THE CONTEXT: Recovering from pandemic-induced contraction, Russian-Ukraine conflict and inflation, Indian economy is staging a broad-based recovery across sectors, positioning to ascend to the pre-pandemic growth path in FY23.

GDP GROWTH

- India’s GDP growth is expected to remain robust in FY24. GDP forecast for FY24 to be in the range of 6-6.8 %.

- Monetary tightening by the RBI, the widening of the CAD, and the plateauing growth of exports have essentially been the outcome of geopolitical strife in Europe. As these developments posed downside risks to the growth of the Indian economy in FY23, many agencies worldwide have been revising their growth forecast of the Indian economy downwards.

- Despite strong global headwinds and tighter domestic monetary policy, if India is still expected to grow between 6.5 and 7.0 per cent, and that too without the advantage of a base effect, it is a reflection of India’s underlying economic resilience; of its ability to recoup, renew and re-energize the growth drivers of the economy.

- Rising inflation and monetary tightening led to a slowdown in global output beginning in the second half of 2022. The global PMI composite index has been in the contractionary zone since August 2022, while the yearly growth rates of global trade, retail sales, and industrial production have significantly declined in the second half of 2022.

- The consequent dampening of the global economic outlook, also compounded by expectations of a further increase in borrowing costs, was reflected in the lowering of growth forecasts by the IMF in its October 2022 update of the World Economic Outlook (WEO).

MACROECONOMIC AND GROWTH CHALLENGES IN THE INDIAN ECONOMY

The impact of the pandemic on India was seen in a significant GDP contraction in FY21 but the third wave did not affect economic activity in India as much as the previous waves of the pandemic did since its outbreak in January 2020 and India gets hope to achieve the pace of growth similar to pre-pandemic level. But still some challenges remain for India economy-

- Inflation: The country’s retail inflation crept above the RBI’s tolerance range (i.e., 6%) in January 2022. It remained above the target range for ten months before returning to below the upper end of the target range in November 2022.

- Depreciation of the Rupee: With monetary tightening, the US dollar has appreciated against several currencies, including the rupee. However, the rupee has been one of the better-performing currencies worldwide.

- Current Account Deficit: The modest depreciation of the Rupee may have added to the domestic inflationary pressures besides widening the CAD. Global commodity prices may have eased but are still higher compared to pre-conflict levels. They have further widened the CAD, already enlarged by India’s growth momentum. However, for FY23, India has sufficient forex reserves to finance the CAD and intervene in the forex market to manage volatility in the Indian rupee.

- Export Growth: Export growth was strong enough to increase India’s share in the world market of merchandise exports. However, due to aggressive and synchronized monetary tightening, global economic growth has started to slow, and so has world trade.

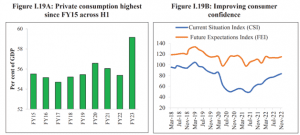

CONSUMPTION

Private consumption in Half-1 is the highest since FY15 and this has led to a boost to production activity resulting in enhanced capacity utilization across the sectors.

- The rebound in consumption has also been supported by the release of “pent-up” demand, a phenomenon not again unique to India but nonetheless exhibiting a local phenomenon influenced by a rise in the share of consumption in disposable income.

- Accelerating growth in personal loans in India testifies to an enduring release of “pent-up” demand for consumption.

- The “release of pent-up demand” was reflected in the housing market too. Demand for housing loans picked up.

Note: Pent-up demand refers to consumer demand for products and services that builds over time due to a recession. People delay purchasing goods and services during a recession, which leads to a large amount of buying once the recession is over.

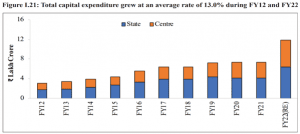

CAPITAL EXPENDITURE

The Capital Expenditure of Central Government and crowding in the private Capex (Capital expenditure) led by strengthening of the balance sheets of the Corporates is one of the growth drivers of the Indian economy in the current year.

- Construction activity, in general, has significantly risen in FY23 as the much-enlarged capital budget (Capex) of the central government and its public sector enterprises is rapidly being deployed.

- Going by the Capex multiplier estimated for the country, the economic output of the country is set to increase by at least four times the amount of Capex.

- Evidence shows an increasing trend in announced projects and capex spending by the private players.

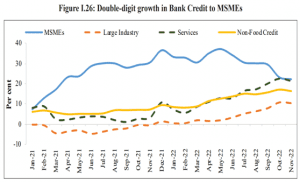

CREDIT SUPPLY

- The credit growth to the MSME sector was over 30.6 per cent on average during Jan-Nov 2022.

- The banking sector in India has responded in equal measure to the demand for credit. The Year-on-Year growth in credit since the January-March quarter of 2022 has moved into double-digits and is rising across most sectors.

- The finances of the public sector banks have seen a significant turnaround, with profits being booked at regular intervals and their Non-Performing Assets (NPAs) being fast-tracked for quicker resolution/liquidation by the Insolvency and Bankruptcy Board of India (IBBI).

