THE CONTEXT: The Insolvency and Bankruptcy Code 2016 has been a path breaking reform in the corporate governance in India. According to the 32nd report of the Parliamentary standing committee on Finance, August 2021 its potential to address the problems of Non performing assets and release of capital to productive areas has not been realised. In this backdrop, this article examines the various aspects of the IBC ecosystem so that students develop the right perspective about IBC and related issues.

NEED FOR INSOLVENCY AND BANKRUPTCY CODE

- Pre IBC insolvency and bankruptcy legal framework in India was fragmented and ineffective

- For corporates, bankruptcy proceedings in India were governed by multiple laws — the Companies Act, SARFAESI Act, Sick Industrial Companies Act, and so on.

- For individuals, The Presidential Towns Insolvency Act 1909 and Provincial Insolvency Act 1920 existed which were rarely used.

- The entire process of winding up was also very long-winded, with courts, debt recovery tribunals and the Board for Industrial and Financial Reconstruction all having a say in the process

- In actual practice, this system worked for the advantages of the Debtors, willful defaulters and resulted in mounting NPA.

- In view of the above. a new legislation was required for the development of credit markets, encourage entrepreneurship and promote ease of doing business.

- The code consolidates around 11 laws relating to insolvency and bankruptcy and creates dedicated institutions for various actions under the code.

- The Code also stipulates the role, responsibilities and the timeline that must be adhered to by all stakeholders.

- Thus IBC replaces the erstwhile “debtors’ regime” with “creditors’ regime” so as to bring financial integrity in corporate management.

KEY PILLARS OF THE IBC ECOSYSTEM.

CLARIFYING CONCEPTS

- INSOLVENCY A situation where the debtor is unable to pay back the creditor. It depicts a condition of financial distress of an individual or an entity.

- BANKRUPTCY A situation when a competent court declares that an individual or entity is insolvent. It is a legal declaration of insolvency.

- LIQUIDATION When the assets of an individual/entity are sold to pay off the debt, it is known as liquidation.

- RESOLUTION It is a plan of rehabilitation or liquidation of a corporate debtor. The approved plan may lead to restructuring the debt or acquisition by another entity or eventual liquidation of assets.

ADJUDICATING AUTHORITY

- National Company Law Tribunal (NCLT) and Debt Recovery Tribunal are statutory bodies responsible for adjudicating resolution of matters related to insolvency and bankruptcy.

- NCLT is for companies and limited liability partnerships and DRT is for unlimited liability partnerships and sole proprietors

COMMITTEE OF CREDITORS(COC)

- COC consists only of financial creditors. The role of the COC is to approve and disapprove the resolution plan proposed by the resolution professional

- The minimum vote required to approve the resolution plan is 75% in a meeting of COC.

INSOLVENCY PROFESSIONALS

- The entire insolvency resolution process is managed by an Insolvency Professional who is appointed by the Insolvency and Bankruptcy Board of India

INSOLVENCY AND BANKRUPTCY BOARD OF INDIA

- Most important institutional arrangement for the new insolvency and bankruptcy regime is IBBI.

- It was created as the Umpiring institution with multiple tasks including creation of regulations and control of agencies and professionals involved in the insolvency and bankruptcy business.

FINANCIAL CREDITOR

- Financial Creditors (FC) are the creditors who give money to the promoters. Banks, home buyers, etc. are considered as financial creditors.

- In the Committee of Creditors of Essar Steel Ltd. v. Satish Kumar Gupta, 2019, the supreme court has upheld the primacy of financial creditors over operational creditors in the resolution process.

OPERATIONAL CREDITOR

- Operational Creditors (OC) are those creditors who do not give money or cash to the promoters but they provide goods and services to the promoters. Both FC and OC can initiate the insolvency resolution although there are substantial and procedural variations.

CORPORATE DEBTOR

- Corporate debtors are the promoters who take loans or money from financial creditors or take goods or services from operational creditors as a debt.

LIQUIDATION

- If the Resolution Process fails to find a resolution for the corporate debtor within the stipulated timeline or if the COC does not approve the resolution plan by a vote of not less than 66% of the voting share, the corporate debtor is liquidated.

