1. SUDAN CRISIS

TAGS: GS 2: INTERNATIONAL RELATIONS

CONTEXT: The ongoing fighting is Sudan is forcing thousands to flee. The humanitarian emergency is spreading creating a dangerous security situation in the Sahel region. Despite talks between warring parties, which met in Jeddah, Saudi Arabia, air strikes were reported in Khartoum amid ongoing fighting.

EXPLANATION:

Background of the conflict:

- When Sudan won independence on New Year’s Day in 1956, two features stood out in the new nation: it was the largest country in Africa, and it was already embroiled in civil war that had erupted several months earlier.

- Sudan has suffered three domestic wars spanning well over 40 years of the country’s 67 years of independence.

Recent issues:

- Violence erupted in mid-April in Sudan between its military, the Sudanese Armed Forces (SAF), and the Rapid Support Forces (RSF), a paramilitary group. The fighting has dashed the country’s hopes for a peaceful transition to a civilian government.

- Rapid Support Force (RSF) forces invaded Merowe town, located 210 kilometres north of the capital resulted in violence. The RSF stated that it retaliated in response to a military attack at one of its bases in South Khartoum. Sudanese foreign ministry declared the RSF a rebel entity and ordered its dissolution. And the agreement between civilians, the military, and paramilitaries intended to reinitiate the democratic transition in Sudan appears to be frozen once more.

What makes this conflict in Sudan so intractable?

- This conflict needs to be considered in terms of three overlapping layers: Local, regional and global. These three layers, which feed through and affect one another, represent various stages of conflict escalation, engagement, and potential resolution.

- And this conflict in Sudan is a prime example of a local conflict that is becoming increasingly intertwined with regional and international power dynamics, making it impossible to find a standalone solution.

Reason of the conflict:

- Sudan has a wide range of ethnic, linguistic and tribal differences. Residents in remote parts of the country feel the elites in Khartoum monopolize the country’s limited resources.

- There is a link between Sudan’s vast landscape, the many different groups that make up the country, and the repeated internal conflicts that have plagued the nation for decades.

- If the Sudanese problem can be divided into three layers, the local level corresponds to the conflict’s primary driver. In essence, this layer is concerned with the issue of who will control Sudan and under what type of political structure. General Abdel Fattah al-Burhan, commander of the Sudanese National Army, also known as the SAF (Sudanese Armed Force), and General Muhammad Hamdan’ Hemedti, Dagalo, commander of the paramilitary group RSF are allegedly involved in a power struggle that is at the heart of this conflict.

- The second layer at the regional level is about who can have the most significant influence in Sudan and the larger Red Sea region. As Sudan is situated where the Horn of Africa, the Sahel, and the Red Sea converge, it is considered valuable by many countries. The strategic location and agricultural resources of Sudan have attracted regional power struggles. Sudan shares its border with seven countries: Chad, Ethiopia, Eritrea, South Sudan, the Central African Republic, Libya, and Egypt. As all these countries have their own vested interests, the conflict risks getting more interwoven with regional rivalries and power struggles.

- The third layer involves the international power rivalry playing out in the Sudanese crisis. In this layer, Sudan serves as a microcosm for a struggle for regional and international power. Energy-rich United Arab Emirates (UAE) and Saudi Arabia have long sought to influence Sudan’s politics. Both have made significant investments in sectors including agriculture, where Sudan has tremendous potential, aviation, and ports near the Red Sea coast. Initially, both the Saudis and the UAE have seen Sudan’s transition from al-Bashir’s rule as an opportunity to push back against Islamist influence in the region. However, the interest of both countries diverged, with Saudi Arabia prioritising its national interest vis-a-vis Saudi Vision 2030 over its alliance with the UAE.

Hakki Pikki

More than 181 members of the Hakki Pikki tribal community from Karnataka are stuck in violence-hit Sudan, even as the government is making efforts to bring them back. Who are the Hakki Pikki, and why did so many travel to far-away Sudan?

The Hakki Pikki is a tribe that lives in several states in west and south India, especially near forest areas. Hakki Pikkis (Hakki in Kannada means ‘bird’ and Pikki means ‘catchers’) are a semi-nomadic tribe, traditionally of bird catchers and hunters.

Operation Kaveri

‘Operation Kaveri’, launched to rescue its nationals stranded in crisis-hit Sudan, with the transport aircraft of the Indian Air Force making its final flight to bring 47 passengers home.

India launched Operation Kaveri on April 24 to evacuate its nationals from Sudan, which has witnessed deadly fighting between the country’s army and a paramilitary group.

2. 27TH MEETING OF FINANCIAL STABILITY AND DEVELOPMENT COUNCIL

TAGS: GS 2: POLITY AND GOVERNANCE

CONTEXT: Union Finance and Corporate Affairs Minister chaired the 27th Meeting of the Financial Stability and Development Council (FSDC) for the first time after the announcement of the Budget 2023-24.

EXPLANATION:

Meeting concluded with following discussions:

- Regulators should maintain a constant vigil as ensuring ‘financial sector stability is a shared responsibility’ of the regulators. Regulators must take appropriate and timely action to mitigate any vulnerability and strengthen financial stability.

