Table of Contents

1. HINDU UNDIVIDED FAMILY AND UNIFORM CIVIL CODE

TAG: GS 1: SOCIETY, GS 2: POLITY

THE CONTEXT: The Law Commission of India has recently initiated a fresh deliberation on the Uniform Civil Code (UCC) and solicited public views on the same. This has resulted in a debate over the institution of Hindu Undivided Family (HUF) and its separate treatment under the tax laws of the country.

EXPLANATION:

Hindu Undivided Family and its tax structure:

- The concept of HUF is closely tied to the concepts of joint family and coparcenary. This is unique to Hindu personal law (deemed to include Jains, Buddhists & Sikhs).

- The existence of the Hindu Undivided Family as a legal entity is based on an acknowledgment of local customs during the British Raj.

- The HUF was seen as an institution which operated on a strong sense of blood ties and kinship, with a view to jointly exercise control over familial property among Hindu families.

- It gave way for family business arrangements to be based on Hindu personal laws rather than contractual arrangements.

- HUF as a legal entity has always portrayed a dual identity one of a family-backed institution and the other of an income-generating entity, solely for the purposes of maintenance of the family.

Tax structure related to HUF:

- As per the Income Tax provisions, the HUF is a family which consists of all persons lineally descended from a common ancestor and includes their wives and unmarried daughters.

- A HUF has its own Permanent Account Number (PAN) and files tax returns independent of members.

- The HUF consists of the ‘karta’ typically the eldest male member of the family with others in the family being coparceners. The ‘karta’ manages the day-to-day affairs of the HUF. Children are coparceners of their father’s HUF.

- Income Tax Act, 1886 which specifically recognised the HUF under the term “person”.

- When the income tax regime was overhauled in 1922, the idea of the HUF as a distinct category of tax payer was incorporated into the law. The Income Tax Act, 1922 formed the basis of the post-independence Income Tax Act, 1961, which is currently in force and recognises the HUF as a person under Section 2(31)(ii)

How Hindu Undivided Families receive beneficial tax treatment

- From 1922 to 1961, there was a practice of granting an additional exemption limit to the HUF when compared with other forms of taxpayers (including individuals).

- This resulted in the HUF paying lesser tax than other similarly placed taxpayers, despite earning the income in the same manner as others. This preferential exemption regime was done away with under the Income Tax Act, 1961.

- The institution of the HUF as a separate tax entity provides an avenue for Hindu families to reduce their tax burden in a number of ways.

- Lastly, Section 10(2) of the Income Tax Act, 1961 provides that any sum received by an individual as a member of the HUF out of the HUF income is not to be included in her total income.

- Additionally, the HUF is entitled to claim expenses, exemptions and several deductions from its taxable income. This further reduces the tax burden of a Hindu family.

Impacts of Uniform Civil Code on Hindu Undivided Family:

- Granting an additional tax treatment which lowers the tax burden only on the basis of religion is arbitrary and contradict Article 14 of the Constitution.

- If the UCC is ultimately implemented, the concept of HUF is tend to be dismissed.

- This may need an amendment in the Income Tax Act on the similar line as contained in the “Kerala Joint Hindu Family System (Abolition) Act, 1975” which provided that all the institutions of HUF will not be recognised in the state of Kerala.

- So, not only the provisions about the rights of persons taking birth after coming into force of UCC but also provisions about the existing joint family will have to be made either under the UCC or under the Income Tax Laws.

- The law may provide that all the assets of erstwhile HUF shall be deemed to have been divided and distributed amongst all the members who are entitled to get a share in the assets of the HUF.

- The properties cannot be divided in pieces, a deemed partition would be assumed and all the members shall hold the immovable property as tenant in common and a member will become a full-fledged owner for his share of the joint family property.

UNIFORM CIVIL CODE

- In India the purpose of Uniform Civil code is to replace the personal laws based on the scriptures and customs of each major religious community in the country with a common set of rules governing every citizen.

Indian constitution on uniform civil code:

- A uniform civil code will mean a set of common personal laws for all citizens. Currently, for example, there are different personal laws for Hindus and Muslims. Personal law covers property, marriage and divorce, inheritance and succession.

- Article 44 of the Constitution calls upon the State to endeavour towards securing a uniform civil code throughout the territory of India.

- It falls within Part IV of the Constitution titled as Directive Principles of State Policy (DPSP) and states that The State shall endeavor to secure for the citizens a uniform civil code throughout the territory of India.

- There are a number of cases where the Supreme Court has referred to Article 44 and the concept of uniform civil code, mainly to highlight the monotonous attitude of the executive and the legislature in the implementation of the directive.

International scenario on uniform civil code:

- Israel, Japan, France and Russia are strong today because of their sense of oneness which we have yet to develop and propagate.