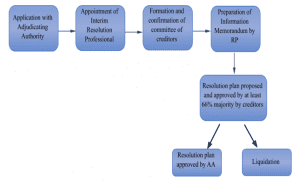

FIGURE 1: INSOLVENCY AND BANKRUPTCY CODE PROCESS

UNIQUE FEATURES AND BENEFITS OF THE CODE

- Comprehensiveness: A comprehensive regime dealing with all aspects of insolvency and bankruptcy of all kinds.

- Division of Responsibilities: Separating commercial aspects of insolvency and bankruptcy proceedings from judicial aspects and empowered stakeholders and adjudicating authorities to decide the matters expeditiously.

- Changes in Orientation: Moving away from the ‘debtor-in-possession’ regime toa ‘creditors-in-control regime where creditors decide matters with the assistance of insolvency professionals.

- Collective Action: Providing collective mechanism to resolve insolvency rather than recovery of loan by a creditor.

- Timeliness: Achieving insolvency resolution in a time bound manner and empowers the stakeholders to complete transactions in time.

- Reducing Business Failure: The code reduces incidence of failure as the inevitable consequence of default in terms of insolvency proceedings prompts behavioral changes on the part of debtor to try hard to prevent business failures.

- Focus on Viability: It reduces failure by setting in motion a process that rehabilitates failing businesses that are viable.

- Safe to Fail approach: By allowing closure of non-viable firms, the code enables an entrepreneur to get in and get out of business with ease, undeterred by failure (honest failure for business reasons).

ACHIEVEMENT OF INSOLVENCY AND BANKRUPTCY CODE

EASE OF DOING BUSINESS RANKING

- The legislation enabled India to leapfrog in World Bank’s Doing Business rankings from a lowly 142 in 2014 to 63 in 2020 due to the faster insolvency resolution process and others.

QUANTUM OF RECOVERY

- IBC resulted in mean recoveries of 44% for financial creditors in comparison to 24% from Debt Recovery Tribunals (DRT), SARFAESI Act and Lok Adalats combined, for financial years 2018-2020.

GROSS NON-PERFORMING ASSETS (GNPA)

- The banking sector’s GNPA ratio is estimated to have declined to 10 per cent in the end-March 2019 from 11.5 per cent the year before on the same date, as recoveries through IBC helped banks recovery bad loans, as per rating agency Crisil.

REDUCTION IN AVERAGE TIME

- The Standing Committee noted that the average time to resolve insolvency reduced from 4.3 years to 1.6 years between 2017 and 2020, since the implementation of the IBC

REVIVAL OF COMPANIES

- Several good debt-laden companies like Essar Steel, Bhushan Steel, Electro Steel, Amtek Steel, Bhushan Power and Steel, Alok Industries, and Reliance Communications have been revived with minimal loss of employment, loss of assets or loss in production.

PRACTICING NUDGE THEORY

- More than half of the CIRPs initiated by the OCs have been closed on appeal, review or withdrawal.

- This indicates that for fear of losing control and ownership of the company, debtors have preferred to pay the OCs and resolve amicably.

SUCCESS STORY OF THE IBC: THE ESSAR STEEL RESOLUTION CASE STUDY

- The Essar Steel Ltd (ESL for short) had financial debts of Rs 49,000 crore. The money was owed to a group of banks led by SBI, which included PSU and private sector banks.

- The NCLT admitted the insolvency proceedings in August 2017 and it was followed by the submission of bids by five metal giants, including ArcelorMittal.

- The NCLT handed over the interim management of ESL to another company which resulted into its turnaround.

- Meanwhile, government introduced Section 29A in the Code, which barred the promoters of companies that defaulted on loans for 12 months from submitting bids.

- These factors encouraged Arcelor Mittal to not only pay back 7500 crores of its due payment but also to increase its bid for ESL to Rs 42,000 crore from its initial bid of Rs. 29,000 crores, amounting to 92% of the credit liability.

