1. DEPOSIT INSURANCE COVER FOR PREPAID PAYMENT INSTRUMENT (PPIs)

TAG: GS 3: ECONOMY

THE CONTEXT: An RBI-appointed committee has recommended that the central bank should examine the extension of Deposit Insurance and Credit Guarantee Corporation (DICGC) cover to PPIs, which, at present, is available only to bank deposits.

EXPLANATION:

- The committee said the RBI has authorised a number of banks and non-banks entities to issue PPIs in the country recently. The money kept in wallets is in the nature of deposits. However, currently, the DICGC cover extends only to bank deposits.

- Prepaid Payment Instrument (PPI) holders may soon get protection for their money against any fraud or unauthorised payment transactions.

What are PPIs?

- PPIs are instruments that facilitate the purchase of goods and services, conduct of financial services and enable remittance facilities, among others, against the money stored in them. PPIs can be issued as cards or wallets.

- There are two types of PPIs – small PPIs and full-KYC (know your customer) PPIs. Further, small PPIs are categorized as – PPIs up to Rs 10,000 (with cash loading facility) and PPIs up to Rs 10,000 (with no cash loading facility).

- PPIs can be loaded/reloaded by cash, debit to a bank account, or credit and debit cards. The cash loading of PPIs is limited to Rs 50,000 per month subject to the overall limit of the PPI.

Who can issue PPI instruments?

- PPIs can be issued by banks and non-banks after obtaining approval from the RBI. As in November, 2022, over 58 banks including Airtel Payments Bank, Axis Bank, Bank of Baroda, Jio Payments Bank, Kotak Mahindra Bank, Standard Chartered Bank, UCO Bank and Union Bank have been permitted to issue and operate prepaid payment instruments.

- There are 33 non-bank PPI issuers. Some of the non-bank PPI issuers are Amazon Pay (India), Bajaj Finance, Delhi Metro Rail Corporation Ltd, Manappuram Finance Ltd, Ola Financial Services, Razorpay Technologies and Sodexo SVC India Pvt.

What is Deposit Insurance and Credit Guarantee Corporation (DICGC)?

- DICGC is a wholly-owned subsidiary of the RBI and provides deposit insurance. The deposit insurance system plays an important role in maintaining the stability of the financial system, particularly by assuring the small depositors of the protection of their deposits in the event of a bank failure.

- The deposit insurance extended by DICGC covers all commercial banks including local area banks (LABs), payments banks (PBs), small finance banks (SFBs), regional rural banks (RRBs) and co-operative banks, that are licensed by the RBI.

What does the DICGC insure?

- DICGC insures all deposits such as savings, fixed, current and recurring including accrued interest. Each depositor in a bank is insured up to a maximum of Rs 5 lakh for both principal and interest amount held by them as on the date of liquidation or failure of a bank.

- The earlier insurance cover provided by DICGC was Rs one lakh. However, the limit of insurance cover for depositors in insured banks was raised to Rs 5 lakh in 2020.

2. SMART BANDAGE

TAG: GS 3: SCIENCE AND TECHNOLOGY

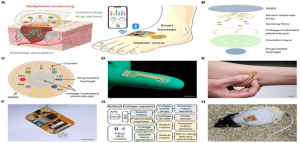

THE CONTEXT: A wearable, wireless, flexible “smart bandage” as big as a finger can deliver drugs while monitoring the healing status of wounds and transmitting data to a smartphone.

EXPLANATION:

- A normal bandage heals by slowly closing wound as the body repaired it, restoring the skin to nearly its initial condition. It consists of various stages in which different skin cells participate.

- Sometimes, complications from conditions like diabetes, insufficient blood supply, nerve damage, and immune system dysfunction can impair wound healing, resulting in chronic wounds.

- In March 2023, a study was published in Science Advances that offered to help accelerate healing in such cases using a wearable, wireless, mechanically flexible “smart bandage” as big as a finger.

What is a smart bandage and how it works?

- This device is built in Dr. Gao’s lab, is assembled on a soft, stretchable polymer that helps the bandage maintain contact with and stick to the skin. The bioelectronic system consists of biosensors that monitor biomarkers in the wound exudate. (Exudates are the fluids exiting the wound.)

- Data collected by the bandage is passed to a flexible printed circuit board, which relays it wirelessly to a smartphone or tablet for review by a physician. A pair of electrodes control drug release from a hydrogel layer as well as stimulate the wound to encourage tissue regrowth.

- In the new design, the researchers enclosed the sensors in a porous membrane, protecting their parts and increasing their operational stability.

- Biosensors determine the wound status by tracking the chemical composition of the exudates, which changes as the wound heals. Additional sensors monitor the pH and temperature for real-time information about the infection and inflammation.

