-

- It is a special type of financial institution that take over a portion of the debts of the bank that qualify to be recognised as Non-Performing Assets and attempts to recover the debts or associated securities by itself.

- Thus, ARCs are engaged in the business of asset reconstruction or securitisation or both.

- ARCs are registered under the RBI and regulated under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act, 2002).

- They are also known as Bad Bank.

ARCs may take following options for debt resolution:

-

- Change or takeover of the management of the business of the borrower.

- Sale or lease of non-viable business.

- Rescheduling the payment of debts – offering alternative schemes, arrangements for the payment of the same.

- Taking possession of the assets offered as security.

- Converting a portion of the debt into equity shares.

India’s Bad Bank Structure

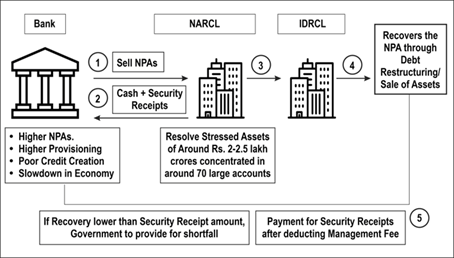

For resolution of stressed assets, the Government of India has created a twin structure of asset resolution institution in 2021:

1. National Asset Resolution Reconstruction Company Limited (NARCL): It will acquire stressed assets worth about Rs 2 lakh crore from various commercial banks in different phases. In return, NARCL will offer a mix of cash and security receipts (SRs) to the selling banks and financial institutions.

2. Indian Debt Resolution Company Limited (IDRCL): it will try to sell the stressed assets in the market which have been acquired by NARCL.

Note: If the bad bank is unable to sell the bad loan, or is forced to sell it at a loss, then the government guarantee will be invoked. For this, a government guarantee of more than Rs 30,000 crore has been created which will be in place for five years from the date of inception.

Spread the Word