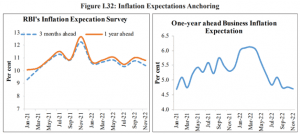

INFLATION

- RBI has projected headline inflation at 6.8 per cent in FY23, which is outside its target range.

- At the same time, it is not high enough to deter private consumption and not so low as to weaken the inducement to invest.

- Moderately high inflation has further ensured the anchoring of inflationary expectations preventing prices from weakening demand and growth in India.

- Additionally, with inflation on the declining path, the interest cost of domestic credit will likely decline, inducing a further increase in demand for credit by corporates and retail borrowers.

INDIA’S INCLUSIVE GROWTH

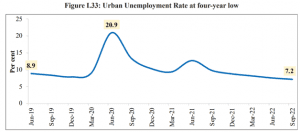

- Growth is inclusive when it creates jobs. Both official and unofficial sources confirm that employment levels have risen in the current financial year. The Periodic Labour Force Survey (PLFS) shows that the urban unemployment rate for people aged 15 years and above declined from 9.8 per cent in the quarter ending September 2021 to 7.2 per cent one year later (quarter ending September 2022).

- In FY21, the Government announced the Emergency Credit Line Guarantee Scheme. The scheme has succeeded in shielding micro, small and medium enterprises from financial distress. A recent CIBIL report (ECLGS Insights, August 2022) showed that the scheme has supported MSMEs in facing the covid shock.

- The Mahatma Gandhi National Rural Employment Guarantee (MGNREGS) scheme has been rapidly creating more assets in respect of “Works on individual’s land” than in any other category. The share of this category rose to about 60 per cent in FY22, indicating that MGNREGA, besides generating daily wage employment, has also been creating assets for individual households to diversify their sources of income and lift their supplementary incomes.

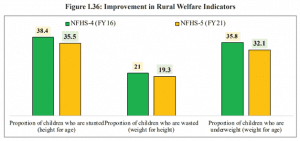

- The National Family Health Survey (NFHS) in India shows improved rural welfare indicators from FY16 to FY20, covering aspects like gender, fertility rate, household amenities, and women empowerment.

- Strong consumption rebound, robust revenue collections, sustained capex in both the public and the private sector, growing employment levels in the urban as well as the rural areas, and targeted social security measures further underpin the prospects for economic and social stability and sustained growth.

- India is the third-largest economy in the world in PPP terms and the fifth-largest in market exchange rates. As expected of a nation of this size, the Indian economy in FY23 has nearly “recouped” what was lost, “renewed” what had paused, and “re-energized” what had slowed during the pandemic and since the conflict in Europe.

OUTLOOK: 2023-24

- India’s recovery from the pandemic was relatively quick, and growth in the upcoming year will be supported by solid domestic demand and a pickup in capital investment. Reforms such as the introduction of the Goods and Services Tax and the Insolvency and Bankruptcy Code enhanced the efficiency and transparency of the economy and ensured financial discipline and better compliance.

- Even as India’s outlook remains bright, global economic prospects for the next year have been weighed down by the combination of a unique set of challenges expected to impart a few downside risks.

- Global growth is forecasted to slow from 3.2 per cent in 2022 to 2.7 per cent in 2023 as per IMF’s World Economic Outlook, October 2022. A slower growth in economic output coupled with increased uncertainty will dampen trade growth. This is seen in the lower forecast for growth in global trade by the World Trade Organisation, from 3.5 per cent in 2022 to 1.0 per cent in 2023.

- On the external front, risks to the current account balance stem from multiple sources. Strong domestic demand amidst high commodity prices will raise India’s total import bill and contribute to unfavourable developments in the current account balance.

- Another risk to the outlook originates from the ongoing monetary tightening Entrenched inflation may prolong the tightening cycle, and therefore, borrowing costs may stay ‘higher for longer’.

- In such a scenario, the global economy may be characterized by low growth in FY24. However, the scenario of subdued global growth presents two silver linings – oil prices will stay low, and India’s CAD will be better than currently projected. The overall external situation will remain manageable.

The upside to India’s growth outlook arises from –

- Limited health and economic fallout for the rest of the world from the current surge in Covid-19 infections in China and, therefore, continued normalization of supply chains.

- Inflationary impulses from the reopening of China’s economy turning out to be neither significant nor persistent.

- Recessionary tendencies in major advances economies triggering a cessation of monetary tightening and a return of capital flows to India amidst a stable domestic inflation rate below 6 per cent.

- This leads to an improvement in animal spirits and provides further impetus to private sector investment.

- Against this backdrop, the survey projects a baseline GDP growth of 6.5 per cent in real terms in FY24.

- The projection is broadly comparable to the estimates provided by multilateral agencies such as the World Bank, the IMF, and the ADB and by RBI, domestically. The actual outcome for real GDP growth will probably lie in the range of 6.0 per cent to 6.8 per cent, depending on the trajectory of economic and political developments globally.

THE CONCLUSION: The year FY23 so far for India has reinforced the country’s belief in its economic resilience. The economy has withstood the challenge of mitigating external imbalances caused by the Russian-Ukraine conflict without losing growth momentum in the process.

Spread the Word