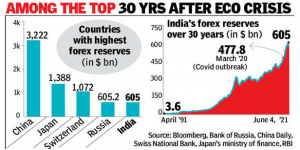

THE CONTEXT: As per the data released by the RBI on 4th June 2021, India’s foreign exchange reserves have crossed the milestone $600 billion marks for the first time in the country’s history. As per the data released by the RBI on 16th July, 2021 forex reserves rose to a record $612.73 billion with which India becomes the 4th largest forex reserves holder globally. A rise in forex is mainly due to a rise in Foreign Currency Assets (FCA).

MORE ON THE NEWS:

- Currently, China has the largest reserves followed by Japan and Switzerland. India has overtaken Russia to become the fourth largest country with foreign exchange reserves.

1. China – $3,349 Billion

2. Japan – $1,376 Billion

3. Switzerland – $1,074 Billion

4. India – $612.73 Billion

5. Russia – $597.40 Billion - To increase the foreign exchange reserves, the Government of India has taken many initiatives like Aatma-Nirbhar Bharat. The government also has started schemes like Duty Exemption Scheme, Remission of Duty or Taxes on Export Product (RoDTEP), Nirvik (Niryat Rin Vikas Yojana) scheme, etc. Apart from these schemes, India is one of the top countries that attracted the highest amount of Foreign Direct Investment.

- Although our foreign exchange reserves have been increasing continuously for the last three decades, the growth has become faster than ever in the last 18 months.

- Compared with 1991, when India faced a situation of acute shortage of foreign exchange, such that our reserves were not enough to pay for imports of even seven days, today the situation is such that our foreign exchange reserves are enough to pay for 18 months of imports.

ALL YOU NEED TO KNOW: FOREX RESERVES

WHAT ARE FOREX RESERVES?

- Forex reserves are external assets in the form of gold, SDRs, and foreign currency assets accumulated by India and controlled by the Reserve Bank of India.

- Reserve Bank of India Act and the Foreign Exchange Management Act, 1999 set the legal provisions for governing the foreign exchange reserves.

- RBI accumulates foreign currency reserves by purchasing from authorized dealers in open market operations.

THE COMPONENTS OF FOREX RESERVES

- The Forex reserves of India consist of four categories:

1. Foreign Currency Assets(capital inflows to the capital markets, FDI, and external commercial borrowings)

2. Gold

3. Special Drawing Rights (SDRs of IMF)

4. Reserve Tranche Position

SIGNIFICANCE OF FOREX RESERVES

- The IMF says official foreign exchange reserves are held in support of a range of objectives like supporting and maintaining confidence in the policies for monetary and exchange rate management including the capacity to intervene in support of the national or union currency.

- It will also limit external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed.

WHAT DOES THE RBI DO WITH THE FOREX RESERVES?

- The RBI functions as the custodian and manager of forex reserves and operates within the overall policy framework agreed upon with the government.

- The RBI allocates the dollars for specific purposes. For example, under the Liberalized Remittances Scheme, individuals are allowed to remit up to $250,000 every year.

- The RBI uses its forex kitty for the orderly movement of the rupee. It sells the dollar when the rupee weakens and buys the dollar when the rupee strengthens.

WHERE ARE INDIA’S FOREX RESERVES KEPT?

- The RBI Act, 1934 provides the overarching legal framework for the deployment of reserves in different foreign currency assets and gold within the broad parameters of currencies, instruments, issuers, and counterparties.

- As much as 64 percent of the foreign currency reserves are held in the securities like Treasury bills of foreign countries, mainly the US.

- 28 percent is deposited in foreign central banks and 7.4 percent is also deposited in commercial banks abroad.

IS THERE A COST INVOLVED IN MAINTAINING FOREX RESERVES?

- The return on India’s forex reserves kept in foreign central banks and commercial banks is negligible.

- While the RBI has not divulged the return on forex investment, analysts say it could be around one percent, or even less than that, considering the fall in interest rates in the US and Eurozone.

WHY IS FOREX RISING DESPITE THE SLOWDOWN IN THE ECONOMY?

RISE IN FPI AND FII

- The major reason for the rise in FOREX reserves is the rise in investment in foreign portfolio investors in Indian stocks and foreign direct investments (FDIs). For example, last year- Reliance Industries subsidiary -Jio Platforms – has witnessed a series of foreign investments totaling 97,000 crores.

CRASH IN OIL PRICES

- The fall in crude oil prices has brought down the oil import bill, saving the foreign exchange.

FALL IN OVERSEAS REMITTANCES AND FOREIGN TRAVEL

- Overseas remittances and foreign travels have fallen steeply, down 61 percent in April from $12.87 billion.

WHAT WE CAN DO WITH EXCESS RESERVES

ACQUIRING STAKES IN DEVELOPED COUNTRY FIRMS

- While keeping the forex reserves in the treasury is costly for the country with low interests in it, countries need to use the funds to acquire stakes in firms of developed countries to increase profit.

SETTING UP FUNDS

- The recent surge in reserves is mostly a result of speculative capital inflows on the capital account. Rather than ‘sovereign wealth’, these inflows are ‘liabilities’ and are therefore vulnerable to sudden outflows by foreign investors amid an increase in domestic or global risk aversion. These funds such as Stabilisation funds or Pension funds can help the economy during outflow.

