-

- It was implemented through the 101st Constitutional Amendment Act, 2017 which amended the concurrent powers of the Central as well as State Governments to levy taxes and duties on sale or supply of goods and services.

-

- It is a value-added tax levied on the consumption of goods and services.

- It is a consumption-based tax which means that it is levied and paid upon consumption of goods or services and not at time of manufacturing, unlike excise duty.

- That is why it is also known as destination-based tax which is collected on the supply of goods and services and not production of goods and services. So, it is said that states that are largely consumption-based are benefited and those states which are producer can suffer potential dip in tax collection.

- So, compensate for this potential loss in tax collection post implementation of the GST structure, there is a compensation mechanism for states to cover for loss of revenue to States for period upto 31st March 2026. For this, GST compensation cess is levied along with GST on few specified luxury and sin goods like luxury cars, tobacco products, aerated drinks, coal etc

Types of Taxes under GST

There are four separate acts which govern the respective types of taxes which are imposed under the GST structure:

a) Central GST Act, 2017

b) Integrated GST Act, 2017

c) The GST (Compensation to States) Act, 2017

d) The Union Territory GST Act, 2017

In addition to these provisions, State Governments have enacted respective State GST Acts to enforce State GST.

1. Integrated GST (IGST)

-

- It is levied on inter-state trade of goods and services.

- It is levied and collected by the Central Government, but the revenue collected as IGST is distributed equally between the Central Government and the government of the state to which the goods/service is supplied (the state of consumption of the goods/service)

2. State GST (SGST)

-

- The State GST or SGST is levied by the state on the goods and/or services that are purchased or sold within the state.

- It is governed by the SGST Act.

- The revenue earned through SGST is solely claimed by the respective state government.

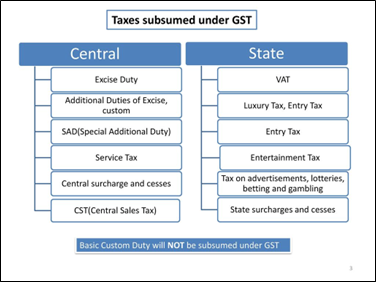

Taxes not subsumed under GST

Basic Custom Duty

Exports Duty

Toll Tax

Stamp Duty

State Excise Duty

VAT on petroleum Products

Anti-Dumping Duty

3. Central GST (CGST)

-

- Like State GST, the Central Goods and Services Tax or CGST is a tax under the GST regime that is applicable on intrastate (within the same state) transactions.

- The CGST is governed by the CGST Act.

- The revenue earned from CGST is collected by the Central Government.

Note: In the case of an intrastate supply of goods and/or services, both State GST and Central GST are levied. However, the rate of GST, in case of intra-state supply of goods and services, are set such that it is split 50-50 between the CGST and SGST.

Suppose 18% is the GST rate and the goods which has been supplied within the state, then the CGST component would be 9% and the other 9% would be the SGST component as applicable.

4. Union Territory GST (UTGST)

-

- It is the counterpart of State Goods and Services Tax (SGST) which is levied on the supply of goods and/or services in the Union Territories (UTs) of India.

- Thus, the UTGST is levied in addition to the CGST in Union Territories.

GST tax slabs

-

- 0 percent: Essential food items like butter milk, meat, bread etc

- 5 percent

- 12 percent

- 18 percent

- 28 percent: Mainly sin goods and luxury goods like pan masala, cigarettes and other tobacco product, air conditioner, motor vehicles, online gaming etc

In addition to these rates, there are 2 special rates:

-

- 25 percent: Rough precious and semi-precious stones

- 3 percent: Gold, silver, platinum, pearl etc

Important concept related to GST

1. Input Tax Credit: It removes cascading effects of taxes. It allows deduction of tax already paid on input items at the time of paying the tax on output. It helps lower the prices of goods and services.

For example- For a manufacturer, tax payable on output (final product) is Rs 500 while tax paid on input (purchases) is Rs 300. The manufacturer can claim input credit of Rs 300 and deposit only Rs 200 in taxes.

2. Composition Scheme: Composition schemes are voluntary schemes available for small businesses with annual turnovers up to Rs. 1.5 crore who can opt for fixed tax rates instead of regular GST rates. No Input Tax Credit can be claimed by a dealer opting for composition scheme.

3. E-Way Bill: It is a document which is required to be carried along with the movement of goods if the consignment value of goods exceeds Rs 50,000. E-way bill, once generated, is valid for one day for upto 200km of travel.

4. GST Network (GSTN): It is a non-profit non-government company. It provides shared IT infrastructure and service to both central and state governments including taxpayers and other stakeholders. It functions as technology backbone for GST in India.

5. Inverted Duty Structure: It is a case where GST rates on inputs materials is more than the rates on finished goods. It leads to cashflows problem, particularly for small businesses as working capital gets blocked due to higher amount of taxed paid on input (which gets only created when output is supplied).

6. Reverse Charge Mechanism: As per the structure of GST, the liability to pay GST is on the supplier of goods and services. But under the reverse charge mechanism, the recipient of goods and services for notified category of supply is liable to pay the GST

Spread the Word