Day-656

Quiz-summary

0 of 5 questions completed

Questions:

- 1

- 2

- 3

- 4

- 5

Information

DAILY MCQ

You have already completed the quiz before. Hence you can not start it again.

Quiz is loading...

You must sign in or sign up to start the quiz.

You have to finish following quiz, to start this quiz:

Results

0 of 5 questions answered correctly

Your time:

Time has elapsed

You have reached 0 of 0 points, (0)

Categories

- Not categorized 0%

- 1

- 2

- 3

- 4

- 5

- Answered

- Review

-

Question 1 of 5

1. Question

1. Consider the following statements:

1. India is the fourth largest oilseeds producer in the world.

2. India meets more than 50% of its edible oil demand through imports.

3. The production of oilseeds in India has declined in the last five years.

4. The National Mission on Edible Oils focuses on the expansion of area under soyabean plantation.

How many of the above statements are correct?Correct

Answer: B

Explanation:

Statement 1 is correct: India is the fourth largest oilseeds producer in the world after the US, China and Brazil. It has 20.8% of the total area under cultivation globally, accounting for 10% of global production. The country produces groundnut, soybean, sunflower, sesamum, Niger seed, mustard, and safflower oilseeds.

Statement 2 is correct: India meets more than 50 per cent of its domestic requirements of edible oils through imports. The country imports palm oil from Indonesia and Malaysia. It imports soyabean oil from Argentina and Brazil. India is the largest importer of palm, soyabean and sunflower oil in the world.

Statement 3 is incorrect: The production of oilseeds in India has been growing for the last five years. In 2022-23, the production of the country was 40.9 million tonnes. From the years 2015-16 to 2022-23, the compound annual growth rate (CAGR) of production was 5%. This was achieved due to the implementation of various programs like special programmes on mustard & rapeseed during Rabi and cluster demonstrations of improved technology by the Government of India. The largest oilseed-producing states in India include Andhra Pradesh, Gujarat, Haryana, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Uttar Pradesh, and West Bengal.

Statement 4 is incorrect: The National Mission on Edible Oils, launched in 2021, is aimed at enhancing the edible oilseeds production and oils availability in the country by harnessing Oil Palm area expansion. The scheme is presently operational in 15 states nationwide, covering a potential area of 21.75 lakh hectares.Incorrect

Answer: B

Explanation:

Statement 1 is correct: India is the fourth largest oilseeds producer in the world after the US, China and Brazil. It has 20.8% of the total area under cultivation globally, accounting for 10% of global production. The country produces groundnut, soybean, sunflower, sesamum, Niger seed, mustard, and safflower oilseeds.

Statement 2 is correct: India meets more than 50 per cent of its domestic requirements of edible oils through imports. The country imports palm oil from Indonesia and Malaysia. It imports soyabean oil from Argentina and Brazil. India is the largest importer of palm, soyabean and sunflower oil in the world.

Statement 3 is incorrect: The production of oilseeds in India has been growing for the last five years. In 2022-23, the production of the country was 40.9 million tonnes. From the years 2015-16 to 2022-23, the compound annual growth rate (CAGR) of production was 5%. This was achieved due to the implementation of various programs like special programmes on mustard & rapeseed during Rabi and cluster demonstrations of improved technology by the Government of India. The largest oilseed-producing states in India include Andhra Pradesh, Gujarat, Haryana, Karnataka, Madhya Pradesh, Maharashtra, Rajasthan, Tamil Nadu, Uttar Pradesh, and West Bengal.

Statement 4 is incorrect: The National Mission on Edible Oils, launched in 2021, is aimed at enhancing the edible oilseeds production and oils availability in the country by harnessing Oil Palm area expansion. The scheme is presently operational in 15 states nationwide, covering a potential area of 21.75 lakh hectares. -

Question 2 of 5

2. Question

2. It is a negotiable certificate representing shares in a foreign company traded on a local stock exchange. It allows investors to hold equity shares of foreign companies without the need to trade directly on a foreign market. It provides the benefits and rights of the underlying shares, which can include voting rights and dividends.

Which of the following financial instruments is being described above?Correct

Answer: C

Explanation:

Depository receipts are financial instruments that represent shares of a foreign company. They trade in the local market in which these are issued and are denominated in local currency.

A company delivers equity shares to a bank that places the security in its custodian account in the domicile country. The bank then issues DRs against such shares in the overseas market.

