A. Liquidity

Liquidity in the context of money refers to how easily and quickly an asset or financial instrument can be converted into cash without significantly affecting its value. High liquidity means an asset can be sold rapidly with little to no loss in value. Cash is considered the most liquid asset because it can be used immediately for transactions and does not need to be converted into another form to be spent.

In terms of various aggregates of money supply, decreasing order of Liquidity: M0 > M1 > M2 > M3 > M4

B. Money Multiplier

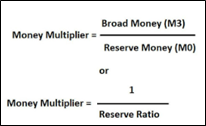

The money multiplier quantifies how an initial deposit in a bank can lead to a greater increase in the total money supply. This occurs because banks are able to lend out a portion of the deposits they receive, which then get redeposited in the banking system and loaned out again, creating an infinite geometric series.

The money multiplier is an important concept for central banks when conducting monetary policy. By adjusting reserve requirements or engaging in open market operations, central banks can influence the amount of money that banks can create, thereby affecting the overall money supply and economic activity.

It is the ratio of Broad Money to Reserve Money (M3/M0) or it is the reciprocal of the Reserve Ratio (or the Cash Reserve Ratio).

C. Legal Tender

A legal tender is a medium of payment which is accepted by a legal system for making payments in order to meet the financial obligation. It is a form of payment that is recognised by the government in order to pay for any kind of debt or the financial obligation.

Spread the Word