TAG: GS- 3: Economy

The context: Recent evaluations reveal that corporate tax cuts in the U.S. and India led to minimal wage increases and significant revenue losses, shifting the tax burden to individuals.

Explanation:

About the Corporate tax:

Corporate tax is a direct tax levied on the net income or profit of public and private companies registered under the Companies Act 1956.Corporate tax is a direct tax imposed on the profits of companies or corporations.

- The rate of corporate tax varies by country and is applied to a company’s taxable income, which is calculated after deducting operating expenses, depreciation, and other allowable deductions from gross revenue. Corporate taxes are a significant source of government revenue and can influence a company’s investment decisions, business operations, and growth strategies.

The U.S. Experience with Corporate Tax Cuts

- The Tax Cuts and Jobs Act, signed into law by then-President Donald Trump, came into effect in 2018.

- One of the most notable provisions of this legislation was the reduction of the top corporate tax rate from 35% to 21%.

- Proponents argued that this move would encourage companies to invest more, leading to economic growth, higher employment, and increased wages.

- They also suggested that new investments would lead to technological advancements and productivity gains, further boosting wages.

- Impact of Corporate Tax Cuts:

- A study titled “Lessons from the Biggest Business Tax Cut in U.S. History,” published in the Journal of Economic Perspectives found that while the tax cuts did result in an increase in investment, the impact was relatively modest, with estimates ranging from an 8% to 14% increase.

- This increase in investment is significant when considering that without the tax cuts, investment levels might have declined.

- Despite this positive effect on investment, the overall economic impact of the tax cuts was limited.

- Moreover, the tax cuts led to a substantial reduction in tax revenue, with long-term projections indicating a 41% decrease.

Corporate Tax Cuts in India:

- In India, corporate tax rates were slashed in 2019:

- rate for existing companies dropping from 30% to 22%, and

- for new companies from 25% to 15%.

- This move resulted in a significant revenue loss, amounting to approximately ₹1 lakh crore in the 2020-21 fiscal year.

- The COVID-19 pandemic, however, severely disrupted India’s labor market, leading to a surge in unemployment.

- Although unemployment rates have since decreased and labor force participation has improved, especially among women, the corporate sector has not played a significant role in this recovery.

- Data from the Periodic Labour Force Survey (PLFS) indicates a decline in the proportion of regular wage employees at the national level, from 22.8% in 2017-18 to 20.9% in 2022-23.

- Moreover, between 2017 and 2022, the compound annual growth rate (CAGR) of nominal monthly earnings for regular wage workers was 4.53% in rural areas and 5.75% in urban areas—barely above the rate of inflation.

- This implies that real wages for rural workers have actually declined, while urban wages have stagnated.

- While corporate tax collections have shown healthy growth post-pandemic, this has not translated into better employment or wages.In fact, several tech companies in India have made headlines for laying off workers, highlighting the lack of expansion in hiring.

Shift in Tax Burden to Individuals:

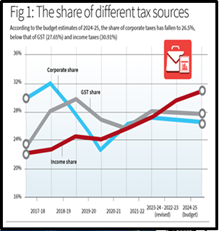

- Due to corporate tax cuts, the shift in the tax burden from corporates to individuals is evident in the changing composition of India’s gross tax revenues.

- In 2017-18, corporate taxes accounted for nearly 32% of gross tax revenues, but this share has since declined.

- According to budget estimates for 2024-25:

- Corporate Taxes contributes 26.5% of gross tax revenues,

- GST contributing 27.65% and

- Income Tax contributing 30.91%.

- This shift may explain the government’s decision to remove indexation benefits and impose taxes on long-term capital gains as it seeks to find new revenue sources to compensate for the reduced share of corporate taxes.

- Corporate tax cuts do not automatically lead to increased investment, especially when businesses are uncertain about future profits.

- Economists argue that a more effective policy approach would involve maintaining high taxes on existing profits while offering greater incentives for future investment.

- The mixed results of these tax cuts underscore the complexities of policymaking in an uncertain global economic environment.