1. EXPECTED CREDIT LOSS (ECL)-BASED LOAN LOSS PROVISIONING FRAMEWORK

TAGS: GS 3: ECONOMY

THE CONTEXT: Banks have sought a one-year extension from the Reserve Bank of India (RBI) for implementation of the Expected Credit Loss (ECL)-based loan loss provisioning framework.

EXPLANATION:

- In January 2023 the RBI came out with a draft guidelines proposing adoption of expected credit loss approach for credit impairment and gave banks one year period after the final guidelines are released for implementation of expected credit loss approach for loss provisioning.

Present framework of incurred loss method:

- At present, banks set aside money after an asset turns bad, and once the new system is put in place, it is widely expected to have an one time impact on bank profit.

- Credit risk losses are bifurcated into two types: expected loss and unexpected loss. Expected loss refers to the amount of loss anticipated on a loan or portfolio of loans and is mitigated using policies, risk pricing and provisions. Unexpected loss is addressed through regulatory capital.

- Currently, banks in India follow the incurred loss approach IRAC norms as prescribed by the Reserve Bank of India (RBI) in accounting for losses on loans and other financial assets. This approach, however, is not aligned with IFRS 9 and Ind AS 109.

- Incurred loss approach is based on the principle that losses are uncertain and difficult to predict, and that they should be recognised when they are certain to have occurred. Accordingly, even if a loan has a high risk of default and expected to result in a loss, the loss will not be recognised until the borrower actually defaults and the loss is incurred.

What is EXPECTED CREDIT LOSS (ECL)-BASED LOAN LOSS PROVISIONING FRAMEWORK

- ECL is a method of accounting for credit risk that is based on the loss that is likely to occur on a loan or portfolio of loans. It is used to estimate potential future losses on financial assets and to recognise those losses in financial statements. It represents the probability weighted estimate of the present value of all cash shortfalls from an instrument.

- In simple terms, ECL is calculated by estimating the forward-looking probability of default for each loan, and then multiplying that probability by the likely loss given default, which is the percentage loss that is expected to occur if the borrower defaults. The resulting value multiplied by the likely exposure at default is the expected loss for each loan, and the sum of these values is the expected loss for the entire portfolio.

- It recognises losses on loans as soon as they are expected to occur, regardless of whether the borrower has actually defaulted.

- The other key differentiator in the computation of provision for credit loss is that ECL factors in the historical credit quality of the lender, while incurred loss approach does not consider the same.

- The ECL models adopted by banks will be subject to rigorous validation as well as process-based checks, and to prudential regulatory floors.

Draft Guidelines:

- The RBI has proposed that banks will be allowed to design own credit loss models and spread the higher provisions over a five-year period under a newer system of setting aside money for lending.

- The banks will also have to make provisions for delays made by borrowers in their repayments under the proposed framework, in addition to existing provisioning requirement.

- This may lead to increased provisioning as the lenders will have to calculate estimated loss of interest income and provide for them.

- Under the ECL norms, banks will be required to classify financial assets (primarily loans, including irrevocable loan commitments, and investments classified as held-to-maturity or available-for-sale) into one of the three categories – Stage 1, Stage 2, and Stage 3, depending upon the assessed credit losses on them, at the time of initial recognition as well as on each subsequent reporting date and make necessary provisions.

- The RBI also proposed to introduce a transitional arrangement for introduction of ECL norms in order to avoid a capital shock.

Applicability of norms

- The measures will be applicable to banks’ loans and advances, including sanctioned limits under revolving credit facilities, lease receivables, financial guarantee contracts and investments in the debt and equity markets and investments classified as held-to-maturity or available-for-sale.

2. APPOINTMENT OF UNION PUBLIC SERVICE COMMISSION (UPSC) CHAIRMAN

TAGS: PRELIMS PERSPECTIVE

THE CONTEXT: Manoj Soni, a former Vice-Chancellor of two universities in Gujarat, was on May 16, 2023 sworn in as the Chairman of the Union Public Service Commission (UPSC). He was already serving as the Chairman in charge since April 2022. He had joined the UPSC as a member in June 2017.

