THE INDIAN POLITY, GOVERNANCE AND SOCIAL JUSTICE

1. CHHATTISGARH’S DRAFT PANCHAYAT PROVISIONS (EXTENSION OF THE SCHEDULED) RULES, 2021.

THE CONTEXT: The Chhattisgarh government has formulated draft rules under PESA Act, 1996, terming it the Chhattisgarh Panchayat Provisions (Extension of the Scheduled) Rules, 2021.

What is the PESA Act, 1996? Why are its rules being formed in the state now?

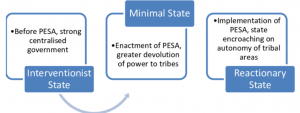

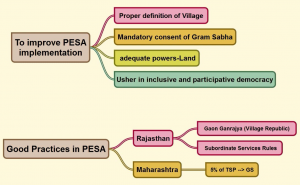

- The Panchayat (Extension of the Scheduled Areas) Act, 1996 or PESA, was enacted by the Centre to ensure self-governance through gram sabhas (village assemblies) for people living in scheduled areas.

- It legally recognises the right of tribal communities, residents of the scheduled areas, to govern themselves through their own systems of self-government, and also acknowledges their traditional rights over natural resources.

- In pursuance of this objective, PESA empowers gram sabhas to play a key role in approving development plans and controlling all social sectors.

- This includes the processes and personnel who implement policies, exercising control over minor (non-timber) forest resources, minor water bodies and minor minerals, managing local markets, preventing land alienation and regulating intoxicants among other things.

- State governments were required to amend their respective Panchayat Raj Acts without making any law that would be inconsistent with the mandate of PESA.

- Six states have formed the PESA laws, and Chhattisgarh would become the seventh state if the rules are enacted.

Issues Related to PESA:

The state governments are supposed to enact state laws for their Scheduled Areas in consonance with this national law. This has resulted in the partially implemented PESA.

- The partial implementation has worsened self-governance in Adivasi areas, like in Jharkhand.

- Many experts have asserted that PESA did not deliver due to the lack of clarity, legal infirmity, bureaucratic apathy, absence of a political will, resistance to change in the hierarchy of power, and so on.

- As per Social audits conducted across the state, In reality different developmental schemes were being approved on paper by Gram Sabha, without actually having any meeting for discussion and decision making.

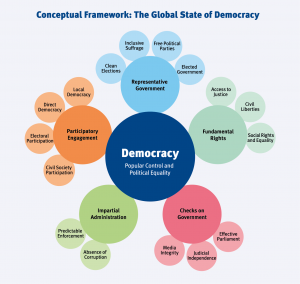

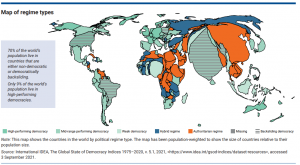

2. THE GLOBAL STATE OF DEMOCRACY REPORT, 2021.

THE CONTEXT: International Institute for Democracy and Electoral Assistance recently released the Global State of Democracy Report, 2021, where it highlighted the number of countries moving towards authoritarianism in 2020 was higher than that of countries going in the other direction, towards democracy.

THE EXPLANATION:

- “The pandemic has prolonged this existing negative trend into a five-year stretch, the longest such period since the start of the third wave of democratisation in the 1970s.

- While 20 countries moved in the direction of authoritarianism, seven countries moved towards democracy.

- The report highlighted the case of Brazil and India as “some of the most worrying examples of backsliding”.

- However, India remained in the category of a mid-level performing democracy as it has since 2000, the report showed.

- “The United States and three members of the European Union [Hungary, Poland and Slovenia] have also seen concerning democratic declines,”.

- In non-democratic regimes, the trend was deepening, “The year 2020 was the worst on record, in terms of the number of countries affected by deepening autocratisation.

- “The uneven global distribution of COVID-19 vaccines as well as anti-vaccine views undermine the uptake of vaccination programmes and risk prolonging the health crisis and normalising restrictions on basic freedoms,”.

About INDIA:

- India is the backsliding democracy with the most democratic violations during the pandemic. Violations include harassment, arrests and prosecution of human rights defenders, activists, journalists, students, academics, and others critical of the government or its policies; excessive use of force in the enforcement of Covid-19 regulations; harassment against Muslim minorities; Internet obstructions; and lockdowns, particularly in Kashmir.

