TAG: GS-3: ECONOMY & ENVIRONMENT AND ECOLOGY

THE CONTEXT: The Bureau of Energy Efficiency (BEE) launched two important guidelines in Hyderabad to help improve India’s Carbon Market, which is part of the country’s plan to fight climate change. These guidelines aim to make carbon credit trading more effective, helping India reduce greenhouse gas emissions.

EXPLANATION:

What are the Carbon Credit Trading Rules?

- The Carbon Credit Trading Rules initiative by the Ministry of Power to regulate and incentivize the reduction of greenhouse gas emissions in India. It involves the issuance and trading of carbon credits to meet emission targets.

- The Bureau of Energy Efficiency (BEE) will issue carbon credit certificates to entities surpassing their emission reduction targets.

- Carbon trade is the buying and selling of credits that permit a company or other entity to emit a certain amount of carbon dioxide or other greenhouse gases. The government authorizes it with the goal of gradually reducing overall carbon emissions and mitigating their contribution to climate change. It is mentioned under the Clean Development Mechanism.

- The objective of carbon markets is to incentivise investments in renewable energy sources. The carbon trading mechanism will mobilise domestic finance and accelerate the shift away from fossil fuels.

What is Carbon Credit?

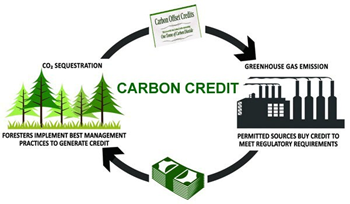

A carbon credit is a tradable permit representing the right to emit a set amount of carbon dioxide or the equivalent amount of a different greenhouse gas.

- It equals one tonne of carbon dioxide removed, reduced, or sequestered from the atmosphere.

How does carbon trading operate?

- Carbon Markets and Carbon Credits are a market-based approach to reduce the concentration of Greenhouse gases (GHG) in the atmosphere. It works by providing economic incentives for reducing the emissions of the designated pollutants.

- A carbon market allows investors and corporations to trade both carbon credits and carbon offsets simultaneously.

- When a company buys a carbon credit, they gain permission to generate more CO2 emissions. One tradable carbon credit equals one tonne of carbon dioxide, or the equivalent amount of a different greenhouse gas reduced, sequestered or avoided.

- If emissions are below the allowed limit, the emitter earns carbon credits. If emissions are above the allowed limit, the emitter must buy carbon credits from those who have excess credits.

- The idea is that this cost will force the emitters to be more efficient and reduce emission.

There are two types of carbon markets:

-

- One is a compliance market, set by “cap-and-trade” regulations at the regional and state levels.

- The other is a voluntary market where businesses and individuals voluntarily buy credits (of their own accord) to offset their carbon emissions.

Rules released by the government for Carbon trading:

- Parliament passed the Energy Conservation (Amendment) Bill, 2022 which amends the Energy Conservation Act, 2001 to empower the Government to establish carbon markets in India and specify a carbon credit trading scheme.

- Under the Bill, the central government or an authorized agency will issue carbon credit certificates to companies or even individuals registered and compliant with the scheme. These carbon credit certificates will be tradeable in nature. Other persons would be able to buy carbon credit certificates on a voluntary basis.

- A similar trading mechanism is implemented in Perform, Achieve and Trade (PAT) scheme. There are around 1,000 industries have been involved in procuring and trading energy-saving certificates (ESCerts).

Source:

Spread the Word