- The wireless nature of the device sidesteps the problems of existing electrical stimulation devices, which usually require bulky equipment and wired connections, limiting their clinical use.

- The researchers tested the properties of their bandage in vitro. They loaded an antimicrobial substance onto the hydrogel platform, and found it – using the bandage’s features – to be effective against a variety of bacteria commonly associated with chronic wounds. Investigations using skin cells showed that the bandage’s electrical stimulation did enhance tissue regeneration.

- It doesn’t have to be removed frequently to monitor the status and apply antibiotics.

3. COMMISSION OF RAILWAY SAFETY (CRS)

TAG: PRELIMS PERSPECTIVE

THE CONTEXT: Investigation into the recent tragic train accident in Odisha, the deadliest train crash in India in over two decades, is being conducted by the Commissioner of Railway Safety for the south-eastern circle. Rail safety commissioners are part of the Commission of Railway Safety (CRS), a government body that acts as the railway safety authority in the country.

EXPLANATION:

Commission of Railway Safety:

- CRS deals with matters related to safety of rail travel and operations, among some other statutory functions – inspectorial, investigatory, and advisory – as laid down in the Railways Act, 1989.

- Investigating serious train accidents is one of the key responsibilities of the CRS, which is headquartered in Lucknow, Uttar Pradesh.

- However, CRS does not report to the Ministry of Railways of the Railway Board. It is, in fact, under the administrative control of the Ministry of Civil Aviation (MoCA). The reason or principle behind this, put simply, is to keep the CRS insulated from the influence of the country’s railway establishment and prevent conflicts of interest.

Early days of railways in India and safety oversight:

- The first railways in India came into being in the 1800s and were constructed and operated by private companies.

- At the time, the British Indian government appointed ‘consulting engineers’ for effective control and oversight of the developing railway network and operations. Their job was to ensure efficiency, economy, and safety in railway operations in India.

- Later, when the British Indian government undertook construction of railways in the country, the consulting engineers were re-designated as ‘government inspectors’, and in 1883, their position was recognised statutorily.

- In the first decade of the twentieth century, the Railway Inspectorate was placed under the Railway Board, which was established in 1905.

- As per the Indian Railway Board Act, 1905, and a notification by the then Department of Commerce and Industry, the Railway Board was entrusted with powers and functions of the government under various sections of the Railway Act and was also authorised to make rules for railway operations in India. This effectively made the Railway Board the safety controlling authority for railways in India.

Separation of safety supervision function and Railway Board:

- The Government of India Act, 1935 said that functions for securing the safety of railway operations, both for the travelling public and personnel operating the railways, should be performed by an authority independent of the federal railway authority or the Railway Board. These functions included conducting railway accident probes. But due to the outbreak of the Second World War in 1939, the idea did not take off and the Railway Inspectorate continued to function under the control of the Railway Board.

- In 1939, a panel headed by the then chief inspecting officer of the British Railways, A.H.L. Mount, suggested that the separation of the Railway Inspectorate from the Railway Board.

Transfer of Railway Inspectorate from Railway Board’s control

- In 1940, the Central Legislature endorsed the idea and principle of separation of the Railway Inspectorate from the Railway Board, and recommended that the senior government inspectors of the railways should be placed under the administrative control of a different authority under the government.

- Consequently, in May 1941, the Railway Inspectorate was separated from the Railway Board and put under the administrative control of the then Department of Posts and Air.

- Since then, the Inspectorate, which was re-designated as the CRS in 1961, has been under the control of the central ministry exercising control over civil aviation in India.

4. UNIFIED PORTAL FOR ‘GOBARdhan’

TAG: PRELIMS PERSPECTIVE

THE CONTEXT: The union minister for Jal Shakti launched the unified registration portal for ‘GOBARdhan’ which will act as a one stop repository to assess investment and participation in biogas or compressed biogas (CBG) sector at pan-India level and streamline the process of setting up biogas plants in India.

EXPLANATION:

- Any government, cooperative or private entity operating or intending to setup a biogas, CBG or Bio CNG plant in India can obtain a registration number by enrolling in the unified registration portal.

- The registration number will enable availing of multitude of benefits and support from the ministries and departments of government of India.

- States have been advised to get their CBG/Biogas plant operators registered on the portal on priority to avail existing and upcoming support from the Centre.

- It is an example of cooperative federalism as the stakeholder central ministries, all line departments of centre and states have come together in development and deployment of the portal.

Galvanizing Organic Bio-Agro Resources Dhan (GOBARdhan)

- It is a Jan Andolan on Safe Management of Cattle and other Biodegradable Waste in Rural India.

- It is a umbrella initiative of government of India, based on the whole of government approach and aims to convert waste to wealth towards promoting circular economy.

