1. Social Inclusion:

Social inclusion is the process of improving the terms on which individuals and groups take part in society—improving the ability, opportunity, and dignity of those disadvantaged on the basis of their identity. It includes removing the visible and invisible barrier for equitable opportunity to be presented to all the section of the society to ensure upward mobility in the economic ladder.

2. Social Cohesion:

Social cohesion refers to the extent of connectedness and solidarity among groups in society. It identifies two main dimensions: the sense of belonging of a community and the relationships among members within the community itself. In the context of economic development, social cohesion leads to increased bargaining power which are essential for higher wages. Higher wages are needed for increased consumption demand that should be more broad-based. Moreover, social cohesion also reflects that the critical role of government in allocating resources to the groups which may otherwise get marginalised and excluded.

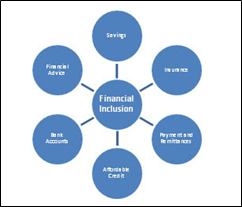

3. Financial Inclusion:

Financial inclusion refers to efforts to make financial products and services accessible and affordable to all individuals and businesses, regardless of their economic capabilities. It means delivering financial products like transactions, payments, savings, credit and insurance – in a responsible and sustainable way. Financial inclusion has been identified as an enabler for 7 of the 17 Sustainable Development Goals.

4. Digital financial inclusion:

It involves the deployment of the cost-saving digital means to reach currently financially excluded and underserved populations with a range of formal financial services suited to their needs that are responsibly delivered at a cost affordable to customers and sustainable for providers. Wider reach of digital payments and identification systems is the core architecture behind ensuring seamless access to digitally available financial products and services.

Spread the Word