USING AS A TOOL OF INTERNATIONAL POLITICS

- The US bonds have been used by China for a long time as a tool for achieving its interests concerning the US. India too needs to learn and use it for favorable terms in trade and solving challenges such as Pakistan.

GROWTH AND DEVELOPMENT OF NATIONS

- The forex reserves can be utilized for reaching the SDG goals given that an adequate amount of funds are maintained for any unforeseen circumstance.

ISSUES RELATED TO RISING FOREX RESERVES

- According to the former RBI Governor YV Reddy, there are some differences among academics on the direct as well as indirect costs and benefits of the level of forex reserves, from the point of view of macro-economic policy, financial stability, and fiscal or quasi-fiscal impact.

- China’s foreign exchange reserves increased mostly thanks to a balance of payments (BOP) surplus of China with most of their trading partners. To some extent, they also grew due to foreign direct investment. Whereas in India’s case, the increases in India’s foreign exchange reserves are mainly due to foreign direct investment (FDI) and foreign portfolio/ institutional investment (FPI). Generally, our balance of payments remains in huge deficit.

- Economists agree that the best option as a source of foreign exchange is the balance of payments surplus.

- Even if the foreign exchange is obtained through investment in the stock markets, then also it has many side effects like-

- It causes volatility not only in the stock markets but also in the exchange rate. Its result can be ominous for the country.

- The country has to pay a heavy price for this inflow of foreign exchange as these investors take back the huge profits to their countries of origin even as the value of their assets keeps increasing.

- While foreign institutional investors have invested a total of $281 billion in India to date, the total valuation of their assets has reached $607 billion as of March 31, 2021. They can sell their $607 billion worth of shares and bonds and go back at any moment and all our foreign exchange reserves can run out in a jiffy. That is why portfolio investment is also called ‘hot money”.

- Foreign investment, foreign loans are taken by private companies, and remittances by Indians are all important for increasing foreign exchange reserves. But not all these sources have a similar effect on the reserves.

- Remittances by Indians normally do not have any repayment obligations and generally, all these amounts remain in India forever.

- Foreign investors (Both foreign direct investors or portfolio investors) repatriate huge amounts of money. In the last ten years (2010-11 to 2019-20), these foreign investors have withdrawn $390 billion, in the form of dividends, royalties, technical fees, interest, and salaries and this amount has been increasing year after year.

- There is no stability in portfolio investment. It is not possible to estimate how much foreign exchange the portfolio investors will bring in and when they will withdraw. Their volatility affects the exchange rate, causing huge losses. Not only this, these investors cause huge volatility in the stock markets as well.

SHOULD FOREX RESERVES FINANCE STIMULUS TO THE INDIAN ECONOMY?

YES

- The sufficiency of forex reserves is sometimes measured by how many months’ worth of imports a country can afford. While forex reserves amounting to import cover of six months is considered sufficient by the RBI, India import cover is enough to sustain imports up to 18 months.

- In case of a credit shock, India can mitigate any balance of payment crisis, as there are sufficient arrangements for foreign exchange reserves in the form of a credit line from the IMF and many Central bank liquidity swap agreements with countries like Japan.

- As there is a lack of considerable space both on the monetary and fiscal front to support economic growth, part of the country’s forex reserves can be used for stimulating the economy.

- Economist has theorized that holding high forex reserves are unnecessary. Not using them for mega-projects (like financing infrastructure projects) are lost opportunities.

NO

- In the future oil prices might increase further. With the rise of 1$ per barrel of crude oil prices, India has to additionally pay nearly Rs 15000 crore. Given this, India should deter using forex reserves for providing economic stimulus.

- The rise in current forex reserves is due to the massive inflow of FIIs. However, FIIs by their nature are investments based on speculation. Therefore, the current surge in forex reserves should not be treated as permanent nature.

- High forex reserves also help India to maintain its global rating, especially in the context of falling GDP growth rate. The depletion in forex reserves may harm these ratings, which in turn may reduce foreign investment inflows into India.

- RBI has been fundamentally using India’s foreign exchange to ensure rupee stability. Given the fluctuation in the Indian rupee vis-a-vis the dollar, the Indian rupee has become one of Asia’s worst currencies. Thus, RBI will need enough forex reserves to maintain the stability of the Indian Rupee.

- An economic stimulus is ineffective without structural reforms. Even using forex reserves would not resolve all the challenges facing Indian infrastructure development.

WAY FORWARD:

- Over-reliance on forex reserves to provide economic stimulus may prove to be dangerous for the economic stability of the Indian economy.

- Foreign investors are repatriating huge profits from India while the country’s returns from these foreign exchange reserves are very negligible. Avenues will have to be found for gainful use of foreign exchange reserves beyond a limit.

- Since there’s continuously the fear that these outside organization speculators may take off with their “hot money” anytime. In this respect, an arrangement of a ‘lock-in period’ can be forced on them. On the off chance that they still need to require their cashback, at that point an arrangement can too be made to levy tax on them. This charge was recommended by an economist named James Tobin; subsequently, it is additionally called ‘Tobin Tax’.

CONCLUSION: Over-reliance on forex reserves is problematic; not using them is a lost opportunity. If the government intends to use forex reserves as an emergency fund, it should ensure that they do not shrink just when they are most needed. Apart from it, there is a need for separate attention to carry out structural reforms that can pull out the Indian economy from a persistent slowdown.

Spread the Word