EXPLANATION:

ABOUT UNION PUBLIC SERVICE COMMISSION (UPSC)

- Article-315 to Article 323 provides for elaborate provisions of constitutional body of Public Service Commission for the Union and a Public Service Commission for each State.

- The Union Public Service Commission is headed by a chairman, and it can have a maximum of 10 members.

- It shall be the duty of the Union and the State Public Service Commissions to conduct examinations for appointments to the services of the Union and the services of the State respectively.

- It shall also be the duty of the Union Public Service Commission, if requested by any two or more States so to do, to assist those States in framing and operating schemes of joint recruitment for any services for which candidates possessing special qualifications are required.

- The expenses of the Union or a State Public Service Commission, including any salaries, allowances and pensions payable to or in respect of the members or staff of the Commission, shall be charged on the Consolidated Fund of India or, as the case may be, the Consolidated Fund of the State

Appointment and term of office of members:

- Article-316 provides for appointment and term of office of members.

- The Chairman and other members shall be appointed by President and in the case of a State Commission by the Governor of the State.

- It is provided that as nearly as may be one-half of the members of every Public Service Commission shall be persons who have held office for at least ten years either under the Government of India or under the Government of a State.

- The terms and conditions of service of chairman and members of the Commission are governed by the Union Public Service Commission (Members) Regulations, 1969.

- Every member holds office for a term of six years or until he attains the age of sixty-five years, whichever is earlier.

Removal of Members

- A member of a Public Service Commission may be removed from his office in the manner provided in clause (1) or clause (3) of article 317.

- The chairman and any other member of the Commission can submit his resignation at any time to the President of India.

- He may be removed from his office by the President of India on the ground of misbehaviour (only if an inquiry of such misbehavior is made and upheld by Supreme Court) or if he is adjudged insolvent, or engages during his term of office in any paid employment outside the duties of his office, or in the opinion of the President unfit to continue in office by reason of infirmity of mind or body.

Further reappointment:

- Chairman of the Union Public Service Commission shall be ineligible for further employment either under the Government of India or under the Government of a State.

- Chairman of a State Public Service Commission shall be eligible for appointment as the Chairman or any other member of the Union Public Service Commission or as the Chairman of any other State Public Service Commission, but not for any other employment either under the Government of India or under the Government of a State.

- A person who holds office as a member of a Public Service Commission shall, on the expiration of his term of office, be ineligible for reappointment to that office.

- Member other than the Chairman of the Union Public Service Commission shall be eligible for appointment as the Chairman of the Union Public Service Commission or as the Chairman of a State Public Service Commission, but not for any other employment either under the Government of India or under the Government of a State.

- Member other than the Chairman of a State Public Service Commission shall be eligible for appointment as the Chairman or any other member of the Union Public Service Commission or as the Chairman of that or any other State Public Service Commission, but not for any other employment either under the Government of India or under the Government of a State.

Functions of UPSC

- It shall be consulted on all matters relating to methods of recruitment to civil services and for civil posts.

- It shall be consulted on the principles to be followed in making appointments to civil services and posts and in making promotions and transfers from one service to another and on the suitability of candidates for such appointments, promotions or transfers.

- It shall be consulted on all disciplinary matters affecting a person serving under the Government of India or the Government of a State in a civil capacity, including memorials or petitions relating to such matters.

- It shall be consulted on any claim by or in respect of a person who is serving or has served under the Government of India or the Government of a State or under the Crown in India or under the Government of an Indian State, in a civil capacity, that any costs incurred by him in defending legal proceedings instituted against him in respect of acts done or purporting to be done in the execution of his duty should be paid out of the Consolidated Fund of India, or, as the case may be, out of the Consolidated Fund of the State.