- Virtually all countries have uniform civil code or for that matter uniform law- civil or criminal.

- The European nations and US have a secular law that applies equally and uniformly to all citizens irrespective of their religion.

- The Islamic countries have a uniform law based on shariah which applies to all individuals irrespective of their religion.

2. CHANDRAYAAN-3 MISSION

TAG: GS 3: SCIENCE AND TECHNOLOGY

THE CONTEXT: Chandrayaan-3 will be the world’s first mission to soft-land near the lunar south pole. All the previous spacecrafts have landed a few degrees latitude north or south of the lunar equator.

EXPLANATION:

- Chandrayan-3 is set to be launched from Andhra Pradesh’s Sriharikota as, India’s third lunar mission.

- It is a follow-up to the Chandrayaan-2 mission, which partially failed after its lander and rover couldn’t execute a soft-landing on the Moon.

- Chandrayaan-3 will reach the lunar orbit almost a month after its launch, and its lander, Vikram, and rover, Pragyaan, are likely to land on the Moon.

- Notably, the landing site of the latest mission is more or less the same as the Chandrayaan-2e near the south pole of the moon at 70 degrees latitude.

- The furthest that any spacecraft has gone from the equator was Surveyor 7, launched by NASA, which made a moon landing way back in 1968. This spacecraft landed near 40 degrees south latitude.

Why hasn’t any spacecraft ever landed near the lunar south pole?

- Most of the landings on the Moon so far have happened in the equatorial region.

- Even China’s Chang’e 4, which became the first spacecraft to land on the far side of the moon the side that does not face the earth landed near the 45-degree latitude.

- It is easier and safer to land near the equator. The terrain and temperature are more hospitable and conducive for a long and sustained operation of instruments.

- The surface here is even and smooth, very steep slopes are almost absent, and there are fewer hills or craters.

- Sunlight is present in abundance, at least on the side facing the earth, thus offering a regular supply of energy to solar-powered instruments.

- The polar regions of the Moon, however, are a very different, and difficult, terrain. Many parts lie in a completely dark region where sunlight never reaches, and temperatures can go below 230 degrees Celsius.

- Lack of sunlight and extremely low temperatures create difficulty in the operation of instruments. In addition, there are large craters all over the place, ranging from a few centimetres in size to those extending to several thousands of kilometres.

Why do scientists want to explore the lunar south pole?

- Due to their rugged environment, the polar regions of the Moon have remained unexplored.

- There are indications of the presence of ice molecules in substantial amounts in the deep craters in this region.

- India’s 2008 Chandrayaan-1 mission indicated the presence of water on the lunar surface with the help of its two instruments onboard.

- In addition, the extremely cold temperatures here mean that anything trapped in the region would remain frozen in time, without undergoing much change. The rocks and soil in Moon’s north and south poles could therefore provide clues to the early Solar System.

Why don’t some parts of the lunar polar regions receive any sunlight?

- Unlike the Earth, whose spin axis is tilted with respect to the plane of the Earth’s solar orbit by 23.5 degrees, the Moon’s axis tilts only 1.5 degrees. Because of this unique geometry, sunlight never shines on the floors of a number of craters near the lunar north and south poles. These areas are known as Permanently Shadowed Regions, or PSRs.

- In a 2019 report, NASA said, “Water that happens to find its way into PSRs may remain there for long periods of time.

- Data from the Lunar Reconnaissance Orbiter, robotic spacecraft currently orbiting the Moon which measures temperatures across the Moon indicate that some surfaces are cold enough so that water is stable at the surface.

Chandrayaan mission of India:

Chandrayaan 1:

- Chandrayaan-1 was the first lunar space probe of the Indian Space Research Organisation (ISRO).

- It found water on the Moon. It mapped the Moon in infrared, visible, and X-ray light from lunar orbit and used reflected radiation to prospect for various elements, minerals, and ice.

- It was launched in 2008 by Polar Satellite Launch Vehicle launched, from the Satish Dhawan Space Centre on Sriharikota Island, Andhra Pradesh state.

- It launched a small craft, the Moon Impact Probe (MIP), that was designed to test systems for future landings and study the thin lunar atmosphere before crashing on the Moon’s surface.

- MIP impacted near the south pole, but, before it crashed, it discovered small amounts of water in the Moon’s atmosphere.

Chandrayaan 2:

- Chandrayaan-2 launched in, 2019, from Sriharikota by a Geosynchronous Satellite Launch Vehicle Mark III.

- The spacecraft consisted of an orbiter, a lander, and a rover. The orbiter will circle the Moon in a polar orbit for one year at a height of 100 km.