Drivers of the Democratic Decline

- The rise of illiberal and populist parties in government in the last decade is a key explanatory factor in democratic backsliding and decline.

- Democratic backsliding is also linked to increasing levels of societal and political polarization and low levels of support for democracy.

- Economic crises are also tied to declining support for democracy and democratic backsliding.

- Mimicking contributes to the spread of democratic deterioration as countries tend to imitate the (anti-) democratic behaviour of others.

- The struggle to balance freedom of expression (especially through social media) with public safety, as well as the scourge of disinformation, can further democratically declines.

To curb rising authoritarianism and reverse this course, International IDEA calls for a global alliance for the advancement of democracy through a three-point agenda:

DELIVER: Government institutions, in close consultation with civil society, must take the lead in recrafting social contracts. These contracts should be the result of inclusive societal deliberation that sheds light on the gaps between what people require to meet their aspirations and what governments can currently provide.

REBUILD: Government institutions, political parties, electoral management bodies (EMBs) and media should reform democratic institutions, processes, relationships and behaviors so that they are better able to cope with the challenges of the 21st century. They should update practices in established democracies, build democratic capacity in new democracies, and protect electoral integrity, fundamental freedoms and rights, and the checks and balances essential to thriving and resilient democratic systems.

PREVENT: Government institutions, along with civil society and the media, must prevent rising authoritarianism and democratic backsliding by investing in democracy education at all levels of schooling, by buttressing the pillars of democracy that ensure accountability, including broad participation and access to information, and by actively learning from other countries’ experiences in fighting disinformation, building democratic cultures and strengthening democratic guardrails.

THE ECONOMY

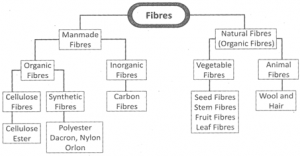

3. 12% GST RATE ON MMF

THE CONTEXT: The finance ministry has notified uniform 12 per cent GST rate on manmade fibre (MMF), yarn, fabrics and apparel, thereby addressing the inverted tax structure in the MMF textile value chain.

THE EXPLANATION:

- The GST Council, chaired by Union Finance Minister and comprising state finance ministers, had decided that the inverted duty anomalies in the textile sector would be corrected from January 1, 2022.

- Currently, tax rate on MMF, MMF yarn and MMF fabrics is 18 per cent, 12 per cent and 5 per cent, respectively.

The taxation of inputs at higher rates than finished products created build-up of credits and cascading costs. It further led to accumulation of taxes at various stages of the MMF value chain and blockage of crucial working capital for the industry. - The world textiles trade has been moving towards MMF, but India was not able to take advantage of the trend as its MMF segment was throttled by the inverted tax regime, they said, adding the correction in duty anomaly will help the segment grow and emerge as a big job provider.

What is Man Made Fibre?

- Man-made fibres Like plastics, man-made fibres are also made from polymers. Man-made fibres are not the same as natural fibres, such as silk, cotton, and wool. There are two types of man-made fibres – synthetic fibres and regenerated fibres.

- Regenerated fibres are made from cellulose polymers that occur naturally in plants such as cotton, wood, hemp, and flax. Materials like rayon and acetate two of the first manmade fibres to be produced were made from cellulose polymers. Here plant cellulose was taken and then made into fibres.

- Synthetic fibres are made only from polymers found in natural gas and the by-products of petroleum. They include nylon, acrylics, polyurethane, and polypropylene. Millions of tons of these fibres are produced all over the world each year.

Classification:

How is the textile market of India?

- India is the largest producer of cotton in the world accounting for 25% of global output

- But cotton yarn’s share in the nation’s export basket has halved since the turn of the century because of the shift from natural fibres like cotton to man-made fibres (MMF) such as polyester, viscose and Kevlar.

- India’s share in MMF based readymade garment trade is a mere 2 per cent despite the fact that it is the second-largest producer of MMF.

What steps have been taken to push the textile sector?

- The government removed the anti-dumping duty levied on purified terephthalic acid (PTA), a key raw material to make Polyester Staple Fibre.

- Mega Investment Textiles Parks (MITRA) policy, 2021– Under which seven large integrated textile parks, each spread over 1,000 acres, will be set up in the next three years benefitting both cotton and MMF segments.

