, the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 during the recently concluded Winter Session of the Parliament to classify cryptocurrencies as financial assets while protecting the interests of small investors. The Bill also proposes to lay the groundwork for the creation of the official digital currency to be issued by the Reserve Bank of India (RBI) and regulated under the RBI Act.

Note: The Bill has not been introduced in the Winter Session.

WHAT IS CRYPTOCURRENCY?

A cryptocurrency is a medium of exchange such as the Indian Rupee, US dollar etc. Bitcoin, the first cryptocurrency, appeared in January 2009 and was the creation of a computer programmer using the pseudonym Satoshi Nakamoto.

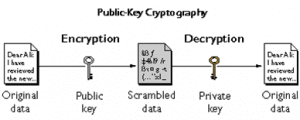

The term cryptocurrency is used because the technology is based on public-key cryptography, meaning that the communication is secure from third parties. This is a well-known technology used in both online transactions and communication systems.

Public key cryptography involves a pair of keys known as a public key and a private key (a public key pair), which are associated with an entity that needs to authenticate its identity electronically or to sign or encrypt data. Each public key is published, and the corresponding private key is kept secret. Data that is encrypted with the public key can be decrypted only with the corresponding private key.

CRYPTOCURRENCY V/S NORMAL CURRENCY

Cryptocurrency

- Like the US dollar, cryptocurrency has no intrinsic value. Therefore, it is not redeemable for another commodity such as gold.

- Cryptocurrency is not backed by any central bank

- Cryptocurrency doesn’t have any physical form

- Its supply is not determined by a central bank and the network is completely decentralized, with all transactions performed by the users of the system.

US Dollar ($) or Indian currency (₹)

- It also has no intrinsic value.

- It is a legal tender, which implies it is backed by a central bank or the government. Thus, banks cannot refuse to accept it.

- The currency does have a physical form

- Its supply is determined by the central bank on the basis of inflation or contractionary or expansionist fiscal policies.

WHY DO CRYPTOCURRENCIES NEED TO BE REGULATED?

PREVENT MARKET MANIPULATION AND PROTECT INVESTORS:

- Market manipulation and price volatility are common in cryptocurrencies. Take, for example, Bitcoin, the world’s oldest and most popular cryptocurrency, which rose to all-time highs since the beginning of 2021, before plummeting and losing a huge amount of its value.

- So, the lack of authorised information on these digital assets and the technological complexities associated with them makes it imperative to put regulations in place for safeguarding investors.

PROVIDING MARKET INFORMATION

- Thousands of cryptocurrencies exist around the world. Most investors, however, are only familiar with a few of those, such as Bitcoin, Ether, Ripple, and Dogecoin among others. They hardly have any knowledge about the thousands of other virtual assets.

- So, to protect customers, a regulatory authority clearing cryptocurrency is required, which can disclose all information about the performance of the digital assets, their risks, and potential.

UNDERSTANDING RISKS ASSOCIATED WITH TECHNOLOGY

- Technology is advancing at a breakneck pace. This carries a significant danger, as such changes have the potential to render technology, including blockchain, outdated in the future.

- Given the rapid rate of technological change, information infrastructure and professional financial advisors skilled in cryptocurrency are required. That way, investors can understand the technological risks of cryptocurrencies and make informed decisions.

ENSURING ACCOUNTABILITY

- Investing in cryptocurrencies comes with another risk — online fraud. Hacking is a major threat worldwide, and cyber-attacks have become common. One cyber-attack could result in losses for investors who have put their savings in cryptocurrencies.

- Through regulations, the authorities can implement measures to help cryptocurrency investors protect their assets. Also, investors can address concerns or reclaim their investments in case they lose them.

MONEY LAUNDERING

- Any unregulated system has the ability to fund criminal acts. As a result, a client due diligence process akin to that of a bank is required.

- For long, it was theoretical that cryptos could be used for money laundering and for terror financing. Recently, it turned out that the Enforcement Directorate of India had identified that using cryptos, Rs 4,000 crores has been laundered out of India in the last one year.

- This can help in keeping track of investors’ real identities and verifying their locations when they are buying or selling cryptocurrencies. Any infringement of such norms should be met with severe sanctions.

TAX ON THE TRANSACTIONS

- Nearly 10 crore Indians already have investments exceeding a total of $10 million in them.

