THE CONTEXT: India experienced a power crisis in October 2021, as the stock of coal held by the country’s thermal power plants has hit critically low levels. Many power plants are operating with zero reserve stock or with stocks that could last just a few days. Some States have witnessed partial load-shedding aimed at saving power. This article analyses the reasons behind the coal shortage and provides the way forward for ensuring an uninterrupted power supply in the country.

ABOUT THE COAL CRISIS

How bad is the problem?

- According to data released by the Central Electricity Authority, as of 13th October 2021, India’s 135 thermal power plants overall had on average coal stock that would last just four days.

- The government usually mandates the power plants to hold stocks that would last at least two weeks. It has, however, reduced this requirement to 10 days now to avoid hoarding and ensure a more equitable distribution of coal among the plants.

- India relies on coal to meet over 70% of its power needs, and Coal India Limited (CIL) supplies over 80% of the total coal.

- The current coal crisis comes amid a broader energy crisis across the world, with the prices of natural gas, coal and oil rising sharply in the international market.

Is it a “crisis” or shortage?

- “Crisis” is a subjective term. There are no objective criteria for determining whether there is a crisis or not. However, “shortage” can be determined objectively.

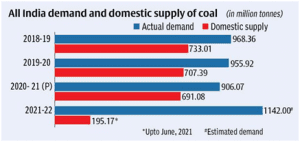

- No one can deny the fact that the supply of coal in India is well below the demand. Whereas the demand is nearly a billion million tonnes (MT), the country’s supply is well below 800 MT.

- When this shortage becomes acute, in terms of the availability of coal at power plants, it is sometimes called a crisis.

- The acute shortage can be on account of production, increased demand or a failure of supply chain management when the stocks are sufficient at the pit head but requisite supply is not made to the power plants.

ANALYSIS

What are the reasons behind the present crisis?

- The current crisis in the availability of coal has been the result of lacklustre domestic production and a sharp drop in imports over the last few years.

- According to BP Global Energy Statistics, domestic coal production in India has stagnated since 2018. At the same time, the amount of coal imported from other countries to meet domestic demand, too, has dropped significantly. In fact, the government last year said it would stop all coal imports by FY24.

- Reasons also include short-term issues like flooding in coal-mining areas, transport issues, labour disruptions in major coal-mining countries and the sudden rise in power demand as the economy revives from the pandemic.

- Stagnating supply did not cause trouble last year, with the economy shut down to tackle the COVID-19 pandemic. But the rise in power demand this year has exposed the government’s inability to push domestic production or compensate for insufficient domestic production by increasing imports.

What are the structural problems in coal sector and power industry?

- Populist politics has ensured that the price that many consumers pay for power is not commensurate with the production costs. In FY19, for instance, the revenues of distribution companies covered only about 70% of their total costs.

- This has discouraged private investment in power generation and distribution even as the demand for power continues to rise each year.

- It has also increased the debt burden on public sector distribution companies as they have not been compensated for their losses while selling power at subsidized rates.

- The mining of raw materials such as coal is nearly monopolized by public sector companies like CIL that are not run primarily for profits. In fact, CIL has kept its coal price low even as international prices have risen significantly this year.

- The financial crisis is brewing in the power sector. GENCOs have a receivable of more ₹2,00,000 crore from distribution companies. They, in turn, owe more than ₹20,000 crores to CIL.

What can we expect in the near future?

- In recent years, many countries have been trying to cut down on their fossil fuel consumption in order to meet emission targets. But with the current energy crunch, which is prevalent not just in India, fossil fuels are likely to make a strong comeback.

- India and China, the top two consumers of coal in the world, are expected to further increase the production of fossil fuels.

- The Indian government has been pushing CIL to ramp up production to meet the rising demand and cut down on the country’s reliance on imported coal. However, it is expected to ease restrictions on imported coal in the near future to tide over the crisis.

- China, which consumes half of the world’s coal output and has committed itself to reduce its carbon emissions by 65% by 2030, is set to install more coal-powered power plants to meet its rising energy needs.

THE WAY FORWARD:

- Increase the coal production to meet the increased demand:

- Ironically, all the coal resides in States that are ruled by non-National Democratic Alliance (NDA) parties. Officers from the Union Government will have to go down to the States, convey a value proposition and sit with State-level officers to resolve issues related to land acquisition and forest clearances.

- The Union Government will also have to take up clearance-related issues with the Ministry of Environment, Forest and Climate Change.

- Funds will have to be arranged to CIL for the expansion of existing mines as well as the opening of new ones.

- First, the Union Government should stop squeezing more funds out of CIL as it has done during the past few years by way of dividends to balance its budget when this money should have been used to open new mines and expand existing ones.

- Second, it should consider providing cash to CIL against the dues owed by GENCOs.

- Non- CIL production will have to be augmented.

- An inter-ministerial Coal Project Monitoring Group (CPMG), which was set up in 2015 to fast-track clearances, became dormant. This will need to be revived.

- Ease restrictions on imported coal and compulsory use of imported coal: The government recently mandated the thermal power plants to blend imported coal with domestic coal up to a limit of 10%.

- Reducing the power losses from the transmission and improving the efficiency & management of power DISCOMS.

- Shifting towards renewable energy sources for power production and integrating them into national grid. India has the ambitious target of installing 450 GW capacity by 2030 from renewable sources. This will also help to meet the NDCs committed to Paris Agreement.

- Working on demand-side management to optimize the demand of power especially in domestic and agriculture sector Power-efficient appliances should be promoted and solar energy for irrigation pumps used by farmers (PM KUSUM scheme).

THE CONCLUSION: The coal crisis may be temporarily over, but if the fundamentals of the crisis are not taken care of, it is likely to recur. Uninterrupted supply of power is of paramount importance for economic growth in the country. Therefore, the government of India should address the structural problems in the coal sector and power sector so as to avoid any energy crisis in the near future.

Spread the Word