Financial Market

Financial markets refer broadly to any marketplace where the trading of securities occurs. There are many kinds of financial markets, including forex, money, stock, and bond markets. Financial markets create securities products that provide a return for those with excess funds (investors/lenders) and make these funds available to those needing additional money (borrowers).

Types of Financial Market

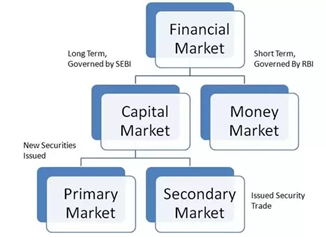

Financial Market Instruments (based on maturity or investment period)

Short-term: Investments in financial assets with maturity upto 1 year.

Long-term: Investments in financial assets with maturity of more than 1 year.

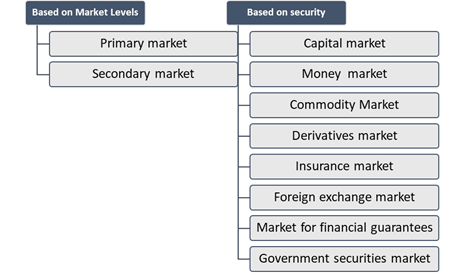

Classification of financial markets

Based on Market Levels

1. Primary Market: Issuing of securities for raising fresh capital. It is also known as ‘new issue market’.

2. Secondary Market: Trading of already issued securities through stock exchanges.

Based on Security

1. Money Market: Buying and selling of short-term financial instruments.

2. Capital Market: Involves financial instruments which are long-term.

3. Commodity Market: Marketplace for buying, selling, and trading raw materials or primary products. Eg- crude oil, metals, food grains etc.

4. Derivative Market: The financial market for derivatives, which are derived from other forms of assets.

5. Insurance Market: Securitisation of insurance and reinsurance products.

6. Foreign Exchange Market: Trading of foreign currency

7. Market for financial guarantee: Trading of financial guaranteed certificates

8. Government Securities Market: It is also known as the gilt market. Buying and selling of government securities.

Spread the Word