THE CONTEXT: Over the last two years, fiscal policy has remained a significant tool for addressing the economic fallout of the pandemic. The government of India has adopted a calibrated fiscal policy approach to the pandemic, which had the flexibility of adapting to an evolving situation to support the vulnerable sections of society/firms and enable a resilient recovery. India’s unique agile policy response differed from the waterfall strategy of introducing front-loaded stimulus packages, adopted by most other countries in 2020. Such an adaptive approach has now been widely accepted in policy circles (IMF Fiscal Monitor October 2021). This chapter reviews the fiscal developments in India in the aftermath of the pandemic outbreak. It begins with fiscal policy strategy and performance of the fiscal parameters in the current year 2021-22, followed by a detailed analysis of the medium to long-term trends in Central, State, and General Government finances. The chapter concludes with a discussion on policy measures to enhance the efficiency of Government spending.

FISCAL POLICY STRATEGY IN THE AFTERMATH OF THE PANDEMIC OUTBREAK

- The agile fiscal policy response adopted by the Government of India encompassed a change in the mix of the stimulus measures amidst an uncertain evolution of the pandemic situation.

- In the initial phase of the pandemic, the fiscal policy focused on building safety-nets for the poor and vulnerable sections of society to hedge against the worst-case outcomes.

- Stimulus measures such as direct benefit transfers to the vulnerable sections, emergency credit to the small businesses, and the world’s largest food subsidy program targeting 80.96 crore beneficiaries enabled the creation of safety-nets, by ensuring that the essentials are taken care of.

- This was followed by a series of stimulus packages spread throughout the year 2020-21, driven by a Bayesian updating of information as the situation evolved.

- With the restoration of economic activities, the fiscal response focused on stimulating demand in the economy.

- During this phase of economic recovery, the stimulus mix included investment boosting measures like Production Linked Incentives (PLI), steps to encourage investment in the infrastructure sector, and enhancing capital expenditure by the Central and State Governments.

- This enhanced focus on capital expenditure in the second half of the year 2020-21 is reflective of the responsive fiscal policy which the Government of India has adopted against COVID-19.

- Due to movement restrictions in containment zones, and unwillingness or inability of contractors and workers to carry out works, the quarterly capital expenditure was restrained during the first two quarters of 2020-21.

- With the easing of movement and health-related restrictions in Q3 of 2020-21, capital spending was pushed for encouraging expenditure in sectors with the most positive effect on the economy.

- The focus on capital spending has been sustained during the current fiscal, as the capital expenditure shows an increasing trend during the first three quarters of 2021-22.

- Building on the same approach, the Union Budget 2021-22 had enhanced the budget outlays for the more productive capital expenditure.

- The Government budgeted for a 34.5 percent growth in capital expenditure over 2020-21 with emphasis on railways, roads, urban transport, power, telecom, textiles, and affordable housing amid continued focus on the National Infrastructure Pipeline.

- The National Infrastructure Pipeline covering 6835 projects was expanded to 7400 projects in Budget 2021-22.

- To unlock the domestic manufacturing potential across sectors, such as renewable energy, heavy industry, agriculture, automotive, and textiles, Budget 2021-22 launched PLI schemes for 13 sectors, with an outlay of `1.97 lakh crore, for 5 years starting from 2021-22.

- All these initiatives are expected to collectively generate employment and boost output in the medium to long term through multiplier effects.

- The stimulus measures announced during the year 2021-22 have continued the emphasis on liquidity enhancing and investment boosting measures such as the PLI Scheme, credit guarantee schemes, and export boosting initiatives to support the reviving economy, apart from providing free food grains to the poor.

PERFORMANCE OF FISCAL INDICATORS DURING 2021-22

- This section analyses the performance of financial indicators and their components for the period April to November 2021.

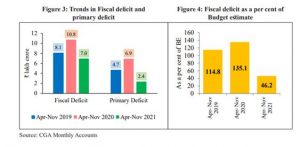

- The data on Government accounts for April to November 2021, released by the Controller General of Accounts, show that the fiscal deficit of the Central Government at the end of November 2021 stood at 46.2 percent compared to 135.1 percent during the same period in 2020-21 and 114.8 percent during the same period in 2019-20.

- During this period both fiscal deficit and primary deficit stood at levels much below the corresponding levels in the previous two years.

