THE CONTEXT: In January 2023, The RBI released the annual ‘State Finances – A Study of Budgets’ report for 2022-23. The focus of this report is ‘Capital Formation in India – The Role of States’. The report highlights that the States have been spending a greater share of their Gross State Domestic Product (GSDP) on capital expenditure compared to the Centre. In this article, we will analyse the report comprehensively and take the major outcomes of the report. Also, at last we will provide the way forward after analyzing the report on State finances.

ABOUT THE REPORT

The Reserve Bank of India (RBI) released the Report titled “State Finances: A Study of Budgets of 2022-23”, an annual publication that provides information, analysis and an assessment of the finances of State governments for 2022-23 against the backdrop of actual and revised/provisional accounts for 2020-21 and 2021-22, respectively. The theme of this year’s Report is “Capital Formation in India – The Role of States”.

KEY HIGHLIGHTS OF THE REPORT

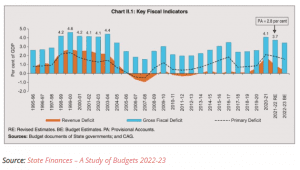

- The fiscal health of the States has improved from a sharp pandemic-induced deterioration in 2020-21 on the back of a broad-based economic recovery and resulting high revenue collections – States’ gross fiscal deficit (GFD) is budgeted to decline from 4.1 per cent of gross domestic product (GDP) in 2020-21 to 3.4 per cent in 2022-23.

- States’ debt is expected to decrease to 29.5 per cent of GDP in 2022-23 as against 31.1 per cent in 2020-21, it is still higher than 20 per cent recommended by FRBM Review Committee, 2018.

- States are anticipating an increase in non-tax revenue, which is generated from sources such as fees, fines, and royalties such as State GST, excise taxes and sales taxes in the 2022-2023 fiscal year.

- In 2022-23, States have budgeted higher capital outlay than in 2019-20, 2020-21 and 2021-22. Going forward, increased allocations for sectors like health, education, infrastructure and green energy transition can help expand productive capacities if States mainstream capital planning rather than treating them as residuals and first stops for cutbacks in order to meet budgetary targets.

- It is worthwhile to consider creating a capex buffer fund during good times when revenue flows are strong so as to smoothen and maintain expenditure quality and flows through the economic cycle.

- To crowd in private investment, the State governments may continue to focus on creating a congenial ecosystem for the private sector to thrive. States also need to encourage and facilitate higher inter-state trade and businesses to realise the full benefit of spillover effects of State capex across the country

COMPREHENSIVE ANALYSIS OF THE REPORT

STATES HAVE A HIGHER CAPEX TO GDP RATIO COMPARED TO CENTRE

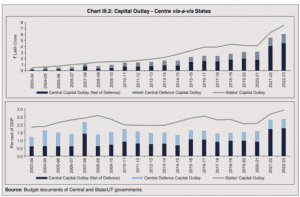

Data indicates that the Capital Expenditure as a share of GDP is higher for the States (all States) compared to the Centre’s Capital Outlay (CO). In 2022-23, the average Capital Outplay of States is 2.7% of GDP compared to 2.4% of the Centre. In recent years, there has been a higher proportionate increase in the Centre’s CO as a share of GDP but is still lower than that of States’. If the Central Defence CO is excluded, the gap widens further.

The individual state’s share of CO out of the total share of CO is provided in the report. Uttar Pradesh has the highest share, followed by Maharashtra, Madhya Pradesh, Karnataka, and Tamil Nadu. Also provided in the report is the ratio of each state’s share of CO and the respective states’ share of GSDP.

DECREASING TREND IN PROPORTION OF ACTUAL CAPEX OF STATES COMPARED TO BUDGET ESTIMATES

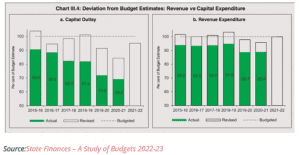

While the data indicates that the States do have a longer trend of higher allocation towards capital outlay compared to the Centre, the actual expenditure is less than the initial budget estimates. Trends indicate there the proportion of Actuals compared to the estimates (both Budget & Revised) is decreasing.

During 2015-16, the Actual Capital outlay was 90.6% of the BE. However, in the following years, there has been a steady decline. In 2019-20, the Actuals were only about 72% of the BE. In the pandemic year of 2020-21, it fell further to 69.2%. The actuals for 2021-22 would be provided by the states in the budget for 2023-24, to be presented in the following days to weeks. The budget for 2023-24 would tell us if this trend has reversed following the pandemic year.

Comparatively, the proportion of Actual Revenue spending compared to the BE is higher, although there is a declining trend even in this case.