- It shall be consulted on any claim for the award of a pension in respect of injuries sustained by a person while serving under the Government of India or the Government of a State or under the Crown in India or under the Government of an Indian State, in a civil capacity, and any question as to the amount of any such award.

3. LAUNCH OF NVS-01 SATELLITE

TAGS: GS 3: SCIENCE AND TECHNOLOGY

THE CONTEXT: The Indian Space Research Organisation (ISRO) will fly NVS-01 to augment the seven-satellite navigation constellation NavIC on May 29, 2023.

EXPLANATION:

- Five years after launching the last navigation satellite in 2018, ISRO is gearing up to launch a new one from Sriharikota to replace an old satellite.

- The aim is to maintain a constellation of functional seven satellites needed to keep its navigation system operational and running.

NVS-01 satellite:

- ISRO is likely to launch NVS-01, a navigation satellite on-board from the Geosynchronous Launch Vehicle or GSLV Mk-II.

- This will be a return flight mission for the GSLV launch vehicle, which will carry the next generation NavIC satellite.

- The NVS-01 satellite will replace the navigational capabilities of another satellite IRNSS-1G in the constellation that was launched in 2016 and has a mission life of 12 years.

- IRNSS-1G was the seventh navigation satellite of the seven satellites constituting the IRNSS space segment. Its predecessors—IRNSS-1A, 1B, 1C, 1D, 1E and 1F—were launched by PSLV-C22, PSLV-C24, PSLV-C26, PSLV-C27, PSLV-C31 and PSLV-C32

- It will retain its communication and messaging capabilities.

Navigation with Indian Constellation (NavIC):

- At present, there are four major global navigation system the US global positioning system, the Russian GLONASS, the European Galileo, and the Chinese Beidou. There are two regional navigational systems in the world Japan’s Quasi-Zenith system and India’s Navic.

- It is a regional navigation satellite system and was established by ISRO which was earlier known as Indian Regional Navigation Satellite System (IRNSS).

- It aims to meet the “positioning, navigation and timing” requirement of the nation.

- NavIC is designed with a constellation of seven satellites and a network of ground stations operating 24×7. Three satellites of the constellation are placed in geostationary orbit and four satellites are placed in inclined geosynchronous orbit.

- The ground network consists of a control centre, precise timing facility, range and integrity monitoring stations, two-way ranging stations, etc.

- NavIC offers two services–standard position service (SPS) for civilian users and Restricted Service (RS) for strategic users. These two services are provided in both L5 (1176.45 MHz) and S band (2498.028 MHz).

- NavIC coverage area includes India and a region up to 1,500km beyond Indian boundary.

- NavIC signals are designed to provide user position accuracy better than 20m and timing accuracy better than 50ns(nano second).

- NavIC SPS signals are interoperable with the other global navigation satellite system (GNSS) signals of GPS (US), Glonass (Russia), Galileo (Europe) and BeiDou.

- Two frequencies, the L5 and S bands, are used by the seven satellites in the NavIC constellation so far to provide positioning information. These satellites’ replacements, the new NVS-01 satellites and later, will also have L1 frequency. Even less sophisticated, consumer-grade gadgets like smartwatches can pick up the L1 signal, which is the oldest and most reliable GPS signal. The use of NavIC in devices for civilian use can therefore increase with this band.

- NavIC is better than GPS in some aspects. While GPS can get you within 20 metres of your target, NaVIC is more accurate and can get you even closer within 5 metres. However, unlike GPS, which can be used anywhere in the world, NaVIC is regional and can only be used within India and up to 1,500 km from its borders.

4. NEW GOODS AND SERVICES TAX (GST) COMPLIANCE MEASURES

TAGS: GS 3: ECONOMY

THE CONTEXT: In two significant measures to curb tax evasion and increase compliance under the Goods and Services Tax (GST) regime, the government has decided to lower the threshold for businesses to generate e-invoice for business-to-business (B2B) transactions, from Rs 10 crore to Rs 5 crore, and has rolled out the automated return scrutiny module for GST returns in a backend application for central tax officers.

