-

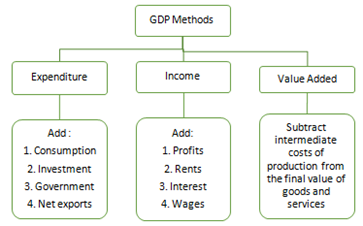

Product Method (or Value-Added Method):

Also known as Output method.

-

- Gross Value Added is calculated for all sectors of economy.

- Where, GVA (or GDPMP) = Value of Output of al the sectors – Intermediate Consumption respective sectors.

- Intermediate consumption is subtracted to avoid Double Counting.

| Changes in GDP calculation methodology in 2015

o Change of base year from 2004-2005 to 2011-2012 o Calculation GVA at Basic Price and Market Price instead of Factor Cost · The National Statistical Office (NSO) will measure GDP by the gross value added (GVA) method at basic prices instead of at factor cost. · The industry-wise estimates will be presented as gross value added (GVA) at basic prices while GDP at market prices will be referred to as GDP. |

-

Income Method:

Also known as Distribution method.

-

- Rent, Wages, Interest and Profits

- Official Classification: Compensation to Employees (wages, salaries, EPF contributions), Operating Surplus (Rent, Interest, Profits), Mixed Income of Self-employed (like – farmers income, professionals etc)

-

Expenditure Method:

Also known as Total Outlay method

Total national expenditure is accounted for to compute GDP.

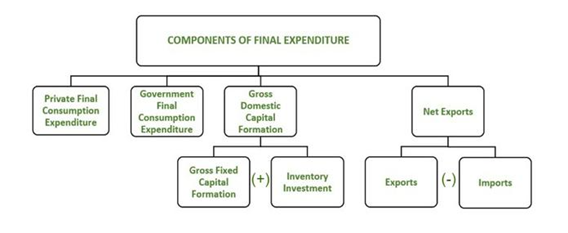

| GDPMP = C + I + G + (X-M) |

C- Private Final Consumption Expenditure (or Consumption Expenditure)

I- Gross Fixed Capital Formation (or Investment)

G- Government spending or Government Final Consumption Expenditure

X-M – Net Exports (Exports or X – Imports or M)

- Private Final Consumption Expenditure (PFCE)

-

- It is the total final household consumption expenditure and final consumption expenditure of other private non-profit institutions on various types of consumer goods and services, including durable (except houses, as any expenditure incurred on the purchase or construction of houses occupied by owners comes under Gross Fixed Capital Formation), non-durable, semi-durable goods and services.

- It also includes all the domestic and international expenditures incurred by citizens of a country.

- This means that if a resident of India consumes anything even on foreign land, it will be added up in this component of expenditure, whereas consumption by a foreigner on Indian land will be subtracted from PFCE.

| PFCE = Household Final Consumption Expenditure + Non-profit Private Institutions Final Consumption Expenditure |

Gross Fixed Capital Formation (GFCF)

-

- It is the expenditure borne in acquiring fixed assets, such as machinery and equipment for any production unit (Gross Business Fixed Investment).

- It also includes expenditure incurred in purchasing a new house by the household (Gross Residential Construction Investment) and in generating public investments, like in the construction of roads, bridges, railways, etc., by the government (Gross Public Investment).

- Inventory Investment is the change in the stock of finished and semi-finished goods. It is viewed as an investment as the good has been produced but has not yet been consumed.

| GFCF= Gross Business Fixed Investment + Gross Residential Construction Investment + Gross Public Investment + Inventory Investment |

-

Government Final Consumption Expenditure (GFCE)

-

- The government spends money on the development and maintenance of various administrative and infrastructural services like defense, education, roads, law and order, as well as on various welfare schemes.

- Thus, this component measures the expenditure incurred by the government of an economy on these services for its functioning.

- Essentially, these expenditures are consumption in nature as there is an absence of creation of liquidation of assets or liabilities.

-

Net Exports (X – M)

-

- An economy often trades goods through exports and imports with other economies to take comparative advantage and promote healthy market competition.

- Net export is derived as the difference between the export and import of an economy for a given year.

- Exports (X) are the foreign expenditure on the consumption of domestic goods, and since they are produced in domestic territory, it is added to the total output.

- Imports (M) are the domestic expenditure incurred from the consumption of foreign goods, as it is produced in foreign territory, they must be excluded from the total output of the domestic economy.

Spread the Word