Meaning

-

- Those companies which are involved in business of financial products and are not categorised as banks are known as Non-Banking Financial Companies (NBFCs).

- Most of the NBFCs are not allowed to take deposits from the public.

- The various categories of business include Business of loans and advances; insurance; buying/selling of shares, bonds and debentures; chit-fund etc.

- There are range of other activities which are undertaken by NBFCs.

- Regulation by 3 regulators:

- Loan and advances, Government Securities: By RBI

- Insurance: By Insurance Regulation and Development Authority of India (IRDAI)

- Shares, Corporate Bonds: By Securities and Exchange Board of India (SEBI)

Note:

-

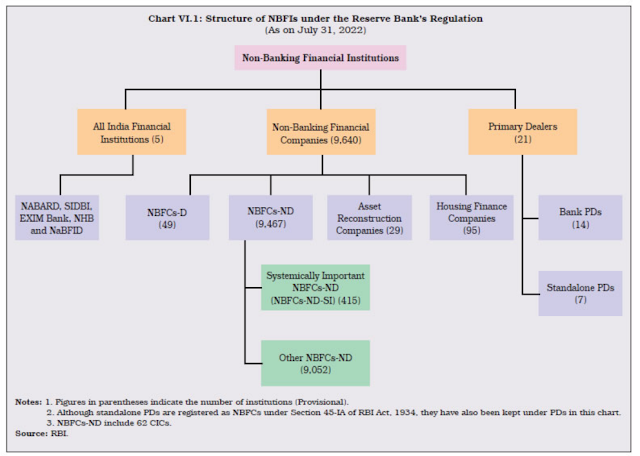

- NBFCs – D: may access public funds, either directly or indirectly through public deposits, CPs, debentures, inter-corporate deposits and bank finance.

- NBFCs – ND: They may access public funds through all of the above modes except through public deposits.

- NBFC-ND-SI: Those NBFC-ND whose asset size is of ₹ 500 crores, or more are considered as systemically important NBFCs. The rationale for such classification is that the activities of such NBFCs will have a bearing on the financial stability of the overall economy.

- Primary Dealers (PDs): They deal with the market of Government Securities (G-Secs) of both Central and State Governments.

- AIFIs: All the AIFIs are also classified as NBFCs as per RBI classification.