- The primary deficit during the period April to November 2021 turned up at nearly half of the level it had reached during April to November 2019.

REVENUE COLLECTION

- Revenue receipts have grown at a much higher pace during the current financial year (April to November 2021) compared to the corresponding periods during the last two years. This performance is attributable to considerable growth in both tax and non-tax revenue. Net tax revenue to the Centre, which was envisaged to grow at 8.5 percent in 2021-22 BE relative to 2020-21 PA, grew at 64.9 percent from April to November 2021 over April to November 2020 and at 51.2 percent over April to November 2019.

EXPENDITURE

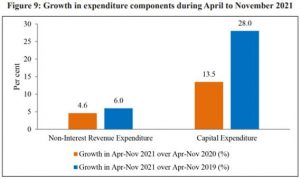

- The expenditure policy of the government during 2021-22 has been characterized by restructuring and prioritization of spending in sectors that have a long-term impact on output. The total expenditure of the Government increased by 8.8 percent from April to November 2021 and stood at 59.6 percent of the Budget Estimate. While the revenue expenditure has grown by 8.2 percent during the first eight months of 2021-22 over the same period in 2020-21, the non-interest revenue expenditure grew by 4.6 percent over April to November 2020.

LONG-TERM TRENDS IN GOVERNMENT FINANCES: CENTRE, STATES, AND GENERAL GOVERNMENT

- During the year 2020-21, the shortfall in revenue collection owing to the interruption in economic activity and the additional expenditure requirements to mitigate the fallout of the pandemic on vulnerable people, small businesses, and the economy in general, created immense pressure on the available limited fiscal resources.

- As a result, the budgeted fiscal deficit for 2020-21 was revised from 3.5 percent in BE to 9.5 percent in RE. The fiscal deficit for 2020-21 Provisional Actuals stood at 9.2 percent of GDP i.e. lower than RE.

- The MediumTerm Fiscal Policy (MTFP) Statement presented with Budget 2021-22 envisaged a fiscal deficit target of 6.8 percent of GDP for 2021-22.

- This reduction in deficit during the current year was budgeted on account of reduction in expenditure from 17.7 percent of GDP in 2020-21 RE to 15.6 percent in 2021-22 BE; and a budgeted marginal increase in gross tax revenues to the tune of 0.1 percent of GDP.

- The data on Government accounts for April to November 2021, released by the Controller General of Accounts, shows that the Government is well on track for achieving the budget estimate for fiscal deficit in 2021-22.

TAX REVENUE

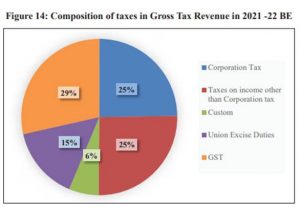

- The Provisional Actual figures released by the Controller General of Accounts for 2020-21 show that the gross tax revenue grew by 0.7 percent (YoY) during 2020-21.

DIRECT TAXES

- Within direct taxes, personal income tax has grown at 47.2 percent over April-November 2020 and at 29.2 percent over April-November 2019. The corporate income tax registered a growth of 90.4 percent over April-November 2020 and 22.5 percent over April-November 2019.

INDIRECT TAXES

- The indirect tax receipts have registered a YoY growth of 38.6 percent in the first eight months of this fiscal year. The revenue collection from customs from April to November 2021 has registered a growth of almost 100 percent over April to November 2020 and over 65 percent compared to April to November 2019.

- The revenue from excise duties has registered a YoY growth of 23.2 percent during April- November 2021. The GST collections for the Centre were 61.4 percent of BE from April to November 2021.

- Gross GST collections, Centre and States took together, were `10.74 lakh crore during April to December 2021, which is an increase of 61.5 percent over April to December 2020 and 33.7 percent over April to December 2019.

NON-TAX REVENUE

- The non-tax revenue collections up to November 2021 registered a YoY increase of 79.5 percent. This increase was driven by dividends and profits, which stood at `1.28 lakh crore against BE of `1.04 lakh crore. The key component of dividends and profits during this period was ` 0.99 lakh crore surplus transfer from RBI to the Central Government.

EXPENDITURE

- The total expenditure of the Government increased by 8.8 percent from April to November 2021 and stood at 59.6 percent of the Budget Estimate. While the revenue expenditure has grown by 8.2 percent during the first eight months of 2021-22 over the same period in 2020-21, the non-interest revenue expenditure grew by 4.6 percent over April to November 2020.