- This not only creates an avenue for the generation of tax revenue for the nation but also puts forth a Herculean challenge for the tax authorities who must track and tax transactions involving cryptocurrencies.

WHAT HAS BEEN THE STEPS TAKEN BY THE GOVERNMENT TO REGULATE THE CRYPTOCURRENCY?

Currently, there is no regulation or any ban on the use of cryptocurrencies in the country. The Reserve Bank of India’s (RBI) order banning banks from supporting crypto transactions, was reversed by the Supreme Court order of March 2020.

HERE WE EXAMINE THE REGULATORY JOURNEY OF CRYPTOCURRENCY IN INDIA SO FAR.

- In 2013, the Reserve Bank of India (RBI) issued a circular warning to the public against the use of virtual currencies. The bank warned users, holders, and traders of virtual currencies about the potential financial, operational, legal, customer protection, and security-related risks they are exposing themselves to.

- The central bank pointed out that it has been keeping a close eye on developments in the virtual currency world, including Bitcoins, Litecoins, and other altcoins.

- But as banks continued to allow transactions on cryptocurrency exchanges — on February 1, 2017, RBI released another circular, reiterating its concerns with virtual coins. And by the end of 2017, a warning was issued by RBI and the finance ministry clarifying that virtual currencies are not legal tender.

- At the same time, two Public Interest Litigations (PILs) were filed in the Supreme Court, one asking for a ban on buying and selling of cryptocurrencies in India, the other asking for them to be regulated. In November, the government formed a committee to study issues around virtual currencies and propose actions.

- At this time, there was no ban on cryptocurrencies and most banks allowed transactions from cryptocurrency exchanges.

2018-2020

- In March 2018, the Central Board of Direct Tax (CBDT) submitted a draft scheme to the finance ministry for banning virtual currencies.

- A month later, the RBI issued a circular that restrained banks and financial institutions from providing financial services to virtual currency exchanges.

- In April 2018, the finance ministry appointed committee proposed a draft Bill for the regulation of virtual currencies but did not recommend a ban. However, in February 2019, the committee proposed a fresh draft Bill that recommended a blanket ban.

- In March 2020 a significant development took place, the Supreme Court of India lifted the curb on cryptocurrency imposed by RBI, which restricted banks and financial institutions from providing access to banking services to those engaged in transactions in crypto assets.

2021

- In November 2021, the Standing Committee on Finance met representatives of crypto exchanges, Blockchain and Crypto Assets Council (BACC), among others, and came to the conclusion that cryptocurrencies should not be banned, but regulated.

- In the same month, Prime Minister Narendra Modi called a meeting on cryptocurrencies with senior officials. The indications are that strong regulatory steps will probably be taken to deal with the issue.

- Meanwhile, the Reserve Bank of India has repeatedly underlined its strong view against cryptocurrencies, saying these pose a serious threat to the macroeconomic and financial stability of the country. It has also raised doubts about the number of investors trading on cryptocurrencies and their claimed market value.

- During the winter session, the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 was listed for introduction in Parliament’s. However, it allows for certain exceptions to promote the underlying technology of cryptocurrency and its uses.

Although, Government wants to regulate cryptocurrencies, RBI in a complete ban on such currencies. In December 2021 RBI Said that “Cryptocurrencies are a serious concern to RBI from a macroeconomic and financial stability standpoint”.

SO, IF BITCOIN IS LEGALISED IN INDIA, THE FOLLOWING WOULD HAPPEN:

- It would fall under the purview of RBI’s 1934 Act.

- Its investors would be taxed.

- RBI would issue guidelines regarding investment and purchase of Bitcoin.

- If any foreign payment is made through Bitcoins, it would fall under the purview of the FEMA Act.

- Returns from investment in Bitcoin would be taxed.

HOW THE CRYPTOCURRENCIES ARE BEING REGULATED AROUND THE WORLD?

- United States:The US has regulations under the central and state governments (similar to India), which means that rules differ from state to state. The overall sentiment, however, is positive.

- China:China has been the harshest towards cryptocurrencies, moving from initially welcoming crypto mining to completely banning it as of June 2021.

- United Kingdom:The UK does not have specific legislation on cryptocurrencies and the sector is currently governed by the Financial Conduct Authority (FCA), which grants licenses for crypto businesses and exchanges.

- El Salvador: The South American country became the first to officially declare Bitcoin legal tender.