Example: American Depository Receipts are certificates issued by a U.S. bank that represents shares in foreign stock. These certificates trade on American stock exchanges.Incorrect

Answer: C

Explanation:

Depository receipts are financial instruments that represent shares of a foreign company. They trade in the local market in which these are issued and are denominated in local currency.

A company delivers equity shares to a bank that places the security in its custodian account in the domicile country. The bank then issues DRs against such shares in the overseas market.

Example: American Depository Receipts are certificates issued by a U.S. bank that represents shares in foreign stock. These certificates trade on American stock exchanges. -

Question 3 of 5

3. Question

3. Consider the following:

1. Veblen goods

2. Giffen goods

3. Normal goods

How many of the above-mentioned goods-type follow the law of demand principle?Correct

Answer: A

Explanation:

The law of demand states that quantity purchased varies inversely with price, i.e. as price increases, quantity demanded decreases and vice versa.

Veblen goods: Veblen goods are luxury goods whose desire to buy increases as their prices rise. This is because of the exclusive nature of the goods and their consumption represents status symbols in the society. For example, super luxury cars, Yachts, etc. They do not follow the law of demand.

Giffen goods: Giffen goods’ demand increases as price increases and vice-versa, thus they do not follow the law of demand. Examples include potato and other staple goods. These goods have low substitutes and form a high percentage of a household’s budget. This phenomenon is witnessed in low- income households as the increase in their prices leaves less money for other goods. Hence, households buy more of these goods to compensate for other goods.

Normal Goods: Normal goods are those which follow the law of demand. Their demand increases as price decreases and vice versa. For example, milk, shoes, clothes, etc.Incorrect

Answer: A

Explanation:

The law of demand states that quantity purchased varies inversely with price, i.e. as price increases, quantity demanded decreases and vice versa.

Veblen goods: Veblen goods are luxury goods whose desire to buy increases as their prices rise. This is because of the exclusive nature of the goods and their consumption represents status symbols in the society. For example, super luxury cars, Yachts, etc. They do not follow the law of demand.

Giffen goods: Giffen goods’ demand increases as price increases and vice-versa, thus they do not follow the law of demand. Examples include potato and other staple goods. These goods have low substitutes and form a high percentage of a household’s budget. This phenomenon is witnessed in low- income households as the increase in their prices leaves less money for other goods. Hence, households buy more of these goods to compensate for other goods.

Normal Goods: Normal goods are those which follow the law of demand. Their demand increases as price decreases and vice versa. For example, milk, shoes, clothes, etc. -

Question 4 of 5

4. Question

4. Consider the following:

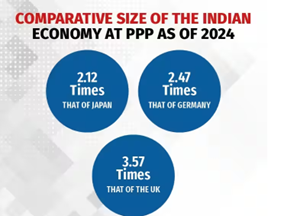

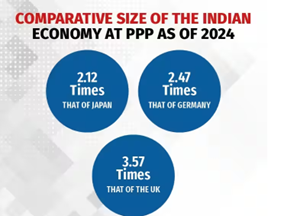

Statement-I: While India is the third largest economy in PPP (Purchasing Power Parity) terms, it is the fifth largest economy in nominal terms.

Statement-II: PPP takes into account the difference in the cost of living, which is lower in India.

Which one of the following is correct in respect of the above statements?Correct

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Statement 1 is correct: India is the third-largest economy in the world in terms of purchasing power parity (PPP), while it is fifth largest globally in nominal terms.

Purchasing Power Parity or PPP refers to an economic theory that compares the economic productivity and living standards of different countries using the basket of goods approach. The PPP exchange rate is the rate at which the currency of one country would have to be converted into that of another country to buy the same amount of goods and services in each country.

According to the IMF, the PPP exchange rate of India is 23.37 per dollar against the market exchange rate of 83.45 per dollar.

A PPP-based GDP takes into consideration the factor price-based exchange rate. In India, our wages are low, products are cheaper and so PPP based exchange rate will be lower or in other words, the purchasing value of our currency in the domestic economy is higher.

● Take an example of a Big Mac burger: Suppose in the USA, it costs $7 dollars. In India, McDonalds sells their highest priced burger similar to Big Mac for Rs 150 rupees.

● Let’s the market or nominal exchange rate of Rs 80 per dollar.