- Regulators should adopt a focused approach to reduce the compliance burden further and ensure a streamlined and efficient regulatory environment.

- The regulators need to be proactive and ensure cyber-security preparedness of the information technology systems to reduce the risk of cyber-attacks, protect sensitive financial data, and maintain overall system integrity, thus safeguarding the stability and resilience of the Indian financial ecosystem.

- Regulators should conduct a special drive to facilitate the settlement of unclaimed deposits and claims in the financial sector across all segments, such as banking deposits, shares and dividends, mutual funds, insurance, etc.

- Action Taken Report on Budget announcements made since 2019 was discussed. A focused approach should be adopted by the regulators to implement the announcements made in the Budget 2023-24, for which timelines were also decided.

About Financial Stability and Development Council (FSDC)

- With a view to strengthening and institutionalizing the mechanism for maintaining financial stability, enhancing inter-regulatory coordination and promoting financial sector development, the Financial Stability and Development Council (FSDC) was set up by the Government as the apex level forum in December 2010.

- The Council is chaired by the Union Finance Minister and its members are Governor, Reserve Bank of India; Finance Secretary and/or Secretary, Department of Economic Affairs; Secretary, Department of Financial Services; Chief Economic Adviser, Ministry of Finance; Chairman, Securities and Exchange Board of India; Chairman, Insurance Regulatory and Development Authority and Chairman, Pension Fund Regulatory and Development Authority.

- Council monitors macro prudential supervision of the economy, including functioning of large financial conglomerates, and addresses inter-regulatory coordination and financial sector development issues. It also focuses on financial literacy and financial inclusion.

FSDC Sub-Committee:

- The FSDC Sub-committee has also been set up under the chairmanship of Governor, RBI. It meets more often than the full Council.

- All the members of the FSDC are also the members of the Sub-committee. Additionally, all four Deputy Governors of the RBI and Additional Secretary, DEA, in charge of FSDC, are also members of the Sub Committee.

3. PRADHAN MANTRI JEEVAN JYOTI BIMA YOJANA (PMJJBY), PRADHAN MANTRI SURAKSHA BIMA YOJANA (PMSBY) AND ATAL PENSION YOJANA (APY) COMPLETES 8 YEARS OF PROVIDING SECURITY COVER

TAGS: PRELIMS PERSPETIVES: SCHEMES

CONTEXT: Three social security (Jan Suraksha) schemes Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY) completed 8th anniversary. PMJJBY achieved more than 16 crore Cumulative Enrolments and PMSBY achieved more than 34 crore Cumulative Enrolments and APY achieved over 5 Crore subscribers.

EXPLANATION:

- The three schemes are dedicated to the welfare of the citizens, recognising the need for securing human life from unforeseen eventualisation and financial uncertainties. In order to ensure that the people from the unorganised section of the country are financially secure, the Government launched two insurance schemes PMJJBY and PMSBY; and also introduced APY to cover the exigencies in the old age.

- In the year 2014, the National Mission for Financial Inclusion was launched with the primary objective of ensuring that every citizen in India has access to banking facilities, financial literacy, and social security coverage.

- Building on this initiative, the Prime Minister introduced three Jan Suraksha schemes in 2015 with the aim of further promoting and advancing financial inclusion in the country.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY):

- Scheme: PMJJBY is a one-year life insurance scheme renewable from year to year offering coverage for death due to any reason.

- Eligibility: Persons in the age group of 18-50 years having an individual bank or a post office account are entitled to enroll under the scheme. People who join the scheme before completing 50 years of age can continue to have the risk of life covered up to age of 55 years upon payment of regular premium.

- Benefits: Life cover of Rs. 2 Lakh in case of death due to any reason against a premium of Rs. 436/- per annum.

- Enrolment: Enrolments under the scheme can be done by visiting the branch/ BC point or website of the bank of the account holder or at the post office in case of post office savings bank account. The premium under the scheme is auto debited every year from the subscriber’s bank account based on a one-time mandate from the account holder.

- Achievements: As on 26.04.2023, the cumulative enrolments under the scheme have been more than 16.19 crore and an amount of Rs. 13,290.40 crore has been paid for 6,64,520 claims.

Pradhan Mantri Suraksha Bima Yojana (PMSBY):

- Scheme: PMSBY is a one-year accidental insurance scheme renewable from year to year offering coverage for death or disability due to accident.

- Eligibility: Persons in the age group of 18-70 years having an individual bank or a post office account are entitled to enroll under the scheme.

- Benefits: Accidental death cum disability cover of Rs.2 lakh (Rs.1 lakh in case of partial disability) for death or disability due to an accident against a premium of Rs.20/- per annum.

- Enrolment: Enrolment under the scheme can be done by visiting the branch/ BC point or website of the bank of the account holder or at the post office in case of post office savings bank account. The premium under the scheme is auto debited every year from the subscriber’s bank account based on a one-time mandate from the account holder.

- Achievements: As on 26.04.2023, the cumulative enrolments under the scheme have been more than 34.18 crore and an amount of Rs. 2,302.26 crore has been paid for 1,15,951 claims.