TRANSFER TO STATES

- The Union Government has accepted the recommendations made by the Fifteenth Finance Commission (XV-FC) in its Report for the award period 2021-22 to 2025-26 relating to the grants-in-aid amounting to ` 2,33,233 crore to the States during 2021-22 for Post Devolution Revenue Deficit grant, grants to Local Bodies, Health sector grant and Disaster Management grants.

CENTRAL GOVERNMENT DEBT

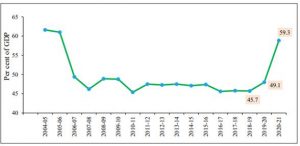

- During the year, a major challenge in the aftermath of the COVID-19 pandemic was the management of debt, both for the Central and State Governments. In this milieu, conventional and unconventional measures were taken to maintain the orderly market conditions to ensure that the increased financial needs of the Governments are met smoothly while keeping in mind the major objectives of cost minimization, risk mitigation, and market development. Supported by these measures, the weighted average cost of the Government on dated securities during 2020-21 was at a 17-year low of 5.79 percent, despite a 141.2 percent jump in net market borrowings.

- The increase in total liability of central government is on account of higher borrowing resorted to due to COVID-19 pandemic as well as a sharp contraction in the GDP. The Debt-GDP is however expected to follow a downward trajectory in the upcoming years.

STATE FINANCES:

- The Gross Fiscal Deficit of States is estimated to cross the Fiscal Responsibility Legislation (FRL) threshold of 3 percent of GDP during 2020-21 RE and 2021-22 BE. The Revenue Deficit of the States also increased from 0.1 percent of GDP in 2018-19 to 2 percent of GDP in 2020-21.

- This relaxation in borrowing limits was allowed on account of the additional expenditure needs and constrained revenues of the States due to COVID-19. The net borrowing ceilings of the States were enhanced to 5 percent of GSDP of the States for the year 2020-21 and 4 percent of GSDP of the States for 2021-22.

- Both Gross Fiscal Deficit and Revenue Deficit for the States are budgeted to decline in 2021-22 from the high levels they reached in 2020-21.

POLICY MEASURES TO ENHANCE THE EFFICIENCY OF GOVERNMENT SPENDING

GOVERNMENT E-MARKETPLACE (GEM):

- The Government in 2016 had set up a dedicated e-market known as Government e-Marketplace (GeM) for the purchase of certain standard day-to-day use goods. This is a simple, transparent, and completely digital process for procurement. The General Financial Rules 2017 mandates all Ministries and Departments to procure Goods and Services available on GeM from GeM.

NEW GUIDELINES FOR REFORMS IN PUBLIC PROCUREMENT AND PROJECT MANAGEMENT:

- Apart from the purchases of common goods from GeM, the government also procures non-routine Goods, Services, and Works like construction of highways, buildings, hiring of consultants, etc.

- Keeping in mind the limitations of the earlier procurement strategy, the Government issued new guidelines for procurement and project management in October 2021, which have expanded the ambit of selecting bidders for executing government projects and procuring goods and services. The key changes in the procurement process are as follows:

- Quality and Cost Based Selection for Works and Non-consultancy Services.

- Fixing of Evaluation/ Qualification and Scoring Criteria under QCBS for Works and Non-consultancy Services.

- Stringent deadlines for making payments.

- Single bid rejection.

- Fixed Budget-based Selection for Consultancy Services.

HIGHLIGHTS

- The revenue receipts from the Central Government (April to November 2021) have gone up by 67.2 percent (YoY) as against expected growth of 9.6 percent in the 2021-22 Budget Estimates (over 2020-21 Provisional Actuals).

- Gross Tax Revenue registers a growth of over 50 percent during April to November 2021 in YoY terms. This performance is strong compared to pre-pandemic levels of 2019-2020 also.

- During April-November 2021, Capex has grown by 13.5 percent (YoY) with a focus on infrastructure-intensive sectors.

- Sustained revenue collection and a targeted expenditure policy have contained the fiscal deficit for April to November 2021 at 46.2 percent of BE.

- With the enhanced borrowings on account of COVID-19, the Central Government debt has gone up from 49.1 percent of GDP in 2019-20 to 59.3 percent of GDP in 2020-21 but is expected to follow a declining trajectory with the recovery of the economy.