- Recently, the government scrapped the anti-dumping duty on viscose staple fibre (VSF), a critical input for MMF textiles.

- Remission of Duties and Taxes on Export Products (RoDTEP) scheme – Introduced to reduce the tax burden on exporters and make them more competitive.

Connect the Dots: PLI scheme for textiles – Focussing on MMF and technical textiles was announced involving incentives worth Rs.10,683 crore.

|

About GST Council

o the vote of the Central Government shall have a weightage of one third of the total votes cast, and o the votes of all the State Governments taken together shall have a weightage of two-thirds of the total votes cast, in that meeting. |

THE SCIENCE AND TECHNOLOGY

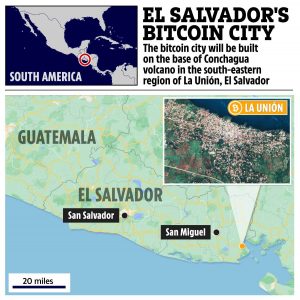

4. EL SALVADOR’S BITCOIN CITY

THE CONTEXT: President of El Salvador announced that El Salvador is the only country to recognise Bitcoin as a legal tender, is planning to build an entire city based on the largest cryptocurrency Bitcoin.

THE EXPLANATION:

- El Salvador, the only country to recognise Bitcoin as a legal tender, is planning to build an entire city based on the largest cryptocurrency Bitcoin.

- El Salvador’s “Bitcoin City” would be funded with the issuance of a $1 billion Bitcoin Bond. The city will be located along the Gulf of Fonseca near a volcano.

- NOTE: El Salvador has not had its own monetary policy since 2001 when a right-wing government made the US dollar the official currency. Along with Ecuador and Panama, El Salvador is currently among three nations in Latin America to have a ‘dollarized economy.

What is Bitcoin city? How will Salvadoran’s benefit?

- The city will be built near the Conchagua volcano to take advantage of the country’s geothermal energy— to power both the city and cryptocurrency mining —an energy-consuming process of solving complex mathematical calculations day and night to verify and add crypto coins to the Blockchain network.

- It is worth noting that El Salvador is already running a pilot Bitcoin mining venture at another geothermal power plant beside the Tecapa volcano.

- According to the President, the residents of Bitcoin city won’t have to pay any income, property, capital gains or even payroll taxes. The city would be built with attracting foreign investment in mind.

- Further, there would be residential areas, malls, restaurants and a port in the Bitcoin city. In addition, the country will have access to “digital education, technology and sustainable public transportation.

- Besides, the only tax collected there will be the value-added tax, half of which will be used to pay the municipal bonds and the rest for municipal infrastructure and maintenance. Also, he pointed out there would be “no property, income or municipal taxes and the city would have zero carbon dioxide emissions,”. However, the El Salvador president didn’t provide a timeline for the city’s creation.

What is Cryptocurrency?

- A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend.

- Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

- A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

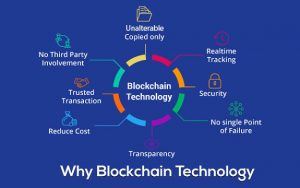

Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system. A blockchain is essentially a

digital ledger of transactions that is duplicated and distributed across the entire network of computer systems on the blockchain.

India’s stand on Cryptocurrency:

Currently, cryptocurrencies are under no regulation in India, which makes it a grey area for Indian investors. The central government had formed the inter-ministerial panel on cryptocurrency to examine the issues related to digital currencies. However, virtual currencies issued by the state may be allowed.

The RBI has repeatedly reiterated its strong views against cryptocurrencies since it gained popularity in India following a sudden boom in Bitcoin prices. The central bank’s argument is that cryptocurrencies pose serious threats to the macroeconomic and financial stability of the country. The RBI also doubted the number of investors trading on them as well their claimed market value.

THE ENVIRONMENT AND ECOLOGY

5. GANGA EXPRESSWAY GETS ENVIRONMENTAL CLEARANCE

THE CONTEXT: State-level environmental impact assessment committee in Uttar Pradesh (UP) has given Environmental Clearance (EC) for construction of ambitious Ganga Expressway project of UP government.