- Centre intends to build a robust ecosystem for setting up Biogas/Compressed Biogas (CBG)/ Bio-Compressed Natural Gas (CNG) plants to drive sustainable economic growth.

- GOBARdhan scheme is being pursued as a national programme priority under Swachh Bharat Mission Grameen-Phase II.

- Department of Drinking Water and Sanitation is working with Ministry of New and Renewable Energy, Ministry of Petroleum and Natural Gas, Department of Animal Husbandry and Dairying, Department of Agriculture, Cooperation and Farmers Welfare, Department of Agricultural Research and Education, Department of Rural Development, state governments, public and private sector institutions and village communities to give this a shape of “Jan Andolan” so that community collective action on GOBARdhan is achieved. I

Objectives of GOBARdhan:

- To support villages safely manage their cattle and agricultural waste, and make the villages clean

- To support communities in converting cattle and organic waste into wealth using treatment systems.

- To convert organic waste, especially cattle waste, to biogas and organic manure for use in rural areas

- To promote environmental sanitation and curb vector-borne diseases through effective

disposal of waste in rural areas - To promote rural employment and income generation opportunities by involving entrepreneurs, SHGs and youth groups in seƫting up, operating and managing GOBARdhan units

Benefits:

- Manages waste: Helps manage the major solid waste in villages, i.e, cattle dung, and promotes environmental sanitation

- Generates organic manure: Helps generate organic manure, which boosts agriculture and farm

productivity - Increases employment: Promotes employment and income generation opportunities for SHGs/

farmers groups - Improves savings: Promotes household income and savings as the use of biogas as fuel will

cut down the LPG cost - Protects health: Substantially reduces the incidence of vector-borne diseases and promotes

public health

5. KERALA FIBRE OPTICAL NETWORK (KFON)

TAG: PRELIMS PERSPECTIVE

THE CONTEXT: The Kerala government officially launched the Kerala Fibre Optical Network (KFON), one of its flagship projects to ensure high speed broadband internet access to all houses and government offices.

EXPLANATION:

- Through KFON, Kerala, which was the first state to declare the right to internet as a basic right, aims to reduce the digital divide by ensuring high speed broadband internet access to all houses and government offices.

- It is also intended to give a fillip to e-governance and accelerate Kerala’s journey towards being a knowledge-based economy.

What is KFON?

- KFON will act as an infrastructure provider. It is an optical fibre cable network of 30,000 kms, with 375 Points-of-Presence across Kerala.

- The KFON infrastructure will be shared with all service providers, including cable operators. While KFON will do the cable work for government offices, individual beneficiaries will have to depend on private, local internet service providers.

- The KFON infrastructure would also benefit private service providers, as they can use its cable network. Internet connectivity to the households would be provided by local ISP/TSP/cable TV providers.

- KFON promises an internet speed from 10 mbps to 10 Gbps.

Beneficiaries:

- In the first phase, it was aimed to provide Internet connections to 14,000 BPL families, with 100 each from the State’s 140 assembly constituencies.

- The panchayats and the urban local bodies were given the responsibility of choosing the beneficiaries.

- Each household will get 1.5 GB of data per day at 15 Mbps speed.

Who are the stakeholders?

- The KFON project is a joint venture of Kerala State Electricity Board and Kerala State IIT Infrastructure Limited.

- The project implementation was taken up by a consortium led by Central PSU Bharat Electronics Limited. PriceWaterhouseCoopers is the consultant of the project.

- While KSITIL would be responsible for the operations and maintenance of the project, the infrastructure asset shall be owned by KSEBL.

- BEL is the system integrator for the KFON project. BEL has taken the tasks of rolling Optical fibre cable network, setting up network point of presence locations and providing connectivity to government institutions.

- BEL would be in charge of operation and maintenance of the project for seven years. The project is fully funded by Kerala Infrastructure Investment Fund Board (KIIFB), the state government agency for funding infrastructure projects.

What services will it provide?

- The aim of the KFON is to create a core network infrastructure (information highway) with non-discriminatory access to all service providers, and to ensure a reliable, secure and scalable intranet connecting all government of offices and educational institutions.

- Its major services are connectivity to government offices, leasing of dark fibre, internet leased line, fibre to the home, wifi hotspots, colocation of assets under network operating centres and Point-of-Presences, internet protocol television, OTT, and cloud hosting.

- The Union Department of Telecommunications had provided Infrastructure Provider (category one) licence as well as the Internet Service Provider licence (category B) to the KFON.

- The IP licence allowed the KFON to obtain fibre optic lines (dark fibre), towers, duct space, network and other related infrastructure facilities for establishing an optic fibre network.