TAG: GS 2: INTERNATIONAL RELATIONS, GS 3: ECONOMY

THE CONTEXT: Recent attacks on ships passing through the Red Sea trade route, conducted by Yemen-based Houthi rebels, have raised significant concerns regarding the disruption of global trade.

EXPLANATION:

- The attack on the Chemical tanker MV Chem Pluto near Gujarat, India, has heightened tensions among Indian oil importers and exporters dealing in commodities like basmati rice and tea.

- The Houthi rebels’ attacks, driven by their opposition to Israel’s military actions in Gaza, have prompted swift countermeasures from the US-led maritime security coalition.

- However, these attacks represent just one facet of the challenges impacting global shipping routes.

Critical Choke Points and Trade Implications

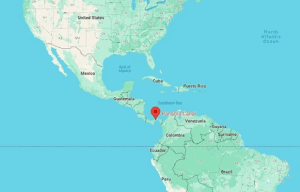

- Two pivotal choke points, the Suez Canal and the Panama Canal, are under threat, potentially disrupting over one-third of global trade.

- These choke points serve as essential channels for global maritime transport, with over 80% of global goods trade relying on sea routes.

- Any blockage in these critical passages forces shipping lines to adopt longer alternative routes, elevating freight rates and causing significant logistical disruptions.

- The disturbance in the Red Sea route, coupled with the potential blockage or slowdown in the Panama Canal due to drought conditions, poses severe repercussions for global trade.

- The diversion of shipments through alternative routes, such as the Cape of Good Hope, adds to transit times and increases freight costs significantly.

Impact on Indian Trade and Agriculture

- India, heavily reliant on sea routes for trade, faces adverse consequences due to these disruptions.

- For instance, Indian agricultural product prices are anticipated to surge by 10-20% as shipments reroute through longer paths.

- This price hike is particularly concerning amidst higher interest rates in Western countries, potentially impacting demand for Indian exports and affecting sectors like textiles and gems, majorly exporting to the European Union.

Challenges in the Panama Canal and Trade Route Deterioration

- The Panama Canal has experienced a more than 50% reduction in shipping due to drought conditions, compelling vessels traveling from Asia to the US to opt for the lengthier Suez Canal

- Concerns arise about prolonged canal bottlenecks due to Panama’s exceptionally dry rainy season.

- Additionally, LNG vessels are resorting to costly auctions to expedite their transit, revealing the severity of the situation.

Resilience of Indian Oil Imports and Impact on Prices

- Surprisingly, India’s oil imports from Russia have not suffered disruptions despite global shipping majors like Maersk avoiding the Red Sea route.

- Russian tankers, perceived as allied with Iran, continue their passage through the Red Sea despite the ongoing attacks by Houthi rebels.

- However, the spike in global benchmark crude prices to around $80 per barrel post-attacks on the Red Sea highlights market volatility and concerns regarding oil flow stability.

Freight Rate Surge and Economic Consequences

- War risk surcharges imposed by global shipping firms due to Red Sea security concerns have led to an escalation in freight rates.

- Indian exporters fear a substantial surge of 25-30% in freight rates for shipments bound to Europe and Africa, impacting crucial export sectors like textiles and gems, already grappling with reduced demand from the European Union.

Potential Resumption of Operations and Future Scenario

- While shipping giant Maersk plans to resume operations in the Red Sea following increased security measures, uncertainties persist.

- The company remains cautious, prepared to divert ship traffic based on evolving safety conditions, highlighting the volatile and precarious nature of current global trade routes.

Conclusion

- The combined challenges faced by global shipping routes due to Red Sea attacks and Panama Canal droughts pose severe threats to the stability of global trade.

- India, a significant player in international trade, faces potential disruptions impacting its exports and economic sectors.

- The evolving situation underscores the need for strategic planning and robust measures to navigate the complexities of global trade in an increasingly uncertain environment.

Related posts

GST 2.0-NEXT‑GEN GST

French System of government and its comparison with India

A CASE OF EMPATHY: THE SC TO THE SOLDIER’S RESCUE