THE BLOCKCHAIN TECHNOLOGY AND ITS USE IN CRYPTOCURRENCY

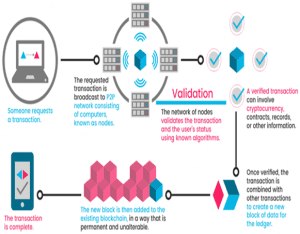

- The blockchain is the technology underlying Bitcoin and other cryptocurrencies. In the blockchain, the data is stored in the cloud network. In the case of Bitcoin, the decentralized public ledger takes the place of cloud storage that keeps a record of all transactions that take place across the peer-to-peer network.

- This technology allows participants to transfer assets across the Internet without the need for a broker or an intermediary (central third party).

- Blockchain technology uses public-key cryptography to secure transactions. Public-key cryptography employs two keys: a public key and a private key. An individual party to the crypto transaction will have a public key and a private key. The public key is widely distributed across the network, while the private key is a secret key for the individual.

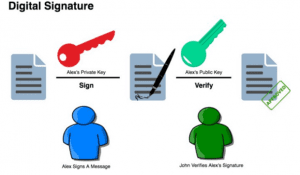

- Using a private key, a digital signature can be created so that anyone with the corresponding public key can verify that the message was created by the owner of the private key and was not modified since (See the diagram: Digital Signature).

- Using this a transaction record is created. One transaction record is called one block. When other transactions happen in the future, those transactions are recorded once again in a block and connected to the earlier block in a chain network. This chain of transactions from the source of origin to the end is called the blockchain. Thus, you can backtrace the source money by travelling back in the chain.

- Given the latest block, it is possible to access all previous blocks linked together in the chain, so a blockchain database retains the complete history of all assets and instructions executed since the very first one – making its data verifiable and independently auditable.

FEATURES OF BLOCKCHAIN

- Data is stored in a decentralized cloud network. In the case of Bitcoin, this cloud is the public transaction ledger.

- Blockchain code is resistant to counterfeiting since data once added, can’t be reversed.

- Data security is enabled by public-private key cryptography.

WHAT ARE THE DIFFERENCES BETWEEN PUBLIC AND PRIVATE BLOCKCHAINS?

There are different types of blockchain: some are open and public and some are private and only accessible to people who are given permission to use them.

PUBLIC BLOCKCHAIN

- A public blockchain is an open network. Anyone can download the protocol and read, write or participate in the network.

- A public blockchain is distributed and decentralised. Transactions are recorded as blocks and linked together to form a chain. Each new block must be time stamped and validated by all the computers connected to the network, known as nodes before it is written into the blockchain.

- All transactions are public, and all nodes are equal. This means a public blockchain is immutable: once verified, data cannot be altered.

- The best-known public blockchains used for cryptocurrency are Bitcoin and Ethereum: open-source, smart contract blockchains.

PRIVATE BLOCKCHAIN

- A private blockchain is an invitation-only network governed by a single entity.

- Entrants to the network require permission to read, write or audit the blockchain. There can be different levels of access and information can be encrypted to protect commercial confidentiality.

- Private blockchains allow organisations to employ distributed ledger technology without making data public.

- But this means they lack a defining feature of blockchains: decentralisation. Some critics claim private blockchains are not blockchains at all, but centralised databases that use distributed ledger technology.

- Private blockchains are faster, more efficient and more cost-effective than public blockchains, which require a lot of time and energy to validate transactions.

ADVANTAGES OF BLOCKCHAIN IN THE INDIAN CONTEXT

- Online voting: With a unique digital identity to identify the voter and a private key, online voting can be facilitated. Since blockchain doesn’t allow reversing the data once entered, every voter using this option can exercise this privilege only once.

- To trace black money: Provided people become completely cashless and shift to digital transactions. That is the biggest challenge since this operates on a digital network. Most blockchains are entirely open-source software. This means that anyone and everyone can view its code. This gives auditors the ability to review cryptocurrencies like Bitcoin for security.

- Improve the efficiency of the approval process in the social benefits scheme: If personal health record is stored on a cloud network and secured with blockchain, every single addition of data by a medical practitioner will be recorded and connected to earlier blocks of data. Tracing the sequence of earlier treatments and medical tests will reduce the duplication of the same tests and treatment. This will make the process of approval of health insurance policies faster and more efficient.