Large variation exists between the states with respect to Actual vs Budgetary capital outlay. Among the large States, Punjab and Andhra Pradesh have cut down their actual Capex compared to the BE by about 40%. Bihar & Chhattisgarh are the other states which have on average reduced their actual capital outlay compared to their estimates. Meanwhile, Haryana, Madhya Pradesh and Karnataka have managed to spend better on capital outlays in proportion to their initial estimates.

INCREASE IN CAPEX TOWARDS HEALTH POST-PANDEMIC

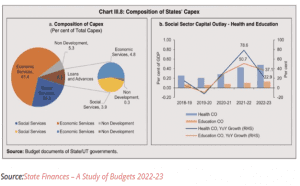

- The COVID-19 pandemic highlighted the importance of investing in Health Infrastructure. The alignment of states’ spending towards this can be seen with an increased Capital outlay for Health. Out of the total CapEx of the states, Economic services constitute the major portion with about 61%. Expenditure on Social Services, of which Health constitute a part, is about a quarter of the total capital spending.

- There is an increased allocation towards Health as a proportion of GDP in recent years. There is a 79% y-o-y increase in CO to GSDP ratio in 2021-22 compared to the earlier year.

- Although not at the same proportion, there is also an increase in the capital outlay towards another important Social Service i.e., Education.

- While the overall capital outlay of States shows an encouraging trend, there exists a large variation among the states. Among the large states, Haryana, Punjab, and Madhya Pradesh have a higher CO to GSDP ratio towards health. These states also have a higher share of outlay on Health out of the total capital outlay, compared to other major states.

WITH AN IMPROVED FISCAL POSITION, NEED FOR THE STATES TO IMPROVE THEIR CAPEX

- The Study of State Budgets report indicates an improved fiscal position of the States after the pandemic-induced stress. It reports increased revenues and more prudent expenditure by the states. The Gross Fiscal Deficit (GFD) was 4.1% of GSDP in 2020-21. The RE indicates a fall in GFD to 3.7% in 2021-22, with a further estimated fall in 2022-23. As indicated earlier, the actuals for 2021-22 of the States would be known once the budgets for 2023-24 are presented by all the states.

- The report highlights that with the States’ capital expenditure having a higher share of the total country’s capital expenditure (Centre + States), there is more emphasis on the States having a larger contribution to the Capital formation. Education, health, Infrastructure and Green Energy are a few of the sectors in which increased allocation of capital expenditure can be made to help expand productive capacities as well as create a broader development agenda for the States.

STRUCTURAL PROBLEMS IN FISCAL MANAGEMENT OF STATES

VERTICAL FISCAL IMBALANCE BETWEEN THE CENTRE AND THE STATES

- The constitutional allocation of taxation powers between the Centre and the States is based on some economic and administrative considerations such as minimising/avoiding the problem of double taxation, tax rivalry among States, and duplication of tax administration.

- While determining expenditure responsibilities, subjects of regional concern, such as law and public order, agriculture, irrigation, public health and sanitation, roads and bridges are assigned to States due to their proximity to the local issues.

- However, this allocation of taxation powers and expenditure responsibilities between the Centre and the States creates an imbalance referred to as vertical fiscal imbalance. States have the responsibility of development in areas such as education, health, agricultural and industrial growth, construction of roads, bridges and irrigation schemes, etc. However, their revenue raising powers to meet these expenditure responsibilities are inadequate.

- This led to States’ growing dependence on transfers from the Centre to finance their expenditure commitments. The expenditure policies of States are also influenced by the Centre under the objectives of planning (Centrally Sponsored Schemes).

HORIZONTAL IMBALANCES DUE TO DIFFERENCES IN REVENUE GENERATION CAPACITIES AND EXPENDITURE COMMITMENTS ACROSS STATES

- The existence of region-specific disparities as well as diverse socioeconomic structure across States causes variations in resource mobilisation and expenditure responsibilities across States. Populist fiscal measures such as non-levy of certain taxes, differences in tax rates, and State-specific expenditure schemes, also contribute to the differences in revenue generating capacity and expenditure commitments across States. These differences create fiscal imbalances, commonly referred to as horizontal fiscal imbalances.

DOMINANCE OF COMMITTED EXPENDITURE

- The revenue expenditure of States is dominated by committed expenditures such as interest payments, administrative services and pension. Higher committed expenditure resulted in deficit on the revenue account of the States.

MEASURES SUGGESTED BY RBI IN THE REPORT

- Debt consolidation which would help lower overall interests costs, simplify payments, and make it is easier to pay off the debt. Debt consolidation means combining more than one debt obligation into a new loan with a favourable term structure such as a lower interest rate.

- Allocating more resources to key sectors such as healthcare, education, infrastructure, and green energy, the states can promote economic growth and

- State governments can promote investment through both direct and indirect channels. The direct channel involves spending on physical infrastructure and human capital. The indirect channels act by crowding in private investment, promoting good governance, and attracting foreign direct investment (FDI).

