Economy

Union Budget 2026–27: Key Highlights & Policy Shifts:

-

- Context: The Union Budget for 2026–27 was presented in Lok Sabha on 1 February 2026 by Finance Minister Nirmala Sitharaman, marking her ninth consecutive Budget. It emphasizes economic growth, infrastructure, fiscal discipline, services and tech-sector reforms.

- Total expenditure ~ ₹53.5 lakh crore; non-debt receipts ~ ₹36.5 lakh crore.

- Fiscal deficit pegged at 4.3% of GDP, signalling calibrated expansion.

- Capital expenditure increased to ₹12.2 lakh crore to boost infrastructure.

- Seven high-speed rail corridors proposed to strengthen national connectivity.

- High-Powered “Education to Employment and Enterprise” Standing Committee launched for services sector reforms.

- Tax holiday for AI Data Centres & Cloud investments until 2047 to attract global capital.

- Scheme for five Regional Medical Hubs to promote medical tourism.

- Threshold for Safe Harbour for IT services raised from ₹300 cr to ₹2000 cr.

- Focus on sectors: MSME, AVGC Labs in schools & colleges, Biopharma Shakti.

- Defence & security allocations increased significantly (e.g., MHA forces, paramilitary).

(PIB+ET)

Geography, Mapping, Ecology & Environment

Inclusion of Heatwaves & Lightning as National Disasters:

-

- Context: The 16th Finance Commission recommended recognizing heatwaves and lightning as nationally notified disasters to enable mitigation funding and early warning enforcement.

- Finance Commission under Article 280 recommends fiscal relations and disaster allocations for 2026–31.

- Record heat in 2024 made heatwaves more lethal and frequent.

- Lightning strikes increased dramatically, causing high fatalities.

- National disaster status enables central mitigation funds.

- Improves early warning dissemination accountability.

- Urban heat island effects strain infrastructure (power/water).

- Heat Action Plans exist in multiple states.

- Lightning mitigation (MPLS) focuses on high-risk states.

(IE+DTE)

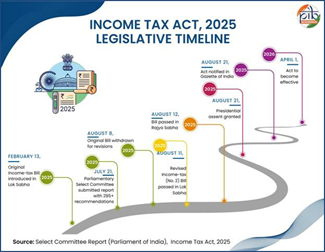

New Income Tax Act, 2025:

-

- Context: The Union Budget 2026–27 announced the coming into force of the Income Tax Act, 2025 from 1 April 2026, replacing the old 1961 law.

- Effective from 1 April 2026.

- Simpler tax compliance procedures and forms.

- Staggered filing deadlines by taxpayer category.

- Extended revision window till March 31 of next year.

- Certain defaults decriminalised.

- Special Foreign Asset Disclosure Scheme (FAST DS) introduced.

- Penalty and prosecution rationalised.

- Post-reassessment return update allowed at extra tax.

(PIB)

Livestock & Fisheries Boost in Budget 2026–27:

-

- Context: Budget 2026–27 prioritized livestock and fisheries as growth drivers in agriculture.

- Allocation to fisheries, animal husbandry, & dairying increased ~27%.

- Services sectors grew faster than crops, contributing significantly to farm income.

- 20,000+ veterinary professionals target.

- Loan-linked subsidies for private infrastructure in animal care.

- Enhanced Rashtriya Gokul Mission funds.

- Inland reservoir fisheries development.

- Coastal employment through women-led groups.

- Export reforms including EEZ catch duty exemptions.

(TH+PIB)

RBI Monetary Policy:

-

- Context: On 2 February 2026, the Reserve Bank of India (RBI) maintained the policy repo rate amid stable inflation.

- Policy repo rate maintained at 6.50%.

- CPI inflation around 4.2% within target band.

- GST collections for Jan 2026 were ₹1.78 lakh crore (11% YoY).

- Banking NPAs declined to about 2.8%.

- Forex reserves around $675 bn (~11 months import cover).

- Mixed stock market trends.

- RBI’s stance keeps growth-inflation balance.

- Investor sentiment influenced by global dynamics.

(PIB)

Science & Technology

Digital Economy & Technology Push – AI, Semiconductors, AVGC & Farms:

-

- Context: Government announced structural incentives in Budget 2026 aimed at deepening technology ecosystem, semiconductor manufacturing and digital agriculture support.

- AI Data Centres: Tax holiday till 2047 to attract global cloud/AI infra.

- Semiconductor Mission 2.0: Deepen design, manufacturing ecosystem.

- ‘Bharat-VISTAAR’: Multilingual AI tool to boost farm decision-making.

- AVGC Labs in 15,000 schools expand digital creative economy.

- Potential to improve rural tech adoption and innovation pipeline.

(PIB)

Government Schemes & Initiatives

Biopharma Shakti Initiative:

-

- Context: Union Budget 2026–27 launched the Biopharma Shakti initiative to strengthen India’s biopharmaceutical ecosystem.

- ₹10,000 crore outlay over 5 years.

- Targets biologics and biosimilars production.

- New and upgraded National Institutes of Pharmaceutical Education & Research (NIPERs).

- Over 1,000 accredited clinical trial sites planned.

- Strengthened regulatory agency (CDSCO) scientific cadre.

- Cluster-based chemical parks for pharma and allied biotech.

- Support for traditional medicine exports and research.

- Integration of AI tools (e.g., Bharat-VISTAAR) for farm and bio applications.

(IE+PIB)

Spread the Word