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks. - Reduces chances of fraud: Since all the data is stored in the cloud and encrypted and can be transferred across platforms, it will help to reduce frauds since this can be checked immediately. For e.g., if all the banks and insurance companies collaborate the data of blacklisted people on a common blockchain platform that they can check, chances are rare that the person under suspicion will be able to commit the same once again. Since every single payment will be recorded on the blockchain network and transparent to authorized people on the blockchain network, it will reduce the chances of scams.

- To reduce the burden of pending cases on courts: If all the land records are digitized and stored on the blockchain, each and every transaction can be back-traced with complete details including the identity of the person, time and place when the land title was transferred etc. This will help to immediately trace out frauds.

- Protection of Aadhaar data by creating a Dynamic registry (a distributed database that updates as assets are exchanged on the digital platform: Since the blockchain stores all the records including, when the transaction has happened, who stored the data, who added value to it, it can be used to trace when and from where my Aadhar data was accessed by whom. This will help to trace the source of leakage if any fraud has happened by using Aadhar data.

WHAT ARE THE CURRENT BOTTLENECKS IN REGULATING CRYPTO?

TYPE OF REGULATION

- The Industry bodies demand self-regulation by crypto exchanges while the RBI wants complete ban. The government has set up committees and which said regulation by government. Thus, there seems to be divergence on this aspect.

WHETHER CRYPTO CAN BE REGULATED AT ALL?

- Some analysts point out that it is nearly impossible to regulate crypto currencies as they simply move to P2P exchanges outside India, may use hawala type informal system to get around regulation.

- Crypto exchanges that are operating outside India and accessible from India just like any other internet-based service will not follow the laws of the Indian government.

- How can one enforce any regulation brought in by the government in such a case?

CURRENCY OR COMMODITY?

- Cryptocurrency itself is a misnomer as its legal existence in most countries is that of a commodity and not a currency. What it implies is that most countries globally do not accept cryptos as legal tender.

- In the Indian context, this aspect need to be made clear and the regulation need to tailored accordingly

CAPACITY TO REGULATE

- Crypto is a cutting edge technological innovation that is being improved upon day by day. Thus to regulate them, the regulator should have the expertise, technical capacity etc.

- Whether the country especially the government sector has the talent pool is a debatable issue.

ISSUE OF PRIVATE AND PUBLIC CRYPTO CURRENCY

- The Bill seeks to ban all private crypto currencies in India with some exceptions. But since the Bill is not in the open, what is public crypto and private crypto is open to interpretation.

- Whether the Central Bank Digital Currency will be the public crypto that will be allowed is also not clear?

- If RBI regulates crypto and is itself a player, that would create conflict of interest is another issue.

THE WAY FORWARD:

- Banning cryptocurrency is not a viable solution, so it must be regulated. Banning will lead to underground activities and people will continue illegal trading of these currencies.

- The decision for banning/regulation should be based on consensus and it should not be taken in a hurry.

- India can learn from other countries how to regulate such currencies and how to tax them (for example, Israel).

- Digital currencies have the potential to solve many issues, India needs to use it utility.

- Accepting cryptocurrency allows scope for effective regulation. RBI has already expressed interest in blockchain technology and is even planning to introduce its own Digital Rupee, much like the Digital Yuan. This entry into the e-money market could well be a balancing act by the RBI, perhaps making it a more acceptable fiat than crypto, while being well within the ambit of regulation.

- Cryptocurrency opens great opportunities for the economy. It poses an intriguing ‘regulator’s dilemma’ – striking a balance between technological progress ushering financial innovation while remaining as sovereign authority. The central bank can investigate what constitutes crypto and technologies like blockchain to assess its role in the value chain instead of banning it altogether.

- A comprehensive crypto currency Bill is the need of the hour.

THE CONCLUSION: India is considered an inspiration when it’s comes to frugal innovation. Combing the advantage of a highly skilled workforce in IT Sector, Artificial intelligence and encrypted data stored on the blockchain, India can be a scale up the efficiency of the delivery of its various schemes and the pace of delivery of justice. The need of the hour is to develop an architecture or an institution that can implement this at the grassroots level.

Spread the Word

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.

This is what Estonia has done and can be used in the Indian context to improve the efficiency of medical insurance schemes faster. Additionally, since the data is stored in the cloud, some person can sell it for clinical trials or experiments or research to a pharma company within a few seconds, since the digital data can be transferred in a few mouse clicks.