- The mission’s Vikram lander was planned to land in the south polar region where water ice could be found under the surface.

- Vikram carried the small Pragyan rover. Both Vikram and Pragyan were designed to operate for 1 lunar day (14 Earth days).

- India would have been the fourth country to have landed a spacecraft on the Moon after the United States, Russia, and China if landed properly.

3. BATTERY ELECTRIC VEHICLES (BEVs)

TAG: GS 3: SCIENCE AND TECHNOLOGY

THE CONTEXT: Battery electric vehicles are at the heart of the government’s push for net zero. As it is clear that electrification is the future, the roadmap to achieve the same is not so clear.

EXPLANATION:

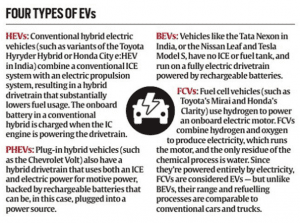

- The EVs that qualify for a clear upfront tax incentive are the ones referred to as BEVs.

- India’s electric mobility plan is largely focussed on battery electric vehicles (BEVs) replacing internal combustion engine (ICE) vehicles, with Li-ion seen as the most viable battery option for now.

Issues in BEV push:

- Upfront Subsidy: There is need of an elaborate system of incentives as the electric push works only if it is backed by state subsidies.

- Charging network: A World Bank analysis found that investing in charging infrastructure is 4-7 times more effective in EV adoption than providing upfront purchase subsidies. There is need of development of infrastructure.

- Value chain: There is need to diversify the country’s dependency on Li-ion batteries in the EV mix. India is almost entirely dependent on imports from a small pool of countries to cater to its demand as more than 90% of the global Li production is concentrated in Chile, Argentina, and Bolivia alongside Australia and China.

New technologies

- Hybrids: The hybrid technology is seen as a good intermediate step towards achieving the all-electric goal. Hybrids typically have improved fuel efficiency through electrification of the powertrain, but do not require the charging infrastructure base that is an essential for BEVs. However, hybrids too have the issue of Li-ion batteries being the main source, even though the self-charging mode obviates the need for charging points.

- Ethanol & flex fuel: A flex fuel, or flexible fuel, vehicle has an internal combustion engine, but unlike a regular petrol or diesel vehicle, it can run on more than one type of fuel, or even a mixture of fuels such as petrol and ethanol.

- FCEVs & Hydrogen fuel cell electric vehicles (FCEVs) are practically zero emission, but a major hurdle to their adoption has been the lack of fuelling station infrastructure.

- Hydrogen Ice: Hydrogen Ice vehicles are similar to conventional internal combustion engine vehicles, with a few tweaks to prep them to run on hydrogen.

Government Measures:

- The Government of India is continuously showing its support to develop India as a global leader in the EV sector. Several schemes and incentives have been launched by the government to boost the demand for electric vehicles.

- FAME-II: The FAME India initiative was launched in 2015 to reduce the usage of petrol and diesel automobiles. It aims to incentivize all types of vehicles. The four focus areas of the Fame India Scheme are as follows: Demand for technology, Pilot Projects, Technology development, Infrastructure for Charging.

- The FAME II scheme: It was introduced in 2019 to drive greater adoption of EVs in India. The scheme was supposed to end in 2022. But now, In the budget for FY2022-23, the Government of India has decided to extend the FAME-II scheme till 31 March 2024.

- PLI scheme: The Department of Heavy Industry launched the Production Linked Incentive for Advanced Chemistry Cell Battery Storage (PLI-ACC Scheme). Its goal is to entice domestic and international investors to invest in India’s Giga scale ACC manufacturing facilities.

- Special E-mobility Zone: The government plans to establish dedicated mobility zones for electric vehicles. Only electric vehicles or comparable vehicles will be permitted to operate in the zones identified by the administration. It will help curb overcrowding due to private vehicles.

4. INDIAN MONSOON

TAG: GS 1: GEOGRAPHY

THE CONTEXT: Unceasing rains over the weekend have brought north India to its knees, with deluges, landslides, and waterlogging in cities due to western disturbances.

EXPLANATION:

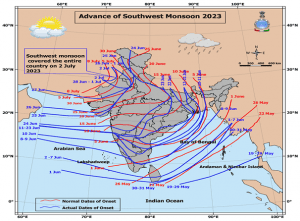

- The IMD said the intense rainfall over north India is because of an interaction between western disturbance and monsoonal winds.

- The excessive rains in many parts of India in the first eight days of July have bridged the rainfall deficit for the entire country (243.2 mm, which is two per cent above the normal of 239.1 mm).

Monsoon in India:

- Indian monsoon is the most prominent of the world’s monsoon systems, which primarily affects India and its surrounding water bodies.