EXPLANATION:

- Amid rising instances of GST frauds and cases of fake invoices, these changes are expected to broaden the compliance mandate for more businesses, especially small and medium enterprises and help boost the GST revenue collections.

Recent changes:

->Automated return scrutiny module:

- Finance Minister in a review of the Central Board of Indirect Taxes & Customs (CBIC), had given directions to roll out an automated return scrutiny module for GST returns at the earliest.

- This will enable the officers to scrutinize GST returns of centre-administered taxpayers selected on the basis of data analytics and risks identified by the system.

- This will display discrepancies on account of risks associated with a return to the tax officers. They will interact with the taxpayers through the GSTN common portal for communication of discrepancies noticed in returns and subsequent action in form of either issuance of an order of acceptance of reply or issuance of show cause notice or initiation of audit/ investigation.

->Changes for e-invoicing:

- The government has also lowered the threshold for businesses to generate e-invoice for business-to-business (B2B) transactions to Rs 5 crore from Rs 10 crore under GST. The changes will come into effect from August 1. 2023.

- At present, businesses with turnover of Rs 10 crore and above are required to generate e-invoice for all B2B transactions.

->What is e-invoicing?

- The GST Council in its 37th meeting in September 2019 had approved the standard of e-invoice with the primary objective to enable interoperability across the entire GST ecosystem.

- Under this, a phased implementation was proposed to ensure a common standard for all invoices, that is, an e-invoice generated by one software should be capable of being read by any other software and through machine readability, an invoice can then be uniformly interpreted.

- With a uniform invoicing system, the tax authorities are able to pre-populate the return and reduce the reconciliation issues.

- With a high number of cases involving fake invoices and fraud availment of input tax credit, GST authorities have pushed for implementation of this e-invoicing system to help to curb the actions of tax evaders and reduce the number of frauds as the tax authorities will have access to data in real-time.

- E-invoicing was initially implemented for large companies with turnover of over Rs 500 crore, and within three years the threshold has now been lowered to Rs 5 crore.

- E-invoicing for B2B transactions was made mandatory for businesses with turnover of over Rs 500 crore from October 1, 2020. Then it was extended to businesses with turnover of over Rs 100 crore from January 1, 2021, after which it was extended to businesses with turnover of over Rs 50 crore from April 1, 2021, and then the threshold was lowered to Rs 20 crore from April 1, 2022. It was further reduced to Rs 10 crore from October 1, 2022.

- Reduction in the e-invoicing threshold is seen as an important factor for boosting GST revenue collections and checking frauds, it will also increase compliance requirements for smaller businesses.

GOODS AND SERVICES TAX (GST) COUNCIL:

- It has been provided in the Constitution (One Hundred and First Amendment) Act, 2016 that the GST Council, in discharge of various functions, shall be guided by the need for a harmonized structure of GST and for the development of a harmonized national market for goods and services.

- As per Article 279A, the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities/disasters, special provisions for certain States, etc

GST Council which will be a joint forum of the Centre and the States, shall consist of the following members: –

- a) Union Finance Minister – Chairperson

- b) The Union Minister of State, in-charge of Revenue of finance – Member

- c) The Minister In-charge of finance or taxation or any other Minister nominated by each State Government – Members

Working of council:-

The Constitution (One Hundred and First Amendment) Act, 2016 provides that every decision of the GST Council shall be taken at its meeting by a majority of not less than 3/4th of the weighted votes of the Members present and voting. The vote of the Central Government shall have a weightage of 1/3rd of the votes cast and the votes of all the State Governments taken together shall have a weightage of 2/3rd of the total votes cast in that meeting. One half of the total number of members of the GST Council shall constitute the quorum at its meeting.

