TAG: GS 3: ECONOMY

THE CONTEXT: The Reserve Bank of India (RBI) recently released its financial stability report highlighting changes in banks’ Liquidity Coverage Ratio (LCR) and other key indicators affecting financial stability.

EXPLANATION:

Liquidity Coverage Ratio (LCR) and its Decline

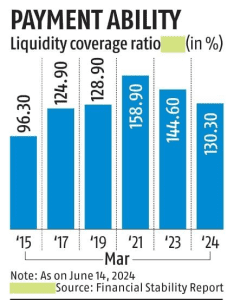

- The LCR refers to the ratio of high-quality liquid assets (HQLA) held by banks to cover their net cash outflows over a 30-day stress period.

- It is a critical measure ensuring banks have sufficient liquidity to withstand financial stress.

- According to the RBI report, the LCR of banks in India declined from 135.7% in September 2023 to 130.3% in March 2024.

- This decline indicates a slight reduction in banks’ ability to cover their short-term obligations under stressed conditions.

- Private Banks: Specifically, private banks saw their LCR drop to 126.9% by March 2024, recovering from a low of 118.8% in the previous financial year’s third quarter.

- This highlights varying liquidity management challenges across different segments of the banking sector.

Factors Influencing LCR

- The RBI report identified weakening efficiency indicators among banks, attributed to rising staff costs and an increased cost-to-income ratio.

- Despite holding substantial liquidity buffers above regulatory requirements, banks’ LCR was affected negatively.

Regulatory Response and Future Outlook

- RBI’s Response

- RBI Governor announced plans to review the LCR framework to enhance liquidity risk management by banks.

- A draft circular is expected to outline these enhancements, aiming to strengthen financial resilience in the face of economic uncertainties.

- Credit-Deposit (CD) Ratio Analysis

- The report also highlighted the credit-deposit (CD) ratio, a measure indicating the extent of funds deposited by customers that are extended as loans by banks.

- Current CD Ratio: As of May 31, 2024, the incremental CD ratio for scheduled commercial banks stood at 90.8%, showing a high proportion of deposits being utilized for lending activities.

- Correlation with SLR: The report noted a negative correlation between the CD ratio and banks’ excess Statutory Liquidity Ratio (SLR) holdings, suggesting potential implications for liquidity management strategies.

- Financial Stability Implications

- The decline in LCR, coupled with a high CD ratio, underscores the importance of robust liquidity risk management frameworks for banks.

- It also emphasizes the need for regulatory oversight to ensure adequate liquidity buffers while facilitating credit growth to support economic activities.