INDIAN POLITY

1. 16TH FINANCE COMMISSION

TAGS: PRELIMS PERSPECTIVE-GS-II POLITY

THE CONTEXT: The Union government will soon kick off the process to set up the 16th Finance Commission, with the Finance Ministry likely to notify the terms of references for the constitutional body, tasked with recommending the revenue sharing formula between the Centre and the States and their distribution among the States, towards the latter half of this year.

THE EXPLANATION:

- The 15th Finance Commission was set up in November 2017 with a mandate to make recommendations for the five-year period from 2020-21. While the Constitution requires a Finance Commission (FC) to be set up every five years, the 15th FC’s mandate was extended by a year till 2025-26, breaking the cycle.

- “In the normal course of things, the next Finance Commission should have been appointed by now, but since our report covered six years instead of five, it must be appointed this year,” the 15th FC’s chairperson N.K. Singh told The Hindu. In late 2019, the commission was asked to give a standalone report for 2020-21 and another report for an extended five-year period till 2025-26.

- The last time an FC was granted a six-year time frame was for the 9th Finance Commission, formed in June 1987. It was asked to submit a single year report for 1989-90 and a five-year report for the five years till 1994-95. These reports were submitted in 1988 and 1990, when the country’s Finance Ministers were S.B. Chavan and Madhu Dandavate, respectively. The 10th Finance Commission was still constituted in June 1992 within the five-year deadline specified by Article 280 of the Constitution, which has not been the case this time.

- “The commission is usually granted about two years to deliberate on its terms of reference, consult States and frame its recommendations, and the government should ideally have its report by October 2025 to consider it in time for Budget 2026-27 — where it will have to place its action taken report on the Commission’s report”.

VALUE ADDITION:

FINANCE COMMISSION

- Article 280 provides for this quasi-judicial body.

- It is constituted by the President every five years or even earlier.

- It is required to make recommendations to the President on the following matters:

o Distribution of net proceeds of taxes shared between the centre and the states, and the allocation between the states, the respective shares of such proceeds

o Principles which should decide the grants-in-aid as per article 275

o Measures needed to augment the Consolidated Fund of the state to supplement the resources of panchayats and municipalities in the state based on the recommendation of the state finance commission

o Any other matter referred to it by the President

Some bills can be introduced in the Parliament only on the recommendation of the President so as to protect the financial interests of the states: - A bill which imposes or varies any tax or duty in which states are interested

- A bill which varies the meaning of the term ‘agricultural income’ as defined for the purposes of the enactments relating to the income tax

- A bill which affects the principles on which moneys are or may be distributable to states; and

- A which imposes any surcharge on any specified tax or duty for the purpose of the centre.

HEALTH ISSUES

2. NEGLECTED TROPICAL DISEASES

TAGS: PRELIMS PERSPECTIVE-GS-II-HEALTH ISSUES

THE CONTEXT: The recent World Health Organization (WHO) report said that Neglected Tropical Diseases (NTD) continue to disproportionately impact the most impoverished members of the international community.

THE EXPLANATION:

About Neglected Tropical Diseases

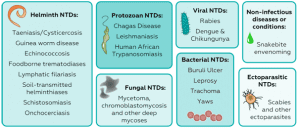

- Neglected tropical diseases (NTDs) are a diverse group of tropical infections which are common in low-income populations in developing regions of Africa, Asia, and the Americas.

- They are caused by a variety of pathogens such as viruses, bacteria, protozoa and parasitic worms (helminths).

- There are a diverse group of 20 diseases that are affecting more than 1 billion people who live in impoverished communities.

- They include Buruli ulcer, Chagas Dengue, Chikungunya, Echinococcosis; foodborne trematodes; human African trypanosomiasis; leishmaniasis; leprosy; Lymphatic filariasis, mycetoma, etc

Global Initiative to end NTDs

The WHO’s new road map for 2021–2030 calls for three strategic shifts to end NTDs:

- From measuring process to measuring impact.

- From disease-specific planning and programming to collaborative work across sectors.

- From externally driven agendas reliant on programmes that are country-owned and country-financed.

ENVIRONMENT, ECOLOGY & CLIMATE CHANGE

3. WHAT ARE INVASIVE PLANT SPECIES?

TAGS: PRELIMS PERSPECTIVE-GS-III-ENVIRONMENT & ECOLOGY

THE CONTEXT: The Nodal Centre for Biological Invasions (NCBI) at the Kerala Forest Research Institute (KFRI) has come out with a management plan to eradicate Senna spectabilis, the exotic invasive plant that is posing a severe threat to the State’s wildlife habitat.

THE EXPLANATION:

- Based on the results of the experimental study done at the Periyar Tiger Reserve, the plan envisages landscape-level management of the tree. The two key factors considered in developing the management protocol were the fast nature of the spread of the tree in natural forests, and restoration of natural forests based on landscape.

What are invasive species?

- Invasive alien species are plants, animals, pathogens and other organisms that are non-native to an ecosystem, and which may cause economic or environmental harm or adversely affect human health.

