About:

-

- It pertains to positions held by Members of Parliament (MPs) or Members of the Legislative Assembly (MLAs) that may provide financial benefits.

- The term originated from English Act of Settlement, 1701 and is borrowed from UK.

- The Constitution and RPA 1951 does not have a clear definition of office of profit.

- Pradyut Bordoloi vs Swapan Roy (2001): SC provides for a test to determine office of profit

- Whether the government is the one appointing the individual

- If government has authority to terminate the appointment

- If government sets remuneration for the position

Constitutional and legal provisions:

| Article 102 | It provides for disqualification of member of either House of Parliament for holding an office of profit under the Government of India. |

| Article 103 | The question of disqualification under Article 102 shall be referred to the President and his decision shall be final. |

| Article 191(1) | A person shall be disqualified if they hold an office of profit under the Government of India or any State listed in the First Schedule, unless the office has been exempted by state legislation from causing such disqualification. |

| The Parliament (Prevention of Disqualification) Act, 1959 | The Act provides for a list of offices exempted from disqualification, like: Minister of union or state Leader of opposition in the Parliament Chairman of National Commission on Minorities, for Scheduled Castes, for Scheduled Tribes, for Women, etc. |

| Representation of People Act, 1951(RPA,1951) | Disqualification from holding an office if there is some contract with the government for the supply of goods or the execution of any works undertaken by that government. |

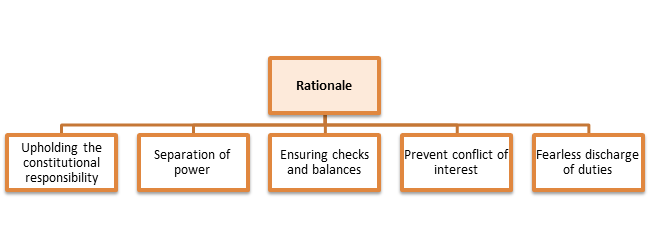

Rationale:

Examples:

-

- In 2006, SP Rajya Sabha member Jaya Bachchan was disqualified for holding the post of the Chairperson of the Uttar Pradesh Film Development Corporation.

- In 2018, 20 MLAs of the Delhi Legislative Assembly were disqualified for holding office of profit as they were appointed parliamentary secretaries.

- In 2022, Jharkhand Chief Minister accused of granting himself a stone chips mining lease, as holding an office-of-profit.

| SC Judgments:

Ø CVK Rao vs Dentu Bhaskara Rao (1964): A mining lease does not constitute a contract for the supply of goods. Ø Kartar Singh Bhadana v. Hari Singh Nalwa & Others (2001): A mining lease does not equate to the execution of a government-commissioned work. Ø Jaya Bachchan v. Union of India (2006): The SC held that an office of profit is an office capable of generating profit or financial gain. Also, the actual receipt of profit is not necessary, the potential to earn profit suffices. Ø UC Raman Case (2014): The Constitution permits the legislature to enact laws exempting certain offices of profit from disqualification. Ø Calcutta High Court Judgment (2015): Appointing legislators as parliamentary secretaries is a means to circumvent constitutional limits on the number of ministers and granting them the rank of junior ministers. Ø Bombay High Court Judgment (2009): The court ruled that appointing parliamentary secretaries with the rank and status of Cabinet Ministers violates Article 164. |

Way forward

-

- 2nd ARC: Amend the Constitution or RPA 1951 to define office of profit.

- Joint Committee of Parliament (2019) suggested some additional criteria to determine office of profit.

- Office of profit not merely a legal protection but also to ensure transparency in functioning of legislatures.