TAG: GS 2: GOVERNANCE

THE CONTEXT: The Pradhan Mantri Jan Dhan Yojana (PMJDY), launched by Prime Minister on 28th August 2014, completes a decade of successful implementation.

EXPLANATION:

Pradhan Mantri Jan-Dhan Yojana (PMJDY)

- Pradhan Mantri Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, a basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner.

- PMJDAY was launched in 2014 under Ministry of Finance.

- Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account.

Features under PMJDY

- One basic savings bank account is opened for unbanked person.

- There is no requirement to maintain any minimum balance in PMJDY accounts.

- Interest is earned on the deposit in PMJDY accounts.

- Rupay Debit card is provided to PMJDY account holder.

- Accident Insurance Cover of Rs.1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened after 28.8.2018) is available with RuPay card issued to the PMJDY account holders.

- An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

- PMJDY accounts are eligible for Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

- The Jan-Dhan Aadhaar and mobile (JAM) trinity, with PMJDY as one of its pillars, has proven to be a diversion-proof subsidy delivery mechanism.

- Through JAM, under Direct Benefit Transfer, the government has successfully transferred subsidies and social benefits directly into the bank accounts of the underprivileged.

- The successful implementation of PMJDY during the last 10 years has seen achieving many milestones.

- The major aspects and achievements of the PMJDY are presented below.

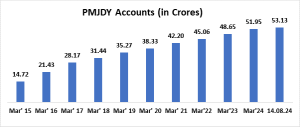

- PMJDY Accounts: 53.13 crore

- As on 14th August 24 number of total PMJDY Accounts: 53.13 crore; 55.6% (29.56 crore) Jan-Dhan account holders are women and 66.6% (35.37 crore) Jan Dhan accounts are in rural and semi-urban areas

- PMJDY Accounts: 53.13 crore

-

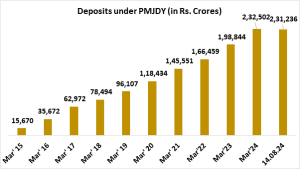

- Deposits under PMJDY accounts – 2.31 Lakh Crore

- Total deposit balances under PMJDY Accounts stand at Rs. 2,31,236 crore.

- Deposits have increased about 15 times with increase in accounts 3.6 times (Aug’24 / Aug’15)

- Deposits under PMJDY accounts – 2.31 Lakh Crore

-

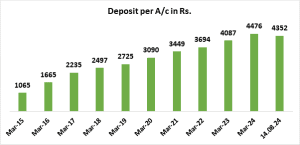

- Average Deposit per PMJDY account – Rs 4352

- Average deposit per account is Rs. 4,352 as on 14.08.2024. Avg. Deposit per account has increased 4 times over August 15. Increase in average deposit is another indication of increased usage of accounts and inculcation of saving habit among account holders.

- Average Deposit per PMJDY account – Rs 4352

-

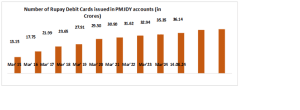

- RuPay Card issued to PMJDY account holders: 36.14 crore

- 14 crore RuPay cards have been issued to PMJDY accountholders: Number of RuPay cards & their usage has increased over time.

- RuPay Card issued to PMJDY account holders: 36.14 crore