- In particular, they impact adversely upon biodiversity, including decline or elimination of native species – through competition, predation, or transmission of pathogens – and the disruption of local ecosystems and ecosystem functions.

The impacts of invasive species include:

- Reduced biodiversity.

- Decreased availability and quality of key natural resources.

- Water shortages.

- Increased frequency of wildfires and flooding.

- Pollution caused by overuse of chemicals to control infestations.

VALUE ADDITION:

Senna spectabilis

- It is an invasive species.

- It is introduced as an ornamental species and for use as firewood from South and Central America.

- The species has become highly invasive in the Sigur plateau in both the core and buffer zones of the MTR.

- Senna spectabilis, along with Lantana camara, is among five major invasive weeds that had taken over vast swathes of the Nilgiris.

- Eucalyptus and pine, though exotic, do not spread as quickly as the other species and are considered easier to manage.

SCIENCE AND TECHNOLOGY

4. CHINA’S BAIDU MAY LAUNCH CHATGPT

TAGS: PRELIMS PERSPECTIVE-GS-III-SCIENCE AND TECHNOLOGY

THE CONTEXT: The BAIDU is a Chinese-based technology company. It offers a popular search engine in China called BAIDU. (Major search engines like Google are banned in China).

THE EXPLANATION:

- The company works on artificial intelligence and internet-related products. The headquarters of the company is in Beijing. The company is one of the largest AI companies in the world. The TECH giant is now planning to develop a chatbot similar to that of ChatGPT.

What is Baidu’s plan?

- The Beln Crypto report recently said that BAIDU is to launch a ChatGPT-like chatbot. Beln Crypto is one of the most popular and largest cryptocurrency news platforms in the world. BAIDU’s chat platform will have conversation-style interfaces just like ChatGPT.

Background

- BAIDU has been investing millions and millions of dollars in this AI platform. With this, the company is planning on shifting into a complete technology company and stopping all its online marketing services.

Features

- BAIDU’s chatbot is to be built on the Ernie system. ERNIE stands for Electronic Random Number Indicator Equipment. It is a hardware random number generator. It was invented to be used in lotteries and casinos.

ChatGPT

- It is a Microsoft product. Today it is at the peak of its success. Apart from BAIDU, other Chinese investors are also looking for ways to develop an AI chatbot just like ChatGPT.

ECONOMIC DEVELOPMENTS

5. ECONOMIC SURVEY: WHAT IS IT AND WHAT TO EXPECT IN 2023

TAGS: PRELIMS PERSPECTIVE-GS-III-ECONOMY

THE CONTEXT: The Chief Economic Adviser (CEA) will release the Economic Survey for the current financial year (2022-23). The survey is always presented a day before – typically January 31 since Union Budgets are scheduled for February 1 – the Finance Minister unveils the Union Budget for the next financial year (2023-24 in the present case).

THE EXPLANATION:

What is the Economic Survey?

- As the name suggests, the Economic Survey is a detailed report of the state of the national economy in the financial year that is coming to a close.

- It is prepared by the Economic Division of the Department of Economic Affairs (DEA) under the guidance of the CEA. Once prepared, the Survey is approved by the Finance Minister.

- The first Economic Survey was presented for 1950-51 and until 1964, it was presented along with the Budget.

- Similarly, for the longest time, the survey was presented in just one volume, with specific chapters dedicated to different key sectors of the economy – such as services, agriculture, and manufacturing – as well as key policy areas – such as fiscal developments, state of employment and inflation etc. This volume carries a detailed statistical abstract as well.

- However, between 2010-11 and 2020-21, the survey was presented in two volumes. The additional volume carried the intellectual imprint of the CEA and often dealt with some of the major issues and debates facing the economy.

- Last year’s (2022) survey reverted back to a single volume format, possibly because it was prepared and presented while there was a change in guard in the CEA’s office and the current CEA – V Anantha Nageswaran – took charge when the survey was released.

What is the Economic Survey’s significance?

- Even though it comes just a day before the Budget, the assessment and recommendations carried in the survey are not binding on the Budget.

- Still, the survey remains the most authoritative and comprehensive analysis of the economy that is conducted from within the Union government.

- As such, its observations and details provide an official framework for analysing the Indian economy.

What should one look for in this year’s survey?

- The Indian economy has been struggling to grow at a fast pace since the start of 2017-18. The years immediately after Covid may have registered fast growth rates but that was just a statistical illusion. Many outside economists have argued that India’s potential growth itself has fallen from 8% to 6%.

- Along with a deceleration in growth, the economy has also witnessed historically high unemployment and a sharp rise in poverty and inequality during the Covid pandemic.

- The survey is expected to diagnose the true extent of economic recovery in the Indian economy and whether India’s growth potential has lost a step or not.

- The survey can be expected to paint future scenarios and also suggest policy solutions. For instance, what can be done to boost manufacturing growth in the country? How can India continue to grow fast at a time when both global growth and world trade is likely to remain muted.