The Council is empowered to make recommendations to the Union and the States on the following:-

(a) the taxes, cesses and surcharges levied by the Union, the States and the local bodies which may be subsumed in the goods and services tax

(b) the goods and services that may be subjected to, or exempted from the goods and services tax

(c) model Goods and Services Tax Laws, principles of levy, apportionment of Integrated Goods and Services Tax and the principles that govern the place of supply

(d) the threshold limit of turnover below which goods and services may be exempted from goods and services tax

(e) the rates including floor rates with bands of goods and services tax

(f) any special rate or rates for a specified period, to raise additional resources during any natural calamity or disaster

(g) special provision with respect to the States of Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand

(h) the date on which GST shall be levied on petroleum crude, high speed diesel, motor spirit (petrol), natural gas and aviation turbine fuel

(i) any other matter relating to the goods and services tax, as the Council may decide.

5. THAWING PERMAFROST

TAGS: GS 3: ENVIRONMENT

THE CONTEXT: With rising global temperatures, thawing permafrost is likely to destabilise thousands of industrial sites and linked contaminated areas in the Arctic, which could result in the spread of toxic substances across the region, according to a new study. The study, ‘Thawing permafrost poses environmental threat to thousands of sites with legacy industrial contamination’, was published in the journal Nature Communications.

EXPLANATION:

What is Permafrost?

- Permafrost is essentially any ground that stays frozen 0 degree Celsius or lower for at least two years straight.

- Permafrost can be found both on land and beneath the ocean’s surface. It can be found in locations where the temperature rarely rises above freezing. This indicates that permafrost is common in Arctic locations such as Greenland, Alaska, Russia, China, and Eastern Europe.

- According to the National Aeronautics and Space Administration (NASA), permafrost is composed of “a combination of soil, rocks and sand that are held together by ice. The soil and ice in permafrost stay frozen all year long.” However, although the ground remains perennially frozen, permafrost regions aren’t always covered with snow.

- As Earth’s climate warms, the permafrost is thawing. That means the ice inside the permafrost melts, leaving behind water and soil. Thawing permafrost can have dramatic impacts on our planet and the things living on it.

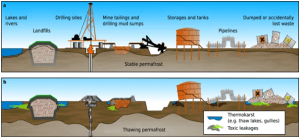

Findings of the study:

- Because of the characteristics of permafrost, countries and corporations began building infrastructure on the Arctic’s permafrost. The region witnessed a further expansion of industrial and economic development during the Cold War, it became a centre for resource extraction and military activities. This led to the accumulation of industrial and toxic waste on or in permafrost which was never removed.

- The known industrial waste types in the region include drilling and mining wastes, toxic substances like drilling muds and fluids, mine waste heaps, heavy metals, spilled fuels, and radioactive waste.

- But as the Arctic is getting warmer nearly four times as fast as the rest of the planet due to climate change, permafrost is thawing rapidly, which could destabilise not only the industrial sites but also the contaminated areas.

- And once the destabilisation takes place, toxic substances would be unleashed across the region, threatening numerous species living there and the health of people who depend on them.

- According to the report, current models predict that “a pulse of carbon released” from permafrost to the atmosphere will occur within the next hundred years, if not sooner. It is unknown how much carbon will be released from permafrost in the coming years.

Other consequences of thawing permafrost:

- One of its most dangerous consequences is the release of greenhouse gases into the atmosphere. A 2022 report by NASA said, “Arctic permafrost alone holds an estimated 1,700 billion metric tons of carbon, including methane and carbon dioxide. That’s roughly 51 times the amount of carbon the world released as fossil fuel emissions in 2019.”

- A 2022 study by Columbia University observed that thawing permafrost would unleash thousands of dormant viruses and bacteria. Some of these “could be new viruses or ancient ones for which humans lack immunity and cures, or diseases that society has eliminated, such as smallpox or Bubonic plague.

- Furthermore, Plant matter frozen in permafrost does not decay, however, when permafrost thaws, microbes within the dead plant material begin to break down the matter, releasing carbon into the atmosphere.