Table of Contents

POLITY AND GOVERNANCE

1. COMPETITION COMMISSION OF INDIA

TAGS: PRELIMS PERSPECTIVE-GS-II- POLITY & GOVERNANCE

THE CONTEXT: Recently, the Google has said that the order passed by India’s competition regulator — the Competition Commission of India (CCI) — against Android’s operating system policies will result in devices getting expensive in India and lead to proliferation of unchecked apps that will pose threats for individual and national security.

THE EXPLANATION:

About Competition Commission of India:

- The Competition Commission of India has been established to enforce the competition law under the Competition Act, 2002.

- It comes under the Ministry of Corporate Affairs.

- It should be noted that on the recommendations of Raghavan committee, the Monopolies and Restrictive Trade Practices Act, 1969 (MRTP Act) was repealed and replaced by the Competition Act, 2002.

- The Commission consists of a Chairperson and not more than 6 Members appointed by the Central Government.

- It is the statutory duty of the Commission to eliminate practices having an adverse effect on competition, promote and sustain competition, protect the interests of consumers and ensure freedom of trade carried on by other participants, in markets in India as provided in the Preamble as well as Section 18 of the Act.

- The Commission is also mandated to give its opinion on competition issues to government or statutory authority and to undertake competition advocacy for creating awareness of competition law.

- Advocacy is at the core of effective competition regulation.

- Competition Commission of India (CCI), which has been entrusted with implementation of law, has always believed in complementing robust enforcement with facilitative advocacy.

- It is a quasi-judicial body.

- CCI also approves combination under the act so that two merging entities do not overtake the market.

The Competition Act

- The Competition Act, 2002, as amended by the Competition (Amendment) Act, 2007, follows the philosophy of modern competition laws.

- The Act prohibits anti-competitive agreements, abuse of dominant position by enterprises and regulates combinations (acquisition, acquiring of control and M&A), which causes or likely to cause an appreciable adverse effect on competition within India.

ECONOMIC DEVELOPMENTS

2. ALTERNATE INVESTMENT FUND AND CREDIT DEFAULT SWAP

TAGS:PRELIMS PERSPECTIVE- GS-III- INDIAN ECONOMY

THE CONTEXT: The Securities and exchange board of India has allowed alternative investment funds) to participate in credit default swaps (CDS) as protection for both buyers and sellers.

THE EXPLANATION:

- Category I and Category II AIFs may buy CDS on underlying investment in debt securities, only for the purpose of hedging.

- Category III AIFs may buy CDS for hedging or otherwise, within permissible leverage

- Credit default swap market is very illiquid at present.

Alternate Investment Fund(AIFs):

- In India, AIFs are defined in Regulation 2(1) (b) of Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012.

- Meaning – It refers to any privately pooled investment fund, (whether from Indian or foreign sources), in the form of a trust or a company or a body corporate or a Limited Liability Partnership (LLP).

- They include angel funds, commodities, real estate, venture capital, private equity, etc.

- Categories of AIFs

- Category I: Mainly invests in start- ups, SME’s or any other sector which Govt. considers economically and socially viable

- Category II: private equity funds or debt funds for which no specific incentives or concessions are given by the government or any other Regulator

- Category III : hedge funds or funds which trade with a view to make short term returns or such other funds which are open ended and for which no specific incentives or concessions are given by the government

Benefits of AIF:

- Security against volatility – These schemes do not put their funds in investment options that trade publicly. Hence, they are not related to the broader markets and do not fluctuate with their ups and downs.

- Excellent portfolio diversification to a wide array of assets

- Profitable returns – as these funds have numerous investment options, They are a better source of passive income. Further, returns are less prone to fluctuations as these schemes are not linked to the stock market.

GOVERNMENT SCHEMES AND INITIATIVES IN NEWS

3. ‘SAHARSH’ INITIATIVE

TAGS: PRELIMS PERSPECTIVE-GOVERNMENT SCHEMES IN NEWS

THE CONTEXT: Recently, the Tripura government has launched a special education programme called ‘Saharsh’ in an effort to encourage social and emotional learning.

THE EXPLANATION:

The initiative was launched on a pilot basis in August 2022 in 40 schools in the state, and from January 2023, it will be extended to all government and aided schools of the state. The programme is aimed at empowering children to learn with happiness and contribute to empathetic development.

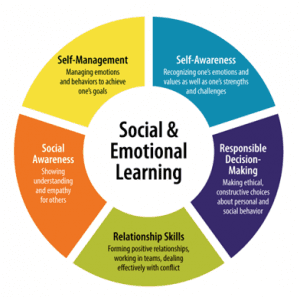

What is Social and Emotional Learning?

- Social and emotional learning (SEL) is the process through which children and adults learn the skills they need to understand and manage emotions, set and achieve positive goals, feel and show empathy for others, establish and maintain positive relationships, and make responsible decisions.

- SEL is critical for students to succeed in school and in life. The ‘Saharsh’ initiative is designed to help students develop these skills and become well-rounded, resilient individuals.