THE EXPLANATION:

- According to a 2006 notification of Union Ministry of Environment, environment clearance for these projects covered under the schedule was mandatory.

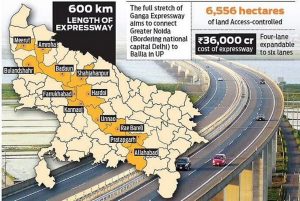

Ganga Expressway Project

- The Ganga Expressway Project is a greenfield six-lane expressway project.

- It is being built at an estimated cost of Rs 36,230 crore.

- The expressway connects Meerut in west UP to Prayagraj in east UP.

- It will be around 594 km long and 6-lane wide, which can further be expanded to eight lanes.

Environmental Clearance Process

The process of granting of environment clearance includes

- Specifying Terms of Reference(ToR).

- Preparing Environmental Impact Assessment (EIA)

- Holding Public Consultation.

THE MISCELLANEOUS

6. TRIBAL FREEDOM FIGHTERS’ MUSEUM

THE CONTEXT: Union Home Minister laid the foundation stone for setting up of the Rani Gaidinliu Tribal Freedom Fighters Museum at Luangkao village in Manipur’s Tamenglong district.

THE EXPLANATION:

- The Union Home minister also remembered the life and sacrifices made by Rani Gaidinliu whose struggle to free her people from the British began from an early age.

- Mentioning, freedom fighters of Manipur and others from northeast region, the union minister also reminded the gathering of the Central government’s decision to rename Mount Harriet, the third-highest island peak in Andaman and Nicobar Islands, where Manipur’s Maharaja Kulchandra Singh and 22 other freedom fighters were imprisoned after the Anglo-Manipur war (1891).

- Stressing the need for remembering the tribal freedom fighters, November 15 will be observed as Janjatiya Gaurav Divas every year as a mark of homage to the tribal freedom fighters of the country.

About Rani Gaidinliu

- Rani Gaidinliu, ‘daughter of the hills’ who spent 14 years in jail for India’s independence

- Rani Gaidinliu began her own version of the Non-Cooperation Movement in the 1930s among Naga tribes and made it difficult for the British administration to function in the region.

Heraka movement

- Gaidinliu was at the forefront of the Heraka movement, which was first started by her cousin Haipou Jadonang.

- Heraka was a socio-religious movement that arose in the 1920s in the Zeliangrong territory. Heraka, which literally means pure, is a monotheistic religion where the followers worshipped Tingkao Ragwang.

- It was started by Jadonang to resist the infiltration of Christian missionaries as well as the reforms imposed by the British government. He witnessed the repression by British officers, who forced the tribals into harsh labour and imposed high yearly revenue tax on every household.

- She was awarded with the Tamra Patra — an award bestowed upon distinguished individuals for their contribution to the Indian freedom struggle — in 1972 and the Padma Bhushan in 1982.

- On 17 February 1993, at the age of 79, Rani Gaidinliu passed away. In her honour, the Indian government also released a postage stamp in 1996.

PRELIMS PRACTICE QUESTIONS

- At the national level, which ministry is the nodal agency to ensure effective implementation of the Scheduled Tribes and Other Traditional Forests Dwellers (Recognition of Forest Rights) Act, 2006?

a) Ministry of Environment, Forest and Climate Change

b) Ministry of Panchayati Raj

c) Ministry of Rural Development

d) Ministry of Tribal Affairs

- ‘Right to Privacy’ is protected under which Article of the Constitution of India?

a) Article 15 b) Article 19

c) Article 21 d) Article 29

ANSWER FOR NOVEMBER 22th, 2021 PRELIMS PRACTICE QUESTIONS

Answer: A

Explanation:

- The state is “a community of persons permanently occupying a definite portion of territory, independent of external control, and possessing an organized government”

- According to Max Weber, a state is a human community that (successfully) claims the monopoly of the legitimate use of physical force within a given territory.

- The state possesses a government that has the authority to enforce a system of rules over the people living inside it. That system of rules is commonly composed of a constitution, statutes, regulations, and common law.

- Its main functions can be maintaining law, order and stability, resolving various kinds of disputes through the legal system, providing common defence, and looking out for the welfare of the population in ways that are beyond the means of the individual, such as implementing public health measures, providing mass education and underwriting expensive medical research.