- It blows from the northeast during cooler months and reverses direction to blow from the southwest during the warmest months of the year. This process brings large amounts of rainfall to the region during June and July.

- The southwest monsoon that starts around the first week of June, making the first landfall in Kerala. It is one of the most anticipated events of the year, as India receives 70-90 percent of its annual rainfall during this monsoon

Factors causing monsoon:

- Location of India near equator

- Frequent westerly winds occur at the surface almost constantly throughout the year

- Jet streams

- Westerly subtropical jet stream still controls the flow of air across northern India

- Availability of energy in the atmosphere,

- Intertropical convergence zone

- Coriolis effect

- Indian Ocean Dipole

- Equatorial Indian Ocean Oscillation

Western Disturbances:

- A western disturbance is an extratropical storm originating in the mediterranean region that brings sudden winter rain to the northern parts of the Indian subcontinent

- It extends as east as up to northern parts of Bangladesh and South eastern Nepal.

- It is a non-monsoonal precipitation pattern driven by the westerlies.

- It is global phenomena with moisture usually carried in the upper atmosphere, unlike their tropical counterparts where the moisture is carried in the lower atmosphere. In the case of the Indian subcontinent, moisture is sometimes shed as rain when the storm system encounters the Himalayas. Western disturbances are more frequent and stronger in the winter season.

- Western disturbances are important for the development of the Rabi crop , which includes the locally important staple wheat.

5. LAMBANI EMBROIDERY

TAG: GS 1: ART AND CULTURE

THE CONTEXT: As part of the third G20 culture working group (CWG) meeting in Hampi, a Guinness world record was created for the ‘largest display of Lambani items’.

EXPLANATION:

- Over 450 women artisans and cultural practitioners from Lambani a nomadic community of Karnataka came together to create embroidered patches with GI-tagged Sandur Lambani embroidery.

- The display titled ‘Threads of Unity’ celebrates the aesthetic expressions and design vocabulary of Lambani embroidery.

Lambani embroidery:

- The Lambani embroidery is an intricate form of textile embellishment characterised by colourful threads, mirror-work and stitch patterns.

- It is practised in several villages of Karnataka such as Sandur, Keri Tanda, Mariyammanahalli, Kadirampur, Sitaram Tanda, Bijapur and Kamalapur.

- The Lambani craft tradition involves stitching together small pieces of discarded fabric to create a beautiful fabric.

- The embroidery traditions of the Lambanis are shared in terms of technique and aesthetics with textile traditions across Eastern Europe, West, and Central Asia.

- The Lambani embroidery is an amalgam of pattern darning, mirror work, cross stitch, and overlaid and quilting stitches with borders of “Kangura” patchwork appliqué, done on loosely woven dark blue or red handloom base fabric.

- Lambani embroidery is commonly mistaken as Kutchi (Kachhi) embroidery because of mirror work, but shells and coins are unique to this type of embroidery. Also, the stitches used are different.

- The 14 types of stitches used in Lambani embroidery are Kilan, Vele, Bakkya, Maki, Suryakanti Maki, Kans, Tera Dora, Kaudi, Relo, Gadri, Bhuriya, Pote, Jollya, Nakra. Products made with such embroidery have wonderful textures and a bohemian style, making them very popular with tourists.

- A distinctive design range is its revival and use of local mud-resist handloom fabric, and the mirrors, shells and white ornamental trims that are a traditional part of Lambani as well as the Irikil saris of Dharwad-Hubli and other local fabrics.

- Some of the villages around Hampi, where this craft is practiced are Kadirampur, Mariyammanahalli, Sitaram Tanda, Kamalapur, Keri Tanda.

Lambani community:

- Lambani elsewhere known as “Banjaras”, originally came from Marwar are semi-nomadic people who reside mostly in Southern and Middle India.

- As with many tribal groups, especially those with a nomadic heritage, there is a modern tendency to either isolate or assimilate.

- The Lambani women practice a unique mirror and embroidery craft, which they mostly use for making their own traditional dresses or for giving to their daughters for their weddings.

About Hampi:

- Hampi also referred to as the Group of Monuments at Hampi, is a UNESCO World Heritage Site located in Vijayanagara district, east-central Karnataka.

- It predates the Vijayanagara Empire and is an important religious centre, housing the Virupaksha Temple.

- Hampi was the capital of the Vijayanagara Empire in the 14th century. It was a fortified city.

- Hampi was a prosperous, wealthy and grand city near the Tungabhadra River, with numerous temples, farms and trading markets.

- Hampi and its nearby region remained a contested and fought-over region claimed by the local chiefs, the Hyderabad Muslim nizams, the Maratha Hindu kings, and Hyder Ali and his son Tipu Sultan of Mysore through the 18th century.