Effectiveness of the Program

- The ‘Saharsh’ initiative is based on a similar programme that was found to be effective in social and economic development in research studies of Harvard and Columbia Universities. The programme is being contextualised with local realities of India before implementing it in Tripura.

- According to the state government, it has already trained 204 schools for the ‘Saharsh’ curriculum while 200 more will be trained soon. Thirty assistant headmasters from different districts of Tripura were also selected to work as Saharsh implementation ambassadors.

PRELIMS PERSPECTIVE

4. WHO ARE THE THARU PEOPLE?

TAGS:PRELIMS PERSPECTIVE- GS-I & III-CULTURE & HERITAGE- ENVIRONMENT

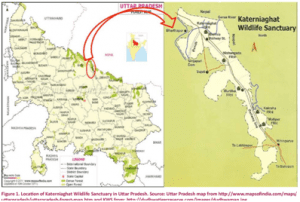

THE CONTEXT: Recently, forest officials of the Katarniaghat division plans the works for the financial inclusion of the Tharu groups that live near the Katarniaghat Wildlife Sanctuary (KWS) and are much affected by human-wildlife conflicts.

THE EXPLANATION:

About Tharu people

- They are an ethnic group indigenous to the Terai region of the Himalayan foothills, located in southern Nepal

and in the state of Uttar Pradesh in India.

and in the state of Uttar Pradesh in India. - Tharu in Nepal officially numbered about 1.5 million and those in India about 170,000.

- They speak various dialects of Tharu, a language of the Indo-Aryan subgroup of the Indo-Iranian group of the Indo-European family, and they are largely Indian in culture.

- Most Tharu practice agriculture, raise cattle, hunt, fish, and collect forest products.

- Although they are Hindu, the Tharu use their own traditional ritual specialists in addition to the Hindu Brahman priests.

- Each Tahru village is governed by a council and a headman.

Katarniaghat Wildlife Sanctuary (KWS):

- Location: It is situated in the Upper Gangetic plain falling in the Terai of Bahraich district of Uttar Pradesh.

- It is part of Dudhwa Tiger Reserve Lakhimpur kheri.

- The Katarniya Ghat Forest provides strategic connectivity between tiger habitats of India and Nepal.

- Flora: The sanctuary has a mosaic of Sal and Teak forests, lush grasslands, numerous swamps and wetlands.

- Fauna: It is home to a number of endangered species including gharial, tiger, rhino, Gangetic dolphin, Swamp deer, Hispid hare, Bengal florican, the White-backed and Long-billed vultures.

REPORT AND INDEXES

5. OXFAM’S “SURVIVAL OF THE RICHEST” REPORT

TAGS: GS-III- ECONOMY- REPORT & INDEXES

THE CONTEXT: According to a new study by Oxfam International, the richest 1% of people in India now own more than 40% of the country’s total wealth, while the bottom half of the population together share just 3% of wealth.

THE EXPLANATION:

REPORT HIGHLIGHTS:

- The report suggests that taxing India’s ten-richest at 5% could fetch enough money to bring children back to school. Additionally, if India’s billionaires were taxed once at 2% on their entire wealth, it would support the requirement of Rs 40,423 crore for the nutrition of malnourished in the country for the next three years.

- A one-time tax of 5% on the 10 richest billionaires in the country (Rs 1.37 lakh crore) is more than 1.5 times the funds estimated by the Health and Family Welfare Ministry (Rs 86,200 crore) and the Ministry of Ayush (Rs 3,050 crore) for the year 2022-23.

Impact on Earnings: The report also highlights the impact of gender inequality on earnings. It states that female workers earned only 63 paise for every 1 rupee a male worker earned. For Scheduled Castes and rural workers, the difference is even starker – the former earned 55% of what the advantaged social groups earned, and the latter earned only half of the urban earnings between 2018 and 2019.

Pandemic Impacts: Since the pandemic began in November 2022, billionaires in India have seen their wealth surge by 121% or Rs 3,608 crore per day in real terms, Oxfam said. On the other hand, approximately 64% of the total Rs 14.83 lakh crore in Goods and Services Tax (GST) came from bottom 50% of the population in 2021-22, with only 3% of GST coming from the top 10%. The total number of billionaires in India increased from 102 in 2020 to 166 in 2022.

Wealth Inequality in India: According to sources, “The country’s marginalized – Dalits, Adivasis, Muslims, Women and informal sector workers are continuing to suffer in a system which ensures the survival of the richest.” To implement progressive tax measures such as wealth tax and inheritance tax, which they said have been historically proven to be effective in tackling inequality.

- Citing a nationwide survey by Fight Inequality Alliance India (FIA India) in 2021, Oxfam said it found that more than 80% of people in India support tax on the rich and corporations who earned record profits during the Covid-19 pandemic. More than 90% participants demanded budget measures to combat inequality such as universal social security, right to health and expansion of budget to prevent gender-based violence.

and in the state of Uttar Pradesh in India.

and in the state of Uttar Pradesh in India.