Table of Contents

THE CONTEXT: The Reserve Bank of India has recently introduced a mechanism to facilitate international trade in rupees. Now the import and export payments may be settled through a special Vostro account, while banks, with prior approval from the RBI, can act as authorised dealers for such transactions. This article intends to analyze the implications of rupee internationalization from the UPSC perspective.

INTERNATIONALIZATION OF RUPEE: UNDERSTANDING BASICS

DEFINING CURRENCY INTERNATIONALIZATION

- Currency internationalization is the widespread use of a currency outside the borders of its original country of issue.

- The level of currency internationalization for a currency is determined by the demand that users in other countries have for that currency.

- This demand can be driven by the use of the currency to settle international trade, to be held as a reserve currency or a safe-haven currency, or in general use as a medium of indirect exchange in other countries’ domestic economies via currency substitution.

ORIGIN OF THE DEBATE

OUTBREAK OF GLOBAL FINANCIAL CRISIS (GFC) OF 2008

- The global financial crisis (GFC) of 2008, for a variety of complex reasons, prompted emerging markets (EMs) to reconsider the role of their currencies as global alternatives to the “big four” currencies (US dollar, Yen, Euro, Pound).

- The outbreak of the GFC and its spillover to the entire world reflected the inherent vulnerabilities and systemic risks in the existing international monetary system.

- This was an indirect assertion that the US was taking advantage of the reserve currency status of the US dollar and dollar liquidity shortages were a real problem for EMs during the GFC.

EMERGENCE OF THE RENMINBI

- China in response, embarked on an ambitious project of “Renminbi internationalization” with the coupled goals of international monetary reform and diversification of global currency risk through internationalizing its currency.

IMPLICATIONS ON INDIAN RUPEE

- China’s policy pivot prompted policymakers in India to consider the possibility of internationalizing the Indian Rupee (INR). The Reserve Bank of India (RBI) commissioned two studies in 2010 and 2011 (Ranjan and Prakash, 2010; Gopinath, 2011) to examine the issues surrounding the internationalization of the INR.

- Both studies recommended a cautious approach towards currency internationalization given the size of the Indian GDP, lower presence in global trade and partial capital account convertibility.

- They also added that while the Rupee is a natural contender for transitioning into a global currency, policymakers should start by increasing the role of the INR in its local region, where the Renminbi has taken the lead over the Rupee.

- In spite of an early interest in pursuing a policy of currency internationalization, both the Indian government and the RBI do not consider it to be a priority in the short to medium term.

LATEST DEVELOPMENT

- The recent push of RBI for rupee internationalization is a great step in the right direction, considering the limitation for using the US dollar as a medium of international transactions, especially with counties under sanctions.

- This would also help reduce exchange rate risk on traders and pressure on the Indian rupees.

PROCESS OF INTERNATIONALIZATION OF A CURRENCY

There are certain necessary preconditions which are as follows:

- The government must remove all restrictions on the freedom of any entity, domestic or foreign, to buy or sell its country’s currency, whether in the spot or forward market.

- Domestic firms are able to invoice some, if not all, of their exports in their country’s currency, and foreign firms are likewise able to invoice their exports in that country’s currency, whether to the country itself or to third countries.

- Foreign firms, financial institutions, official institutions and individuals are able to hold the country’s currency and financial instruments denominated in it in amounts that they deem useful and prudent.

- Foreign firms and financial institutions, including official institutions, are able to issue marketable instruments in the country’s currency.

- The issuing country’s own financial institutions and non-financial firms are able to issue on foreign markets instruments denominated in their country’s own currency.

- International financial institutions, such as the World Bank and regional development banks, are able to issue debt instruments in a country’s market and use its currency in their financial operations.

- The currency may be included in the “currency baskets” of other countries, which they use in governing their own exchange rate policies.

ANALYZING RUPEE INTERNATIONALIZATION

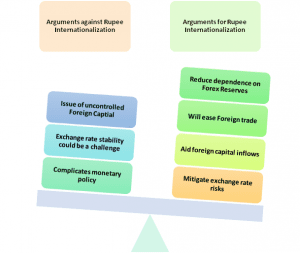

CHALLENGES FOR INDIA: CRITICAL ANALYSIS

ATTAINING SUFFICIENT SCALE

- The issuing country must have sufficient scale, both in terms of nominal gross domestic product and volume of international transactions. For instance, while China is a $10.36 trillion economy, India is roughly at $2 trillion.

- For India to attain sufficient scale, the economy needs to grow at a sustainable average rate of 7-8% for the next five years or so. India’s current share of global trade is also relatively small, and the bulk of it is invoiced in US dollars.

- Improvements in scale are linked to macroeconomic fundamentals, which cannot be changed through an internationalization-driven agenda.

STABILITY OF THE RUPEE

- The value of the currency must be stable over time. A currency is considered stable when the general level of prices does not vary too much. Stability has multiple aspects: macroeconomic, financial and political.

- On macroeconomic stability, earlier this year, India undertook an important reform in the form of the Monetary Policy Framework Agreement that formally lays down inflation targeting as the objective of monetary policy in India. But recent high inflations showed limited outreach of MPC.

- The banking system continues to be overburdened with burgeoning non-performing assets.

- In terms of political stability, the fact that India is a democracy, like issuers of most international currencies in the 19th and 20th centuries, goes in its favour.

ENSURING LIQUIDITY OF THE RUPEE

- A currency is liquid if significant quantities of assets can be bought and sold in the currency without noticeably affecting its price.

- This requires depth in financial markets, a large stock of domestic currency-denominated bonds and adequate options to hedge currency risk exposures.

- India lacks a deep, liquid and well-functioning corporate bond market. Hedging opportunities for foreign investors are limited.

- India has one of the least open capital accounts among emerging economies. Relaxing capital controls to attract foreign investor participation is crucial for enhancing rupee liquidity.

THE WAY FORWARD

- The Reserve Bank of India (RBI) has made a strong case for the internationalization of the rupee and sought to differentiate it from capital account convertibility. According to RBI, countries that can borrow in their own currency are less susceptible to the international crisis.

- As the currency risks are born by the lenders and not by the borrowers back in India, this is always a safer option for the Indian economy; hence, it must be promoted.

- Democracy and associated checks and balances on the executive instil confidence in foreign investors about the policy credibility of the government, thereby imparting stability to the national currency. Thus, India can explore the option of controlled internationalization of the rupee.

THE CONCLUSION: Any possibility of conversation on rupee internationalization must be backed by a sustained and stable position of the Indian Rupee. Scale, stability and liquidity can be achieved through strong economic fundamentals and a process-driven regulatory environment. These, by themselves, are important policy goals to achieve for India. It is possible that once these are achieved, the rupee will come to be accepted as an international currency.

QUESTIONS TO PONDER

1. “Only if scale, stability and liquidity of Indian Rupee are achieved, will it be accepted as an international currency.” Examine critically in the light of the recent push by RBI for the internationalization of the rupee.

2. What do you understand by ‘internationalization of currency? Discuss the positives and negatives of the internationalization of the currency.

Spread the Word