- State should establish a fund during strong revenue growth which can be used to buffer capital expenditure. The purpose of this fund would be to maintain a consistent level of spending on capital projects.

- Creating a favourable environment for the Private sector to operate and grow through proper policies implementation and regulations that make it easy for private companies to do business ,as well as providing incentives and support for private investment.

- States also need to encourage and facilitate higher inter-state trade and commerceto realize the full benefit of spillover effects of state capex across the country.

THE WAY FORWARD

TAKING ADVANTAGE OF THE PRESENT SITUATION

- The fiscal health of States has rebounded from pandemic induced stress, aided by buoyant revenue collections and prudent expenditure management. These developments have extended into 2022-23 so far.

- A coincident indicator of this sustained improvement is that market borrowings are much lower than in the indicative calendar due to comfortable cash flow positions of the States, boosted by timely payment of GST compensation by the Centre (May and November 2022) and release of two advance instalments of tax devolution (August and November 2022).

- The States need to take advantage of this ‘sweet spot’ by building up fiscal buffers and stepping up capex.

CREATING A CAPEX BUFFER

- Going forward, increased allocations of capital expenditure for sectors like health, education, infrastructure and green energy transition can help expand productive capacities and create a broad-based developmental agenda for the States. Outlays on social services and physical infrastructure can enhance productivity; hence, States must mainstream capital planning rather than treating them as residuals and first stops for cutbacks in order to meet budgetary targets.

- In this context, it is worthwhile to consider creating a capex buffer fund during good times when revenue flows are strong so as to smoothen and maintain expenditure quality and flows through the economic cycle.

STEP TOWARDS CLIMATE GOVERNANCE

- Climate change is another area that deserves special attention in the coming years. There is a growing recognition of the need for responsible climate change policies at the State level in areas such as clean energy, energy efficiency, clean transport, and sustainable land use, among others.

- Capacity building on access to finance and climate governance would help States meet their potential and realise the committed national target of net zero emissions by 2070.

STEPS SHOULD BE TAKEN STEP TOWARDS SUSTAINABLE DEVELOPMENT GOALS (SDGS)

- The COVID-19 pandemic, geopolitical events and global spillovers from synchronised aggressive monetary policy tightening have stalled the progress on Sustainable Development Goals (SDGs). Going ahead, India’s commitment to achieve the SDG goals by 2030 is heavily conditioned by policies and actions adopted by the States. With the Centre’s recent thrust towards ‘SDG Localisation’2 , States are now better equipped to orient their spending and investment patterns towards areas requiring attention.

- Capital expenditure by States in critical areas, viz., health, education, infrastructure, R&D and green energy transition holds the key to India achieving the SDGs.

SETTING UP OF STATE FINANCE COMMISSIONS (SFC)

- As a part of institutional reforms, State governments need to set up Finance Commissions (SFC) in a regular and timely manner to decide on the assignment of taxes, fees and other revenues to local governments.

- Institutionalisation of a well defined and timely devolution mechanism to local governments can improve the provision of quality services for the greater public good.

RESEARCH AND DEVELOPMENT (R&D)

- States also need to step up their expenditure on research and development (R&D) from the current lows compared to global peers so as to spur innovation and progress.

THE CONCLUSION: Over the years, considerable progress has been made in terms of creation of infrastructure, both physical and social, through several government initiatives. In particular, the post-pandemic economic recovery in India has been supported by enhanced public capex by both the Central and State governments. As a result, fiscal stimulus by design emphasized sustainable and non-inflationary normalization of economic activity. Also, States should also step up capex in areas like research and development and green energy. States can also realize the full benefit of positive spillover effects by facilitating higher inter-state trade and businesses. Going ahead, all tiers of government must engage along with private participation to create world-class capital assets in India.

JUST ADD TO KNOW YOUR KNOWLEDGE

WHAT IS GROSS FISCAL DEFICIT?

- The gross fiscal deficit (GFD) is the excess of total expenditure including loans net of recovery over revenue receipts (including external grants) and non-debt capital receipts. Since 1999-2000, GFD excludes States’ share in small savings as per the new system of accounting.

- A decrease in GFD is generally considered a positive sign as it indicates that the state government is able to balance its revenue and expenditure more effectively.

- It is calculated by subtracting total revenue from total expenditure.

QUESTIONS FOR MAINS EXAMINATION:

- According the the Report titled “State Finances: A Study of Budgets of 2022-23”, States have been spending a greater share of their GSDP on capital expenditure compared to the Centre. Explain the reasons behind it.

- The lack of financial capacity of states has become a significant problem in recent times. Discuss the reasons behind it and also suggest measures to solve this problem.