- Various benefits accrued from these developments are outlined below.

BENEFITS TO THE BANKING SECTOR(FCs)

- Rs 42,000 crores (92%) were realised and introduced in the economy as against a debt of Rs. 49,000 crores within three years.

- In the earlier system, the resolution would have involved a protracted legal battle for a decade or so, while the debtor company would have closed down operations, and assets, plants and machinery would have been put to disuse and decay.

- Finally, only a pittance would have been recovered from whatever asset could be salvaged.

BENEFIT TO OPERATIONAL CREDITORS

- Since the company continued to be run by the turnaround specialists, the OCs were willing to extend credits.

- The company achieved operational turnaround and so the operational creditors got to continue their business with the company and also realise their dues. This was a win-win for both the OCs and the company.

BENEFIT TO EMPLOYEES

- The resolution proceedings ensured that not only did the company continue its operations but also achieved an operational turnaround. This was great news for employees who feared retrenchment.

- After the resolution, ArcelorMittal took over the company and continued its operations. Hence, most of the employees except the top management echelons would get to keep their jobs. This could never happen in resolution proceedings prior to the Code.

IBC PITFALLS AND SOLUTIONS: STANDING COMMITTEE OBSERVATIONS

ITEMS

CRITICISM

WAY FORWARD

EXCESSIVE AMENDMENTS

- The IBC has deviated from its original intent due to as many as six amendments in the last 5 years. The IBC now have a different orientation from its basic design

- There is a need for an evaluation of the extent of fulfilment of the original aims during the implementation of the Code over the years and a thorough overhauling based on the findings.

VERY LOW RECOVERY

- 95% haircut and delay in the resolution process with more than 71% cases pending for more than 180 days meant deviation from the objective of the Code.

- Provide greater clarity to strengthen creditor rights and have a benchmark for haircuts comparable to global standards.

DELAY AND VACANCIES IN NCLT

- 13,170 IBC cases involving nine lakh core rupees are pending before the NCLT

- More than 50% of the sanctioned strength of the NCLT is vacant including that of the President (32 out of 64)

- To address this delay, it recommended creating dedicated benches of the NCLT for matters related to IBC.

- Analyzing required capacity based on projected number of cases and planning recruitment in advance among others can reduce vacancies.

CRISIS IN MSMEs

- MSMEs were negatively impacted by the COVID-19 pandemic and under the current mechanism, they are considered as operational creditors, whose claims are addressed only after secured creditors

- Instituting additional protections for MSMEs, considering the current economic situation by suitable changes in the code is necessary

POST HOC BIDS

- Bidders wait for the highest bidder(H1) to become public and then try to exceed this bid through an unsolicited offer that is submitted after the specified deadline.

- This creates tremendous procedural uncertainty; delay and genuine bidders are discouraged from bidding at the right time.

- IBC needs to be amended so that no post hoc bids are allowed during the resolution process.

- There should be sanctity in deadlines so that value is protected and the prices move smoothly.

INSOLVENCY RESOLUTION PROFESSIONALS (IRPS)

- Fresh graduates are being appointed as IRPs whose competence is highly doubtful in handling the complex cases.

- Also there are issues of professional misconduct and disciplinary action has been taken against 123 IRPs.

- Professional self-regulator for insolvency resolution professionals (IRPs) that functions like the Institute of Chartered Accountants of India (ICAI) should be put in place.

- An Institute of Resolution Professionals may be established to oversee and regulate the functioning of IRPs so that there are appropriate standards and fair self-regulation

CONCLUSION: The IBC system provides a reformed resolution regime that balances the interests of all stakeholders. However, its potential to be the game changer in Indian financial landscape has not been fully successful. Now that, the one-year pause in IBC process due to Covid 19 has been lifted, fast tracking reforms cannot wait. Thus a comprehensive rejig of the Code by incorporating the recommendations of the Standing Committee and findings of a post legislative impact study is imperative. The success of IBC also depends on reforms in banking governance, working of tribunals and judicial interventions or its lack thereof, which must also be addressed immediately.

Spread the Word