● So, we see there the Big Mac is costing around (7×80)=Rs 560 and in India it is Rs 150 rupees. So the ppp-based GDP of India will be overstated by (560/150) times the nominal GDP here.

Thus, Statement 2 is correct: PPP takes into account the difference in cost of living, which is lower in India due to lower wages and other factor prices.

India now accounts for 6.7 percent of world GDP in terms of PPPs, compared to 16.4 percent and 16.3 percent, respectively, for China and the United States. The PPP figure is what offers a unique, and optimistic trend, for Indians as it shows the relatively strong purchasing power in domestic currency, implying that the average Indian faces a comfortable cost of living.Incorrect

Answer: A

Explanation:

Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

Statement 1 is correct: India is the third-largest economy in the world in terms of purchasing power parity (PPP), while it is fifth largest globally in nominal terms.

Purchasing Power Parity or PPP refers to an economic theory that compares the economic productivity and living standards of different countries using the basket of goods approach. The PPP exchange rate is the rate at which the currency of one country would have to be converted into that of another country to buy the same amount of goods and services in each country.

According to the IMF, the PPP exchange rate of India is 23.37 per dollar against the market exchange rate of 83.45 per dollar.

A PPP-based GDP takes into consideration the factor price-based exchange rate. In India, our wages are low, products are cheaper and so PPP based exchange rate will be lower or in other words, the purchasing value of our currency in the domestic economy is higher.

● Take an example of a Big Mac burger: Suppose in the USA, it costs $7 dollars. In India, McDonalds sells their highest priced burger similar to Big Mac for Rs 150 rupees.

● Let’s the market or nominal exchange rate of Rs 80 per dollar.

● So, we see there the Big Mac is costing around (7×80)=Rs 560 and in India it is Rs 150 rupees. So the ppp-based GDP of India will be overstated by (560/150) times the nominal GDP here.

Thus, Statement 2 is correct: PPP takes into account the difference in cost of living, which is lower in India due to lower wages and other factor prices.

India now accounts for 6.7 percent of world GDP in terms of PPPs, compared to 16.4 percent and 16.3 percent, respectively, for China and the United States. The PPP figure is what offers a unique, and optimistic trend, for Indians as it shows the relatively strong purchasing power in domestic currency, implying that the average Indian faces a comfortable cost of living. -

Question 5 of 5

5. Question

5. Consider the following:

1. Increase in capital outflows from India

2. Improvement in foreign exchange reserves

3. Appreciation of Indian currency

4. Increased risk of imported inflation for India

How many of the above-mentioned scenarios can be the likely effects of ‘quantitative easing’ by the US Fed on the Indian economy?Correct

Answer: B

Explanation:

Quantitative easing is a monetary policy strategy used by central banks like the Federal Reserve in which a central bank purchases securities in an attempt to reduce interest rates, increase the supply of money and drive more lending to consumers and businesses.

During quantitative easing, the Indian economy can witness:

• Increase in capital inflows and not capital outflows: This is because reduction in interest rates by the US Fed makes it lucrative for the investors to invest in the Indian market.

• Improvement in foreign exchange reserves: Increase in capital inflows to the Indian market results in increase in foreign exchange reserves.

• Appreciation of Indian currency: When there is an inflow of capital into a country, it increases the demand for the local currency, which leads to an appreciation of the currency.

• There is no increased risk of imported inflation: This is because high capital inflows lead to increase in the value of domestic currency (here Indian rupee). This makes the imported goods cheaper. There is a high risk of imported inflation in case of depreciation of currency.Incorrect

Answer: B

Explanation:

Quantitative easing is a monetary policy strategy used by central banks like the Federal Reserve in which a central bank purchases securities in an attempt to reduce interest rates, increase the supply of money and drive more lending to consumers and businesses.

During quantitative easing, the Indian economy can witness:

• Increase in capital inflows and not capital outflows: This is because reduction in interest rates by the US Fed makes it lucrative for the investors to invest in the Indian market.

• Improvement in foreign exchange reserves: Increase in capital inflows to the Indian market results in increase in foreign exchange reserves.

• Appreciation of Indian currency: When there is an inflow of capital into a country, it increases the demand for the local currency, which leads to an appreciation of the currency.

• There is no increased risk of imported inflation: This is because high capital inflows lead to increase in the value of domestic currency (here Indian rupee). This makes the imported goods cheaper. There is a high risk of imported inflation in case of depreciation of currency.