Atal Pension Yojana (APY):

- Background: The Atal Pension Yojana (APY) was launched to create a universal social security system for all Indians, especially the poor, the under-privileged and the workers in the unorganised sector. It is an initiative of the Government to provide financial security and cover future exigencies for the people in the unorganised sector. APY is administered by Pension Fund Regulatory and Development Authority (PFRDA) under the overall administrative and institutional architecture of the National Pension System (NPS).

- Eligibility: APY is open to all bank account holders in the age group of 18 to 40 years who are not income tax payers and the contributions differ, based on pension amount chosen.

- Benefits: Subscribers would receive the guaranteed minimum monthly pension of Rs. 1000 or Rs. 2000 or Rs. 3000 or Rs. 4000 or Rs. 5000 after the age of 60 years, based on the contributions made by the subscriber after joining the scheme.

- Disbursement of the Scheme Benefits: The monthly pension is available to the subscriber, and after him to his spouse and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the nominee of the subscriber.

- In case of premature death of subscriber (death before 60 years of age), spouse of the subscriber can continue contribution to APY account of the subscriber, for the remaining vesting period, till the original subscriber would have attained the age of 60 years.

- Contribution by Central Government: The minimum pension would be guaranteed by the Government, i.e., if the accumulated corpus based on contributions earns a lower than estimated return on investment and is inadequate to provide the minimum guaranteed pension, the Central Government would fund such inadequacy. Alternatively, if the returns on investment are higher, the subscribers would get enhanced pensionary benefits.

- Payment frequency: Subscribers can make contributions to APY on monthly/ quarterly / half-yearly basis.

- Withdrawal from the Scheme: Subscribers can voluntarily exit from APY subject to certain conditions, on deduction of Government co-contribution and return/interest thereon.

- Achievements: As on 27.04.2023 more than 5 crore individuals have subscribed to the scheme.

4. INDIA’S FIRST UNDERSEA TWIN TUNNELS

TAGS: PRELIMS PERSPECTIVE

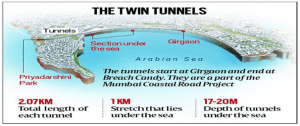

CONTEXT: India’s first undersea twin tunnels in south Mumbai are close to completion and is set to open in November 2023.

EXPLANATION:

- Tunnels start near Girgaon (ahead of Marine Drive), extend north under the Arabian Sea, Girgaon Chowpatty and Malabar Hill, and end at Breach Candy’s Priyadarshini Park.

- The 2.07-km tunnels are a part of the Rs 12,721-crore Mumbai Coastal Road Project (MCRP) being built by the Brihanmumbai Municipal Corporation (BMC).

- Tunnel will be built between the underground station at Bandra-Kurla Complex and Shilphata in Thane district of Maharashtra thus connecting the two cities.

- National High Speed Railway Corporation Limited (NHSRCL) invited this week bids for the construction of a 21-km-long tunnel, seven kilometres of which will be under the sea, for the Mumbai-Ahmedabad High Speed Rail Corridor.

- The tunnels, which have a diameter of 12.19 metres, run 17-20 m below sea level. A nearly 1-km stretch lies under the sea. The tunnels hit peak depth at Malabar Hill at 72 m.

- Resembling the shape of the Queen’s Necklace the famous C-shaped Marine Drive promenade the tunnel entry and exit points will have fiberglass facades.

- It is stated that the tunnel will be built using a tunnel boring machine and the New Austrian Tunneling Method (NATM).

5. GREEN PORT GUIDELINES “HARIT SAGAR”

TAGS: GS 3: ENVIRONMENT

CONTEXT: The ministry of ports, shipping and waterways on Wednesday launched the “Harit Sagar” Green Port Guidelines, aimed at achieving zero carbon emissions by promoting eco-friendly practices in port development, operation, and maintenance.

EXPLANATION:

- The ‘Harit Sagar’ Guidelines -2023 provide a comprehensive framework for our Major Ports, empowering them to create a comprehensive action plan aimed at achieving quantifiable reductions in carbon emissions over defined timelines.”

- It emphasizes the use of clean and green energy, such as green hydrogen, green ammonia, green methanol/ethanol.

- The objective of the guidelines is to minimize waste through reduce, reuse, repurpose, and recycle to attain zero waste discharge from port operations while promoting monitoring based on Environmental Performance Indicators.

- The guidelines are aimed at minimising waste through Reduce, Reuse, Repurpose and Recycle to attain zero waste discharge from port operations.

- It also promotes monitoring based on environmental performance indicators.

- It lay emphasis on the use of clean and green energy in port operations, developing port capabilities for storage, handling, and bunkering greener fuels like green hydrogen and green ammonia, among others.

- The guidelines were launched to meet the larger vision of achieving Zero Carbon Emission Goal set by the Ministry.

- Harit Sagar Guidelines – 2023 envisages ecosystem dynamics in port development, operation, and maintenance while aligning with the ’Working with Nature’ concept and minimizing impact on biotic components of harbor ecosystem.